Coal cost trends: Higher labour costs could continue into the long term

Key Findings

The operating costs of Australia’s top 6 thermal coal producers have increased an average of 22% in 2022.

Labour shortages contributed to a significant decline in coal production in the second half of 2022, putting additional pressure on labour costs.

Pressure from labour costs looks increasingly like a long-term trend, one that will become clearer when recent record high coal prices return to ‘normal’.

Record thermal coal prices following the invasion of Ukraine delivered Australia’s thermal coal producers record profits, debt reduction and returns to shareholders.

While much has been made of these returns in the latest financial reporting, on the other side of the ledger production costs barely rated a mention until very recently.

The operating costs of Australia’s top 6 thermal coal producers have increased an average of 22% in 2022.

In November 2022, Whitehaven revised up its outlook for unit operating costs 7% higher than its previous expectation for the year. It’s battling the combined effects of inflationary pressures on costs as well as reduced production because of flooding. Whitehaven’s per tonne production costs have roughly doubled since 2016.

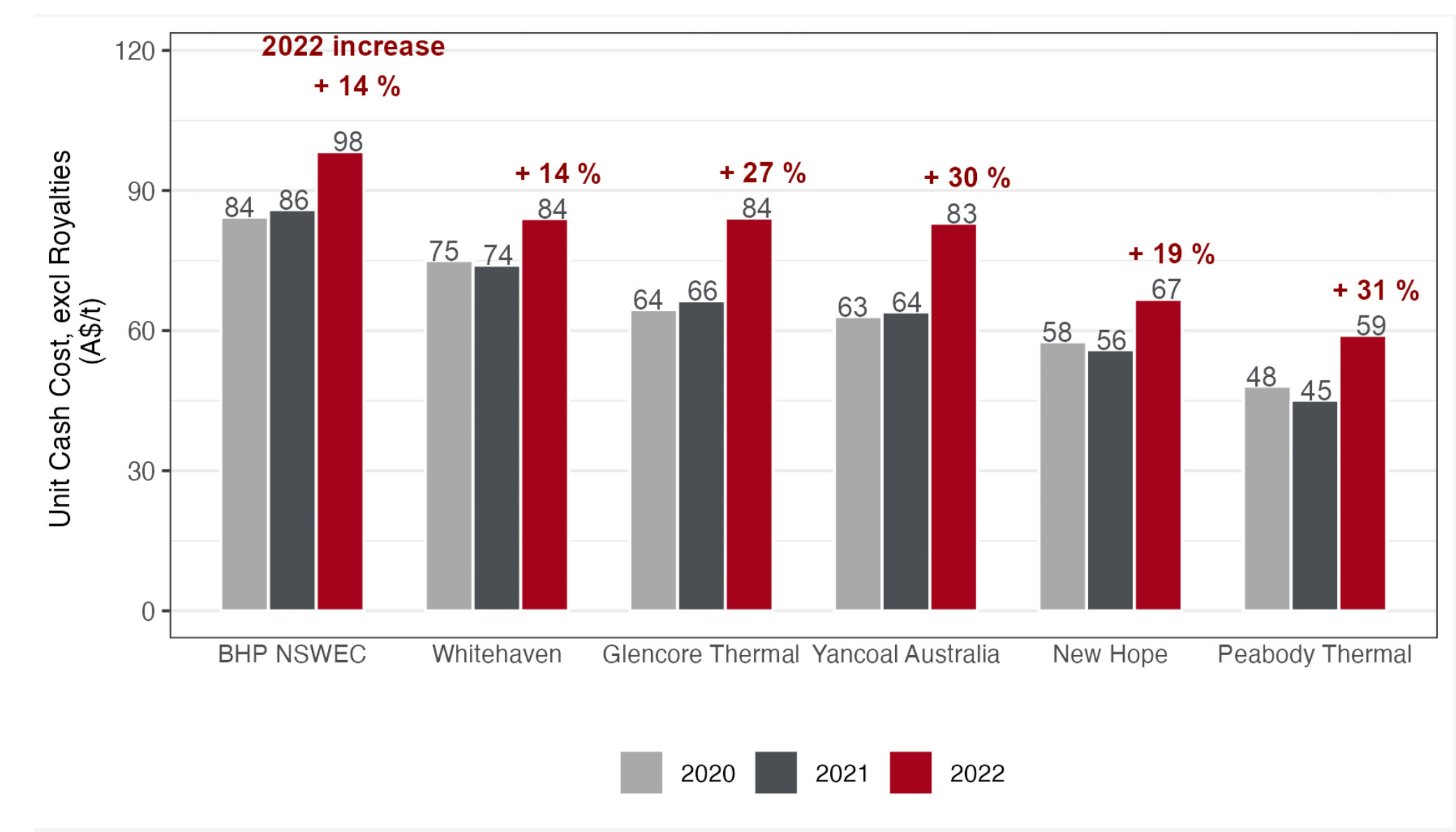

A review of thermal coal producers' operating costs has revealed a collective increase of 22% in 2022, ranging from 14% to 31%. (Figure 1). Until prices return to a ‘normal’ range, such cost increases may not receive much attention. Miners are focused on ensuring they can deliver as much product to market while prices are elevated.

