Global gas turbine shortages add to LNG challenges in Vietnam and the Philippines

Download Full Report

View Press Release

Key Findings

The world’s largest gas turbine manufacturers — GE Vernova, Siemens Energy, and Mitsubishi Heavy Industries (MHI) — face extensive production backlogs and are advising developers of new gas-fired power projects to plan seven to eight years ahead for turbine procurement. Manufacturing capacity expansions are unlikely to reduce wait times or costs for gas turbines in the medium term.

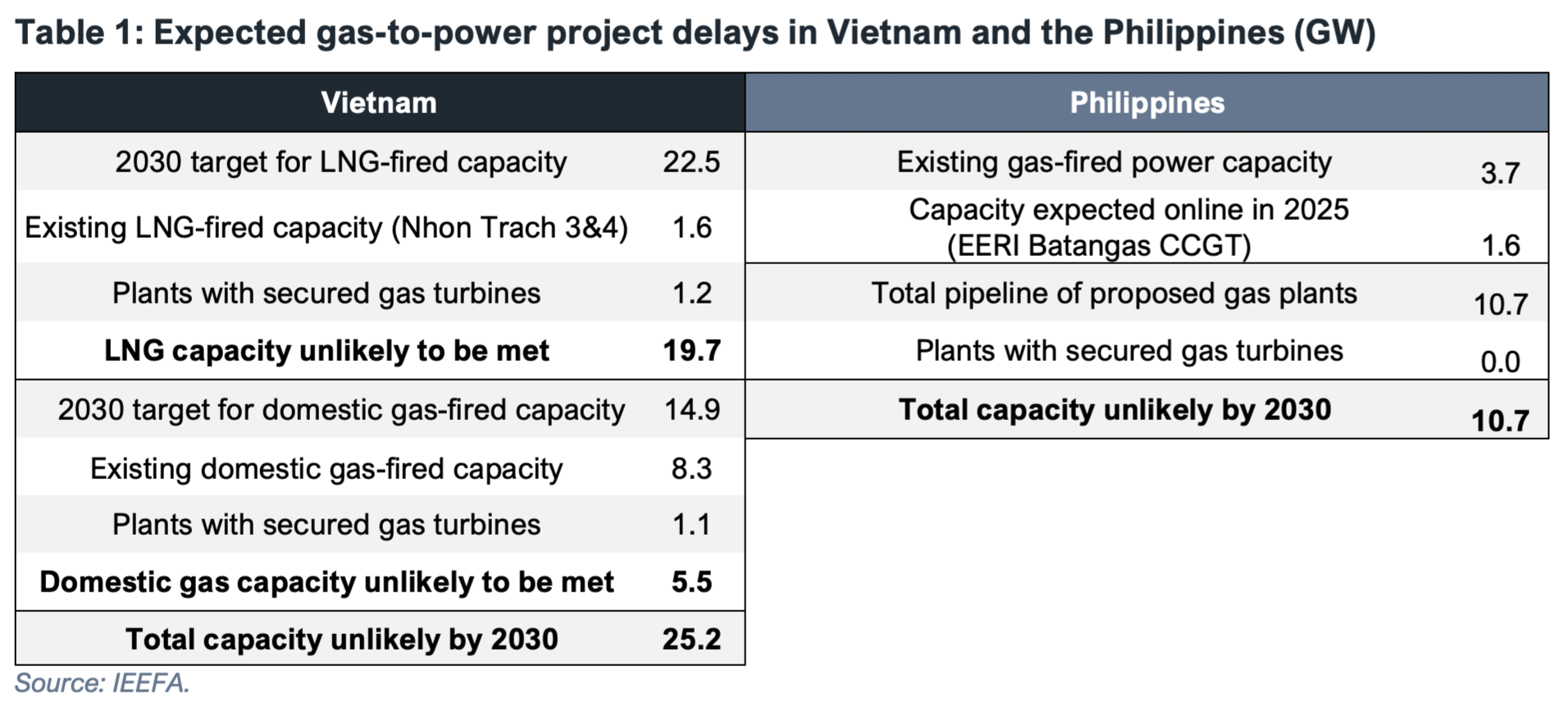

Turbine bottlenecks add to a lengthy list of regulatory and bankability challenges delaying gas and liquefied natural gas (LNG) fired power plants in Vietnam and the Philippines. As a result, Vietnam is likely to miss its 2030 targets for domestic gas and LNG-fired power capacity by a combined 25.2 gigawatts (GW). Two projects have disclosed turbine contracts but still face other significant barriers to financial closure.

The Philippines has one LNG-to-power project expected to begin fully operating in 2025 but is unlikely to bring another LNG-fired power plant online this decade. All the country’s remaining projects, with a combined capacity of 10.7GW, remain in early development stages and are unlikely to have secured gas turbine orders.

Delays for LNG-to-power projects extend opportunities for the growth of low-cost renewables and storage, reducing the long-term need for LNG. Although the LNG industry often cites Asia’s power sector as a major demand driver, gas turbine constraints present yet another challenge to rapid LNG demand growth forecasts for key Asian economies.

Executive Summary

Plans to build significant new gas-fired power capacity in the Philippines and Vietnam are running headfirst into a global gas turbine shortage, likely extending multi-year project delays and putting both countries off-track to meet gas-to-power development targets.

Existing gas projects in Vietnam and the Philippines have relied exclusively on turbines from Siemens Energy, Mitsubishi Heavy Industries (MHI), and GE Vernova — the world’s three largest gas turbine manufacturers that together have accounted for roughly 90% of the global market over the last decade. Despite recent announcements to boost manufacturing capacity1, all three companies are currently reporting extensive backlogs and delivery timelines of up to eight years.

Ongoing shortages are frequently discussed in a Western context, with little coverage of the implications for emerging Asian economies. However, for the 35.9 gigawatts (GW) of gas projects still in early development stages in Vietnam and the Philippines (Table 1), turbine backlogs will likely increase project costs, and add to an already lengthy list of regulatory, legal, and financial challenges facing gas-to-power project developers. The Institute for Energy Economics and Financial Analysis (IEEFA) expects that no new liquefied natural gas (LNG) fired power plants will come online in the Philippines this decade. While two projects in Vietnam have likely secured turbines, they still lack key contracts necessary for financial close.

1 Bloomberg. Mitsubishi Heavy to Double Turbine Capacity as Demand Soars. 31 August 2025.