Systemic risk reduction funds: Why impact investing needs to get selfish

Download Full Report

Key Findings

Asset owners are increasingly concerned by systemic risk, which modern portfolio theory remains fundamentally ill-equipped to address.

IEEFA proposes the establishment of “systemic risk reduction” funds, designed to support the long-term health of investors’ wider portfolios instead of short-term returns at the fund level.

Legal discourse of fiduciary duty is already evolving. The door has opened for funds targeting systemic risk reduction to proliferate as part of broader investor strategies.

Systemic risk reduction funds represent a potentially significant growth market and business opportunity for asset managers while also providing a stepping stone to system-level investing.

Executive Summary

While modern portfolio theory (MPT) provides a framework for managing idiosyncratic risk, diversification remains largely powerless to combat systemic risk. Long-term portfolio values are under threat. Unlike the models upon which their investments are built, asset owners are not blind to systemic risks. Rather the opposite – market intelligence shows growing consternation. And while climate change remains the most pressing concern for asset owners, nature loss, geopolitical instability, social issues and technological disruption are increasingly seen as interconnected, escalating threats. In Europe, pension funds have already begun to pull mandates from managers failing to take these concerns seriously.

Forced to look beyond MPT, investors have traditionally relied on corporate engagement to combat systemic risk, but questions are being asked as to how meaningful such activity has been. IEEFA firmly believes that financial market participants are not bystanders. However, with modern investment architecture built almost entirely around MPT, financial product development itself is part of the problem. Strict short-term performance objectives severely restrict existing approaches from meaningfully targeting sources of systemic risk. In response, IEEFA proposes the establishment of “systemic risk reduction” (SRR) funds, a new breed of impact vehicle that would sit outside traditional strategic asset allocation.

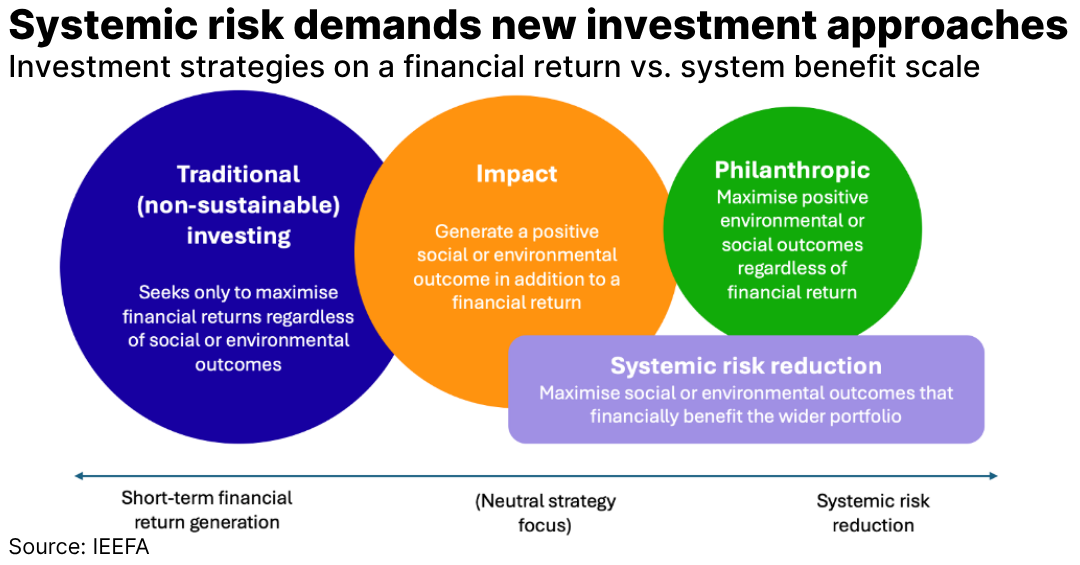

Whereas an impact product is designed as a standalone proposition that broadly seeks fund-level financial returns alongside positive social or environmental outcomes, an SRR vehicle should specifically target impact outcomes that support the health of an investor’s wider portfolio. So that systemic goals might be more aggressively pursued, such funds must adopt only very long-term fund-level performance objectives (over periods of at least 10 years). Despite foregoing near-term return expectations, investing for SRR is more self-serving a philosophy than standard impact investing. This is because an SRR vehicle should focus on impact outcomes that are likely to be most financially beneficial to the universal owner’s wider portfolio, as opposed to those that might be most societally beneficial. Impact outcomes are quite clearly a means to an end, rather than the ultimate goal. This distinction matters. SRR funds should not be confused with philanthropy, even if fund-level return targets were to be removed entirely. Rather, they should be seen as a pragmatic part of a broader investment strategy – one that aims to reduce an asset owner’s wider exposure to escalating threats.

Two methods for building SRR products are proposed with a focus on climate change. One approach targets system-wide decarbonisation through aggressive impact investments selected as a hedge to other parts of a wider portfolio. The other seeks decarbonisation through unconstrained, forceful engagement of outsized systemic risk contributors. IEEFA argues that the two are not mutually exclusive – in fact, clear synergies mean that a combined approach could be far stronger than the sum of its parts.

Once a potential roadblock, recent legal interventions on fiduciary duty are increasingly supportive, opening the door for products without short-term fund-level return goals to proliferate as part of wider investor strategies. For active asset managers, SRR funds represent a timely strategic opportunity. As asset owners are expecting more from their managers on systemic risk, first movers will not only help address some of the most pressing threats facing global markets but will also gain a competitive, commercial edge in what may become a major growth area for institutional capital – system-level investing.