IEEFA Canada: Royal Bank of Canada is falling short on climate change pledges

Key Takeaways:

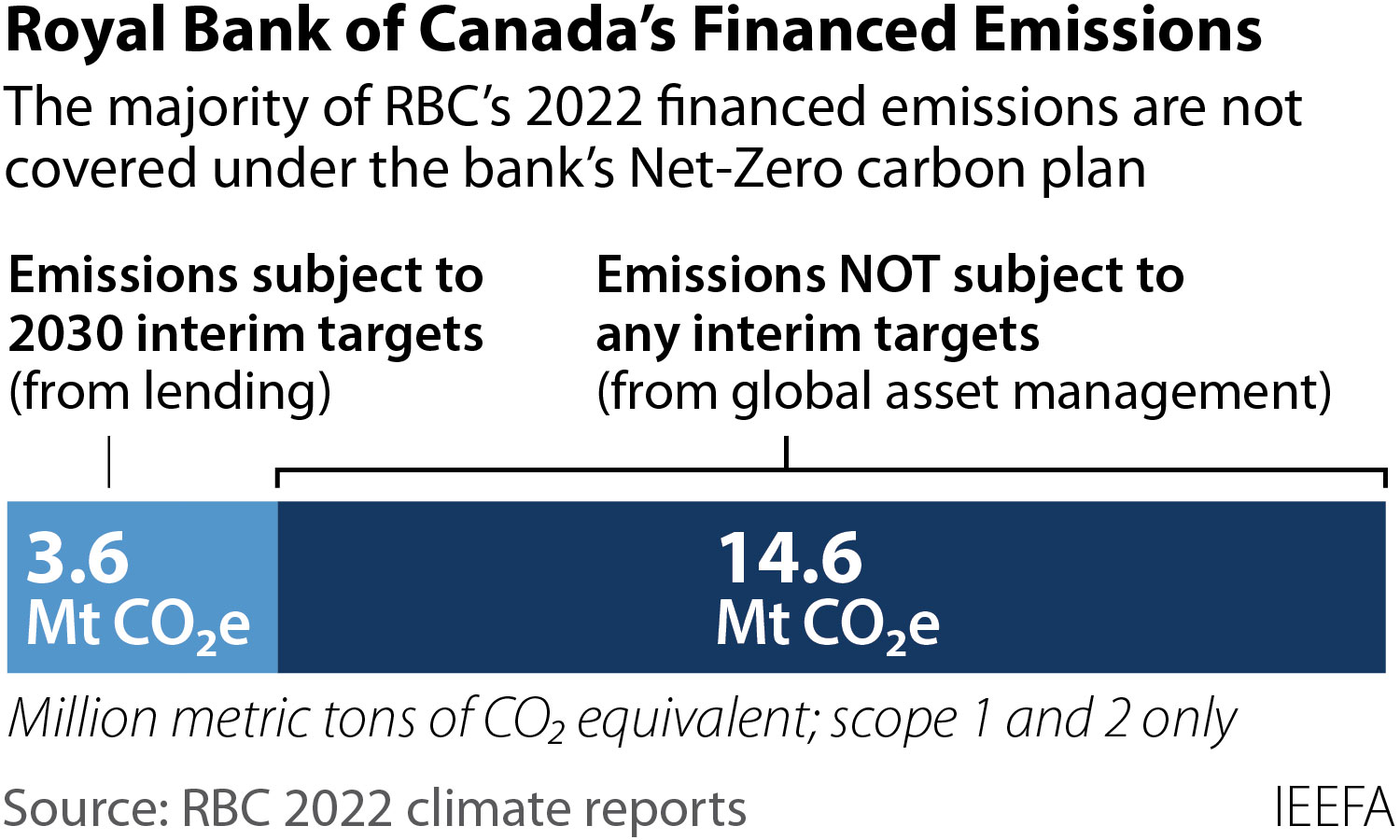

RBC’s climate and sustainable finance program fails to address ending fossil fuel expansion and excludes significant segments of its business from climate targets.

RBC’s 2030 interim emission reduction goals are focused on intensity rather than absolute emissions, meaning RBC could achieve its targets without any reduction in the actual amount of financed emissions.

The bank’s goal of achieving net-zero emissions in lending by 2050 conflicts with Canada’s goal of achieving net-zero emissions in the economy, because investments must precede implementation.

RBC’s Sustainable Finance Framework and Net-Zero Plan are not based on climate policy, but rather on the demands of a client base—an oil and gas industry that is increasingly speculative in its character.

The Royal Bank of Canada (RBC) has a sustainable finance credibility problem, according to a new Institute for Energy Economics and Financial Analysis (IEEFA) briefing. While RBC has in recent years announced policies outlining a climate and sustainable finance plan, when taken together they represent a lackluster commitment to achieving its net-zero goals.

RBC’s plans fail to update its strategy to end fossil fuel expansion and lack meaningful target dates. The plans also include exemptions of significant segments of its business from stated climate targets, thus making it difficult to achieve its stated net-zero finance goals. Today’s briefing is the first in a series that will further examine RBC’s climate pledges.

“Given RBC’s outsized role in funding the fossil fuel industry and its position at the top of Canada’s banking industry, it is reasonable to expect RBC to set and meet high standards,” said Mark Kalegha, IEEFA energy finance analyst and co-author of the report. “The bank should be a policy leader.”

RBC’s 2030 interim emission reduction goals for various sectors are focused on emission intensity rather than absolute emissions—a key difference that means RBC could end up achieving its targets without any reduction in the actual amount of financed emissions.

RBC’s Sustainable Finance Framework is not based on climate policy but rather on the demands of a client base—an oil and gas industry that is increasingly speculative in its character. RBC must come to terms with the fact that the energy transition is already having an impact, and the fortunes of the fossil fuel industry have begun to wane.