Australia’s coal export market: Shifting trade dynamics with Asia

Key Findings

Australia's coal exports are concentrated across six key trading partners.

Despite strong growth in energy demand, partner countries’ clean energy plans and diversification of coal supply chains are putting Australia’s coal exports under pressure.

For the first time, Australia faces a trade deficit with Vietnam, reflecting a shift in the balance of trade between the two nations.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

More than 80% of Australian coal exports are shipped to Japan, China, India, South Korea, Taiwan and Vietnam. Australia has built stable trading relationships with these partners, and coal has long supported our trade surplus position.

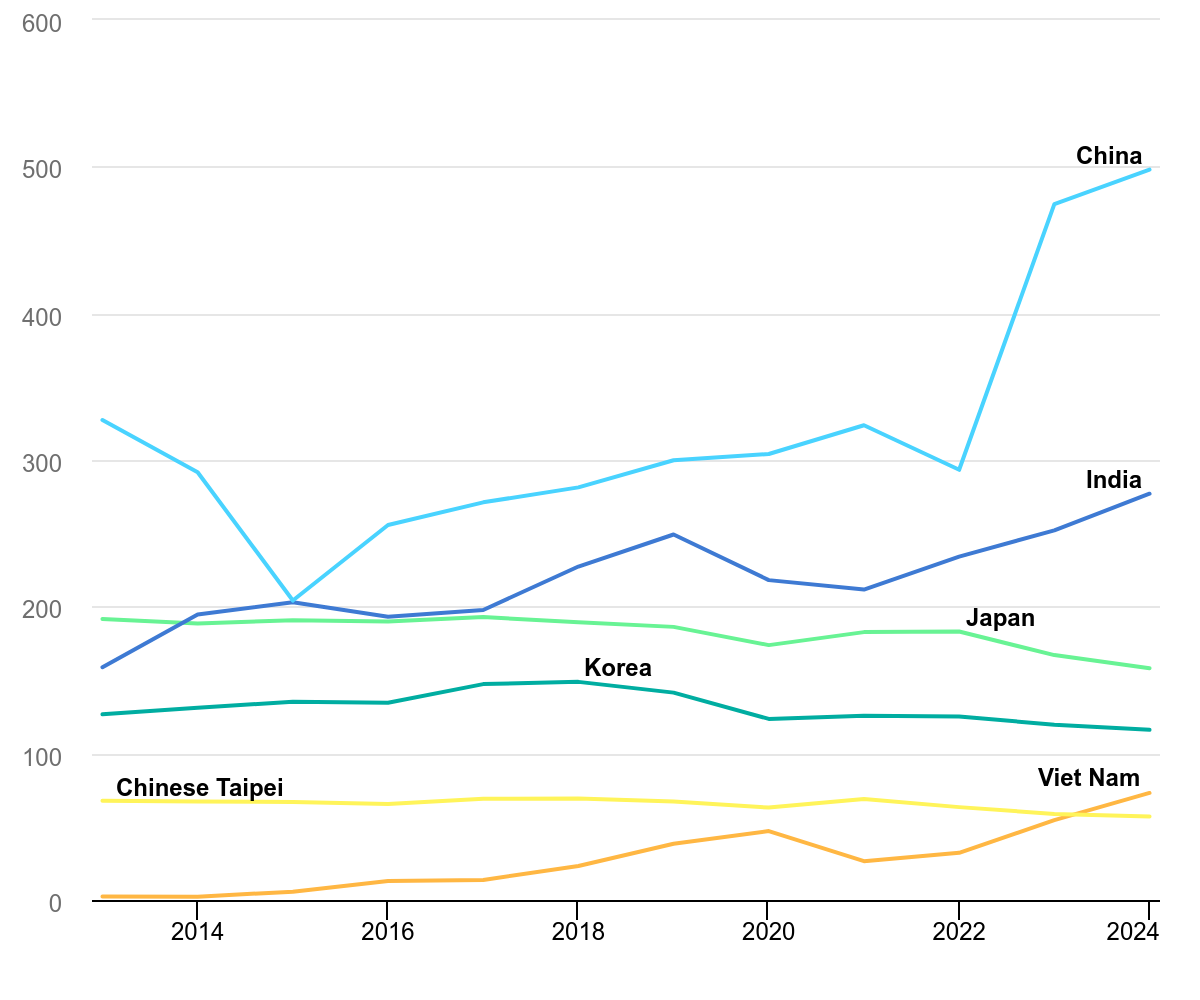

The International Energy Agency’s (IEA’s) mid-year electricity market outlook forecasts that “in 2024 and 2025, the world’s electricity demand is set to grow at the fastest pace since its post-Covid rebound, fuelled by robust economic growth, intense heatwaves and continued electrification worldwide”. The IEA’s mid-year update on coal reported 2023 was a record for global coal consumption. Trade volumes are expected to reach a new high in 2024 (Figure 1) and be broadly flat through 2025. Australia, among others, is expected to benefit from this increased demand.

Figure 1: Coal trade volumes – IEA key countries

