The Energy Transition: 2019-24 and Beyond

Key Findings

The U.S. energy transition is moving faster than most realize. National generation data through the end of 2024 shows this clearly.

The transition in the power sector is not just away from coal; it is a shift away from fossil fuels.

The National Outlook

The U.S. energy transition is moving faster than most realize.

National generation data through the end of 2024 shows this clearly. According to the Energy Information Administration’s hourly grid monitor, total U.S. generation from utility-scale wind and solar has increased 298.8 million megawatt-hours (MWh) since 2019, easily exceeding the growth in overall U.S. power demand, which rose 202.3 million MWh. This shows that renewable energy can not only grow fast enough to meet rising national power demand while also reducing fossil fuel use.

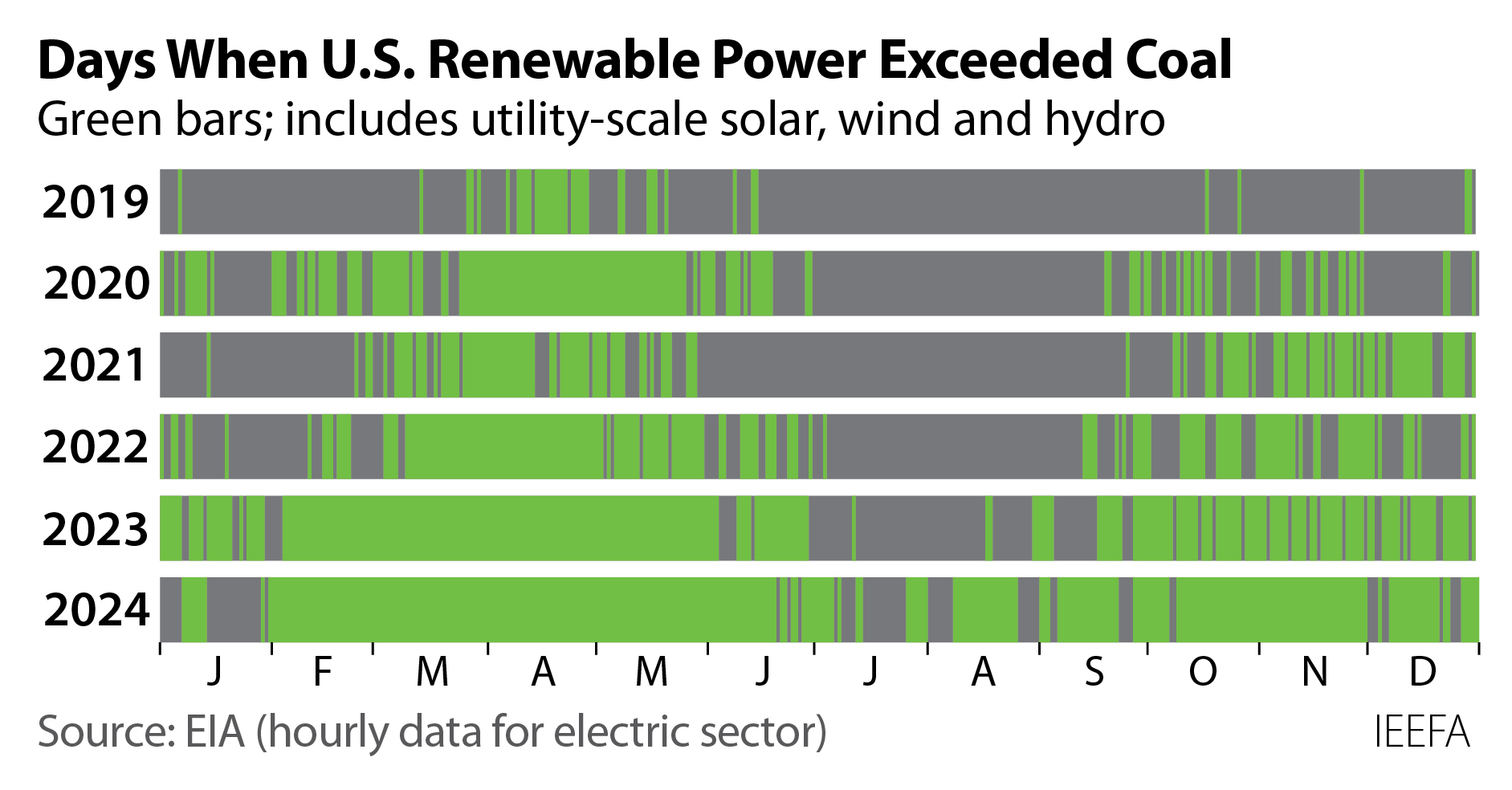

The pace of the transition is perhaps best seen in a day-by-day matchup between coal-fired generation and renewable generation (utility-scale wind, solar and hydropower). In 2019, the power produced by renewables only exceeded coal generation on 38 days. By 2024, roles were almost completely reversed, with renewables out-generating coal on 294 days. With substantial new capacity additions in the works for solar and wind, and more coal-plant retirements coming, it is entirely possible that coal will not top renewable generation on any day by 2026.

