Coal cost trends: Climate impacts on coal mining likely long term

Key Findings

Floods contributed to a 22% increase in unit costs of major Australian thermal coal miners in the first half of 2022 as flooding hampered production and increased costs.

Strategies to minimise the effects of climate events such as flooding, drought, heatwaves and bushfires have the compounding effect on unit costs of adding to costs and reducing production.

With the climate trend set to worsen thanks to the consumption of fossil fuels, the industry can expect more disruption.

Wide-scale floods have plagued eastern Australia throughout 2022. As the climate continues to change – driven to a large extent by the burning of coal – such events can be expected to occur more frequently, significantly impacting unit costs for coal miners.

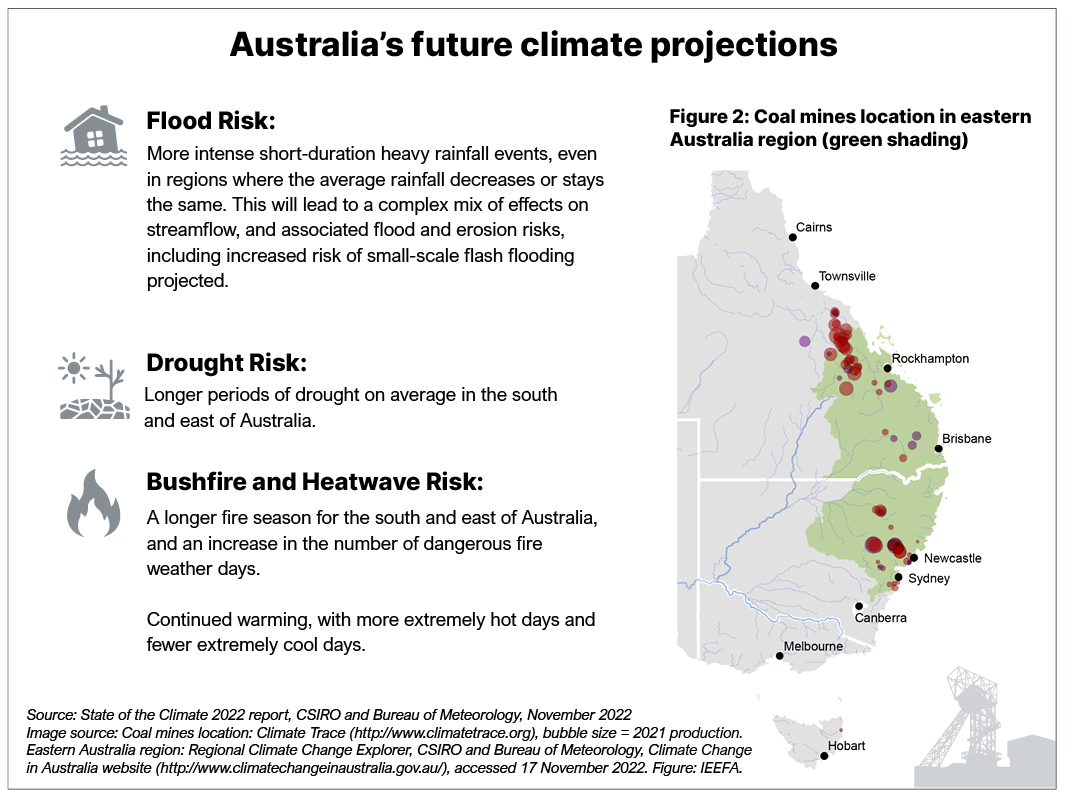

CSIRO and the Bureau of Meteorology’s State of the Climate 2022 report has projected that Australia will experience “an increase in the risk of natural disasters from extreme weather, including ‘compound extremes’, where multiple extreme events occur together or in sequence, thus compounding their impacts”.

More droughts can be expected to be punctuated by more intense bursts of rainfall.

Floods contributed to a 22% increase in unit costs of major Australian thermal coal miners in the first half of 2022.

The floods this year contributed to a 22% increase in unit costs of major Australian thermal coal miners in the first half of 2022 as flooding hampered production and increased costs. Climate events such as floods, drought, heatwaves and bushfires could continue to feature in the long-term impacts to miners.

