A sizzling spring for U.S. solar

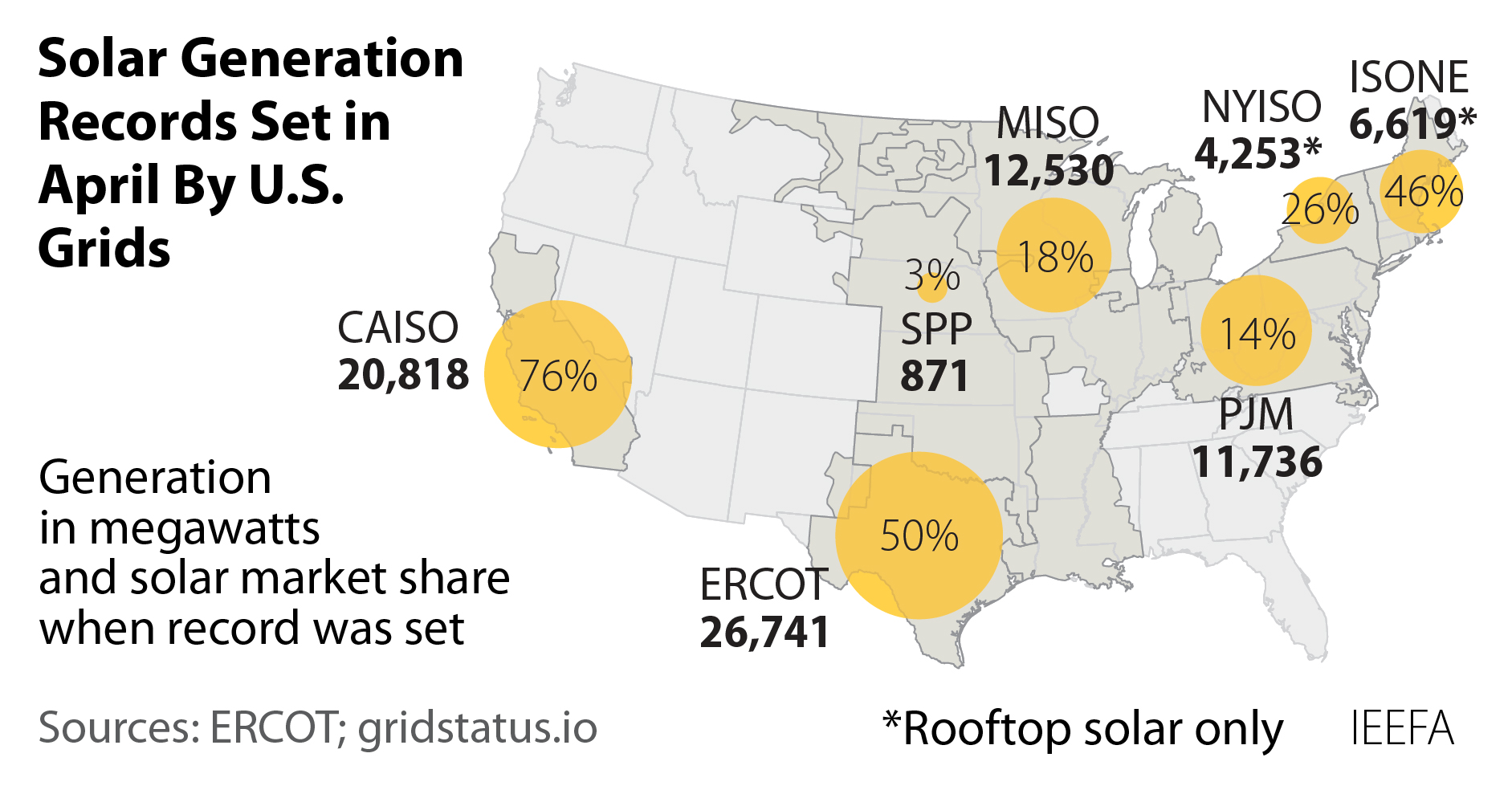

Solar generation records have fallen across the U.S. in the past month, and the most impressive feature of this record-breaking spring is that it has occurred nationwide, not just in the traditional hot spots of California and Texas. Indeed, solar records have been set in all seven of the U.S.’s organized wholesale power markets. Records have also fallen in utility service territories outside these organized markets, notably in Florida.

