200 and counting: Global financial institutions are exiting coal

Download Full Report

View Press Release

Key Findings

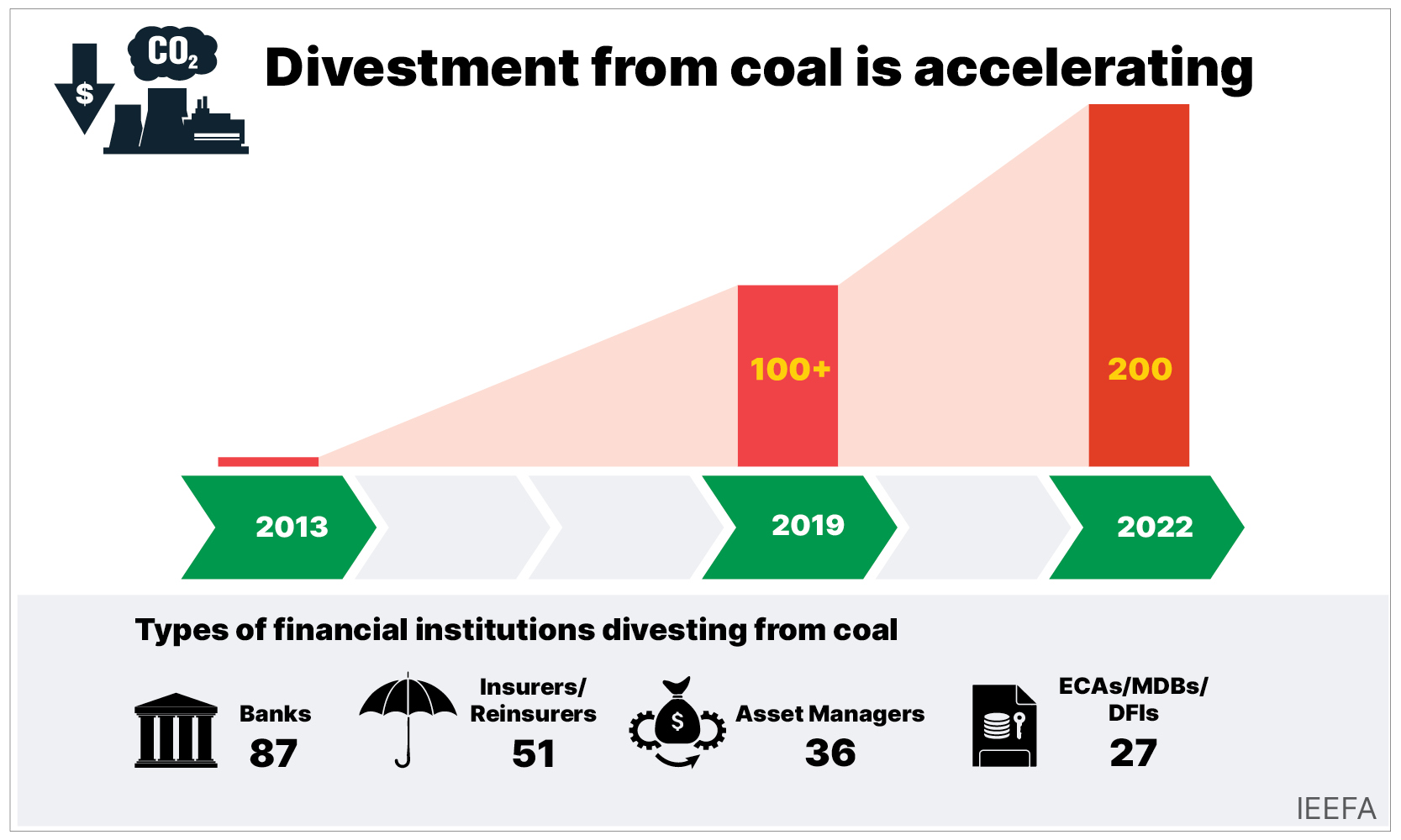

Over 200 globally significant financial institutions have established coal exclusion policies, with divestment momentum away from coal accelerating in the last two years despite record profits being enjoyed by coal companies on the back of the energy crisis.

Europe leads the way with the highest number of financial institutions divesting from coal (114) and with more stringent exclusion policies compared to other regions.

Asia has shown a significant increase in divestment, jumping from 10 financial institutions with coal exclusion policies between 2013 and April 2019 to 41 within the next three years.

Momentum is also building in the number of policy upgrades in the last two years, these strengthened coal exit policies demonstrating that financial institutions are increasingly recognising climate risk as a source of financial risk and ultimately systemic risk for the global financial system.

