Uncertainty looming for Australia’s LNG industry

Global supply gluts, weak demand and growing competition to hit exports and tighten returns on investment

Key Takeaways:

Global liquefied natural gas (LNG) markets are heading towards a supply glut due to unprecedented increases in supply from low-cost producers and weak demand growth.

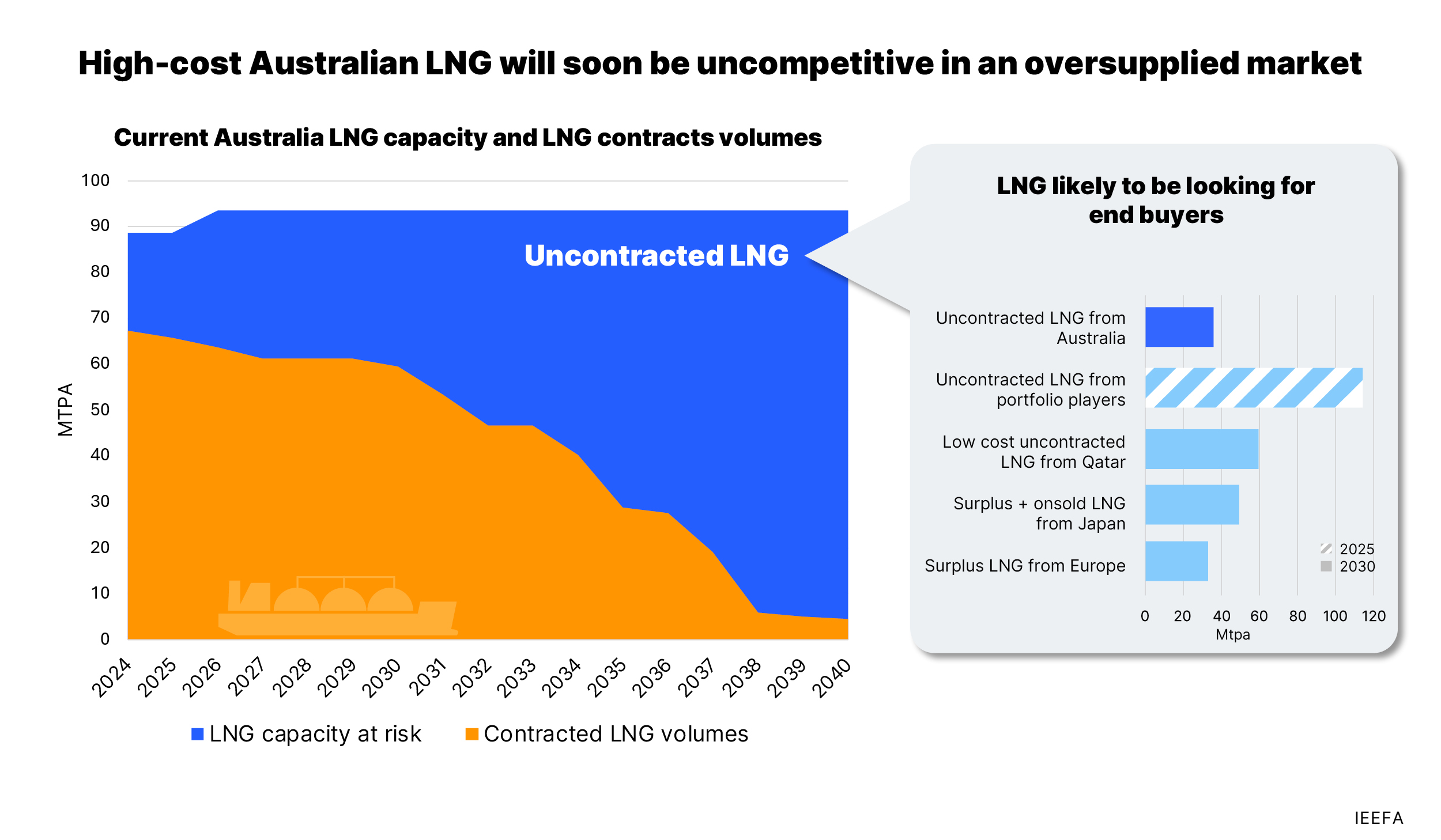

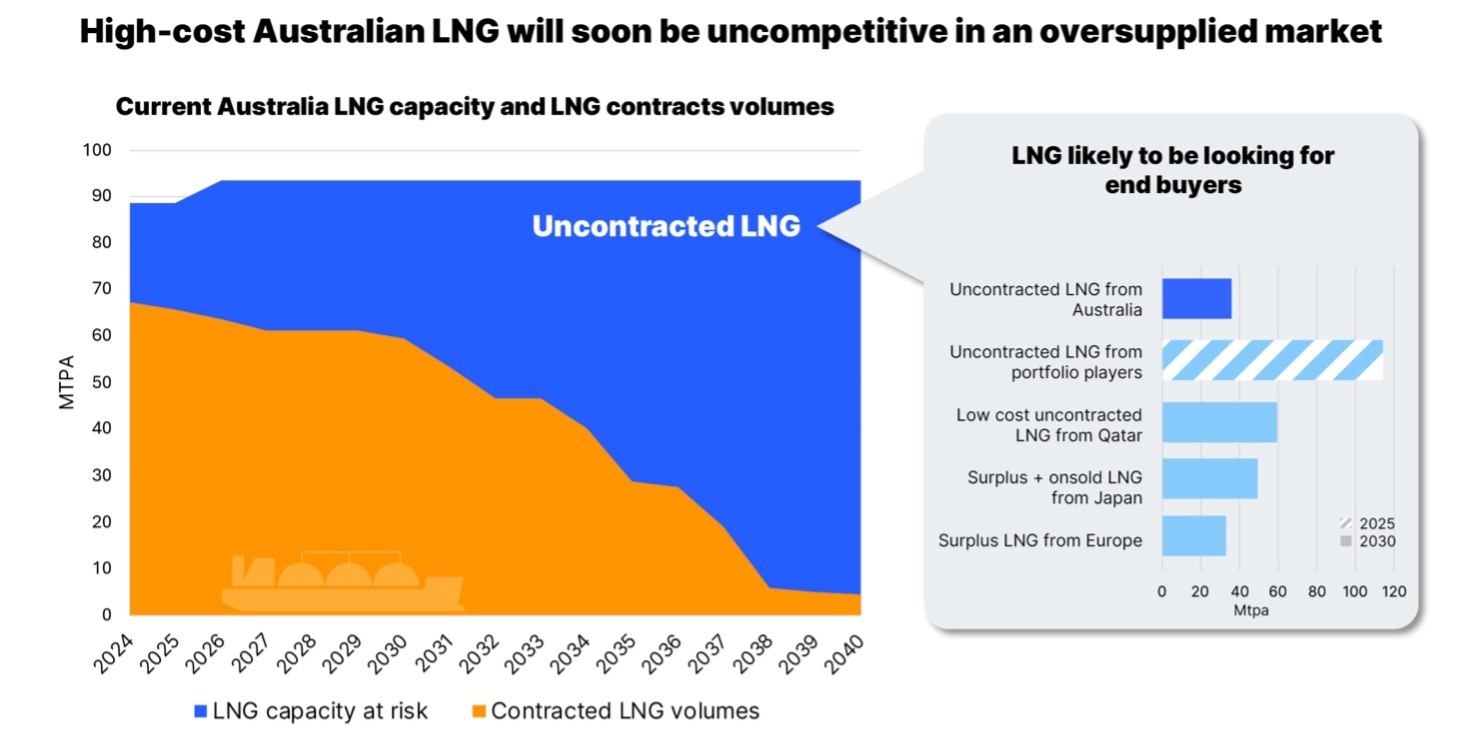

Australian LNG producers are likely to become increasingly exposed to LNG spot markets from 2030, which will be awash with uncontracted gas from low-cost Qatar and surplus LNG from portfolio players and major buyers.

Low volumes of economic reserves and high production costs could see some Australian LNG infrastructure mothballed before the end of its useful life, resulting in decommissioning costs being brought forward.

The various financial risks faced by Australian LNG producers could erode the financial returns for existing assets and undermine the business case for new developments.

7 June 2024 - (IEEFA Australia): New research from the Institute for Energy Economics and Financial Analysis (IEEFA) shows that Australia’s liquefied natural gas (LNG) industry faces the looming prospect of dwindling exports and diminishing returns on investment, as global market dynamics undergo a radical shift.

Analysts have identified a looming global LNG supply glut in the next few years, as a wave of investment in new production by low-cost suppliers comes online. Meanwhile, the map of LNG consumption is being redrawn, with demand among established major buyers of Australia’s LNG about to fall or already falling.

IEEFA’s new report, The Future of Australian LNG, examines how these shifts in the global LNG landscape will affect Australian producers and exporters. It presents an outlook where Australia’s LNG industry will go into decline amid tightening competition and slowing demand.

Joshua Runciman, IEEFA’s Lead Analyst, Australian Gas and the report’s co-author, says: “It’s starting to seem a long time since Australia was the world’s largest LNG exporter.

