Key Findings

RBC’s climate and sustainable finance program fails to address ending fossil fuel expansion and excludes significant segments of its business from climate targets.

RBC’s 2030 interim emission reduction goals are focused on intensity rather than absolute emissions, meaning RBC could achieve its targets without any reduction in the actual amount of financed emissions.

The bank’s goal of achieving net-zero emissions in lending by 2050 conflicts with Canada’s goal of achieving net-zero emissions in the economy by 2050, because investments must precede implementation.

RBC’s Sustainable Finance Framework and Net-Zero Plan are not based on climate policy, but rather on the demands of a client base—an oil and gas industry that is increasingly speculative in its character.

Executive Summary

The Royal Bank of Canada (RBC) has a sustainable finance credibility problem. Policy documents released by RBC in recent years set forth its climate and sustainable financing program. RBC’s plans, however, fail to update its strategy to end fossil fuel expansion, lack meaningful target dates, and exclude significant segments of its business from its climate targets. These plans represent a lackluster commitment to achieving its net-zero financing goals.

RBC is a leader in fossil fuel financing. According to recent data, the bank has been responsible for the fifth-largest total amount of fossil fuel financing in the world—almost $254 billion U.S. dollars—since the 2015 Paris Agreement, surpassed only by JPMorgan Chase, Citi, Wells Fargo and Bank of America. RBC ranked first in 2022, and the bank is widely recognized as the largest Canada-based financier of fossil fuels.

Given RBC’s outsized role in funding the fossil fuel industry and its apex position in the Canadian banking industry, it is reasonable to expect RBC to set and meet high standards. The bank should be a policy leader.

Although RBC has set interim emission reduction goals by 2030, these targets are focused on emission intensity and not absolute emissions. This key difference means RBC could end up achieving its targets without any reduction—and even with increases—in the overall level of emissions it finances.

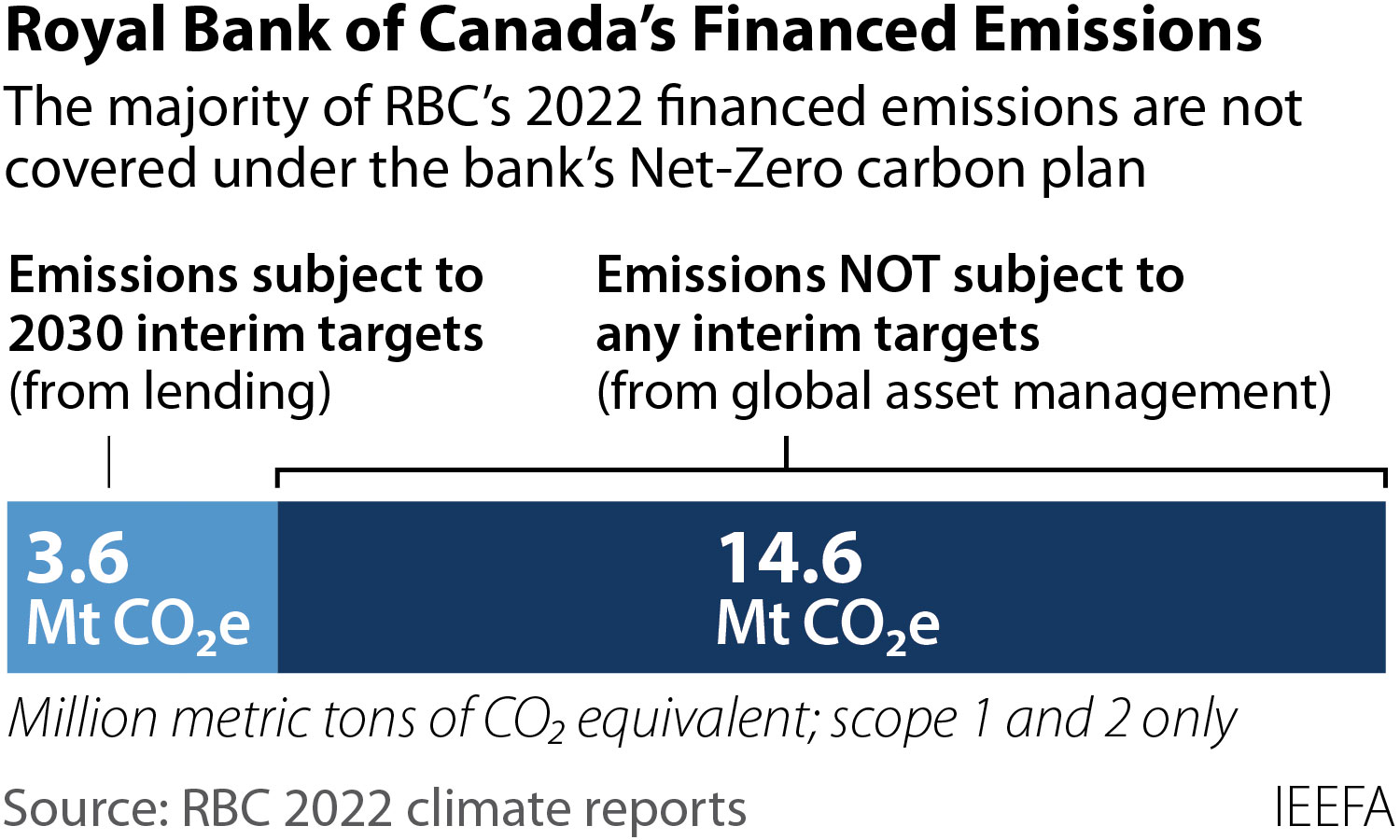

Figure 1: Royal Bank of Canada's Financed Emissions

Source: RBC 2022 Climate Reports.

This paper shows that RBC’s targets are inadequate and its policies and practices are not aligned with its climate goals. Further deductions include:

- RBC has failed to align its lending policies with a robust plan to reduce investment in fossil fuel projects. The policies lack a coherent “Divest-Invest” framework.

- RBC’s failure to consider expanding divestment assumes it can meet emission reduction goals by supporting further oil and gas development. RBC essentially relies on its client base to take action. The client base, however, includes the fossil fuel industry, which has demonstrated weak performance in greenhouse gas emissions reduction and remains unprepared for a low-carbon future.

- RBC has effectively exempted its asset management arms from policies to reduce financial commitments to fossil fuels. RBC states approximately 14% of assets under management in its Global Asset Management unit are invested in companies with Paris-aligned targets, which indicates a weak commitment.

- The bank’s goal of achieving net-zero emissions in lending by 2050 conflicts with the goal of achieving net-zero emissions in the economy by 2050, because investments must precede implementation.

- Even the 2050 target is hedged with a series of qualifications that suggest a future lackluster commitment driven by commercial interests and not climate solutions.

This policy briefing, the first in a series of commentaries by IEEFA on RBC’s role in the energy transition, considers the bank’s policy statements regarding financing fossil fuel projects and companies that sponsor them, and questions its goals and the firmness of its commitments.