Capacity building recommendations for strengthening the Just Transition financing ecosystem

Key Findings

Stakeholders across regulators, ministries, and states face technical and institutional gaps in applying JT principles. These include inadequate coordination, limited financial expertise, and inadequate tools.

Tailored training and shared toolkits are needed to strengthen JT integration. A unified approach can enhance coherence across sectors and promote peer learning.

Sustained efforts like JT cells, national curricula, and inter-agency collaboration must be institutionalised. Long-term support from multilateral and national bodies is crucial.

The transition to a low-carbon economy in India requires a financing approach that is not only sustainable and inclusive but also capable of addressing regional, social, and economic disparities that arise from decarbonisation. While several positive initiatives by stakeholders have the potential to support a Just Transition (JT), significant capacity gaps remain within the financing ecosystem. This paper highlights some of these gaps and presents recommendations to address them.

We utilised a comprehensive approach to assess these capacity gaps. The assessment was structured in four parts: First, we conducted a scoping exercise to map the existing capacities of stakeholders and analyse their current initiatives in alignment with JT principles. This was followed by in-depth stakeholder consultations, which helped validate the findings. Based on these consultations, we developed a roadmap towards strengthening the JT financing ecosystem. This roadmap then informed the capacity gap assessment and the formulation of targeted recommendations.

Stakeholder Initiatives and Current Capacity Landscape

The assessment of stakeholder initiatives and institutional capacities revealed a growing momentum, although limited, across key actors in integrating JT principles into their frameworks and operations. The Securities and Exchange Board of India (SEBI) has launched the Business Responsibility and Sustainability Report (BRSR) Core framework, while the Reserve Bank of India (RBI) is advancing climate-related financial disclosures and supervisory guidelines. The Ministry of Finance is actively engaging in global dialogues on the social implications of a green transition. The Ministry of Environment, Forest and Climate Change (MoEFCC) is incorporating JT, although not exclusively using JT terminology, into national climate policies, and NITI Aayog is developing JT financing and coal transition roadmaps and has also supported studies undertaken by the inter-ministerial committee on JT in India. Meanwhile, corporates and financial institutions are forming Environmental, Social, and Governance (ESG) committees, adding human resources and capacities to develop their sustainability practices, enhancing sustainability disclosures, and using people-centric financial instruments like social bonds and sustainability-linked bonds. This mapping exercise underscores both emerging institutional leadership and areas requiring further technical support to effectively scale JT initiatives.

Capacity Building Discussions Between Stakeholders

As the second part of the process, we conducted in-depth stakeholder discussions to assess capacity-building needs and gather insights on institutional challenges in operationalising JT financing. These dialogues highlighted a strong willingness among stakeholders to engage in JT-related efforts but also revealed significant gaps in technical expertise, inter-agency coordination, and access to practical tools. Stakeholders emphasised the need for targeted training on financial instrument design, integration of social and climate risks, and project-level planning for reskilling, rehabilitation, and community development. Many also expressed interest in peer learning platforms, exposure to global best practices, and guidance on aligning their existing mandates with JT objectives. These discussions played a critical role in shaping a grounded and stakeholder-informed roadmap for strengthening institutional capacities across the JT financing ecosystem.

Just Transition Financing Ecosystem Improvement Roadmap

The Just Transition Financing Ecosystem Improvement Roadmap provided a strategic basis for assessing capacity gaps and guiding capacity-building across the JT financing landscape. It identified key areas where institutional capabilities needed strengthening, including the establishment of inter-ministerial coordination mechanisms to align regulatory, fiscal, and environmental goals; the development of technical expertise to design and scale instruments such as social loans/bonds, sustainability-linked bonds, and blended finance mechanisms; and support for state-level actors to embed JT objectives into energy transition plans. It also emphasised the need for robust data and Measurement, Reporting, and Verification (MRV) systems to track socio-economic impacts. This roadmap directly informed the identification of capacity gaps and supported efforts to enhance the coherence and effectiveness of JT financing.

Capacity Gap Assessment and Recommendations

A key outcome of the stakeholder consultation on JT financing was the identification of critical capacity gaps that hinder the effective design, deployment, and governance of JT-aligned financial instruments and strategies. While there is growing recognition of the need for a socially inclusive energy transition, most institutions have limited specialised knowledge, analytical tools, and coordination mechanisms required to operationalise this agenda. These gaps range from limited understanding of climate-social risk integration to weak capacity for project structuring, community engagement, and monitoring social impact. The assessment has informed a set of targeted, stakeholder-specific recommendations aimed at building institutional and technical capabilities, fostering inter-agency alignment, and equipping actors with the tools to integrate JT principles into financial, environmental, and economic planning processes.