Coal exports from Port Waratah Coal Services at the Port of Newcastle, NSW, are down 18.5% year-on-year for the first 10 months of 2022. At Gladstone port, Queensland, coal exports are down 9% for the first 10 months of 2022 compared to 2021, and 15% lower than 2019 levels.

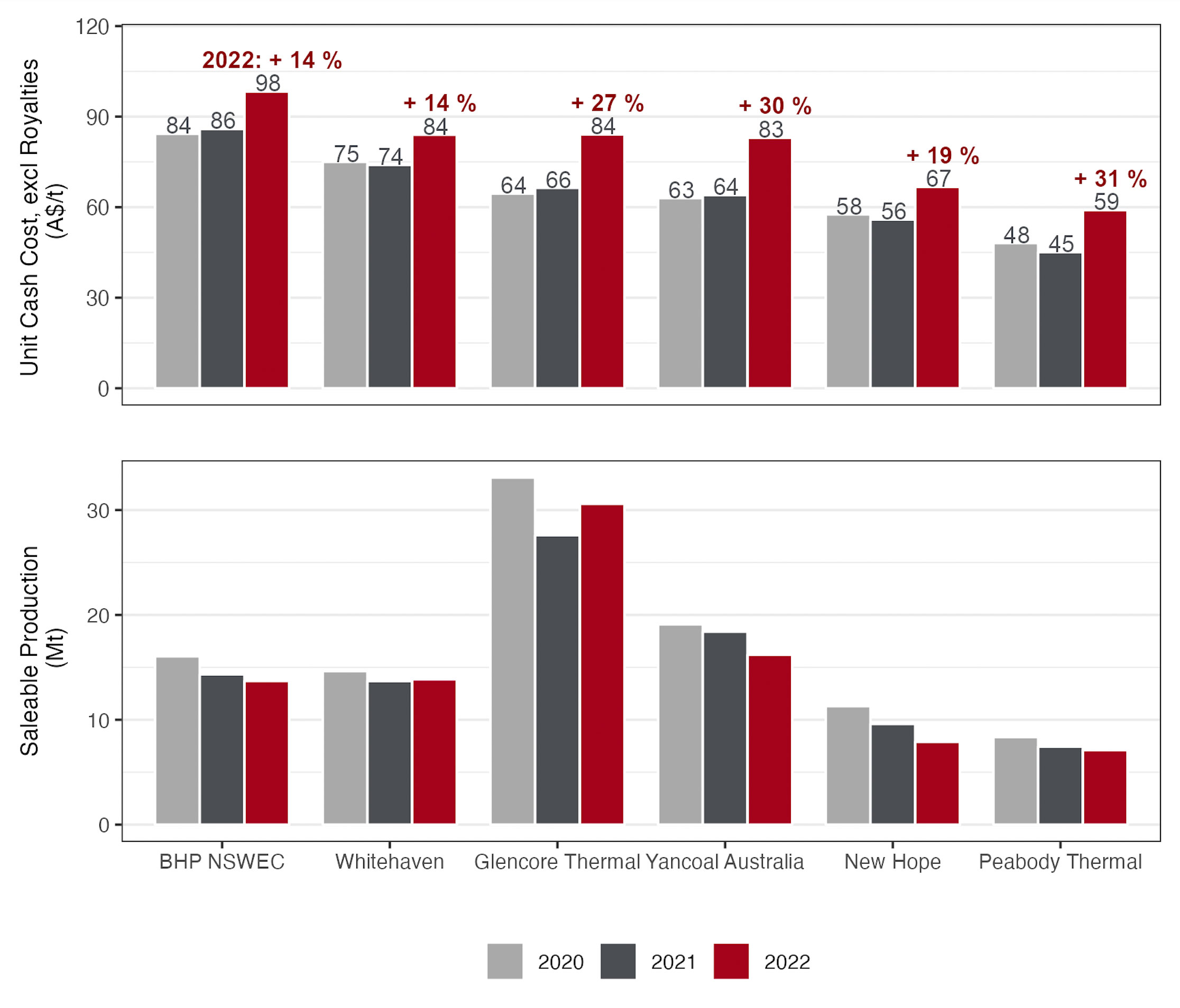

Volumes have trended down for the major thermal coal miners. Along with labour shortages, climate events such as flooding are likely to be long-term pressures on coal miners, reducing production and increasing unit costs (Figure 1).