Source: IEA

The International Monetary Foundation (IMF) has added weight to this forecast, revising upward GDP growth rates to emerging markets and developing economies, driven by stronger activity in Asia, particularly China and India.

Meanwhile, some of the key Asian markets are reporting reduced trade volumes with Australia, particularly in coal. Monitoring volumes is a more important economic indicator for long-term commodity outlooks than prices because of volatility in commodity prices.

Following record prices for Australian coal in 2022 and 2023, some partners have ramped up decarbonisation plans and/or sought to diversify their coal supply chains in support of more affordable coal.

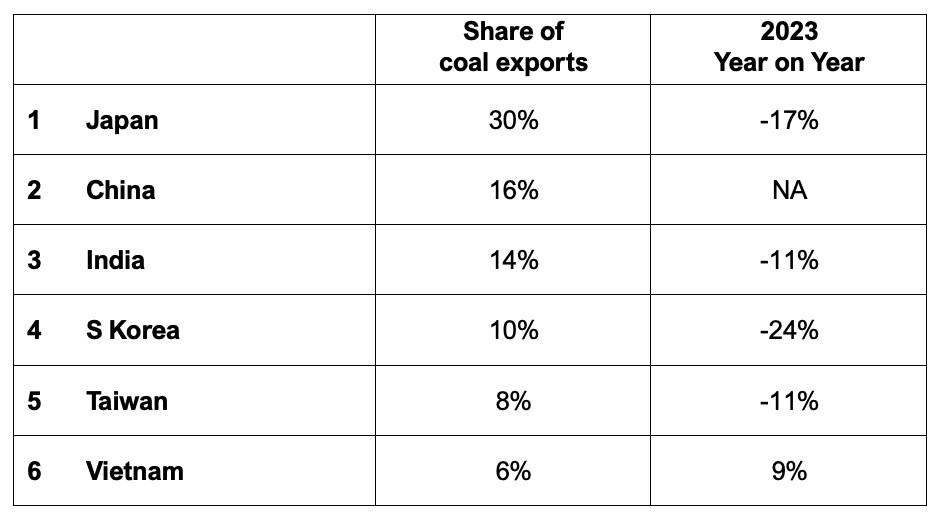

Table: Top 6 markets for Australian coal exports 2023

Sources: TradeMap export total coal volumes, IEEFA

The trade dynamics are varied in each of our major markets.

1. Japan’s declining coal imports

Historically, Japan has been the largest single market for Australian coal. Before 2008, Japan accounted for over half of our thermal coal exports, rebounding to 49% in the energy crisis of 2022.

In 2023, Australia’s coal export volumes to Japan fell by 12%. Since China’s coal trade resumed, the Japan market now represents just 30% of our coal exports. Japan's total coal imports fell in 2023 and a further 6.4% in the first half of 2024.

