Private equity in PJM: Growing financial risks

Download Full Report

View Press Release

Key Findings

The relatively stable and high capacity payments from the system operator that have enabled the buildout of so much privately owned fossil-fuel generation capacity in PJM have disappeared in the last three years.

Low-capacity auction payments, coupled with the recent sharp run-up in interest rates, have worsened the economic outlook for new PJM projects and made merchant projects more economically risky.

The fines from Winter Storm Elliott have pushed some existing plants into bankruptcy while forcing others to seek capital infusions from their private equity sponsors.

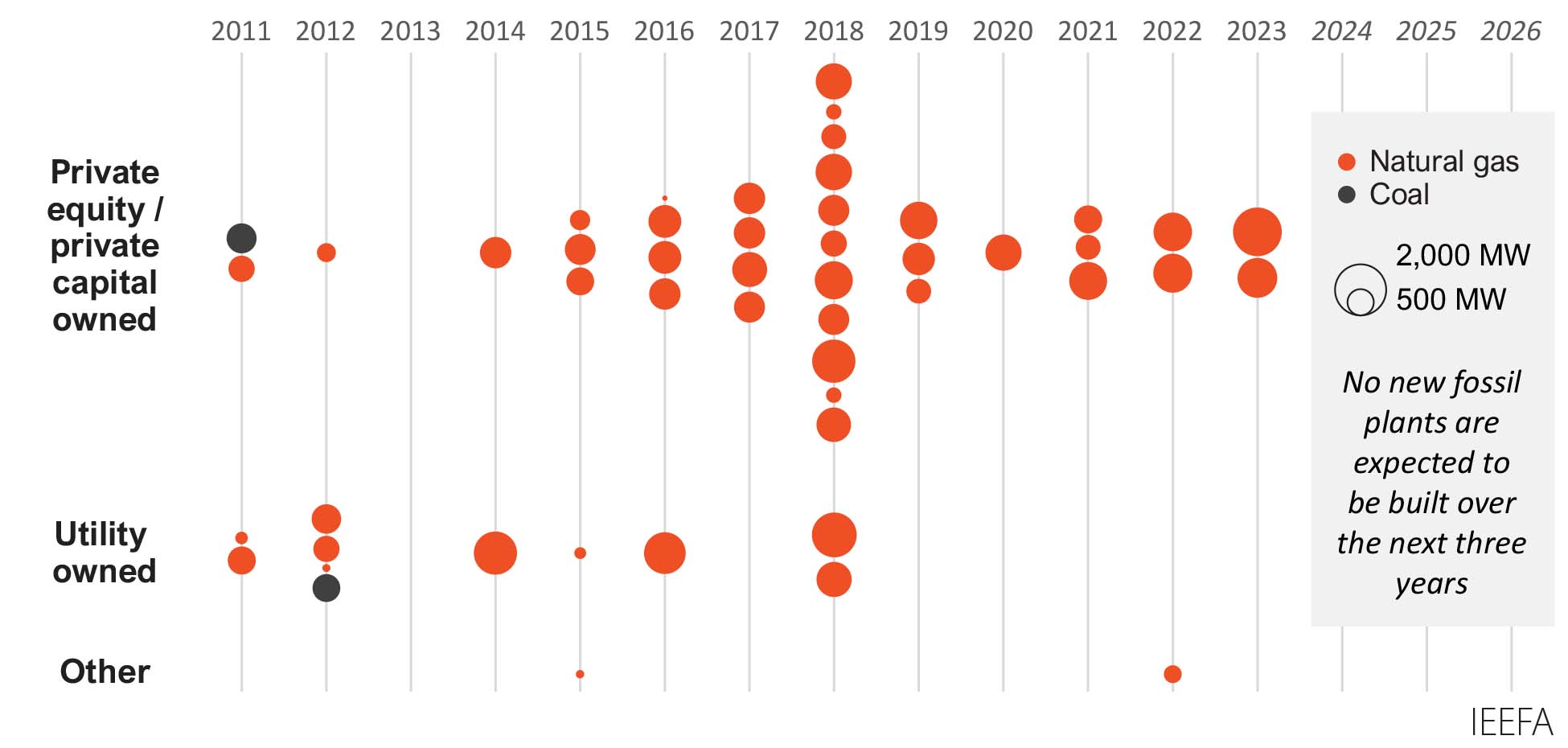

The 2010s saw a massive buildout of new capacity with relatively low risk, but the situation today is reversed, and it is a new, much riskier situation for private equity and private capital in the PJM market.

