Small Modular Reactors: Still too expensive, too slow and too risky

Download Full Report

View Press Release

Key Findings

Small modular reactors still look to be too expensive, too slow to build, and too risky to play a significant role in transitioning from fossil fuels in the coming 10-15 years.

Investment in SMRs will take resources away from carbon-free and lower-cost renewable technologies that are available today and can push the transition from fossil fuels forward significantly in the coming 10 years.

Experience with operating and proposed SMRs shows that the reactors will continue to cost far more and take much longer to build than promised by proponents.

Regulators, utilities, investors and government officials should embrace the reality that renewables, not SMRs, are the near-term solution to the energy transition.

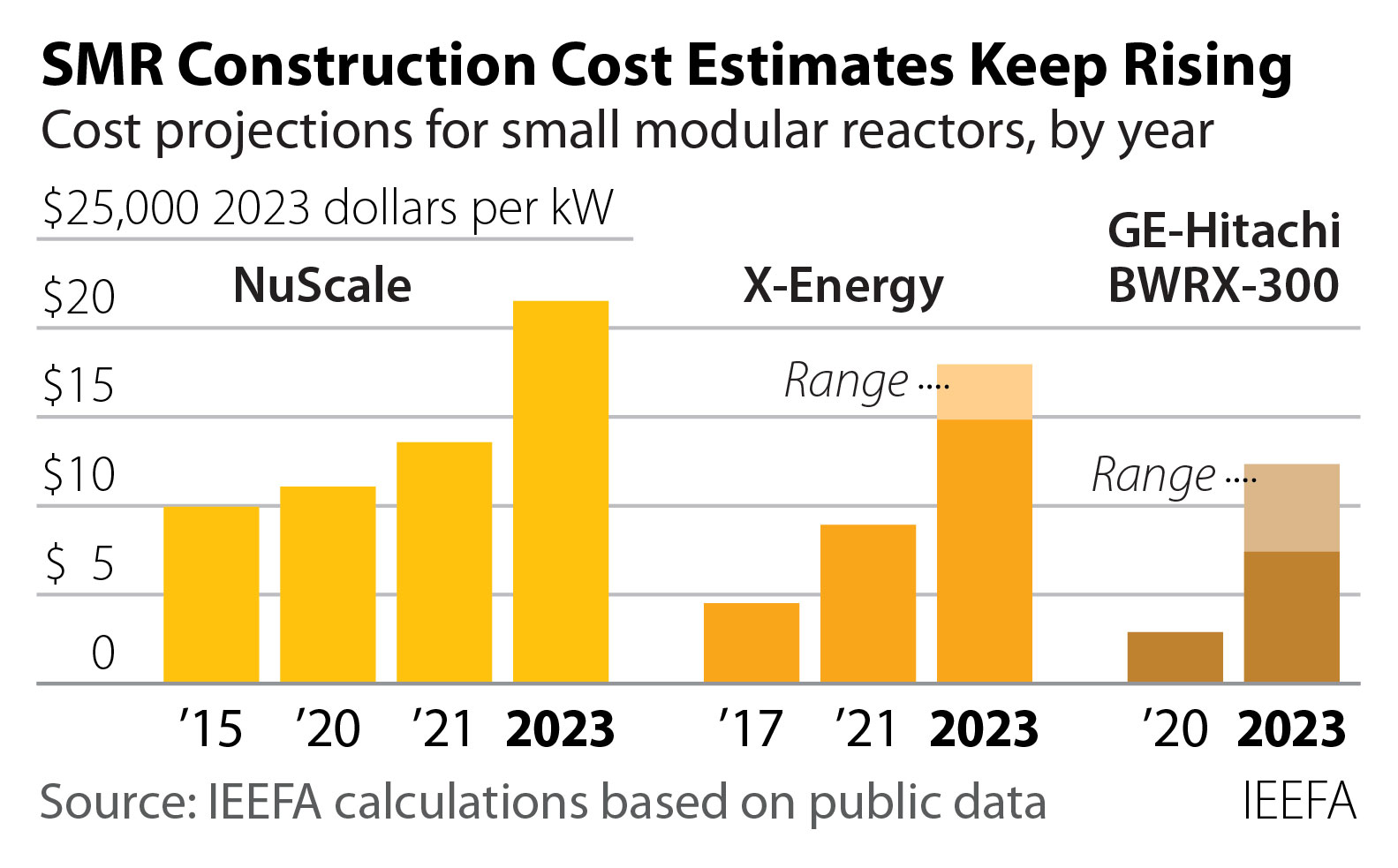

The rhetoric from small modular reactor (SMR) advocates is loud and persistent: This time will be different because the cost overruns and schedule delays that have plagued large reactor construction projects will not be repeated with the new designs. But the few SMRs that have been built (or have been started) paint a different picture—one that looks startingly similar to the past. Significant construction delays are still the norm and costs have continued to climb.

IEEFA has taken a close look at the data available from the four SMRs currently in operation or under construction, as well as new information about projected costs from some of the leading SMR developers in the U.S. The results of the analysis show little has changed from our previous work. SMRs still are too expensive, too slow to build, and too risky to play a significant role in transitioning from fossil fuels in the coming 10 to 15 years.

We believe these findings should serve as a cautionary flag for all energy industry participants. In particular, we recommend that:

- Regulators who will be asked to approve utility or developer-backed SMR proposals should craft restrictions to prevent delays and cost increases from being pushed onto ratepayers.

- Utilities that are considering SMRs should be required to compare the technology’s uncertain costs and completion dates with the known costs and construction timetables of renewable alternatives. Utilities that still opt for the SMR option should be required to put shareholder funds at risk if costs and construction times exceed utility estimates.

- Investors and bankers weighing any SMR proposal should carefully conduct their due diligence. Things will go wrong, imperiling the chances for full recovery of any invested funds.

- State and federal governments should require that estimated SMR construction costs and schedules be publicly available so that utility ratepayers, taxpayers and investors are better able to assess the magnitude of the SMR-related financial risks that they may be forced to bear.

- Finally, it is vital that this debate consider the opportunity costs associated with the SMR push. The dollars invested in SMRs will not be available for use in building out a wind, solar and battery storage resource base. These carbon-free and lower-cost technologies are available today and can push the transition from fossil fuels forward significantly in the coming 10 years—years when SMRs will still be looking for licensing approval and construction funding.