The Financial Case for Fossil Fuel Divestment

The fossil fuel sector has lost its investment rationale. Divestment from fossil fuels is a defensive move to protect the long-term value of an investment portfolio while continuing to meet investment return targets.

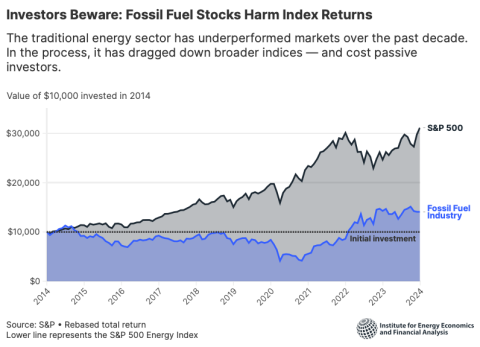

The fossil fuel sector has underperformed the broad market for a decade and has a negative long-term financial outlook. Competitive forces within the sector make it a volatile and unstable store of wealth. Competitive forces outside the sector undermine its growth and share of key markets.

Divestment from fossil fuels has met the test of fiduciary responsibility with almost 1,600 institutional investors that manage more than $40 trillion having implemented an exclusion strategy. Learn more below.

Fossil fuel companies have underperformed the market for a decade

In 1980, fossil fuels comprised 29% of the Standard & Poor’s 500-stock index. As of February 2024, the sector comprised 3.7% of the S&P 500 and in October 2020 it reached a low of 2.0% of the index.

Ten-year annualized returns for the S&P 500 hover around 10%, but only 1% for the S&P 500’s energy sector. This is a significant loss of value by the industry.

Fossil-free stock market indexes like the MSCI All Country World Index ex-Fossil Fuels have outperformed the baseline index that includes fossil fuels. This remains true after factoring in the rise in oil prices caused by Russia’s invasion of Ukraine.

Unstable global oil prices are the main determinant of oil company profits

Oil prices crashed from 2014 to 2016 and again in 2020, leading to trouble for the industry: Financial losses, increased debt, and insolvency.

Price volatility is expected to continue as global oil and gas production remains highly competitive between investor-owned supermajors, shale drillers, and state-owned oil companies whose revenue often contributes substantially to national budgets.

Oil prices saw a short-term spike after Russia invaded Ukraine

The invasion of Ukraine upended global energy markets and caused a short-term improvement in the financial position of fossil fuel companies. The improvement has not lasted.

By early 2023, prices returned to levels seen before the invasion of Ukraine. The price spike undermined confidence in fossil fuels worldwide, with Europe accelerating its energy transition and many Asian countries unable to afford LNG. The price spike caused the long-term decline of the fossil fuel industry to accelerate.

Fossil fuels face structural challenges from the transition to clean energy

In the transport sector, automakers are investing heavily in electric vehicle design and production, with ExxonMobil’s chief executive declaring that new vehicles will be fully electric by 2040.

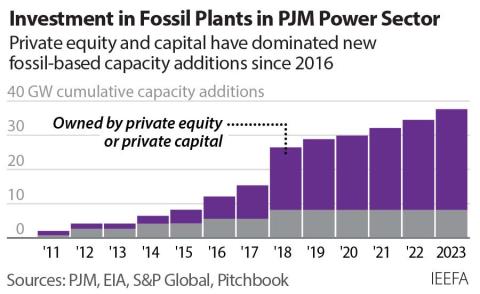

In the electric power sector, utility companies are investing heavily in solar, wind, and battery storage as long run marginal costs have declined below fossil fuel-fired generation. U.S. utilities are building 6 megawatts of new wind and solar for every 1 megawatt of new gas or coal power. Deployed battery storage capacity is expected to grow by 10 times through 2026.

In the petrochemical sector, regulatory efforts and the development of green investment

taxonomies are exerting pressure to reduce fossil fuel inputs into petrochemicals and banning

single-use plastics.

These developments threaten fossil fuels’ market share in their three major markets over the

long term.

The fossil fuel sector’s low-carbon technologies will struggle to prolong its drilling business

The fossil fuel industry has few low-carbon technologies that are commercially viable.

Fifty years of research and development have failed to produce commercial-scale carbon capture and storage (CCS) projects that are able to meet CO2 capture targets of 90% to 95% for commercially relevant durations. Retrofitting CCS technology on most industrial facilities is expensive, requiring significant capital outlays and ongoing expenses.

Another low-carbon technology, “blue” hydrogen produced from natural gas where carbon emissions are stored, relies on both failing CCS technology and reliably low natural gas prices.

Progress in producing biofuels from algae has significantly lagged public relations pronouncements promoting the technology. Congressional investigations reveal that in 2016 and 2017, communications staff at ExxonMobil were anxious that advertisements featuring the company’s investments in algal biofuel research overstated the technology’s progress and achievements. In late 2022 and early 2023, ExxonMobil quietly ended three of the company’s key algae research partnerships, stating that its focus would be to “commercialize” other low- carbon technologies, including CCS.

With little to show for its research and development efforts, the fossil fuel sector is ill-prepared to sustain its traditional drilling business with new low-carbon technologies.

There are two energy economies at play today

The fossil fuel energy economy is trending negative, while the economy based on renewable energy and sustainable economics is trending positive. These economies both cooperate in providing energy and compete for market share as the system begins to rely more on the growing and increasingly profitable clean economy. Divestment from fossil fuels protects investment portfolios exposed to both energy economies from financial losses as this transition accelerates.

Divestment from fossil fuels is widespread and increasingly mainstream

Hundreds of globally significant financial institutions have excluded one or more fossil fuel subsectors from asset management and underwriting businesses. Globally, institutional investors managing USD$40 trillion have divested from fossil fuels.

Made withVisme Infographic Maker

The energy transition demands a response from fiduciaries to protect investment portfolios

Trustees of long-term investment funds should carefully consider the negative long-term financial outlook for fossil fuels. One efficient alternative to protect the portfolio is to reduce or eliminate exposure to the source of risk: Fossil fuel investments. To properly consider divestment, trustees should deliberate over a plan to meet investment return targets without fossil fuels in the portfolio. Trustees can only come to a fully informed judgment of its effects, timing considerations, and its prudence after considering a specific plan.

Two economies collide: Competition, conflict, and the financial case for fossil fuel divestment

Despite recent global developments, the case for fossil fuel divestment is still strong. Sustainable economics are proving their financial reliability and long-term ability as a sound investment.