TIAA’s recent sustainability report raises more questions than it answers

Key Findings

TIAA’s recent status report is a disappointing contribution to the growing body of literature documenting efforts of institutional funds seeking to address climate change.

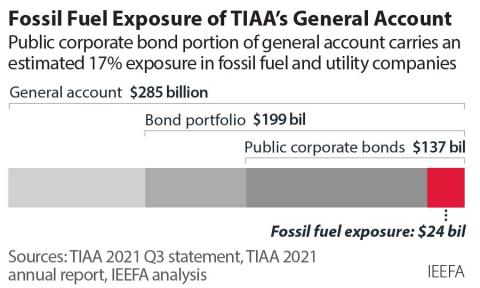

Two years into its plan, TIAA has only begun to identify its carbon exposure and offers almost no evidence of taking financial action to address climate-related financial risk.

At this stage of TIAA’s plan, it should provide clear definitions and rationales for how it determines if an investment has carbon exposure.

TIAA’s recent status report (Rising to the Challenge) is a disappointing contribution to the growing body of literature documenting efforts of institutional funds seeking to address climate change. A recent letter by TIAA Divest, an organization led by TIAA customers, presents a list of questions that reveal significant deficiencies in the report.

TIAA is a powerhouse investment firm. With $1.4 trillion currently under management, the company has outgrown its traditional insurance model and expanded to offer a series of products for retail and institutional investors. It caters largely to academic workers seeking to build retirement savings through defined contribution plans.

The 11-page TIAA Divest letter puts forth a series of questions seeking to understand TIAA’s recent report, which is an update on implementation of its sustainability plan. One deficiency that TIAA Divest’s letter addresses is the fact that TIAA’s report consistently makes statements that are either unsupported or supported by references to studies that are not made accessible to the reader. Greater transparency is needed as the energy transition progresses and new economic formations are developed. TIAA seems to know that, as they frequently reference their commitment to transparency.

The audience for the report includes other institutions grappling with many of the same issues and current or potential TIAA customers or investors—many of them academics. There is great interest in how a large, prestigious firm like TIAA is handling the climate matter. Most of the people reading the document are not well-grounded in climate science or the investment nuances associated with the topic. But as an occupational group, they are professionally responsible for the creation and dissemination of ideas and the facts and logic that support them. The explanations offered by TIAA therefore need to be clear, and references need to be made accessible.

The questions raised by TIAA Divest are not trivial. For example, at this stage of TIAA’s plan, it should provide clear definitions and rationales for how it determines if an investment has carbon exposure. When it is tallying quantities, definitions need to be clearly and consistently applied.

As part of its own background research, TIAA said it has surveyed companies in its portfolio. It uses the results of the survey to support various contentions related to how companies in TIAA’s portfolio are responding to climate change. But TIAA does not offer the results of the survey to the reader—not even a summary.

Similar references to source material without providing access to the reader are made related to classification standards, baseline benchmarks, companies in the portfolio, relevant (and non-confidential) board communications, staff training materials, questions asked of portfolio money managers, communications with regulatory authorities, votes at corporate boards and communications with third-party trade associations.

In one very important area, TIAA tells the reader that it offers a wide variety of climate-friendly investment products to retail customers. There is no evidence that these new investment products meet a reasonable sustainability standard—in fact, there is evidence that its “climate- friendly” investment products do not meet the standard. The environmental, social, and governance (ESG) and other low-carbon products offered by TIAA and Nuveen are rated poorly by industry monitors such as the Fossil Free Fund. For example, there are 30 funds listed with sustainability mandates sponsored by Nuveen/TIAA. Only one scores an “A” and 14 score either a “D” or “F.” The three funds that cover emerging markets rate either a “D” or “F.”

Very little is explained in the TIAA report. And where progress is claimed, the explanations are vague. This is particularly disturbing, since TIAA may be making some industry-leading progress in its bond portfolio. The principle on which TIAA and climate leaders agree is that carbon exposure should be reduced to decrease the financial risk associated with fossil fuel investments. One way to do this is to allow existing carbon-exposed bonds to mature and then have them roll off the portfolio, governed by the policy that new bond purchases should be fossil-free. TIAA appears to be making important progress in this area, but its explanations fail to clarify how new policies are being applied and their outcome. TIAA Divest’s letter offers trenchant questions about this important policy initiative.

Why does this matter? More than 1,500 institutional funds have taken steps to protect assets from value losses related to fossil fuel exposure. Driven by climate risk and the concerns related to the physical loss of property and human life, as well as the transition planning associated with preparing for the move away from fossil fuels, institutional funds are taking financial action.

Actions related to asset allocation take the form of avoiding fossil fuel investments on the one hand and seeking alternative, sustainable investments that meet financial targets. The positive side to those seeking alternatives is that new low-carbon products are being added almost daily by Wall Street heavyweights. Many of the indexes, private equity offerings and bond funds with sustainability mandates are increasing in number, maturing, meeting return targets and proving competitive.

These new products allow investors and corporations both large and small to meet their net-zero pledges. The pledges made over the last few years must now be backed by programs of action that will move companies, investment funds and other stakeholders from where they are today to where they want to be in the sustainable world of tomorrow.

Several large funds report regularly to the public, stakeholders, and the climate community. The reports stimulate discussion—agreement and disagreement over the details of climate change policy and practice. The New York State Comptroller Tom DiNapoli’s regular climate reports and reports issued by both of California’s two large public pension funds—CalPERS and CalSTRS—offer consistent detailed reporting.

Two years into its plan, TIAA’s reporting falters. The irony that TIAA caters to a largely academic clientele and has such weak reporting is compounded by the fact that its board of governors is comprised of prominent individuals with past and current relationships with Johns Hopkins University, Robert Wood Johnson Foundation, Catherine T. MacArthur Foundation, the California Board of Education, and the U.S. Department of Education.

TIAA is too important to allow anything other than top-level performance and reporting. Clear, open and consistent reporting using understandable metrics is needed. Transparency requires clear goals, good explanations, well-sourced facts and methodologically-sound analytics. A spirit of openness is necessary because successes must be broadcast so others can build on them, and shortfalls need to be understood to correct and build on them as well. What is not acceptable are poorly-designed initiatives coupled with muddled reporting.

Bottom line: Two years into its plan, TIAA has only begun to identify its carbon exposure and offers almost no evidence of taking financial action to address climate risk, which TIAA has characterized as a financial risk