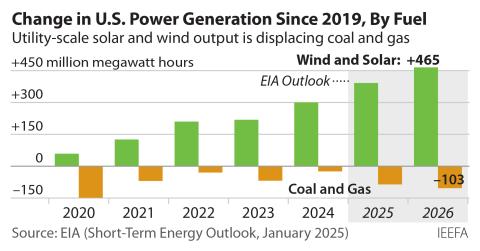

These power production records (all of which are current through April 17) are the direct result of a rapid capacity buildout. According to the Energy Information Administration (EIA), the U.S. added 31 gigawatts (GW) of solar generation capacity in 2024 alone, raising the total to 121.2 GW. An additional 3 GW came online in January, and those additions are now showing up in the record-breaking spring generation numbers. More than 50 GW of additional solar capacity is expected to come online in 2025 and 2026, highlighting solar’s speed to market and its critical role in meeting electricity demand growth.

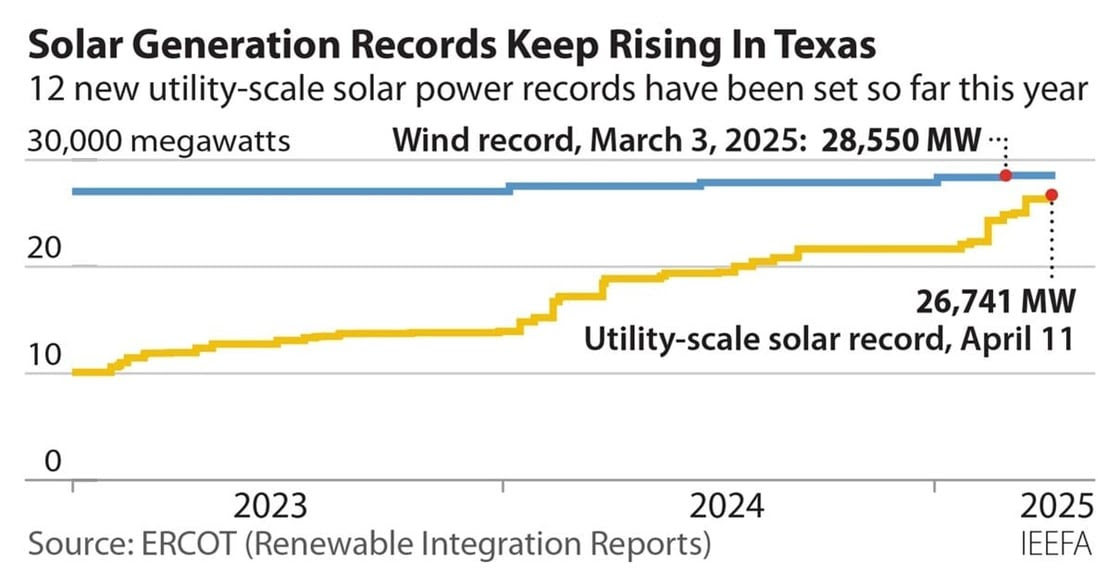

Texas still leads the way in utility-scale solar. It has set a new peak generation record 12 times already in 2025, three of them in April (as of April 17). The latest record on the Electric Reliability Council of Texas (ERCOT) grid, 26,741 megawatts (MW), was set April 11, when it provided 50.4% of the system’s power. On that day, solar was ERCOT’s largest generating resource for almost 10 hours and met at least 40 percent of the total power demand for more than 8 ½ hours. In terms of capacity, there was 30,586 MW of operational, utility-scale solar on the Texas grid, a figure that could increase by 4GW by the end of 2025 and a further 10GW by August 2026, setting the stage for many more peak demand records.

Here, it is worth noting that Texas is the largest state electricity consumer by far. The state generated 563.8 million megawatt-hours (MWh) of electricity from all fuels in 2024 according to EIA data, more than double the 265.4 million MWh generated by No. 2 Florida. ERCOT is the wholesale electricity market operator that accounts for about 90 percent of total power demand in Texas.

Solar likely will also continue growing its share of the overall ERCOT market, even as demand across the region expands. In 2019, when solar’s share of the ERCOT market first topped 1 percent, its generation totaled 4.4 million MWh. In 2024, solar generation hit 48.2 million MWh, pushing its share of the fast-growing ERCOT market to more than 10 percent.

California, long the leader in utility-scale solar generation, has now slipped to second behind Texas. According to data from the California Independent System Operator (CAISO), which runs the market supplying about 80 percent of the state’s electricity, the system had 21,043 MW of installed utility-scale solar capacity as of early April 2025. This is up 1,931MW from a year earlier. The newest peak solar record in CAISO was also set April 11, when generation hit 20,818 MW, a 1,194-MW increase from the previous record set in August 2024 and more than 3,000 MW—17 percent—higher than last April.