Executive Summary

Energy transition efforts are accelerating worldwide, and it is leading to tectonic shifts in all sectors across the global economy. While in the real economy, the energy sector is leading the transformation, the financial sector is also fast re-evaluating and redefining its role in a world where capital today is seen in the colours of green and brown.

There are two prominent trends redefining capital markets. First, there is the shift away from high emissions fossil fuels due to accelerating climate action and improved viability and accessibility of clean energy technologies. Second, there is an increased understanding of climate risk as a source of systemic risk to the global financial system. Both these trends are also supported by the climate movement spearheaded by stakeholder activism which includes policy analysts, climate campaigners and climate scientists globally. The response to both trends has been a diversification away from fossil fuels such as coal. A growing number of financial institutions (FIs) globally are fast establishing policies to exit coal in a bid to decarbonise their operations and commit to net zero targets.

Despite record profits for several of the largest coal mining companies globally over the last two years, the momentum of coal exclusion policies indicates that financial markets do not see their exposure to coal as a great long-term investment. The outperformance of the MSCI World ex Fossil Fuels Index over the MSCI World Index from November 2010 (index start date) to March 2023 underlines that investors recognise the long-term destructive impact of fossil fuel companies on wealth.

Currently, IEEFA’s analysis of coal divestments finds that over 200 globally significant FIs including banks, insurance companies, asset managers, pension funds, export credit agencies (ECAs), multilateral development banks (MDBs) and development financial institutions (DFIs), have formal policies restricting investment in thermal coal mining and/or coal-fired power projects. Banks and insurers are at the forefront of developing coal exclusion policies. Specifically, 87 international banks, 51 insurance and reinsurance companies, 17 ECAs, 7 MDBs, 3 DFIs and 1 central bank, each with assets exceeding US$10 billion, and 36 asset managers and owners, including pension funds managing more than US$50 billion in assets, have created coal restriction policies.

The most comprehensive coal exit policies include restrictions across all financial services and products offered by the FIs, ceasing all types of business relationships with coal companies.

Most of the globally significant FIs in the list have established restrictions on investing in companies that are involved in coal-fired power plants and/or thermal coal mining. The most comprehensive coal exit policies include restrictions across all financial services and products offered by the FIs, ceasing all types of business relationships with coal companies. These restrictions relate to corporate finance, project finance, underwriting and investment but also extend to wider coal activities such as coal gasification, super-critical coal power plants, and coal for rail and port infrastructure.

European financial institutions are leading the way in coal divestment with stricter policies than those in other regions. Though FIs from Asia-Pacific are also increasing rapidly, with 53 now having formal exit policies compared to only seven prior to 2019. A total of 22 FIs in the emerging economies have also established coal divestment policies, including South Africa, China, Malaysia, Turkey, India and the Philippines, among others. The U.S., France, the UK, Japan, South Korea, Germany, the Netherlands and Australia have the highest number of FIs with formal coal exit policies. Overall, there are 114 FIs in Europe, 53 in Asia-Pacific, 27 in North America, 6 in Africa and 2 in South America.

Several leading banks such as Bank of America, Citi, BNP Paribas and Crédit Mutuel Alliance Federale upgraded their policies in 2021 and 2022, seemingly after joining the United Nations Net Zero Banking Alliance. Over the last two years, 47 banks have strengthened their coal exit policies, while 16 banks have announced their coal exit plans for the first time.

Insurance companies, who act as risk managers and underwriters for coal projects and are significant institutional investors themselves, are also fast shunning coal. A total of 51 globally significant insurance and reinsurance companies have established a formal coal exit policy, and the number has more than doubled since IEEFA started reviewing global coal exclusion policies in 2019. One of the notable insurers, which announced its inaugural coal exit policy in 2022, is AIG.

Of the 36 asset managers and owners with formal coal divestment policies, managing assets worth over US$50 billion, half have implemented or improved their policies in the last two years. While several large global asset managers such as Caisse des Dépôts et Consignations, Government Pension Fund Global, Fidelity Investment and Storebrand have established formal coal exit policies, the three largest asset managers, Blackrock, State Street Global Advisors and Vanguard, managing assets worth US$20 trillion, have either formulated weak coal exit policies or have no policy at all.

Globally, FIs are adopting coal exclusion policies to reduce their exposure to the industry. The momentum of coal exclusion policies has gained significant traction in a little over three years to December 2022, with the number of FIs on IEEFA’s list reaching 202, up from 101 in April 2019. This trend is likely to continue, especially in the emerging markets, with more FIs expected to establish coal exclusion policies in the coming years and also strengthen existing ones.

Visit the Coal Divestment website for the full list of financial institutions with a coal exit policy.

Watch a summary of the report by Christina Ng and Sauraubh Trivedi