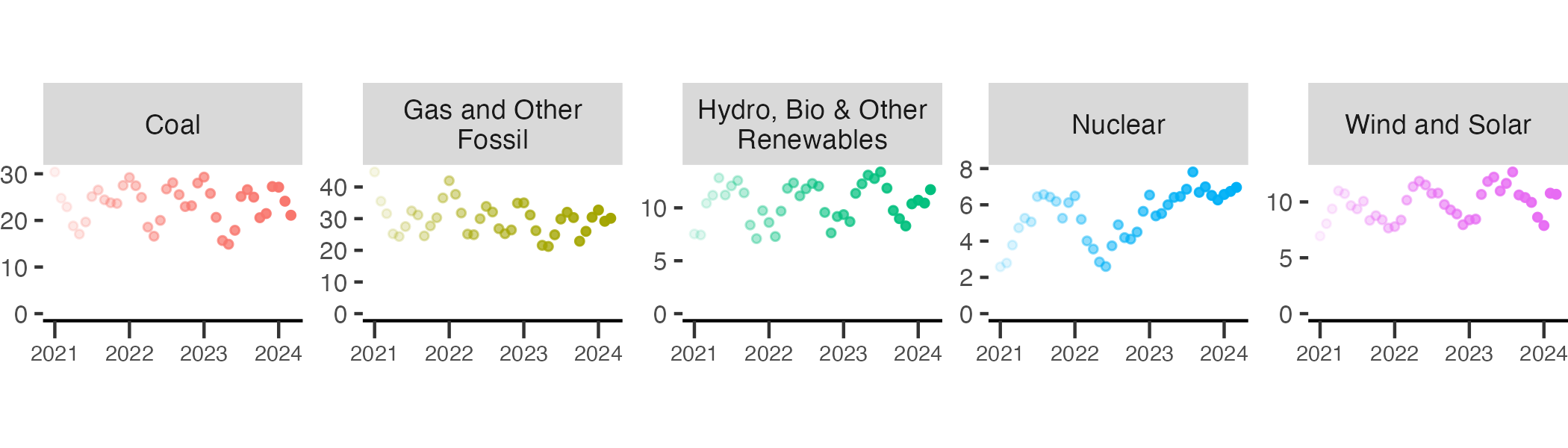

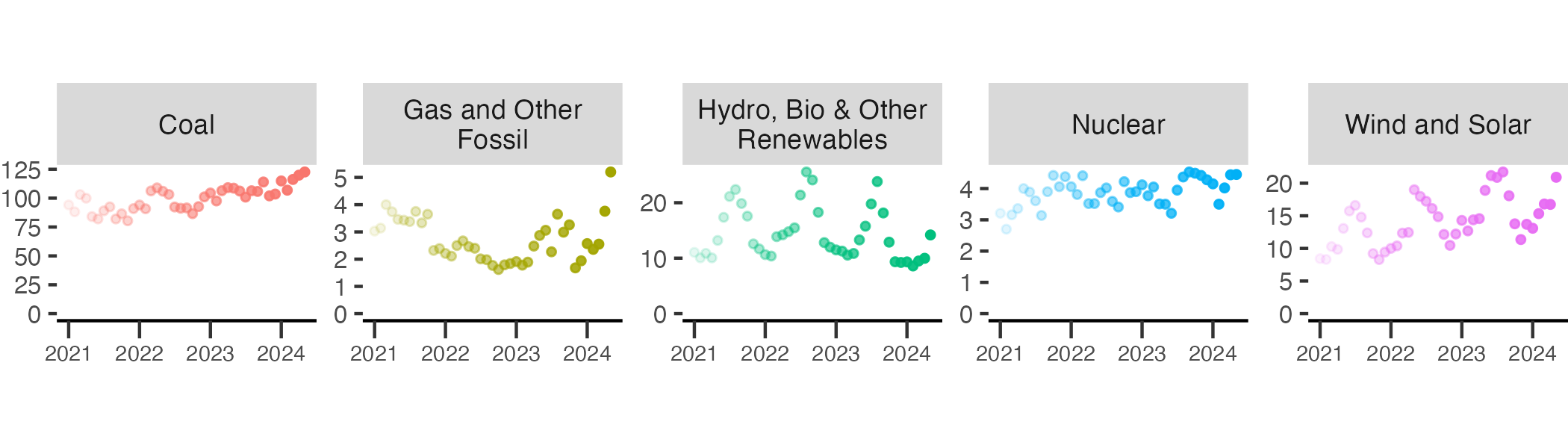

Figure 2: Japan’s coal use is cyclical and dwindling in favour of clean energy (TWh)

Sources: Ember monthly electricity generation data, IEEFA

2. China embraces renewables

China is our overall largest trading partner and number two in coal trade. Following the resumption of coal trade with China in March 2023, exports to China remain strong. Most of this is thermal coal, with metallurgical (met) coal making up less than 10% of exports to China in 2023.

