The transition to renewables is unstoppable

Renewable energy and dispatchable battery storage are economically transitioning the power sector away from fossil fuels.

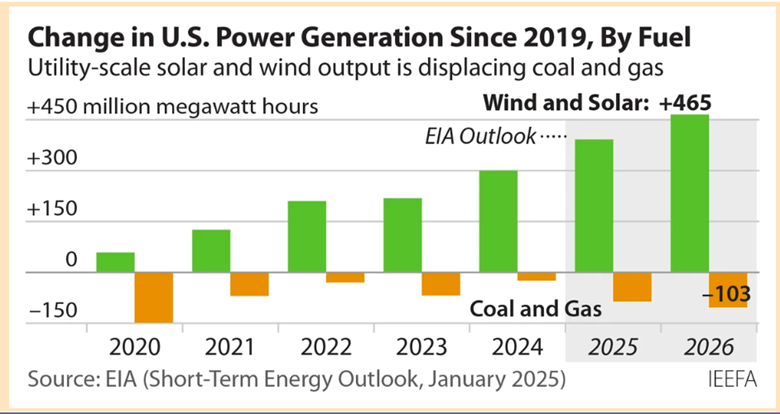

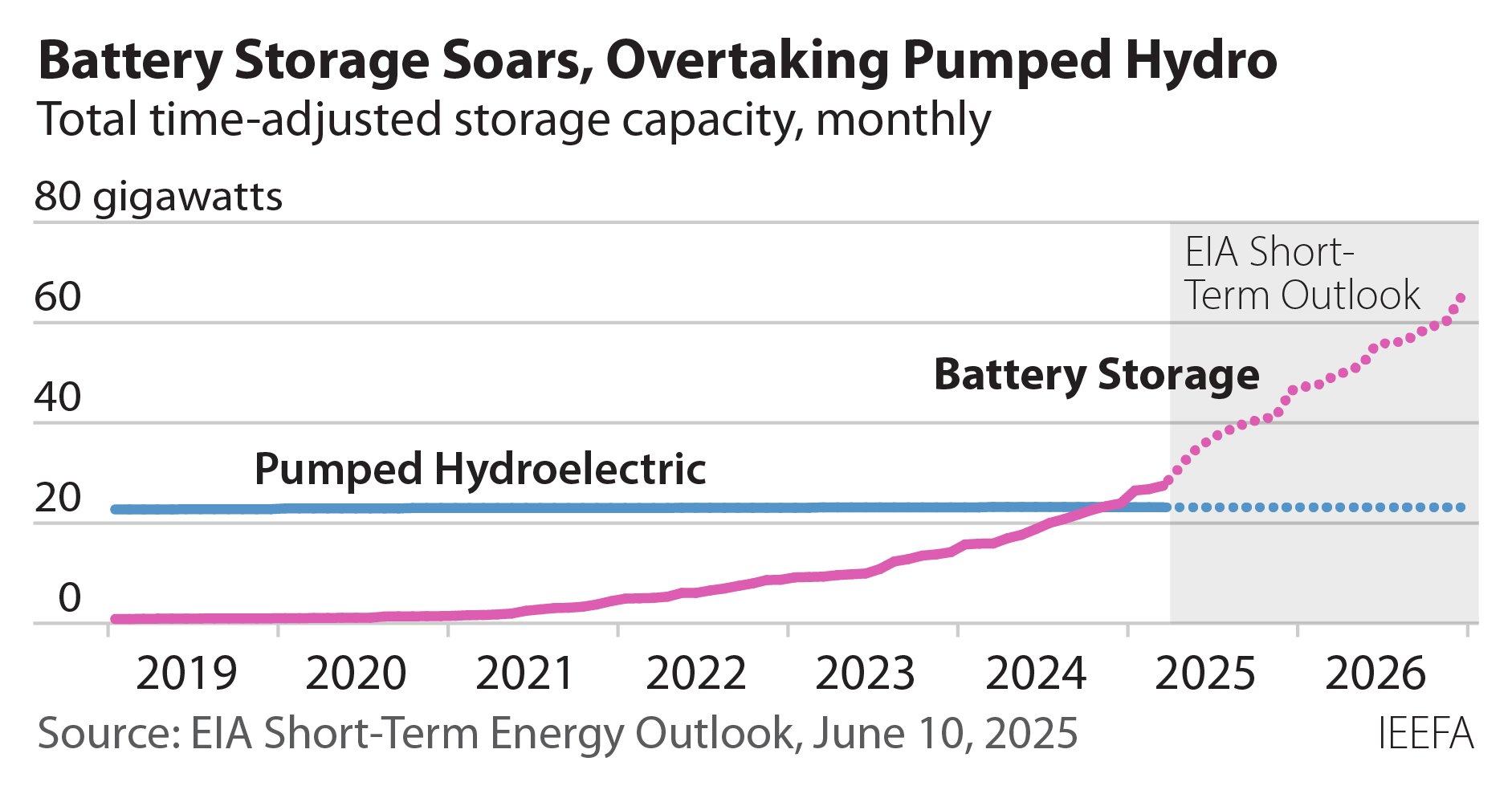

The U.S. energy transition is moving faster than most realize. The power sector is not just moving away from coal; it is shifting away from fossil fuels entirely. IEEFA’s research on the energy transition shows that renewable energy is growing fast enough to both meet rising national power demand and reduce fossil fuel use. Even with heat waves pummeling states like California and Texas, solar, wind, and dispatchable battery storage are reliably and economically transitioning the grid away from fossil fuels.