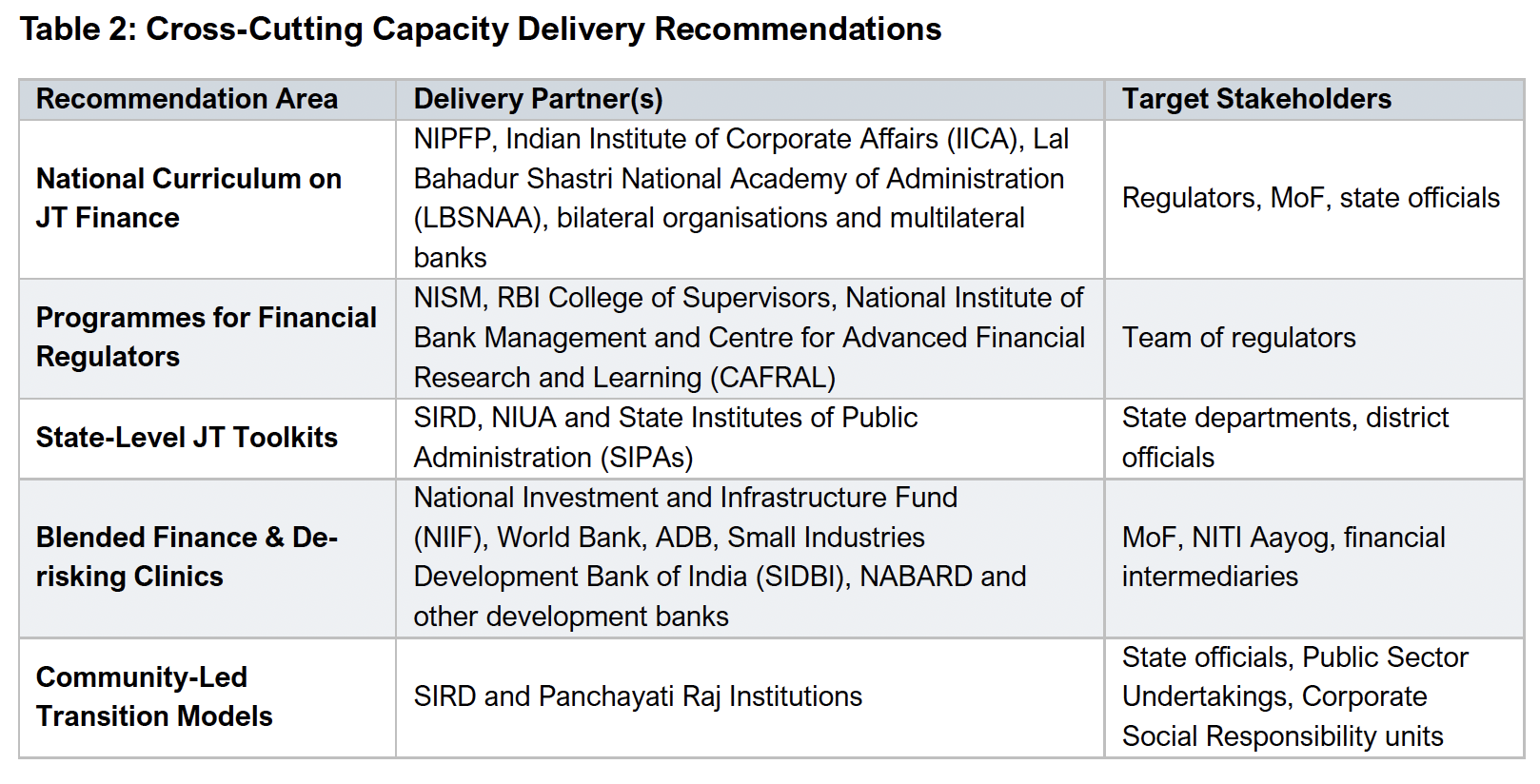

Cross-Cutting Capacity Delivery Recommendations

While each stakeholder group has distinct needs, there is a shared requirement for foundational knowledge, tools, and coordination mechanisms to effectively operationalise JT principles. To address this shared need across diverse stakeholder groups, a unified approach to capacity building is needed. Cross-cutting capacity delivery recommendations aim to create a harmonised ecosystem through common curricula, toolkits, and collaborative platforms that promote peer learning, coherence in regulatory and fiscal frameworks, and on-ground implementation support. By investing in cross-cutting capacities, such as JT finance literacy, project preparation, and data systems, India can accelerate a socially inclusive and financially robust energy transition.

Way Forward

To strengthen the JT financing ecosystem, the next phase must prioritise institutionalising the capacity-building efforts outlined in this assessment. This includes operationalising cross-cutting recommendations through structured national curricula, targeted training programmes, and technical assistance hubs at both, the national and state levels. Building long-term capacity will require sustained collaboration among regulators, ministries, financial institutions, corporates, and state bodies. This should be supported by multilateral partners and knowledge institutions. Dedicated resources should be mobilised to establish JT cells, enhance interdepartmental coordination, and scale tailored toolkits and MRV systems. As JT financing evolves, ongoing peer learning, adaptive governance structures, and integrated planning mechanisms will be critical to ensure India’s energy transition is not only low-carbon but also socially inclusive and economically resilient.