Australia was traditionally the largest supplier of met coal to China. Since the coal trade ban was lifted in 2023, thermal coal shipments have rebounded but met coal is now being sourced from other countries, primarily Russia and Mongolia (accounting for nearly 80%), with other supplies from Canada and USA.

China’s thermal coal appetite is driven by the rapid expansion of its energy infrastructure. In 2023, China reportedly built two-thirds of the world’s new operating coal plants, and two-thirds of large-scale wind and solar plants under construction. In the first five months of 2024, China built 89% of the world’s renewables capacity, including solar, wind and hydro installations.

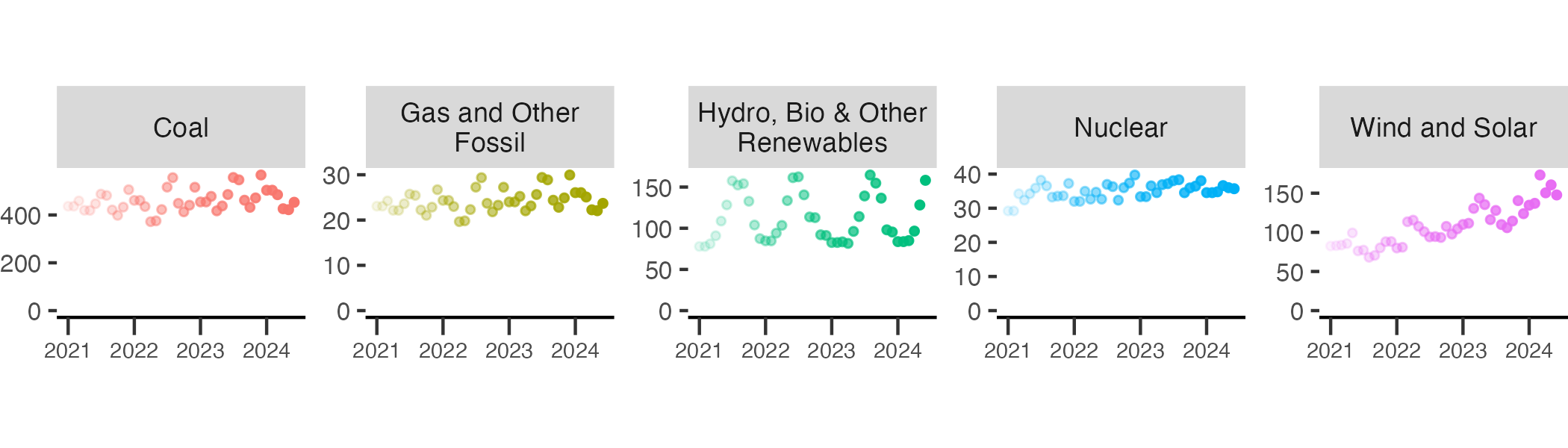

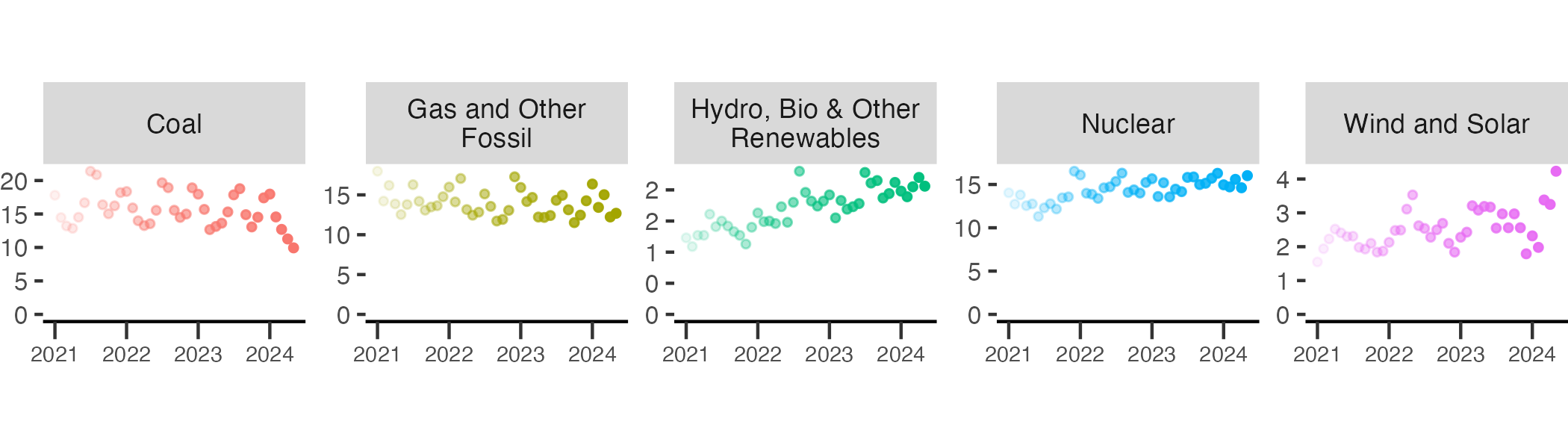

Figure 3: China’s coal-fired electricity increasing despite growth of renewables (TWh)

Sources: Ember monthly electricity generation data, IEEFA

According to the IEA’s World Energy Investment 2024, China “accounted for 95% of global coal-fired power plants that reached Final Investment Decision (FID) in 2023 ... Against a backdrop of rapid expansion of renewable capacity in China, these new unabated fossil fuel power plants face the prospect of very low utilisation and reliance on capacity markets.” Thermal coal use rebounded in 2023 after drought reduced hydropower production.

There is no doubt that coal’s share of the power mix may be falling, but coal use in absolute terms continues to grow, with coal imports rising by 12.5% in the first half of 2024.

3. India a growth powerhouse

India consumed about 1.2 billion tonnes of coal in the 2023-24 financial year, with domestic coal accounting for about 1 billion tonnes of this. India’s prolonged heatwave this year, combined with strong economic growth, has increased electricity demand. The Ministry of Coal plans to boost local production to meet an expected demand of 1.5 billion tonnes by FY2029-30.