Executive Summary

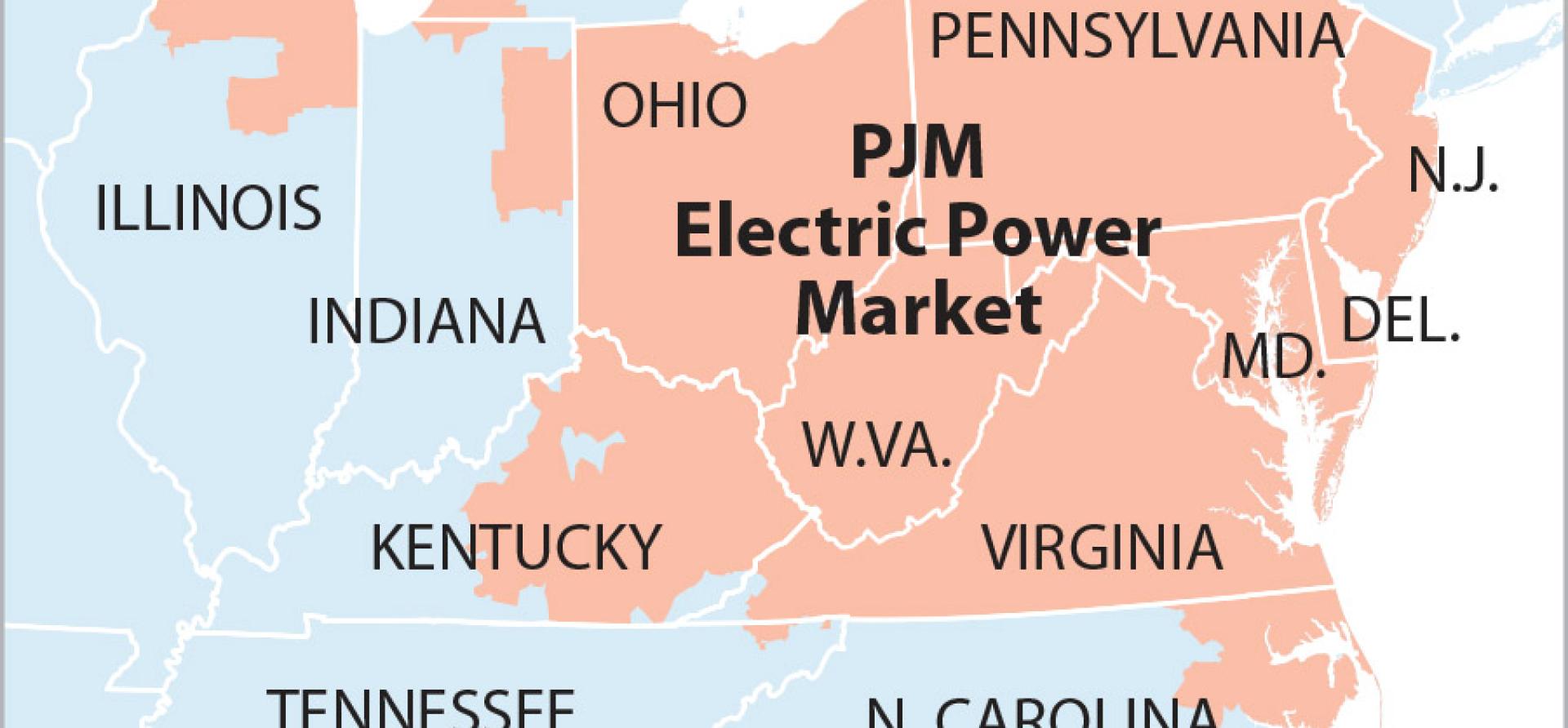

Private capital, particularly difficult-to-track private equity (PE) investment, has reshaped the PJM power market in the past decade. PJM data shows that 35,515 megawatts (MW) of combined cycle gas capacity have been built in the 13-state regional system since 2011, reflecting the impact of the fracking revolution that brought plentiful, low-cost gas supplies to the market. PE and other private sources developed more than 80% of the total—28,815MW.

