SBTi steps up its game on net zero for finance

Key Findings

The Science Based Targets initiative (SBTi) has emerged as a key standard-setter for private sector net-zero plans. Since its founding, it has attracted criticism for a lack of ambition and robustness in its criteria.

The initiative recently released draft standards for financial institutions. They represent a significant step forward—both for the SBTi and for net-zero discourse more broadly.

IEEFA, by and large, commends the latest standards’ temperature pathways, approach to fossil fuel financing, and treatment of carbon offsets, whilst noting some recommendations for improvement.

If the SBTi can strengthen the standards and develop practical tools and guidance, this will go a long way towards improving its credibility and putting more pressure on financial institutions to clean up their act.

Financial institutions (FIs) are finding themselves at a crossroads. The economy-wide push towards decarbonization is creating significant market opportunities. At the same time, systemic financial risk only grows as climate change progresses. Even as more banks, institutional investors, and insurers begin to speak of the risks and rewards of the energy transition, talk has often outpaced action in the sector’s climate commitments.

The Science Based Targets initiative (SBTi) was founded in 2015 to provide guidance, standard-setting, and verification for private sector net-zero plans. In the years since, the SBTi has received significant criticism on matters including inadequate standard-setting ambition, loopholes in its carbon accounting methodologies, and its limited verification procedures. While its mission of advancing corporate and institutional climate strategies should be commended, IEEFA has found many of the critiques compelling.

Yet let us give credit where credit is due: With its recent draft standards for the financial sector released in June 2023, the initiative has undoubtedly stepped up its game. If the SBTi is able to maintain and improve on the proposal’s rigor throughout the consultation process, it will go a long way towards improving its own credibility—and guiding FIs towards better management of climate-related financial risk. FIs could use alignment with these standards to signal seriousness, and FIs that fall short of SBTi approval could face pressure to clean up their act; done right, these guidelines could help protect market actors in the years to come.

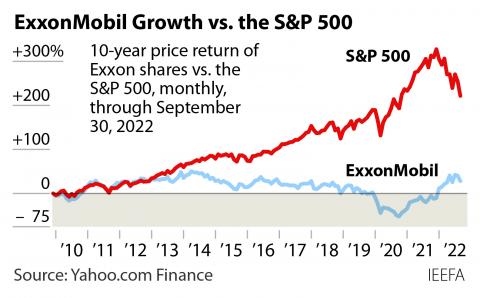

The SBTi’s decision to prioritize financial sector guidelines represents an important realization: Financial institutions have special importance in the energy transition. Oil and gas companies have traditionally leaned heavily on private financial flows to maintain and expand their business model. Since the Paris Agreement, for example, banks have financed and facilitated over $5.5 trillion into the fossil fuel economy, research shows. On the flip side, financial actors are a crucial component in the rapid buildout of sustainable energy solutions and technology, a requisite for a net-zero economy. So how should an FI react when these two economies collide?

The SBTi’s proposal comes in three parts. The first, the “Near-Term Financial Sector Science Based Targets Guidance V2”, represents several criteria changes and clarifications since its first release in October 2020. The second, the “Financial Institutions Net-Zero (FINZ) Standard Conceptual Framework and Initial Criteria”, sets the scene by outlining core requirements around near- and long-term targets, and fossil fuel components. Finally, the “Fossil Fuel Finance Position Paper” recognizes the need for special guidance regarding the energy value chain, given both its disproportionate role in the exacerbation of climate change and its outsized exposure to uncertainty amidst the energy transition. The stakeholder consultation period for these drafts ended yesterday, and the SBTi will be at work finalizing the standards. IEEFA further notes the SBTi’s ongoing efforts in developing a full set of near- and long-term targets, complemented with target-setting methods and guidance for implementation that are currently not included.

The recently released financial sector guidelines represent a significant improvement in net-zero alignment benchmarks. Among the most promising developments are:

- Better temperature pathway alignment in the near term: IEEFA largely welcomes the near-term criteria updates, in particular, reducing the scope 1+2 target timeframe to five to 10 years and increasing the scope 1+2 target ambitions to 1.5°C.