Figure 4: India's coal use in electricity continues to trend upwards (TWh)

Sources: Ember monthly electricity generation data, IEEFA

As IEEFA reported, India expects to commission at least 13,900 megawatts (MW) of additional coal power capacity by the end of 2024, the highest in six years.

Meanwhile, Australia’s coal exports to India declined 11% in 2023, and it may not benefit from India’s coal growth ambitions. According to Stockhead, “India is now the largest customer for Australian coalminers BHP and Coronado, but its 10-year high shipment rate has benefited Russian and US miners more than Australian ones. Their market share in India has dropped from 81% in 2018 to 59% in FY24."

This was echoed by BMI: “Throughout FY2024, Russian coking coal was sold at discounts of 20-25%, while Indian mills also started recalibrating their furnaces to ensure a better mix of high-ash content coal coming in from Russia.”

Whether India follows China’s lead in diversifying its met coal supply chain will be pivotal for Australian coal trade.

4 & 5. South Korea and Taiwan’s energy shifts

Historically, these two countries together have accounted for about 20% of Australia’s coal exports. However, in 2023, coal export volumes to South Korea fell by 24% and by 11% to Taiwan.

South Korea and Taiwan are increasingly moving away from coal to clean energy sources such as renewables and nuclear power. As Reuters reported: “Twelve coal power plants that will become 30 years old in 2037 and 2038 are to be replaced by carbon-free power sources such as pumped-storage hydroelectricity and hydrogen power generation.”