Beyond the significant year-on-year growth, the latest California record is noteworthy because of the clear impact it shows dispatchable battery storage is having on the CAISO grid. At the time of the latest peak solar record, batteries accounted for 5,636 MW, or 29 percent, of total system demand. Without that significant source of demand, solar generation likely would have been curtailed significantly to bring CAISO demand and generation into balance. As it was, solar curtailments at the peak totaled only about 500 MW. This stored solar was then fed back into the CAISO market that evening, when battery storage was the largest single generation resource on the grid for three hours, accounting for more than 20 percent of demand during that period.

April also has been a record-setting month for solar in the PJM market, which incorporates utilities in all or part of 13 states in the East and Midwest and is the nation’s largest in total generation. PJM has been slow to develop utility-scale solar, but that may be changing. The region has set three peak records this month, topping 11,000 MW for the first time April 1 and then breaking that mark April 16 and 17. The current record, 11,736 MW, is a 73 percent increase from April 2024. When the record was set, solar was meeting 13.9 percent of PJM demand.

Solar generation growth has been even faster in the Midcontinent Independent System Operator (MISO), the grid operator for 15 states largely along the Mississippi River running from Louisiana north to Minnesota and North Dakota, plus the Canadian province of Manitoba. The region’s latest solar peak record was set April 16, when output hit 12,530 MW, more than double the April 2024 level and the second record in a week. Solar’s share of the MISO market hit 18.4 percent when the latest record occurred.

The Southwest Power Pool (SPP) operates the grid in all or part of 14 Plains states beginning in Texas and stretching up to the Canadian border. The region has 35,634 MW of installed wind capacity, which provided 38 percent of total SPP generation in 2024. But it has just 986 MW of operating solar capacity, even though the system includes areas with strong resource potential, including parts of New Mexico, Texas and Oklahoma. Still, the region recorded a new solar generation record of 871 MW on April 6, up from 490 MW a year ago.

There is relatively little utility-scale solar in the New York or New England markets either, but both regions have set behind the meter (BTM) solar generation records this spring from small-scale or rooftop installations. In ISO-New England, the smallest of the seven organized markets, rooftop solar generation hit 6,619 MW April 17, accounting for 46.3 percent of systemwide demand. The new record is 510 MW higher than last year, which does not seem like a big increase until you realize that many of these rooftop solar systems are in the 10-kilowatt (kW) range—meaning that it would take 51,000 of them to boost generation by that amount.

Combined with the New England region’s existing utility-scale generation, solar supplied 51.6 percent of total demand at that peak point. For the day, rooftop solar accounted for more than 30 percent of regional demand, and was the largest single resource on the grid, for seven hours.

The New York system operator, called NYISO, also posted its newest BTM solar generation record April 17, when the region’s rooftops produced 4,253 MW of power, up 378 MW from the 2024 record. At the peak, BTM was generating 26.1 percent of New York’s demand.

Organized markets are not the only areas where solar generation is growing quickly. Florida Power & Light (FPL), the largest utility in the U.S., has aggressive plans for solar. According to a 10-year resource plan, filed with state regulators in April, the utility had 7,038 MW of operating solar capacity at the end of 2024; it clearly has added more solar since because peak generation now regularly tops 7,100 MW. FPL’s solar generation also now regularly accounts for more than 25 percent of the utility’s demand.

But this is just the beginning. In the next 10 years, the utility plans to add 17,433 MW of solar capacity, bringing its total systemwide to 24,471 MW by the end of 2034. At that point, FPL estimates solar will account for 35 percent of its annual generation. That growth will push gas out of the generation stack, FPL said, cutting its share of annual generation from 72 percent down to 46 percent.

That shift is going to cut fuel costs charged to FPL ratepayers significantly. In 2024 alone, FPL said, solar generation saved its customers $218 million in gas-related fuel costs; since 2017 when it first ramped up its solar construction program, FPL estimates customers have saved $1.1 billion in fuel costs.

To get the most out of its solar investment, FPL, like utilities across the country, is planning to link the new capacity with dispatchable battery storage—in FPL’s case, a lot of battery storage. The company said it is planning to add 7,603 MW of battery storage capacity through 2034.

“Solar and battery storage remain the most-cost effective resource options as well as the only viable options to meet FPL’s needs in the near term,” the company concluded.

That is a particularly notable statement given that FPL operates one of the nation’s largest and most efficient gas-fired power plant fleets in the country. If FPL’s gas plants cannot compete with solar and dispatchable battery storage, few if any other utility systems will be able to do so, either.

This is a point that IEEFA makes continually. Solar, wind and dispatchable battery storage are available now, cost-competitive and quick to market. They offer utilities and other power developers the opportunity to meet rising electricity demand while boosting system diversity and cutting consumers’ exposure to both gas price volatility and fuel costs. This renewable and dispatchable storage combination should be the go-to option.