Asia’s falling LNG demand in 2025 defies investor optimism for rapid growth

Key Findings

Asia’s LNG demand is on pace to fall by 5% in 2025 as high prices and ongoing trade tensions constrain the region’s appetite for the fuel.

Recent International Energy Agency projections, based on static, conservative energy policies and a slower energy transition, are bolstering industry optimism for LNG’s role in Asia’s energy future.

Market developments in 2025 indicate that policymakers and consumers in Asia are already responding to key LNG challenges in ways that could significantly slow future demand growth.

Asia’s demand for liquefied natural gas (LNG) is set to fall by 5% in 2025, the steepest annual decline since 2022, as high prices and global trade tensions continue to constrain the region’s appetite for the fuel.

The drop comes as the world’s LNG export capacity is on track to grow at the fastest rate on record, and the global gas industry remains unwaveringly optimistic that rapid, sustained demand growth in key Asian markets will absorb new supplies. Recent scenarios from the International Energy Agency (IEA), which exclude future policy changes, have bolstered bullish LNG demand expectations.

However, the recent lull in LNG shipments to Asia challenges this investment thesis and demonstrates that Asian energy policies are not static. Instead, they are constantly responding to LNG barriers — including volatile prices, an economic slowdown, infrastructure challenges, gas turbine shortages, and energy security risks — in ways that may continue to limit demand potential, even in a lower price environment.

Assessing LNG’s faltering demand in Asia

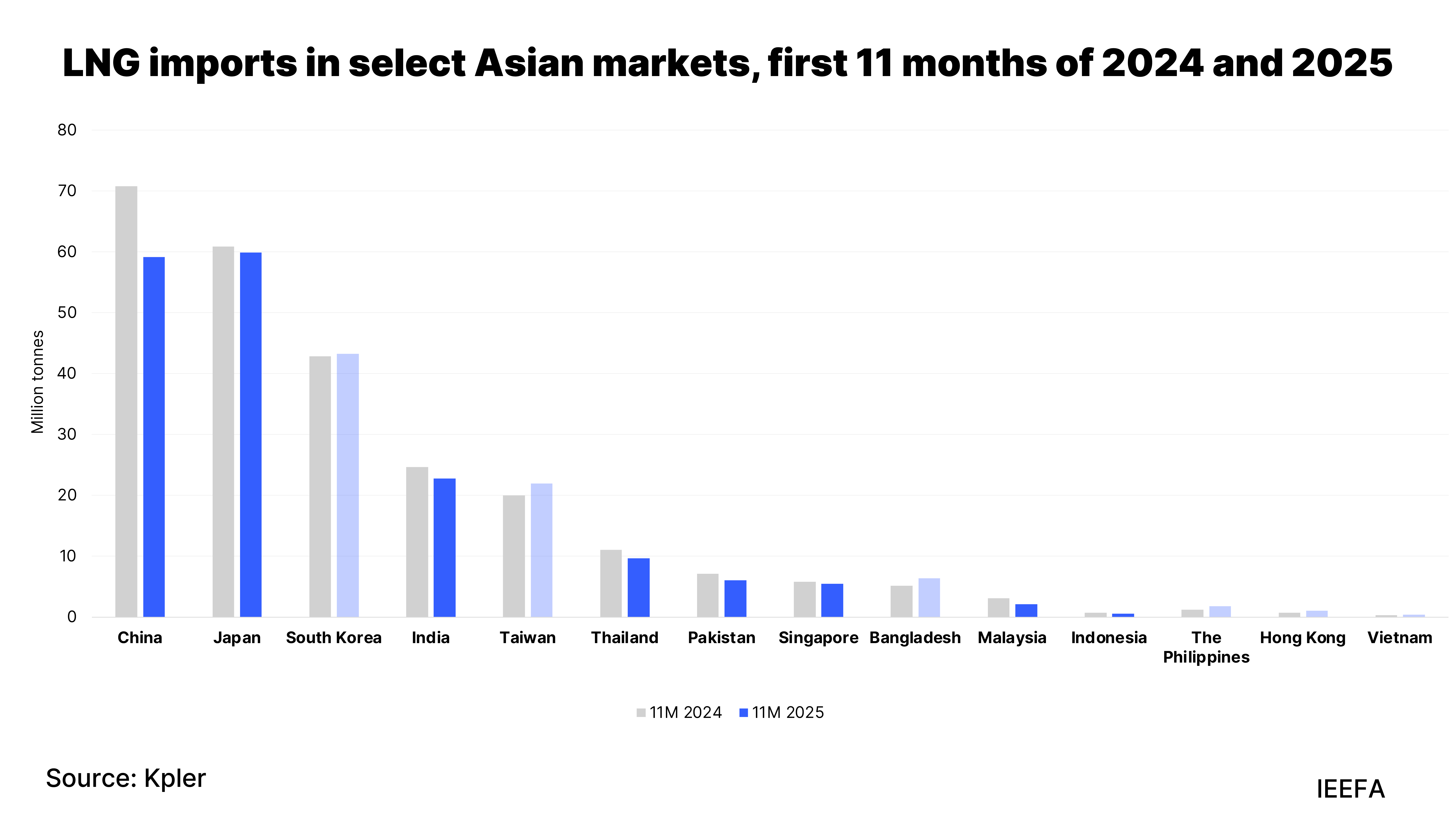

Through November, Asian LNG demand fell from 254 million tonnes (mt) in 2024 to 240mt in 2025, according to Kpler data. The largest decline comes from China, where escalating tensions with the United States (US) prompted Beijing to slash LNG imports and reinforce energy security by relying on fuels sourced closer to home. The availability of cheaper energy sources — including domestic gas production, pipeline gas imports, coal, and domestically manufactured renewable energy — enabled China to abruptly reduce its LNG imports by 16% in 2025.