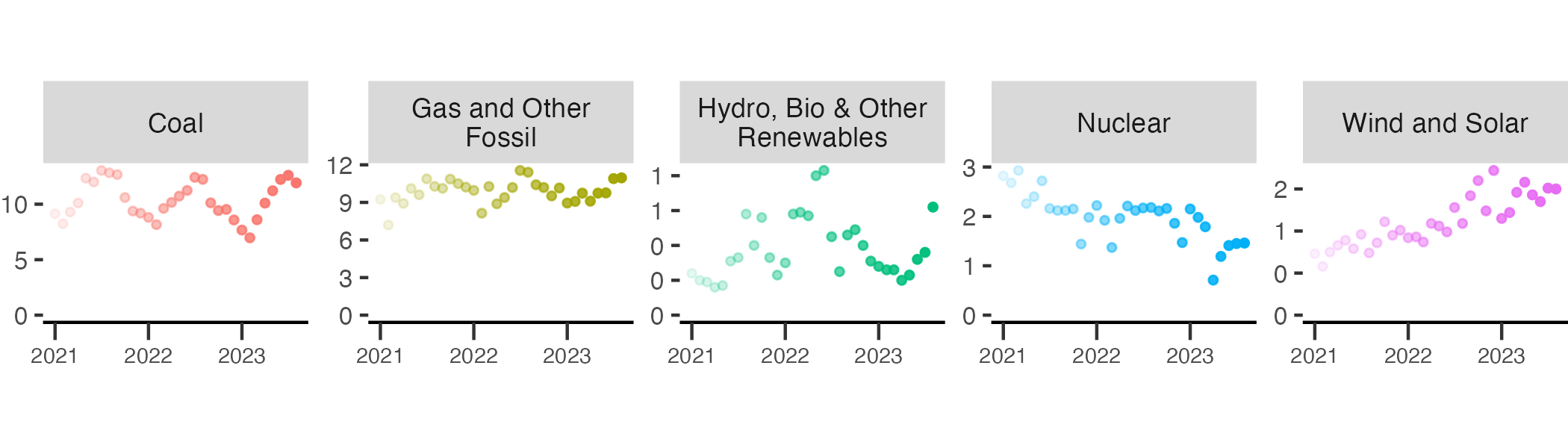

Figure 5: South Korea’s coal use in electricity declines as clean energy grows (TWh)

Sources: Ember monthly electricity generation data, IEEFA

In March, IEEFA reported on South Korea’s costly bet on fossil fuels. Government officials reportedly plan to reduce demand for Australian thermal coal as the country switches from coal plants to nuclear power. “Demand for coal is set to drop as the use of coal in South Korea’s power grid drops to 17.4 per cent in 2030 from 32.9 per cent in 2024, under the proposed changes to the electricity grid.”