- Emphasizing the phaseout of fossil fuel financing: The International Energy Agency has made it clear that investment in fossil fuel expansion must cease if the world is to reach net zero by 2050 (other modeling efforts have reached similar conclusions). The framework reflects this consensus in its declaration that institutions “shall implement the immediate cessation of new financial flows” to unabated fossil fuels and “shall establish targets for all financial flows to existing fossil fuel activities at the company [and] portfolio level”. It also sets out a clear timeframe and region criteria for phaseout—important steps if asset stranding and systemic destabilization are to be avoided. Further, the financial target approach appears to be prudent and necessary as it can track financial flow towards clean energy, reflecting the unique impacts of FIs.

- Better carbon math: Companies often use a variety of tricks, such as carbon credits of dubious efficacy, to avoid actual carbon emissions. The SBTi framework, however, notes that offsets “must not be counted as emission reductions toward the progress of companies’ or FIs’ science-based targets”. Similarly, it mandates high and provable efficacy rates for any claims of abatement. This is an improvement from the status quo, where the word “unabated” is often code for near-term overreliance on carbon capture and storage (CCS) technologies, which, whatever their potential, often fall well short of promised capture rates today.

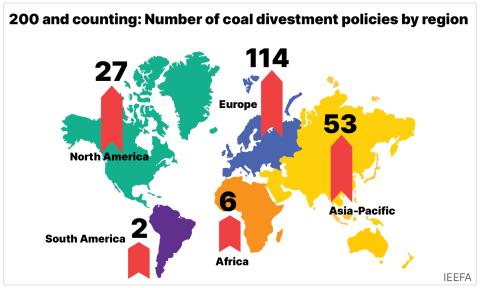

- A prudent approach to engagement/divestment: IEEFA has written elsewhere that engagement versus divestment is a false binary. Divestment is best understood as a form of engagement. Therefore, an engagement strategy should not be taken seriously if it does not have an exit plan in place for when gentler persuasion proves insufficient. The SBTi largely agrees. FIs, it notes, can and should rigorously attempt to change counterparties’ risky behavior—but should do so with clear standards and benchmarks, and should be ready to “phase out [their exposure] at the latest after two years if their engagement efforts fail to bring the project/company into alignment”. This is an appropriately cautious way to think about the matter: Divestment is a tool in a broader stewardship toolkit, and when an FI prematurely throws it away, it only ties its own hands, reduces the incentive for counterparties to listen, and leaves its portfolio exposed to unstable holdings.

Of course, this initial draft is not perfect. IEEFA submitted a response to the consultation this month. In brief, IEEFA recommends that the SBTi should:

- Further tighten the policy coverage in various fronts such that (i) 100% of financing exposure—regardless of the asset class—should be covered for the fossil fuel sector as for electricity generation in the near-term boundary; (ii) portfolio exposure of facilitated emissions should also be considered for the near term; and (iii) all asset management activities—including those within a banking group—should be covered.

- Further tighten the description of “abatement”, based on IEEFA’s belief that CCS facilities must achieve at least a 95% capture rate—which CCS technology manufacturers have themselves long claimed is practical—to be deemed a clean energy project.

- Contextualize the reality of neutralization: Lay out in more detail why it is troubling to assume that voluntary carbon markets are appropriately regulated or are currently reliable.

- Further detail how the engagement process should work, not limited to (i) criteria for assessing counterparty climate alignments; (ii) more specific phase-out timelines when engagement falls short; and (iii) the approach towards a possibility of reinvestment if a divested company shifts course.

- Consider introducing asset-based thresholds—in addition to revenue—in delineating “fossil fuel” activities.

Time will tell what final product emerges once all consultation responses are taken into account. Yet if this draft is any indication, the direction of travel appears to be positive. The FI guidelines represent a significant contribution to net-zero concepts and discourse. If the SBTi can build on this progress in methods, tools, and guidance, it could play an important role in not only protecting financial actors from the risks of climate change but also effectively driving capital flow towards 1.5°C-aligned goals.