This gas-driven growth, coupled with significant PE investment in the region’s coal-fired power plants, has transformed the ranks of PJM’s largest generators. As recently as 2017, the five largest capacity owners were all regulated publicly traded companies: American Electric Power, Dominion Energy (the parent of Virginia Power), Exelon (the parent of Commonwealth Edison), FirstEnergy and NRG Energy. Today, three of the largest generators are private firms—ArcLight with 14,230MW of operating capacity, LS Power (10,803MW) and Talen (the former subsidiary of Blackstone that recently emerged from bankruptcy under new ownership), with 10,370MW.[1] Beyond these three majors, there are a host of private and PE firms that own from 1,000MW to 5,000MW of capacity. Together, private capital now owns roughly 60% of the fossil-fuel fired generation capacity in PJM.

Figure 1: Private Equity Fossil Fuel Capacity Has Soared in PJM Since 2011

Ownership status is important. Utilities are overseen by state regulators who have a vested interest in keeping costs for ratepayers in check; private capital is largely free from that oversight. Utilities, as well as publicly traded independent power producers, are also required to file regular financial reports with the Securities and Exchange Commission; private capital, by and large, is not. These differences largely shield private firms from public pressure and regulatory and financial oversight.

In this three-part report, IEEFA examines the increasing risk environment in PJM, the nation’s largest power market.

The first section takes a close look at the rising financial risks now facing PE and other private firms—risks that contrast sharply with the previous strong, steady growth of the 2010s. That decade-long growth spree was underpinned by relatively high and relatively stable capacity prices; those prices have collapsed, squeezing existing and new developers alike. The fallout from the Christmas storm that rolled across the eastern half of the country in 2022 (Winter Storm Elliott) has further undercut the finances of many market participants. First, PJM came out swinging regarding the unavailability of thousands of megawatts of fossil fuel capacity during the event, levying fines of almost $2 billion for non-performance during the December storm. Second, the grid operator is now evaluating new market structures that could cut into future capacity payments for fossil fuel generators while boosting renewable payouts.

The second section will focus on the limited partners. These pension and retirement funds have poured money into the PE sector in the past decade, and have generally been well rewarded for their investments. But the changing regional power environment is likely to shift the outlook for outside investors by lowering annual returns, raising investment risks, or both. This second section will pay particular attention to the fallout from bankruptcy filings, in which funds and other private entities end up owning assets they may not want. For example, Nuveen/TIAA found itself in that situation following the 2020 bankruptcy restructuring of FirstEnergy Solutions, which became Energy Harbor.

The final section will examine the risks posed by PE’s relative immunity from oversight and public pressure, a growing threat for the localities where the plants operate. PE firms push risks onto the communities. When their plants are no longer economic, PE generators can simply decide to close up shop and get out, leaving unprepared localities facing significant economic dislocations from job and tax losses. This exact scenario played out in the spring at the Homer City power plant in Pennsylvania as we will examine, but that community is not likely going to be the last unless local leaders begin planning now for the coming transition.

Similarly, PE’s lack of public accountability creates the very real possibility that efforts to curb regional carbon dioxide emissions will become more difficult in the years ahead. The fossil fuel plants owned by PE firms and other private capital now account for more than 50% of the region’s annual power-related carbon dioxide (CO2) releases, and that percentage is likely to grow. But the sector’s lack of transparency shields it from the types of public pressure that have helped convince publicly traded electric utilities to move, however haltingly, toward decarbonization efforts.