As a result, Japan may reclaim its spot as the world’s leading LNG importer, even though its own demand is set to decrease by more than 1% in 2025. Higher nuclear and renewables generation has reduced gas-fired power needs, which could fall more steeply in the near-term with the potential restart of the Kashiwazaki-Kariwa nuclear power station.

Asia’s anemic LNG demand spreads beyond the two largest importers.

India’s purchases are on track to fall by 8% as higher prices and rising output from renewable sources reduced LNG use in the fertilizer, refinery, and power sectors.

In Thailand, the largest LNG buyer in Southeast Asia, imports are set to shrink by 13%, as a sluggish economy curbs power consumption and increased output from other sources reduces the need for gas-fired electricity. In contrast to falling LNG demand, solar reportedly surged 58% through August 2025.

In Pakistan, once considered a major prospective LNG growth market, the government no longer views LNG as a key part of the national energy strategy following years of unaffordable import costs. An unprecedented boom in residential and commercial solar has caused the country’s LNG demand to fall 14% in 2025.

South Korea’s LNG demand increased by 1%, but long-term energy plans envision a declining role for the fuel over the next decade. In Taiwan, by contrast, the ongoing phaseout of nuclear facilities has increased reliance on LNG imports.

Collectively, these trends heighten uncertainty about LNG’s long-term future in the region.

Rosier demand outlooks underestimate on-the-ground LNG challenges

Despite these hiccups, many investors and analysts remain bullish about Asia’s thirst for LNG. They point to the IEA’s Current Policies Scenario (CPS) — outlined in its annual World Energy Outlook — which projects strong LNG demand growth to 2035. Under this slow energy transition scenario, LNG demand eventually outstrips the capacity of existing and under-construction export facilities.

However, the CPS assumes no further changes to energy policies beyond those already adopted. Yet, this past year demonstrates that policies in Asia are already responding to key LNG-related challenges in ways that could significantly slow demand growth.

Gas turbine bottlenecks are posing a serious impediment to LNG growth in Southeast Asia. After acknowledging gas turbine constraints in October, the Philippines Secretary of Energy stated that the country is unlikely to add additional capacity, citing a low utilization of import terminals. In November 2025, a 1.1 gigawatt (GW) LNG-to-power project was canceled in the Philippines despite backing from powerful domestic business interests and Blackstone, the US’s largest private equity firm.

In Vietnam, investors in the Thai Binh LNG-to-power project sought a two-year commissioning delay because they were unable to procure gas turbines, a proposal the government ultimately rejected. LNG projects in the country continue to face numerous financial and contractual challenges, and one developer described investing in LNG as “like entering a trap.”

Reluctance to pass high LNG costs on to consumers in both countries could also limit LNG’s future role. In the Philippines, policymakers are working to reduce LNG exposure by ramping up domestic gas exploration. In Vietnam, the lack of a bankable framework for LNG-to-power projects partly stems from a desire to shield consumers from volatile fuel and power costs.

Thailand’s stagnant economy has prompted the government to suspend operations of 4.0GW of gas-fired capacity until 2029 and delay the commissioning of a 0.5GW project by two years.

Across South Asia, the structural shift from low-cost domestic gas to expensive LNG imports continues to challenge industrial activity. While external finance has aided a mild resurgence in Bangladesh this year, the state-owned oil and gas company Petrobangla forecasts little to no growth in gas demand over the short term. As Pakistan pivots away from LNG, policymakers are exploring ways to alleviate contractual oversupply through cargo diversions and deferrals.

The impact of lower prices on demand

With the upcoming LNG glut likely to reduce prices, analysts are assessing the impact of lower prices on consumption. While regional imports may rebound, demand from wealthier Asian markets is typically inelastic, and coal-to-gas switching in the region will require prices under USD6 per million British thermal units (MMBtu) — far lower than the level needed to sustain the LNG supply chain.

China’s embrace of gas alternatives may further limit Asia’s capacity to absorb the looming LNG oversupply. In the power sector, the deployment of renewable energy and flexible coal are limiting the role of gas. Meanwhile, a recent heat pump action plan may displace gas from buildings, while electric trucks are emerging as viable alternatives to gas-fired counterparts in transportation. Restrictions on gas projects in the chemical sector, and policies prioritizing cleaner production methods, will also constrain growth. A pivot in China’s 15th Five-Year Plan may be required to overcome such barriers.

Ultimately, outlooks are not forecasts. Manifesting bullish LNG scenarios into reality will require coordinated policy and market interventions to address major adoption barriers — many of which could persist even in lower price environments.

For many key LNG growth markets in Asia, the obstacles may prove too onerous to overcome.