Figure 1: Unit costs experienced by the top 6 thermal coal miners in Australia

Source: Annual and financial reports periods ending 30 June 2022, except New Hope ending 31 July 2022. BHP, New Hope and Whitehaven are 12-month periods. Glencore, Peabody and Yancoal are 6 months to 30 June.

Notes: IEEFA calculations – US$ reported values (BHP, Glencore, Peabody) converted to AU$ at 0.67, 0.75, 0.72 for 2020, 2021 and 2022, respectively. Production values – BHP NSWEC, excl Cerrejon, Glencore production Thermal Australia operations, Peabody short tonnes converted to metric tonnes. Both Glencore and Peabody published unit cash costs including coal royalties – these have been restated to exclude estimated royalties and so exclude the impact of increased prices in 2022.

While some cost relief for coal miners can be expected in some areas – high diesel prices will eventually come down – there is a growing possibility that some pressures are set to remain in the long term.

One pressure set to be a long-term problem is labour costs.

Labour shortages have contributed to a significant decline in coal production in the second half of 2022 for Whitehaven Coal and BHP. Coal shipments through the Port of Newcastle – the world’s largest coal terminal – were 12% lower over the first nine months of 2022 compared to the same period in 2021, and 15.5% lower than in 2019.

Labour shortages have contributed to a significant decline in coal production in the second half of 2022 for Whitehaven Coal and BHP.

The Minerals Council of Australia (MCA) stated in August 2022 that the Australian mining industry is faced with skills shortages in occupations that “include mining engineers, metallurgists, geologists, mine surveyors, electricians, diesel fitters, and drillers. Their acute shortage is increasing cost, delaying projects and reducing production.”

The National Skills Commission’s 2022 Skills Priority List places mining engineers in the top 20 occupations in demand with other mining occupations also in national shortage. This situation will put additional pressure on labour costs for miners like Whitehaven Coal in 2023 and beyond.

Whitehaven has introduced quarterly retention bonuses in FY2022 to help address labour shortages and will continue these into FY2023. They are even prepared to spend up to A$17 million on employee housing in the NSW Gunnedah basin in an effort to secure skilled labour.

The difficulty in attracting workers to the coal mining sector has also been used to explain Whitehaven CEO Paul Flynn’s fixed remuneration increase, which is to rise 21% from A$1.56 million to $1.89 million. Whitehaven’s board justified this rise by stating in its latest remuneration report that “attracting and retaining top talent to the coal industry necessitates a fixed pay premium”.

Prior to shareholder approval for this salary increase at Whitehaven’s AGM, proxy advisor CGI Glass Lewis stated that it had concerns about the increase to Paul Flynn’s salary package but concluded that such a remuneration premium is necessary to attract suitably qualified candidates to “the controversial and divisive coal industry”.

Thanks to its role in climate change, the increasingly controversial nature of coal mining means labour shortages are likely to persist into the future, if not worsen. Student enrolments in mining engineering courses in the US dropped 46% between 2015 and 2020 and a similar trend is being experienced in Australia, South Africa and Canada. At the same time, the existing mining workforce is approaching retirement.

The increasingly controversial nature of coal mining means labour shortages are likely to persist into the future.

This trend is seen across all metals and minerals mining but the coal sector is particularly impacted due to attitudes to action on climate change among younger generations and amid pushback against fossil fuel materials in Australian schools. In September 2022, Birkbeck, University of London, became the first university globally to ban fossil fuel companies from recruiting students through its careers service.

This cost trend will likely gain more attention when coal prices return to more ‘normal’ levels.

KPMG’s most recently compiled thermal coal price consensus forecast sees prices at US$86 in the long term.

In the recently released World Energy Outlook 2022, the International Energy Agency (IEA) outlines a number of scenarios for traded coal. Under these scenarios, the price of thermal coal in Australia’s largest market, Japan, is anticipated to range between US$59/tonne and US$91/tonne in 2030.

While rising cost pressures are currently being masked by recent record high prices, their impact will become clear as prices return to historic levels. Pressure from labour costs looks increasingly like a long-term trend and – added to the frequency of flooding events and rising pressure on methane emissions – will become a growing factor impacting coal mining profitability going forward.

See also Coal cost trends: Climate impacts on coal mining likely long term