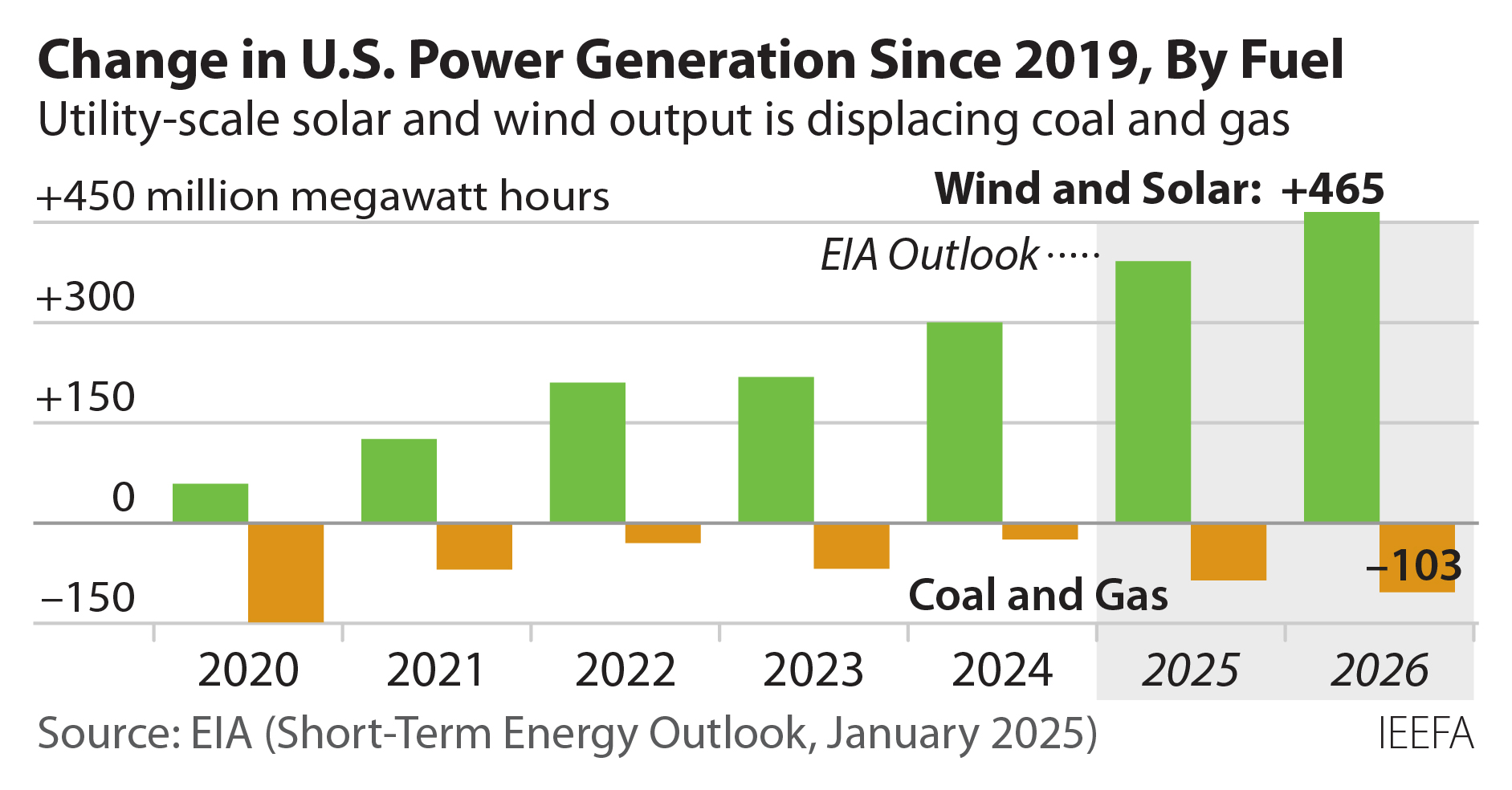

But the transition in the power sector is not just away from coal; it is a shift away from fossil fuels. The surge in renewable generation has continued to cut the total generation market share provided by coal and gas. Those two fossil fuels accounted for two-thirds of U.S. generation a decade ago, but its share has been declining steadily since with the rise in renewables. Fossil fuel’s market share dropped below 60% for the first time during the 2020 COVID-19 pandemic and has continued falling since, ending 2024 at 57.8%. This means that renewables are taking a bigger share of a growing market, a positive sign for a green transition.