Figure 1: Unit costs and production for the top 6 thermal coal miners in Australia

Source: Annual and financial reports periods ending 30 June 2022, except New Hope ending 31 July 2022. BHP, New Hope and Whitehaven are 12-month periods. Glencore, Peabody and Yancoal are 6 months to 30 June.

Notes: IEEFA calculations – US$ reported values (BHP, Glencore, Peabody) converted to AU$ at 0.67, 0.75, 0.72 for 2020, 2021 and 2022, respectively. Production values – BHP NSWEC, excl Cerrejon, Glencore production Thermal Australia operations, Peabody short tonnes converted to metric tonnes. Both Glencore and Peabody published unit cash costs including coal royalties – these have been restated to exclude estimated royalties and so exclude the impact of increased prices in 2022.

Whitehaven’s quarterly report to September 2022 noted production levels at its three mines – Maules Creek, Werris Creek and Tarrawonga – were lower than expected “primarily as a result of rain disruption and flooding impacts in September which cut off mine access”. Flooding also interrupted coal flow movements to the Port of Newcastle, following a cut in the rail line.

Production levels at Whitehaven’s three mines were lower than expected “primarily as a result of rain disruption and flooding impacts”.

The International Energy Agency (IEA) noted in 2021 that the “growing frequency and intensity of extreme weather events presents major risks to the security of energy supplies”.

A recent study by NSW’s Water Research Laboratory on the capacity of dams to deal with future floods suggests “floods will become more severe and more frequent”. While forecasting the expected frequency of such events depends on our collective response to greenhouse gas emissions, this maximum possible rainfall could rise by 15% to 38%.

The State of the Climate 2022 report provides further projections for eastern Australia’s extreme weather events (see inset).

In fact, the Australian Federal budget in 2022 recognised for the first time the fiscal impacts of climate change, noting more extreme weather events would increasingly lower productivity, damage physical capital, and disrupt some regions and industries.

Mining companies have strategies in place to minimise the effects of climate events such as flooding, drought, heatwaves and bushfires. But these have the compounding effect on unit costs of adding to costs and reducing production.

Flooding impacts mining unit costs through increased absolute costs for water management. In 2022, miners’ interests in the 2022 Hunter River Salinity Trading Scheme – used by mining companies to manage water releases – was oversubscribed and well up on previous years.

Other flood hazards include road closures both to mine sites and on haulage routes, damaged infrastructure and equipment, and coal chain disruptions (ports and rail). Whitehaven has employed strategies such as “transporting reduced shifts of employees to site via helicopter when roads are closed, and contracting additional haulage capacity when haulage roads are open”, adding to costs to ensure production continues.

In times of drought, water trucked in or treated through reverse osmosis for coal washing, dust suppression and mine site water supply can lead to higher water costs.

During heatwaves and bushfires, higher temperatures contribute to heat stress in mine site workers, and potential for spontaneous combustion of coal stockpiles or lightning strikes on mines. In 2019, Whitehaven reported “numerous unscheduled production stoppages” at Maules Creek through November and December because of “smoke, dust and haze events”.

Reduced coal production in eastern Australia has impacted coal prices as well as costs. The flooding this year has limited the Australian coal industry’s ability to meet demand following sanctions on Russian coal.

This has helped prop up record high thermal coal prices following the invasion of Ukraine, bringing huge profits to Australian coal miners (despite higher costs) but risking an acceleration in the global shift away from coal. At this stage of the energy transition, prolonged periods of high coal prices will destroy long-term demand even faster. On the launch of the World Energy Outlook 2022, the IEA remarked that the global fossil fuel crisis will accelerate the global transition to cleaner, more affordable energy.

With the climate trend set to worsen thanks to the consumption of fossil fuels, the industry can expect more disruption.

The Australian coal sector seems increasingly vulnerable to extreme weather such as flooding events. With the climate trend set to worsen thanks to the consumption of fossil fuels, the industry can expect more disruption.

Future flooding events may sometimes see the impact on coal prices more than make up for cost increases. However, that won’t save thermal coal from an ironic acceleration of its diminishing future and social licence to operate.

This article was first published in Renew Economy.

See also Coal cost trends: Higher labour costs could continue into the long term