Key Findings

The energy transition is beginning to leave an imprint on equity markets. Fossil fuels, once a primary driver of index returns and economic growth, are becoming an increasingly risky and speculative part of passive equity portfolios.

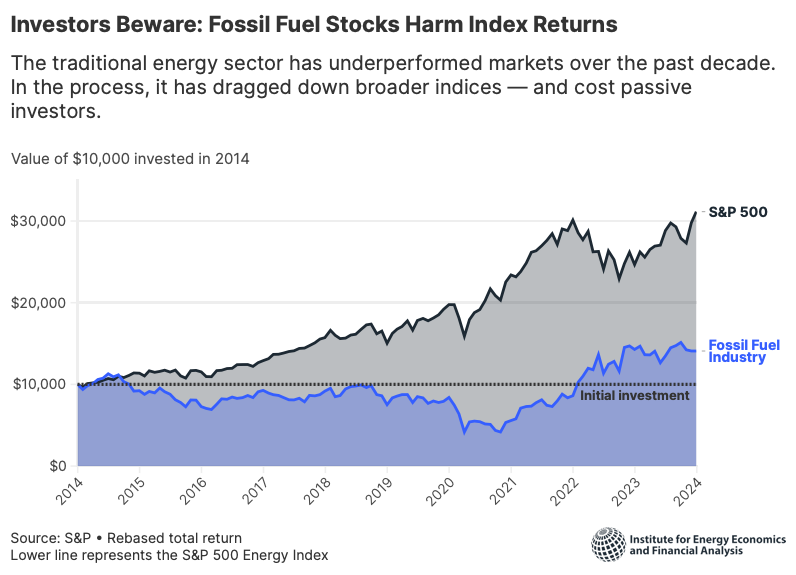

Over the last decade, shedding oil, gas, and coal has proven a winning financial strategy — even taking the recent energy crisis into account. As the sector’s historic value thesis erodes, a few high-profit quarters have been unable to reverse a decade of underperformance.

The passive investment landscape is starting to reflect this shift. In recent years, equity indices with reduced fossil fuel exposure have proliferated, passed major funds’ prudence tests, and been adopted without significant transaction costs.

This is a part of investors’ increasing recognition of the competitive pressures and compounding climate risks undermining the traditional energy sector’s long-term outlook.

As markets move in the direction of a lower-carbon future, the maturation of ex-fossil passive strategies gives investors a key tool for responding to the risks and rewards of a warming world.

Executive Summary

For decades, fossil fuel companies were the epitome of a blue-chip holding: Reliable returns, steady growth and sound underlying fundamentals. Eager for low-risk ways of meeting investment return targets, institutional investors piled in. As the industry powered global economic growth and took hold as a major driver of world equity markets, billions upon billions of dollars in pensions, endowments, and other funds were staked upon its success.

Yet as the 21st century has progressed, this traditional investment thesis has faltered. Disruption and destabilization in fossil fuel commodity markets, competition from renewable energy, the electrification of transport, and growing investor consciousness of climate change’s financial risks have driven some investors to re-evaluate the energy sector’s role in the portfolio.

This report evaluates the effect that these shifts have had on broad-market equity indices. It takes as a starting point a decade-long pattern of underperformance by the energy sector, compared to flagship equity indices like the Standard & Poor’s 500 (S&P 500). The market trajectories are stark. In eight of the 10 years between 2012 and 2021, the energy sector trailed the performance of the S&P 500, and in five of those years, it placed dead last. Once a driver of investment returns, the industry found itself shrinking. At its peak, traditional energy made up almost 30% of the S&P 500 by market capitalization in 1980. By the late 2010s, the figure had declined to low single digits—a stark decline in the fossil fuel sector’s value relative to the other sectors of the stock market.

This decline in the market prominence of fossil fuels occurred alongside notable shifts in equity investing. Passively managed investment funds that track market indexes began seeing significant fund inflows after the Great Recession. And major index providers began launching new equity market indices that excluded or underweighted fossil fuel companies (referred to in this report as “ex-fossil” or “low-fossil” indices). These indices soon came to be tracked by index funds and gained the attention of investors. As market demand increased, just a few signature indices became the basis for a number of various options, strategies, and weighting approaches.

After almost a decade of underperformance, the fossil fuel sector rebounded strongly in 2021 and 2022. Among the key drivers were the world’s emergence from the COVID-19 pandemic, which strained international supply chains to the breaking point, and the Russian invasion of Ukraine, which forced profound reconfigurations of global energy flows. Oil prices surged, the fossil fuel industry posted record profits, and commentators declared that the sector’s golden age had returned. In subsequent quarters, the bump faded. Despite leading equity markets in 2021 and 2022, the fossil fuel sector posted a -4.8% return in 2023. The sector's stock prices and market weighting rose from record lows in 2020 to a modest 5.2% of the S&P 500 in December 2022 before reversing in 2023 with fossil fuels declining to 3.9% at year-end.

Where do these overlapping trends leave the fossil fuel sector’s place in equity portfolios? This report finds that recent disruptions to energy markets have failed to overcome the longer-term market decline of fossil fuels. We compare the risk and returns of some of the most systemically important indices for institutional investors, including the S&P 500, Russell 3000 and MSCI All Country World Index (ACWI) with their ex-fossil variants. We then expand our analysis across more than 60 additional indices and find that the same story remains true. The returns posted by fossil fuel companies amidst a pandemic and war have simply not been enough to rescue the industry from its pattern of longer-term underperformance. The sector has slipped in relation to its historical standing, and markets have taken notice.

We conclude that there is a market evolution at play.

- Across index families, geographies, and target markets, excluding fossil fuels has led to modestly superior returns over the past 10 years, in both absolute and risk-adjusted terms.

- The market for lower-carbon passive investing has matured significantly. Indices that reduce fossil fuel exposure are proving investable and passing fiduciary tests; transaction costs to implement new indices are proving affordable; and investment products benchmarked to them are proliferating.

- There is good reason to believe that this is a durable market trend. Fossil fuel companies once generated shareholder value based on sound underlying fundamentals. More recently, their profitability has become dependent on volatile forces outside their control. The traditional value thesis underlying the industry—that the fossil fuel industry and economic growth are inextricably linked—is eroding. Facing increased competition between fossil fuel producers and from cheaper alternative technologies, the industry is ill-prepared to manage shareholder value in the coming years.

These results bear special significance for passive investing. Passive investment strategies rely on broad-market exposure. As a result, conventional wisdom holds that any restriction on diversification inevitably limits possible returns. In the specific case of fossil fuels, real-world market results show that the inverse has been true. During the past decade, excluding the fossil fuel sector resulted in limited risk exposure and improved performance. These results, combined with the sector’s negative long-term outlook, should raise real concerns for institutional investors with allocations to passive equity strategies.

With an increased availability of ex- or low-fossil variants of flagship indices, an emerging pattern of long-term outperformance of those variants, and a negative long-term outlook for the fossil fuel sector, the stage is set for increased deployment of low-fossil passive equity strategies.