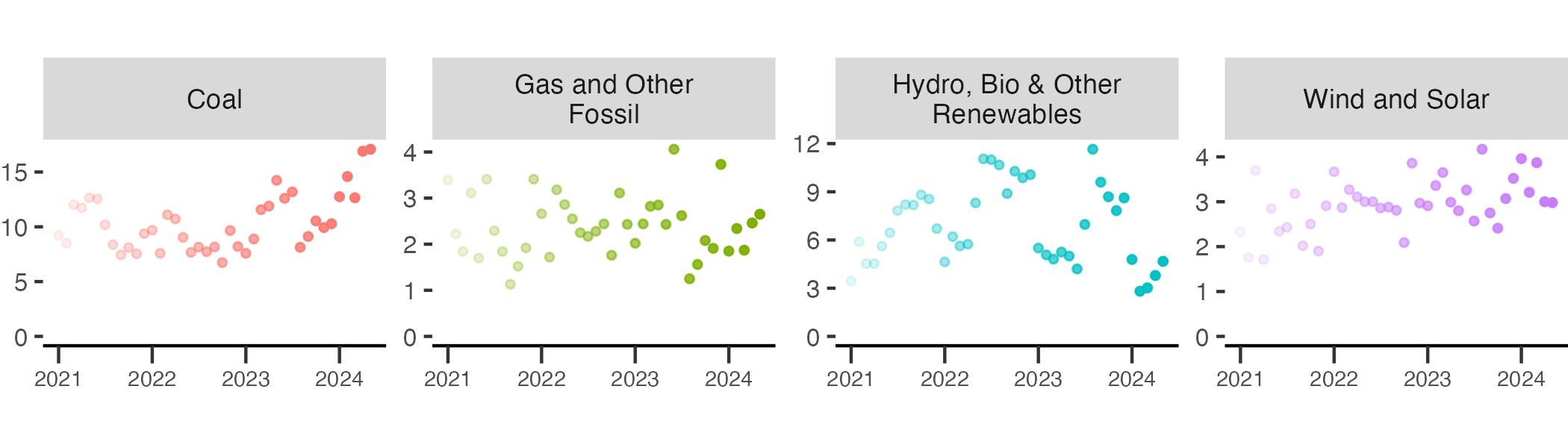

Figure 6: Taiwan's coal use in electricity vs wind, solar and nuclear power (TWh)

Sources: Ember monthly electricity generation data, IEEFA

6. Vietnam’s diversified coal supply chain

Coal has fuelled Vietnam’s recent economic development, and its economy is one of the fastest growing in the world. Coal use is growing rapidly. According to data from Ember, coal's share of the electricity mix increased to 47% in 2023, then in the first five months of 2024 it has grown to 61%.

Like many other countries, Vietnam’s electricity demand has soared as it suffered from climate change impacts. Severe heatwaves and surging air-conditioning loads have contributed.

Figure 7: Vietnam’s coal use in electricity jumps as hydropower reduces (TWh)  Sources: Ember monthly electricity generation data, IEEFA

Sources: Ember monthly electricity generation data, IEEFA

As reported by IEEFA, Vietnam, this month, established a decree permitting direct power purchase agreements (DPPAs) for renewable energy that "could ignite a new wave of rapid renewable energy development in Vietnam".

Vietnam was seen as a significant growth market for Australian coal producers, but this has not materialised. Vietnam’s coal imports shot up 34% year-on-year in 2024, but for the first half of 2024 imports from Australia fell by 24%. Australian volumes sank to levels not seen since 2019 as market share fell, lost primarily to Indonesia.

Australia's share of coal import volumes peaked at 53% in 2022, before falling to 39% in 2023 and 25% for the first half of 2024. Vietnam has diversified its supply chain into Indonesia and other countries with presumably lower-cost supplies.

Despite its record growth in coal use, in 2024 Vietnam has reported its first ever trade surplus with Australia, meaning that we now import more in value of the country's goods than the commodities (such as coal, cotton, wheat, iron and steel) that we export.

Conclusion

Against the backdrop of heightened electricity demand globally and in Australia’s key export markets, the prospects for the nation’s coal exports have been mixed.

Key trends emerging with Australia’s coal trading partners include:

- Global electricity growth is shifting from advanced to emerging markets and developing countries, driven by strong economic activity;

- Peak loads are increasingly at the mercy of extreme heatwaves and associated air-conditioning loads;

- Climate change is causing periods of reduced rainfall, depleting hydropower resources, and coal is filling the gap. Conversely, floods can result in increased hydroelectric generation, displacing coal-fired power;

- Countries are in varying stages of reducing coal dependency, and increasing renewable energy sources;

- Imports from Australia are competing with onshore domestic coal production and low-cost coal supplies from other countries; and

- Markets for “high-quality” Australian coal, such as Japan, Korea and Taiwan (JKT), are in decline. Slowing economic growth and an increased share of clean energy in the electricity mix is lowering demand.

Australia’s historical comparative advantage in supplying the world with “high-quality” coal is eroding. Finding a replacement market for the long-serving JKT premium thermal coal export market has been difficult. Meanwhile, coal production costs in Australia have risen dramatically, putting it further out of reach for some.

Coalminers are targeting higher production volumes to restore output affected by recent floods and make hay while the sun shines. Australia should instead begin winding down its coal resource extraction. It would bring global environmental benefits as well as providing value for the nation by better aligning the supply of its resources with world market demand.

More action is needed to reduce Australia’s economic reliance on coal commodity exports, before our partner markets make the decisions for us.