Risks mount as World Energy Outlook confirms LNG supply glut looms

Key Findings

The International Energy Agency (IEA)’s World Energy Outlook 2024 confirms IEEFA’s analysis that global liquefied natural gas (LNG) markets are barrelling towards an unprecedented supply glut.

This supply glut is likely to depress LNG prices well below long-run production costs and represents a major financial risk for the LNG industry, particularly for new LNG projects. An oil glut is likely to present further risks by driving down prices for LNG sold under oil-linked contracts.

Under the IEA’s most conservative transition scenario, aligned with 2.4°C of warming, there is no need for any new LNG projects (beyond existing and under-construction projects) until 2040 at the earliest, with significant oversupply expected before then.

LNG oversupply presents a major risk for the energy transition. Absorbing so much new supply would require new LNG demand, displacing renewable technologies and energy efficiency improvements, thereby slowing the transition beyond a 2.4°C outcome.

The International Energy Agency (IEA)’s World Energy Outlook 2024 points to a challenging decade for the liquefied natural gas (LNG) industry. Surging supply is set to outstrip demand, creating an LNG supply glut that is likely to persist well into the 2030s.

In addition to pushing down prices, the glut will create financial risks for the LNG industry and inhibit the business case for new LNG supply. Absorbing this new supply, and avoiding a prolonged supply glut, would effectively require significant new LNG demand and displacement of renewable energy and energy efficiency, which will have the effect of slowing the energy transition.

LNG markets are heading for an unprecedented supply glut

Russia’s invasion of Ukraine in 2022 coincided with a material fall in Russian gas supply to Europe, which prompted European gas buyers to turn to LNG markets to replace these lost volumes. This created intense competition for LNG, particularly between Europe and Asia, sending LNG prices to record highs. The resultant global energy crisis had a range of outcomes.

On the supply side, a rush of new LNG projects reached final investment decision, in part supported by the high price environment and expectations of continued strong gas and LNG demand. These new projects mean that LNG markets are facing an unprecedented wave of new LNG supply, primarily from Qatar and the US, but also from new LNG-producing countries. In its recent World Energy Outlook, the IEA forecast that global LNG liquefaction capacity will increase by almost 50%, from 580 billion cubic metres (bcm) now to 850 bcm in 2030.

At the same time, LNG buyers in price-sensitive emerging markets have reduced their LNG consumption, with several state-owned utilities also incurring significant financial hits. High and volatile LNG prices also led to LNG gaining a reputation as an expensive, unreliable fuel source, which prompted some buyers to reverse plans centred on greater LNG consumption. For example, Pakistan reversed plans to roll out new LNG-to-power projects, instead looking to new coal generation and renewables, with the country importing 13GW of solar PV capacity in the first half of 2024 alone.

More generally, LNG demand growth remains uncertain, with demand in the mature markets of Europe, Japan and South Korea likely to decline in coming years. In emerging markets, where the LNG industry anticipates rapid and sustained growth, a range of barriers could inhibit structural LNG demand growth.

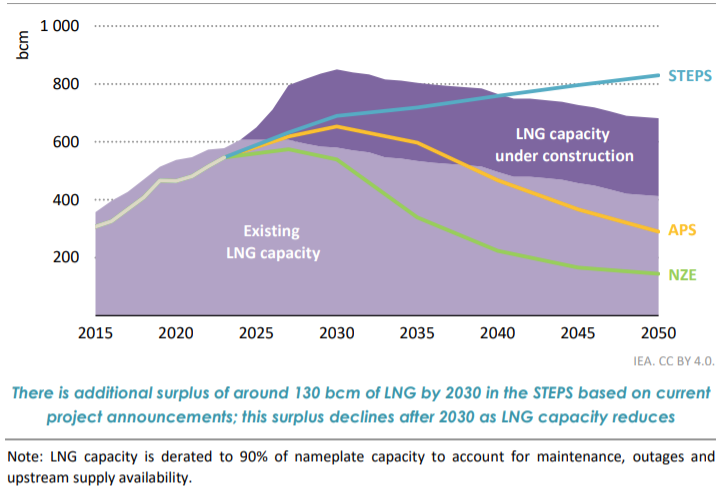

In light of surging LNG supply and weak demand growth, the IEA’s World Energy Outlook 2024 forecasts that LNG markets will see a major supply glut in coming years. The IEA forecasts that by 2030, LNG markets will have surplus LNG liquefaction capacity of 130 bcm under its Stated Policies Scenario (STEPS, aligned with 2.4°C of warming), equivalent to about 15% of global liquefaction capacity (Figure 1). The IEA also anticipates larger LNG liquefaction surpluses under the more ambitious Announced Pledges Scenario (APS, aligned with 1.7°C of warming) and the Net Zero Emissions Scenario (NZE, aligned with 1.5°C of warming).

Figure 1: LNG trade by scenario relative to existing and under-construction export capacity to 2050

Source: IEA. World Energy Outlook 2024. October 2024. Page 180.

The IEA’s analysis clearly suggests the LNG glut will persist into the 2030s, with no new LNG supply required until 2040 at the earliest under STEPS. Under the APS and NZE scenarios, there is no need for any additional LNG supply at all, with existing and under-construction capacity sufficient to fully meet future global LNG demand.

Absorbing additional supply will require new LNG demand, jeopardising the energy transition

The looming supply glut is likely to depress LNG prices, which in turn may trigger a demand response as LNG becomes more competitive with other energy sources. The past year has seen some buyers return to the LNG market as prices have moderated from record highs in 2022.