Looking ahead, EIA projects that both gas and coal generation will drop through 2026—even as total U.S. demand increases. EIA expects combined coal and gas generation to have fallen by 103 million MWh since 2019. Meanwhile, utility-scale solar and wind output will have grown 465 million MWh, including an increase of 165 million MWh in 2025 and 2026. This will be pushed by a 56.9% increase in solar output, which is expected to top 340 million MWh in 2026, or almost 8% of total U.S. demand. (It’s worth noting that solar did not top 1% of U.S. generation until 2017.)

Texas

As impressive as the national totals are, the transition in Texas, the U.S.’s largest and fastest growing electricity user, highlights the sheer scale of the ongoing transition from fossil fuels to renewable energy.

Full-year data released by the Electric Reliability Council of Texas (ERCOT), which supplies 90% of power demand in the state, shows that wind and solar generated 34.6% of the region’s electricity in 2024. Texas renewables have risen steadily over the past 10 years, almost tripling from 11.7% in 2015.

As with the national numbers, solar has been a new addition to the generation stack. ERCOT did not begin breaking out solar generation data until 2016, and it did not top 1% of the Texas system’s generation until 2019. Since then, however, solar’s growth has soared. In 2024, solar output topped 48 million MWh, a tenfold increase from 2019, and its market share hit 10.4%.

Continued rapid growth is coming in 2025 and 2026. On top of the 29,148 megawatts (MW) of utility-scale solar capacity that was in operation at the end of 2024, ERCOT’s generation queue shows another 25,123 MW in advanced development and expected online by the end of 2026. This growth will soon push solar past coal as the state’s third-largest generation resource (behind gas and wind); the only question is whether that landmark will be reached this year or next.

Coal is not the only target. Together, EIA forecasts that wind and solar will become ERCOT’s largest generation resource in 2026, topping gas. For the year, EIA projects that wind and solar generation will total 200.9 million MWh and account for 40.1% of total ERCOT demand; gas generation is forecast to total 194.6 million MWh (38.9% of demand).

This would be a monumental shift in a region where either coal or gas has always been the leading generation resource.

Wind and solar’s march to the top spot is even more remarkable given the sharp increase in total ERCOT demand in recent years. Since 2019, total ERCOT generation has risen 77.4 million MWh, a 20.2% increase. Wind and solar have supplied that entire increase, with their combined generation climbing 78.8 million MWh during the period. In other words, in the fastest-growing power market in the nation, wind and solar generation are growing even faster than demand.

