IEEFA U.S.: Decade of strong growth is over for PE gas plant developers in PJM

Market changes, non-performance fines raise financial risks in PJM

Key Takeaways:

It is a new, much riskier future for private equity and private capital in PJM, contrasting sharply with the previous strong, steady growth of the 2010s.

The high capacity prices that dominated the 2010s have evaporated, with the last three region-wide auction prices averaging less than $40/MW-day, well below the $115/MW-day average in the eight years prior.

The fines from last December’s winter storm have exacerbated these developments, pushing some existing plants into bankruptcy while forcing others to seek capital infusions from their private equity sponsors.

Many new renewable energy and battery storage projects should finally enter commercial operation in PJM, adding yet more risk for existing and proposed gas plants.

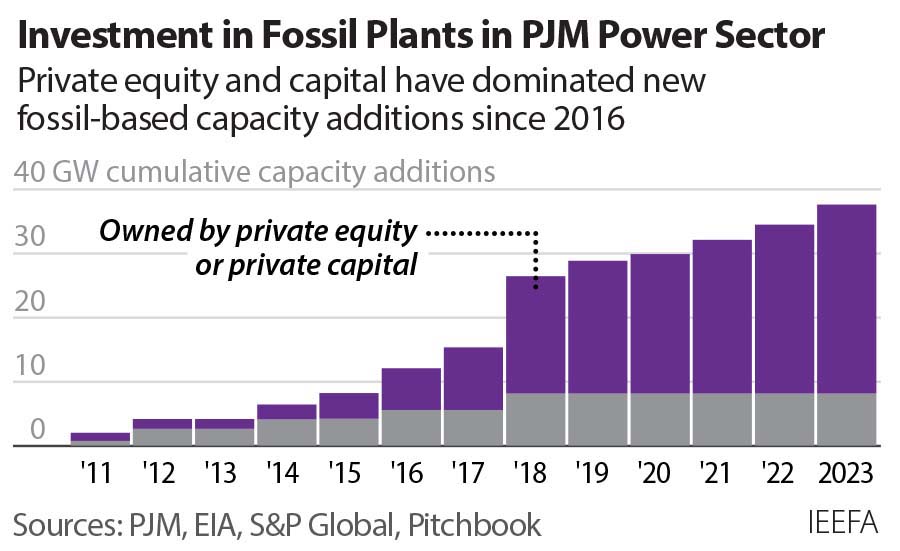

Private capital, particularly difficult-to-track private equity (PE) investment, has reshaped the nation’s largest power market, PJM, in the past decade. PJM delivers electricity to all or parts of 13 states and the District of Columbia, including Ohio, Pennsylvania, West Virginia, New Jersey, Maryland, and most of Virginia.

Since 2011, private capital has funded the development of almost 29,000 megawatts (MW) of combined cycle natural gas-fired capacity in the region—more than 80% of the total. In all, private capital now owns roughly 60% of the fossil fuel generation capacity in PJM. This buildout has been profitable for developers, but new market risks are changing the financial outlook, according to a new Institute for Energy Economics and Financial Analysis (IEEFA) report, Private Equity in PJM: Growing Financial Risks.

Today’s report is the first in a series of three that will examine the increasing risk environment in PJM. Private Equity in PJM: Growing Financial Risks, takes a close look at how financial risks now facing PE and other private firms are significantly increasing—risks that contrast sharply with the previous strong, steady growth of the 2010s. That decade-long growth spree was underpinned by relatively high and relatively stable capacity auction prices; those prices have collapsed, squeezing existing and new developers alike.

“There has been a massive shift in the last several years in the risk environment for PE and private-capital-owned gas plants in PJM. The 2010s saw a massive buildout of new capacity with relatively low risk,” said Dennis Wamsted, IEEFA energy analyst and author of the report. “The situation today is reversed. The buildout has essentially ended, and the risks are accumulating quickly.”

First, the high capacity prices that dominated the 2010s have evaporated, with the last three region-wide auction prices averaging less than $40/MW-day, well below the $115/MW-day average in the eight years prior. That constitutes a major risk for existing plant owners and new projects alike, forcing operating projects to make do with less while requiring new developers to convince lenders that their plans are still worth the risk.

The fines from last December’s winter storm have exacerbated these developments, pushing some existing plants into bankruptcy while forcing others to seek capital infusions from their PE sponsors. On the sidelines, bankers considering a project now know full well that non-performance will be costly, potentially prompting them to raise their financing costs for new gas-fired projects.

Finally, queue and other market reforms look likely, meaning many new renewable energy and battery storage projects should finally enter commercial operation in PJM. This will add yet more risk for existing and proposed gas plants, forcing them to deal both with lower revenues, particularly in the winter with lower capacity accreditation levels and higher wind values, and the likelihood that the addition of new renewable projects will constrain energy prices.

It is a new, much riskier future for PE and private capital in PJM.