Key Findings

Global liquefied natural gas (LNG) markets are heading towards a supply glut due to unprecedented increases in supply from low-cost producers and weak demand growth.

Australian LNG producers are likely to become increasingly exposed to LNG spot markets from 2030, which will be awash with uncontracted gas from low-cost Qatar and surplus LNG from portfolio players and major buyers.

Low volumes of economic reserves and high production costs could see some Australian LNG infrastructure mothballed before the end of its useful life, resulting in decommissioning costs being brought forward.

Executive Summary

Australia’s LNG sector underwent a wave of growth from 2012 to 2017, which saw Australia become the world’s largest LNG exporter. This is remarkable given the remoteness and relatively small scale of Australia’s gas reserves, which are significantly lower than the reserves held by other major LNG exporters.

A looming supply glut meets shifting demand

From 2025 to 2028, LNG markets are set to increase supply by a staggering 40%. This glut of new, low-cost LNG supply will intensify competition between LNG exporters and traders and place downward pressure on LNG prices.

This coincides with a fundamental shift in demand in LNG markets, with demand in mature markets either falling or set to soon fall, leading to the LNG industry pinning its future on significant new demand in emerging markets. IEEFA, in line with the International Energy Agency (IEA), expects more moderate demand increases in those markets, given the range of barriers to increased structural LNG demand in emerging markets and the competition faced by LNG in power generation from renewable energy and coal.

In emerging markets, government policy is already curbing the rollout of gas generation (coinciding with a greater focus on renewable energy). In China, recent energy policy has heralded a softening of the outlook for gas consumption and a greater emphasis on domestic gas production and on pipeline imports rather than LNG imports. In Vietnam and the Philippines, persistent issues with approval processes and power purchase agreements for LNG-to-power have delayed the commissioning of new gas generation and reduced anticipated LNG demand. Recent high prices have also affected LNG demand, particularly in the price-sensitive markets of South and Southeast Asia, with state-owned utilities incurring material financial costs due to higher prices. At the same time, despite the adverse effects of recent high LNG spot prices, buyers in emerging markets outside China are yet to contract significant new LNG volumes.

Growing competition from gas looking for end buyers

Lower-than-anticipated LNG demand and an oversupply due to the massive wave of new investment will create challenging market conditions for Australian LNG exporters. While Australian LNG exporters presently sell about three quarters of their LNG under long-term sale and purchase agreements (SPAs), many of these agreements are set to expire in coming years. This may increase exporters’ exposure to spot markets if they are unable to lock in new LNG SPAs in the face of increasing competition, or will put them in competition with other suppliers for contract extensions. In the absence of new LNG SPAs, Australia’s uncontracted LNG volumes could represent 34 million tonnes per annum (MTPA) by 2030 and 89MTPA by 2040.

LNG markets are likely to soon be awash with uncontracted LNG, particularly from lowest-cost producer Qatar. By 2030, Qatar could potentially have up to 59MTPA of uncontracted LNG capacity. LNG portfolio traders are adding to the stock of uncontracted LNG – these traders have purchased significant volumes of impending new supply under long-term SPAs, which they have not yet sold to end users. The IEA estimates that about half of the LNG supply held by portfolio traders remains uncontracted, representing more than 100MTPA in 2025.

Major LNG buyers are also increasingly facing the problem of surplus LNG supply. IEEFA recently found that Japan’s four largest buyers also have surplus supply, which they are increasingly looking to sell into emerging markets in South and Southeast Asia. Declining demand and gas reduction targets could also lead to nearly 30MTPA surplus LNG in Europe. The IEA also projects that China could be overcontracted by 2030 with existing LNG contracts.

LNG buyers could therefore turn into sellers. Japanese companies already sold more LNG into third countries from 2020-22 than they purchased from Australia. These LNG buyers, who purchase significant quantities of LNG from Australia, have undertaken investments in gas and LNG infrastructure in third countries to drive demand growth for LNG. Government targets suggests that Japan could be selling nearly 50MTPA of LNG by 2030, turning Japan from one of Australia’s largest LNG buyers to potentially one of its largest competitors.

The impending supply glut is also placing pressure on LNG contract prices, with a range of buyers seeking to either reopen negotiations on pricing or seek lower pricing. Market participants, as well as IEEFA, expect that future LNG spot prices will fall due to LNG oversupply, which could lower the returns to Australian LNG producers who are exposed to spot market prices. This includes contracted and uncontracted LNG volumes, with Santos and Mitsubishi having a 10-year LNG SPA for 1.5Mpta, with pricing based on the Asian LNG spot market price.