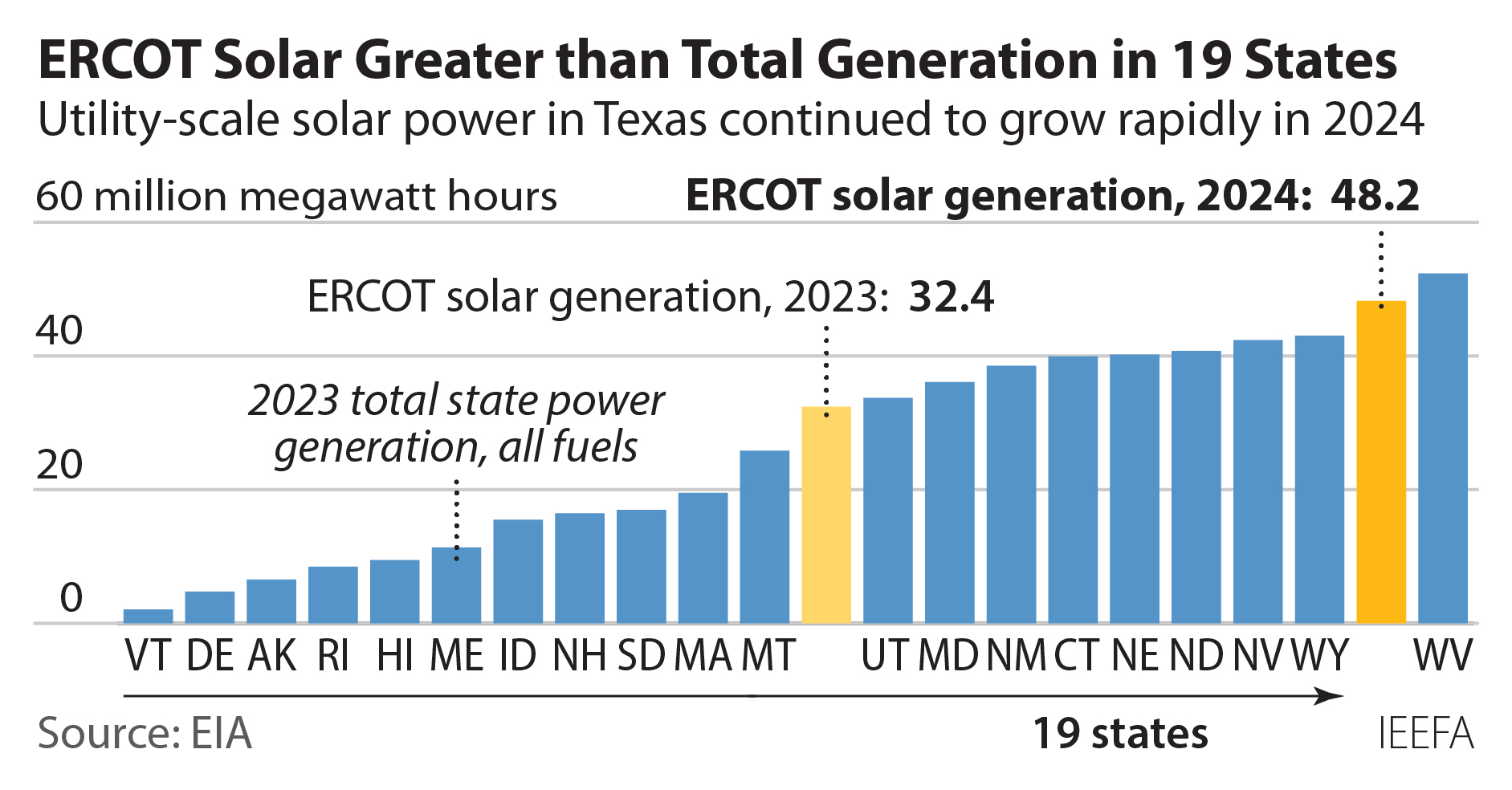

The scope of the Texas transition is evident in a chart showing the rapid growth in ERCOT’s solar generation. The 48 million MWh generated in 2024 would have been higher than the total electric generation in 19 states in 2023.[1] By comparison, ERCOT solar generation in 2019, which was just 4.4 million MWh, would only have generated more than one state. Rapid renewable generation increases are clearly possible.