The scale of new LNG capacity means that material additional demand would need to emerge if a supply glut is to be avoided, a point noted by the IEA in the World Energy Outlook 2024. Specifically, the IEA’s analysis suggests global LNG demand would need to be about 18% higher in 2030 than forecast even under the STEPS scenario.

However, there is likely to be limited scope for LNG demand to grow further without impacting on the energy transition. The IEA notes that its LNG demand growth forecast under STEPS is effectively “constrained by the projected scale of renewables deployment, a gradual reduction in the potential for increased coal-to-gas switching as coal plants retire, and faster efficiency gains and electrification rates than in the past”.

The IEA adds that: “If gas markets are to absorb all the prospective new LNG supply and to continue to grow past 2030, this would require some combination of even lower clearing prices, higher electricity demand and slower energy transitions – with less wind and solar, lower rates of building efficiency improvements, and fewer heat pumps – than projected in the STEPS.”

The IEA notes that extra coal-to-gas switching could arise if LNG prices fall enough, suggesting that “an additional 300 bcm above the level of the potential assumed in the STEPS would be opened to possible switching, primarily in China, India and Southeast Asia”.

In other words, gas demand is likely to rise primarily if global markets see slower progress on the energy transition, creating a larger role for gas.

That said, IEEFA’s analysis has found that in China, one of the world’s largest LNG importers, coal use in electricity generation is being displaced by renewables rather than gas due to the relative expense of LNG, with recent policies aiming to control coal-to-gas switching.

Generally, the relatively high cost of LNG may inhibit further demand growth, particularly in price-sensitive emerging markets and in the context of rapidly falling solar photovoltaic (PV) prices. The IEA’s analysis, for instance, suggests that: “Gas-importing emerging and developing economies would generally need prices at around USD 3-5/MBtu [million British thermal units] to make gas attractive as a large-scale alternative to renewables and coal.” However, the analysis finds that total supply costs for new projects are well above these levels, with most projects likely to require a price of USD8/MBtu to cover operating costs and earn a return on capital.

There remains uncertainty about future LNG demand. However, the IEA’s analysis clearly points to the likelihood of a prolonged LNG glut.

The LNG industry faces significant financial risks

The looming LNG glut means the industry is facing significant financial risks, with more costly LNG producers potentially facing the choice of underutilising their export facilities during the glut, or selling LNG at prices too low to earn an economic return on their significant capital investments.

It is widely expected that LNG prices will fall in coming years, with increasing competition among sellers already putting downward pressure on LNG contract pricing. The IEA notes this likelihood, suggesting that LNG projects that have already recovered their capital costs and have access to low-cost feedgas will be relatively well positioned to effectively compete.

LNG market participants also anticipate that LNG spot prices will fall in coming years, with downward pressure on spot prices potentially magnified by the large volumes of uncontracted LNG likely to be sold into LNG markets. The IEA’s World Energy Outlook 2024 notes that about one third of LNG capacity under construction remains uncontracted, which is likely to be sold into spot markets if not sold under new contracts. IEEFA’s previous analysis also shows that Qatar, one of the largest LNG suppliers globally, will have increasing volumes of uncontracted LNG between 2027 and 2040 due to the expiry of existing LNG contracts.

Many LNG exporters also face financial risks under existing contracts that have oil price mechanisms (which effectively tie the price for LNG under contract to oil prices, typically Brent or the Japan Crude Cocktail). The possibility of an oil glut by the end of the decade, as outlined in the IEA’s World Energy Outlook 2024, could drive down oil prices and oil-linked LNG prices.

These price risks could see some LNG producer returns fall regardless of how they sell their LNG.

There is also a risk that the LNG glut leads to lower LNG plant utilisation for projects that are not well positioned to compete in a low-price environment. The IEA, for instance, forecasts that LNG projects will have an average utilisation rate of about 75% between 2025-35 under STEPS, with this rate even lower under the APS and NZE scenarios. Lower utilisation would similarly reduce LNG project returns and could see some projects not earn a sufficient return on capital. The IEA notes that about 40% of existing projects are yet to recover their capital costs, and under APS, about 30% of under-construction capacity is unlikely to recover capital.

In contrast, higher-than-forecast utilisation could occur if new gas fields (such as Browse and Beetaloo) are developed to backfill existing LNG plants. While this might improve utilisation and capital recovery at some LNG projects, it would also worsen and potentially prolong the supply glut, further depressing prices and lowering returns across the industry.

Conclusion

The IEA’s analysis highlights the risks that LNG market fundamentals pose for the LNG industry, particularly for new projects. A glut of new supply will drive down LNG exporter returns while also potentially creating risks for the energy transition.

It also confirms, however, that even under the IEA’s most conservative transition scenario, there will be no need for any new LNG capacity until 2040 at the earliest. Any additional capacity, including from the US, is likely to further exacerbate the glut.

Under more ambitious transition scenarios that reflect climate commitments already made, there will be no need for any new LNG capacity at all, with supply anticipated to outstrip demand out to 2050. Under these scenarios, some LNG exporters are unlikely to earn a return on their capital investments, and returns to LNG exporters generally face significant downside risks.

This may leave the LNG industry at an impasse, with prices either too high to trigger new demand, or so low that they inhibit new supply and drive large financial losses (at least during the early 2030s). In light of the worsening industry outlook, and the corresponding impacts on the transition, it is vital that the LNG industry carefully consider the need for any new LNG supply.