Uncompetitive costs of production

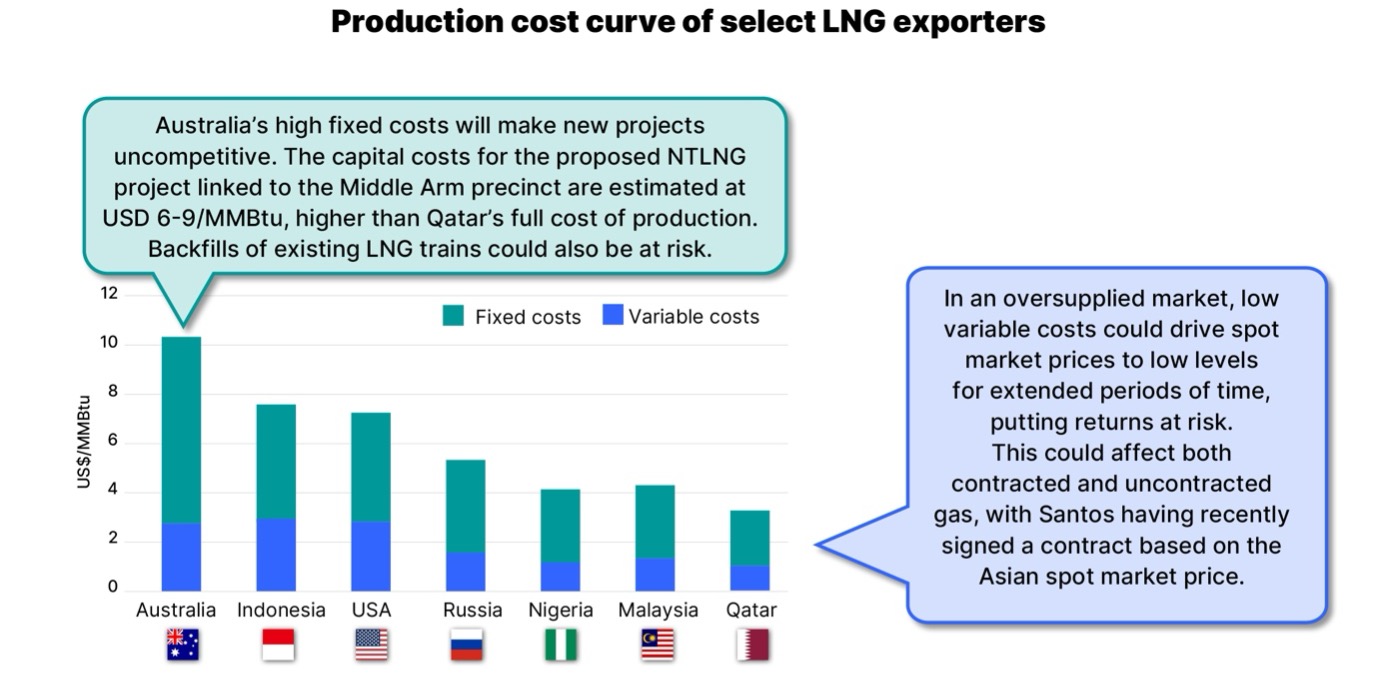

These challenges, along with Australia’s record of high capital costs (and poor shareholder returns) for existing LNG facilities, means that Australia is unlikely to see any new LNG projects reach final investment decision (FID). There is presently only one proposed new LNG project, junior explorer Tamboran Resources’ NTLNG project, which IEEFA previously estimated would have capital costs between USD6.96-10.44 billion, equating to a cost of about USD6-9 per metric million British thermal units (MMBtu). However, in IEEFA’s opinion, the NTLNG project is likely to struggle to attract sufficient investment to reach FID given Australia’s high-cost reputation and the looming glut in new low-cost supply. This is in line with the Australian government’s Future Gas Strategy analytical report, which assessed that established Australian production would be more competitive than prospective new sites in the current market.

Existing LNG projects may also face cost pressures, with development of some new gas fields to backfill existing LNG projects potentially having higher costs than overseas, particularly Qatar. For example, Santos’s Barossa development was estimated to have a cost of about USD5.5/MMBtu, but delays to the project and the requirement to offset all reservoir CO2 emissions are likely to have escalated costs.

These costs are much higher than they are in Qatar, which has an estimated LNG marginal cost of about USD2/MMBtu (and a long-term marginal cost of USD4/MMBtu). If Qatar’s revenue from its production of liquids (which are extracted along with gas) is accounted for, Qatar’s marginal LNG production costs are effectively negative. The differential in shipping costs (to North Asia) between Qatar and Australia is unlikely to make a difference – for example, IEEFA estimates the difference in shipping costs in mid-May 2024 to be less than USD0.30/MMBtu.

Source: IEEFA, Future Gas Strategy analytical report

Australian LNG is entering a declining period

Australia’s high costs and impending supply glut are likely to impact on the financial business case for further LNG developments, whether greenfield LNG plants or backfill projects, which could see Australia’s export volumes decline in coming years. Low expenditure and declining gas reserves will also constrain Australia’s future LNG exports, particularly from 2030 onwards.

Moreover, tightening domestic supply conditions and a need to maintain social licence will likely see gas that could be exported increasingly diverted to the domestic market. LNG exporters may also choose to prioritise domestic supply over discretionary LNG spot sales if domestic prices are higher than LNG spot prices. This could lead to mothballing of LNG and gas infrastructure before the end of its useful life, undermining the returns anticipated at the time of FID. Early retirement of infrastructure would also bring forward decommissioning obligations, with substantial costs.

In addition to creating financial risks for LNG exporters, these factors point to a gloomy future for Australia’s LNG export sector, with the volume and value of Australia’s LNG exports likely to materially decline over the next decade. It is vital that Australia shifts its focus to developing new export markets in which Australia is likely to have a comparative advantage.