Battery Storage

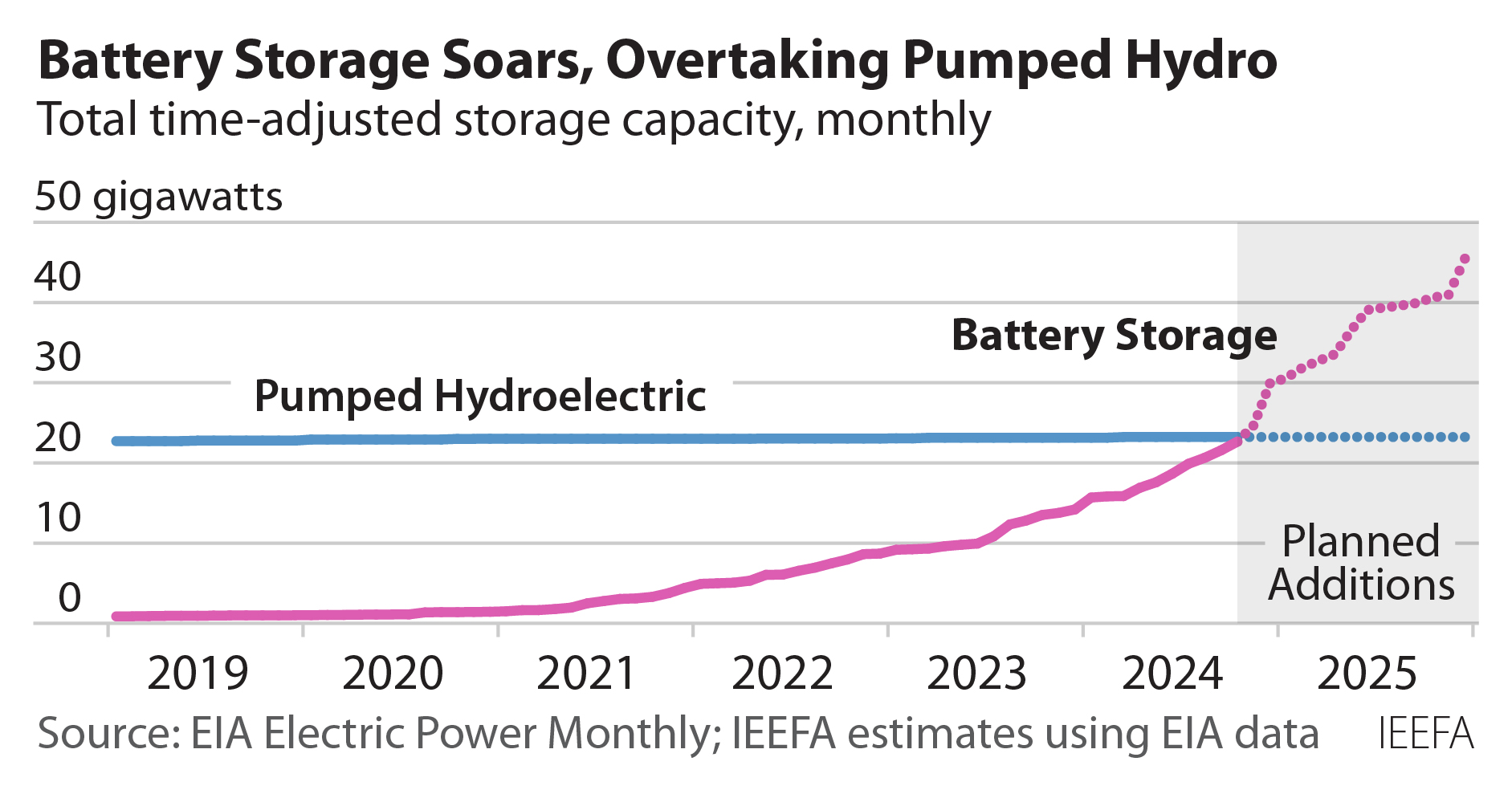

Battery storage is a key technology helping to speed the transition away from fossil fuels. Essentially non-existent as a resource in 2019, installed battery storage capacity in the U.S. has soared since, likely topping 30,000 MW at the end of 2024, with an additional 15,000 MW of storage capacity likely to be added by the end of 2025.

Battery storage resources are already having a dramatic impact on how some of the biggest electric markets operate across the U.S. because of their ability to be charged with cheap solar power during the day or cheap wind power at night, and then deliver that power in the morning or evening when demand rises.

According to the California Energy Commission, the state had installed 13,391 MW of battery storage capacity by the end of 2024, 11,462 MW of which is utility-scale capacity and the rest split between residential and commercial units. Of the statewide total, the California ISO (CAISO), which supplies 80% of the state’s demand, says it operates 11,454 MW of battery storage capacity.

The impact of this capacity is clear in CAISO’s generation statistics.

Figure 1 - CAISO Battery Discharge Record Oct. 7, 2024

This graphic shows the most recent battery discharge record in CAISO, which was set Oct. 7, 2024, at the end of a late-season heat wave that pushed temperatures across the interior of the state to record levels. The record, 8,354 MW, was set at 6:10 PM Pacific time, just as solar generation was rapidly falling off the grid. In years past (certainly in 2019 where this analysis begins), that stored capacity would not have existed, requiring a significant increase in local gas generation or additional imports, with concomitant uncertainty regarding price and availability.

It is also important to note that this record amount of injected battery capacity almost certainly was solar generation from earlier in the day, based on the chart of battery charging/discharging. In other words, CAISO was able to take fuel-free solar generation that otherwise would have been curtailed, store it, and then use it later in the day. The benefits here are broad, cutting emissions from gas generation, saving the cost of the fuel needed to run the generators, and reducing wear and tear from the rapid ramping up and down of thermal generation resources.

Figure 2 - CAISO Battery Storage Charging/Discharging Oct. 7, 2024

Battery storage is a key resource on normal operational days as well, now commonly dispatched both around sunrise and sunset to reduce ramping needs for gas generation. On Jan. 15, for example, batteries sent 3,970 MW of power (14.6% of demand) into the CAISO grid at 7 AM, just as solar began generating for the day. That evening, battery storage injections topped 4,000 MW for more than three hours, providing at least 16% of demand during that period. Two or three years ago, that capacity almost certainly would have come from gas-fired generation. Market forces have driven the energy transition in the past five years, not policy options. Despite the new administration’s stated hostility toward renewable energy, market forces will be difficult to reverse. Solar, wind and battery storage projects with tens of thousands of megawatts of capacity are under construction or in advanced development and likely to come online in the next several years, continuing the move to a greener grid. We can argue over the speed of the transition from fossil fuels, but the direction is clear.