Small Modular Reactor update: The fading promise of low-cost power from UAMPS' SMR

Download PDF

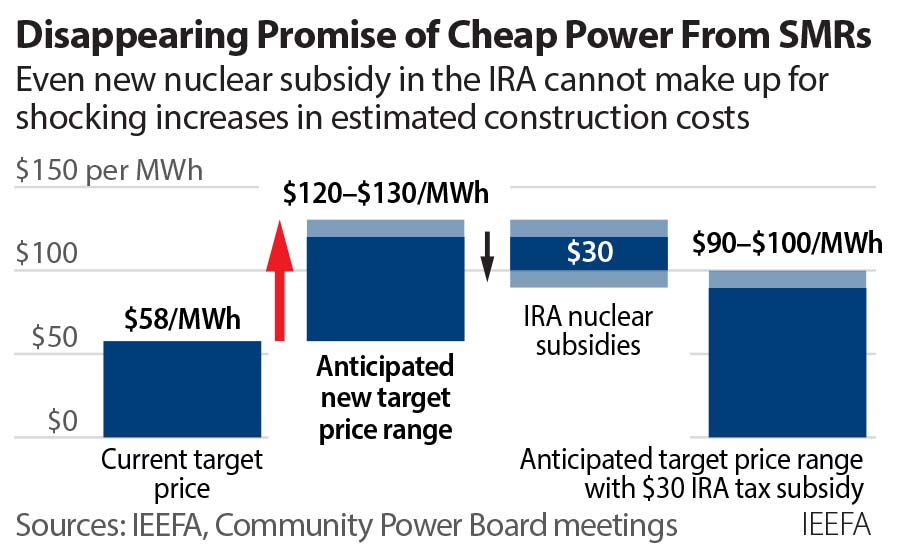

- The original target power price for a planned 12-module SMR by UAMPS (Utah Associated Municipal Power Systems) and NuScale Power Corporation was $55 per megawatt-hour (MWh).

- When UAMPS reduced the size of the carbon-free power plant (CFPP) to six modules in the summer of 2021, it raised the target power price to $58 per MWh.

- Recent presentations to the power boards of Washington City and Hurricane, two of the Utah communities that have signed agreements to buy power from the CFPP, suggest that project power prices are now likely to end up in the range of $90-$100 per MWh.

- The prices include an anticipated $1.4 billion subsidy from the U.S. Department of Energy and a new subsidy from the Inflation Reduction Act (IRA) on the order of $30 per MWh. The unsubsidized price of the power from the CFPP would be substantially higher than $100 per MWh, perhaps even double the current $58 target price.

- The estimated target price of the power from the CFPP has gone up because projected building costs have increased. According to minutes of the October 2022 meeting of the Idaho Falls Power Board, the increased costs in the new Class 3 cost estimate currently being finalized for the CFPP have been shocking, even to NuScale and Fluor, the company responsible for overall management of the project.

- Even if the new target price is only in the range of $90 to $100 per MWh, there is no guarantee that this will be the actual price that communities will pay for the power from the CFPP. The power sales contract for the project binds communities to pay the actual costs and expenses of the project—no matter how much.

- An official at the Hurricane, Utah, power board’s October meeting said the anticipated new cost estimate increase is a “big red flag in our face.”

- If the new estimated target price for the power from the CFPP is higher than the current price of $58 per MWh, which the power department director for Washington City, Utah, has said he believes will happen, communities will be able to terminate their power purchase agreements with UAMPS for the power from CFPP without any financial penalties. UAMPS also would have the option of cancelling the project.

The CFPP Can Be Expected to Experience Additional Cost Increases

- UAMPS currently projects that the CFPP will be completed in 2030. That leaves eight years left in the project schedule to complete the project’s design, licensing, construction and pre-operational and startup testing.

- NuScale has told the Nuclear Regulatory Commission that the project design work won’t be completed until an application for a combined operating license is submitted, which is not expected until early 2024. Nuclear-related construction is not expected to begin before late 2025.

- Nuclear industry experience over the past four decades points to the likelihood of future cost increases and schedule delays during all phases of the project—design, construction, licensing, and testing. For example, the estimated all-in cost of the two new reactors at Georgia Power’s Vogtle project, the only new reactors currently being built in the U.S., has increased by 140% since nuclear construction began in 2011. Vogtle’s construction also has taken far longer than originally estimated; both reactors are currently more than six years behind schedule.

Few New Utilities Have Signed Up to Buy Power From the CFPP

- When IEEFA released its report on the NuScale SMR in February 2022, communities had signed up to buy only 101 megawatts (MW) of the 462MW CFPP. According to the presentations to the Washington City and Hurricane power boards, the situation appears not to have changed. For example, the Washington City power department director told the city’s power board on Nov. 1 that the biggest challenge to the CFPP is the number of MWs subscribed. Parties seem interested in the CFPP but are wary about potential cost overruns.

- It is reasonable to expect that if communities were reluctant to sign on to the CFPP at a target price of $58 per MWh, they’re likely to be much more wary if the project’s target price of power goes to $90 to $100 per MWh or higher.

- The general manager of the Idaho Falls Power Board believes it would be difficult to secure financing for the CFPP without a fully subscribed project.

Higher CFPP Power Prices Will Make It Even Less Competitive

- A February 2022 IEEFA report on NuScale showed that renewable resources and battery storage will provide reliable electricity at lower cost than the UAMPS CFPP—even if price for the power from the project is just $58 per MWh.

- A target power price between $90 and $100 per MWh will make the CFPP even more uneconomic compared to renewable and battery storage resources costs that are expected to continue to decline over the next decade, according to the U.S. Department of Energy’s National Renewable Energy Laboratory’s Annual Technology Baseline for 2022.

For more information, please contact David Schlissel at [email protected].