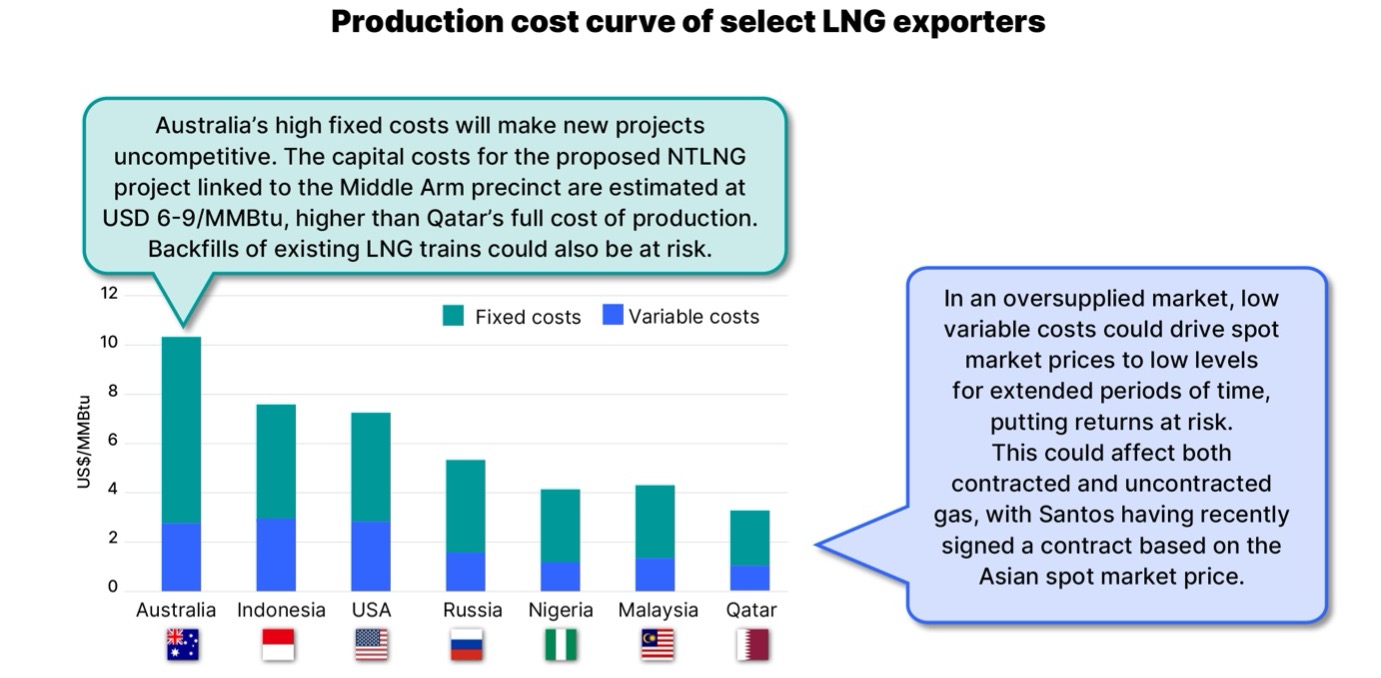

“Between now and 2028, global LNG markets will see a staggering 40% increase in supply, driven by unprecedent investments in new capacity by low-cost suppliers such as Qatar. This will see the market flooded with cheap LNG, leaving Australia’s industry, with its relatively high costs, potentially struggling to compete and remain viable.

“At the same time, key buyers of Australian LNG such as Japan and South Korea are decreasing their LNG consumption as they diversify away from LNG. That leaves emerging markets as the main drivers of demand, but there is considerable uncertainty over how much demand growth we can expect there.”

The situation worsens moving into the 2030s, as the long-term sale and purchase agreements (SPAs) that account for about three quarters of Australia’s LNG exports begin to expire. Australia will face increasing competition to secure extensions on these contracts. If it cannot do so, it will be forced to sell growing volumes of uncontracted LNG capacity into spot markets, where it will need to compete with LNG from Qatar as well as surplus LNG from portfolio players and major buyers.

Kevin Morrison, Energy Finance Analyst, Australian Gas and the report’s co-author, says: “Australian LNG producers are likely to become increasingly exposed to the LNG spot markets from 2030, which by then will be awash with uncontracted gas looking for end buyers.

“It’s widely expected, including by IEEFA, that future LNG spot prices will fall due to oversupply, which could lower the returns to any Australian LNG producers with exposure to spot markets. This could include contracted and uncontracted LNG volumes, with Santos having a contract with pricing based on the Asian LNG spot market price.”

These challenges, along with high capital costs, mean Australia is unlikely to see any new LNG projects reach final investment decision (FID), with for example the NTLNG project linked to the Middle Arm precinct having capital costs materially higher than the total cost of production from Qatar LNG. The development of new gas fields to backfill existing LNG trains could also be at risk, while existing LNG projects may also face cost pressures. Moreover, tightening domestic supply conditions and a need to maintain social licence will likely see gas that could be exported increasingly diverted to the domestic market.

As a result of all these factors, Australia’s export volumes are likely to decline in the coming years. This could lead to the mothballing of LNG and gas infrastructure before the end of its useful life, undermining the returns investors had initially anticipated. Early retirement of infrastructure would also bring forward decommissioning obligations, and substantial costs.

Runciman adds: “The overall picture that comes out of our research is that Australian LNG faces a gloomy future, with it now entering a period of sustained decline. It is vital that Australia shifts its focus to developing new export markets in which Australia is likely to have a comparative advantage.”

Read the report: The future of Australian LNG

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contacts: Joshua Runciman, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)