While renewables are on the rise, coal in the U.S. is in decline. Coal’s role in the U.S. generation system has fallen sharply, and IEEFA believes that trend is irreversible. The long-term move away from coal generation has been remarkably consistent, averaging about 10,000 megawatts of capacity closures annually.

Renewables and dispatchable battery storage in the electricity market

IEEFA’s research has consistently shown that strong demand growth and a renewable energy transition can go hand in hand. According to the U.S. Energy Information Administration’s hourly grid monitor, total U.S. generation from utility-scale wind and solar has increased 298.8 million megawatt-hours since 2019, easily exceeding the growth in overall U.S. power demand.

IEEFA has shown that Texas in particular provides an excellent example of a rapidly transitioning energy grid. The growth in solar generation, coupled with the system’s existing wind capacity, is reshaping the ERCOT grid, which supplies 90% of the load in Texas—even as it continues to grow. In March of 2024, for example, solar generation topped coal’s output for the first time in any month. In addition to solar’s growth, the rapid development of dispatchable battery storage capacity within ERCOT has added greatly to system reliability, even with demand increases due to heat waves in the summer of 2024.

Solar has played a significant role in the energy transition in Puerto Rico as well. Residents and businesses have moved rapidly to install rooftop solar and storage in recent years to improve their resiliency in the face of an unreliable power system.

The coal industry is in decline

While renewables and dispatchable battery storage are taking hold in the electricity market, the coal industry is clearly in structural decline. Based on current announcements and research, IEEFA expects operating coal capacity to continue its steady decline for the remainder of the decade, pushing the total down to about 112,000 MW in 2030. In 2024, IEEFA reported on the planned closure of the last coal plant in New England, marking a significant milestone in the region’s energy transition. Coal closures continue to sweep the Southeast, and solar continues to compete with coal in Texas, topping coal’s output for the first time in any month in March of 2024.

Much of the currently operating coal capacity is also nearing expected operational lifespans. Even remaining coal plants are likely to operate significantly less frequently, continuing another decade-plus trend that has seen the capacity factor at operating coal plants fall steadily since 2011.

Unproven technologies could become a distraction in the transition to reliable renewables

Technologies such as carbon capture and sequestration (CCS), nuclear, including small modular reactors (SMRs), and blue hydrogen are often presented as solutions for cutting CO2 emissions. However, IEEFA’s research has shown that they are economically and technologically risky, and often extend a lifeline to the fossil fuel industry without significant carbon-reduction benefits.

Carbon Capture and Storage (CCS)

The Pathways project in Alberta is an example of how large-scale public investment in CCS is often misguided, as the technology has struggled to achieve meaningful emissions reductions or prove its long-term viability.

Even before it was shuttered in 2022, IEEFA reported on the environmental and financial risks of retrofitting the San Juan Generating Station in New Mexico—risks that ultimately led to the stopping of the project and the demolition of the power plant.

IEEFA also has analyzed the unaccounted-for methane emissions at proposed carbon capture projects, highlighting misleading promises of the technology. Taxpayers could wind up footing the bill for costly projects that promote, rather than contain, greenhouse gas emissions.

Carbon capture at Boundary Dam 3 in Saskatchewan has been an underperforming failure. Despite touting a long-term CO2 capture rate of just 57% (in contrast to the promised 90%), CCS proponents still make false claims about how well carbon capture has worked at Boundary Dam.

Nuclear Energy and SMRs

Small modular reactors are too expensive, too slow to build, and too risky to play a significant role in transitioning from fossil fuels in the coming 10-15 years. IEEFA argues that continued investment in SMRs will take resources away from carbon-free and lower-cost renewable technologies that are available today.

Although nuclear energy has the potential to curb carbon dioxide emissions and produce large amounts of energy, its advantages are overshadowed by significant financial and technological risks. Nuclear advocates often claim that the costs of nuclear reactors fall after a first design, but research has shown that the costs of successive nuclear projects are more expensive than the original project. This often means bad news for ratepayers, as they must pick up the tab for rising construction costs.

In addition to already inexpensive and reliable solar, wind, and dispatchable battery storage resources, IEEFA has shown that geothermal resources can also offer an alternative to risky, costly nuclear projects.

Energy Transition Updates

A new report found renewable energy accounts for the largest sources of power generation in the Texas power grid. Data from the Electric Reliability Council of Texas, or ERCOT, showed wind, solar and battery storage outpaced natural gas, coal and nuclear as the top producers during the first six months of 2025. Dennis Wamsted, energy analyst at the Institute for Energy Economics and Financial Analysis, said renewables are quickly growing in their reliability.

Michigan ratepayers could face tens of millions in costs, though the utility company is trying to spread that cost to other states that use the power Campbell generates.

a new group, West Virginians Against Transmission Injustice, says more information is needed for area residents to be prioritized in the project’s decision-making process. A group member spoke of an Institute for Energy Economics and Financial Analysis study last month that found “West Virginia electricity customers will pay more than $440 million for two proposed transmission lines to support data centers.”

Although Trump made coal central to his first campaign, a coal revival never materialized during his first term. The fracking boom flooded the market with cheap gas and made the United States the world’s largest natural gas producer. Coal power, which is more expensive, was increasingly phased out, and construction of new coal power plants slowed to a halt.

- No more updates to show -