Geothermal resources offer an off-ramp from risky, costly nuclear project

Key Findings

A Nevada geothermal proposal has the potential to be a less expensive, more certain option for a Utah utility than an unproven small modular reactor (SMR) with rising costs

The costs of the geothermal proposal by NV Energy would be considerably cheaper than the SMR proposed by NuScale and based on proven technology

The 27 members of the Utah Associated Municipal Power Systems (UAMPS) should consider backing out of contracts that require them to cover the rising costs of the NuScale SMR

The 140 megawatts of geothermal projects proposed by NV Energy would meet UAMPS needs sooner and cost less than the SMR

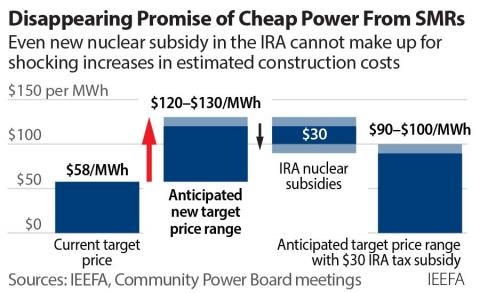

Ballooning costs have thrown plans for the small modular reactor (SMR) proposed by NuScale and backed by members of the Utah Associated Municipal Power Systems into disarray. A recent proposal by NV Energy in neighboring Nevada shows that less expensive, more certain options are available, adding more uncertainty to the SMR project.

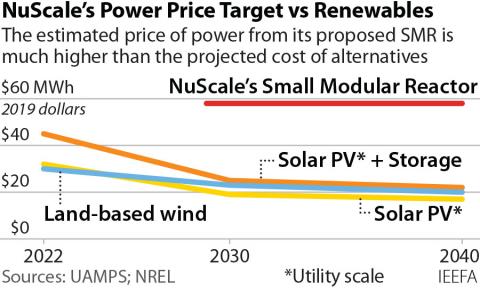

The company, a subsidiary of Berkshire Hathaway whose two operating units are Sierra Pacific Power and Nevada Power, asked state regulators last month to approve two geothermal power proposals that would provide it with 140 megawatts (MW) of new capacity for the next 25 years (2028-53). The first proposal, for 120MW of conventional geothermal power from Ormat Technologies, would be priced at a flat rate of $69 per megawatt-hour (MWh) for the term of the contract. The second proposal, a novel closed-loop process that could be built over a much wider geographic area, is for 20MW and would cost $70/MWh.

Backers should use it or risk saddling their communities with potentially ruinous future power costs

Both amounts are significantly less than the updated $89/MWh cost figure for the planned SMR just released by NuScale and the Utah utility, known as UAMPS. The discrepancy is likely to grow even larger, given that the geothermal proposals are flat-rate contracts while the NuScale SMR figure is simply the current estimate of final project costs, even though the reactor licensing process is not complete and construction has not begun.

The 27 UAMPS members that have signed on to the NuScale SMR project will be contractually bound to pay for their share of the final costs—no matter what that number is—if they remain involved. But the project includes off-ramps allowing participants to back out of the agreement at certain points. The latest off-ramp period has just started, and backers should use it or risk saddling their communities with potentially ruinous future power costs.

A key consideration in these exit discussions should be the availability of alternatives such as two new NV Energy contracts.

UAMPS leadership, and NuScale, repeatedly invoke the need to secure reliable power sources in the current transition away from fossil fuels. The system’s 2021 annual report is typical of this attitude:

“Reliability requires firm, dispatchable energy that is instantly available whenever it is needed, especially to enable and back up intermittent renewable resources like wind and solar. The percentage of affordable renewable resources can be increased significantly in energy portfolios, as long as renewables are backed up by dispatchable carbon-free energy …”

That is exactly what NV Energy’s geothermal proposals offer, and precisely how the company justified them in written testimony to its state regulators:

- “The two geothermal (power purchase agreements) bring round-the-clock capacity to Sierra.”

- The projects “help close the companies’ open capacity positions, and provide other benefits … such as voltage support, load management and other system reliability benefits ...”

- “[A]ll of these projects supply energy after solar resources drop off in the evening hours.”

- The geothermal resources will enable Sierra “to better integrate variable and intermittent resources.”

- The geothermal resources will help NV Energy retire the two-unit, 524MW Valmy coal-fired power plant “by providing around-the-clock renewable replacement capacity, energy and ancillary services.”

The risks, especially associated with the 120MW of capacity being developed by Ormat, are also exceedingly low. The Ormat portfolio includes 60MW of existing generation at four sites and 60MW of capacity at four new sites—all based on technology that has been in use for decades. In other words, it will get built and operate as advertised.

Together, NV Energy said, the Ormat projects will generate 1,050,346MWh annually. The 27 UAMPS NuScale backers are currently subscribed to purchase approximately 112MW from the planned nuclear reactor. Assuming the SMR achieves its projected 95 percent annual capacity factor, that would total 932,064MWh a year. So the Ormat projects could have met UAMPS’ needs, cheaper and sooner.

The risks, especially associated with the 120MW of capacity being developed by Ormat, are also exceedingly low

Although it carries slightly more risk, the second project, being developed by Canadian startup Eavor Inc., has much broader potential. It uses a closed-loop process that does not rely on the availability of hot underground water; instead, it simply harnesses naturally occurring underground heat. The system is “akin to a deep radiator or heat exchanger,” NV Energy said in its approval application.

Eavor’s project with NV Energy will be the first commercial test of the technology, but it has been successfully running a smaller demonstration unit near its headquarters in Alberta since 2019. Further, a recent analysis by the National Renewable Energy Laboratory showed that the company’s power cost estimates are attainable provided its facilities are built in areas with high underground heat gradients (which reduces the amount of drilling required), and its drilling speed and bit life estimates are realistic.

As part of its geothermal development program, which has a goal of reducing geothermal energy system costs by 90 percent by 2035, the U.S. Energy Department awarded two contracts in December to test drilling technologies such as fracking and equipment that can operate at higher temperatures to “dramatically reduce drilling costs and help make geothermal cost competitive.”

Geothermal plants traditionally run essentially as baseload generators. For example, the 100MW McGinness Hills facility, Ormat’s largest U.S. plant, has posted an average capacity factor of 82 percent since it came online in 2012. But NV Energy also underscored the load-following capability offered by Eavor’s geothermal proposal. Load following—essentially the ability of a generator to ramp its output up and down quickly without causing operational problems—has also been touted by UAMPS and NuScale as a key benefit of their planned SMR project.

“Another unique characteristic of Eavor’s AGS [advanced geothermal system],” NV Energy said, “is that the system can operate in either a baseload or a dispatchable manner.” During periods of low demand, the company said, the water used in the closed loop system can be left underground. Then, when demand increases, the circulation can be resumed, which “allows for power generation over the baseline capacity of the system.”

The similarities between the new power supplies NV Energy is seeking to acquire and what UAMPS says it wants are striking, and offer a path forward for UAMPS leadership and its members. UAMPS should take a step back from the NuScale project and issue a request for proposals to see if there are less risky, less costly and more timely means of securing new “firm, dispatchable energy” supplies. Clearly, NV Energy has been able to do just that.

Failing a leadership push at the UAMPS level to revisit the NuScale project, each of the 27 communities now signed on to the development effort needs to carefully consider their options during the current off-ramp decision period. Sticking with the project risks huge future cost increases and uncertainty about the ultimate availability of the power. Less risky, cleaner and cheaper options are available, and should be sought out.

Dennis Wamsted ([email protected]) is an IEEFA energy analyst