South Korea’s misplaced faith in a fossil fuel-oriented power mix cost an additional $17bn in a year

High electricity prices during the global energy crisis attributed to fossil fuel overreliance in the power mix, lack of power market competitiveness, and delayed energy transition

A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) unravels that South Korea's overreliance on fossil fuels, coupled with weak market competitiveness in the power sector and delayed energy transition, were the primary factors driving up electricity prices since 2022, particularly during the Russia-Ukraine crisis.

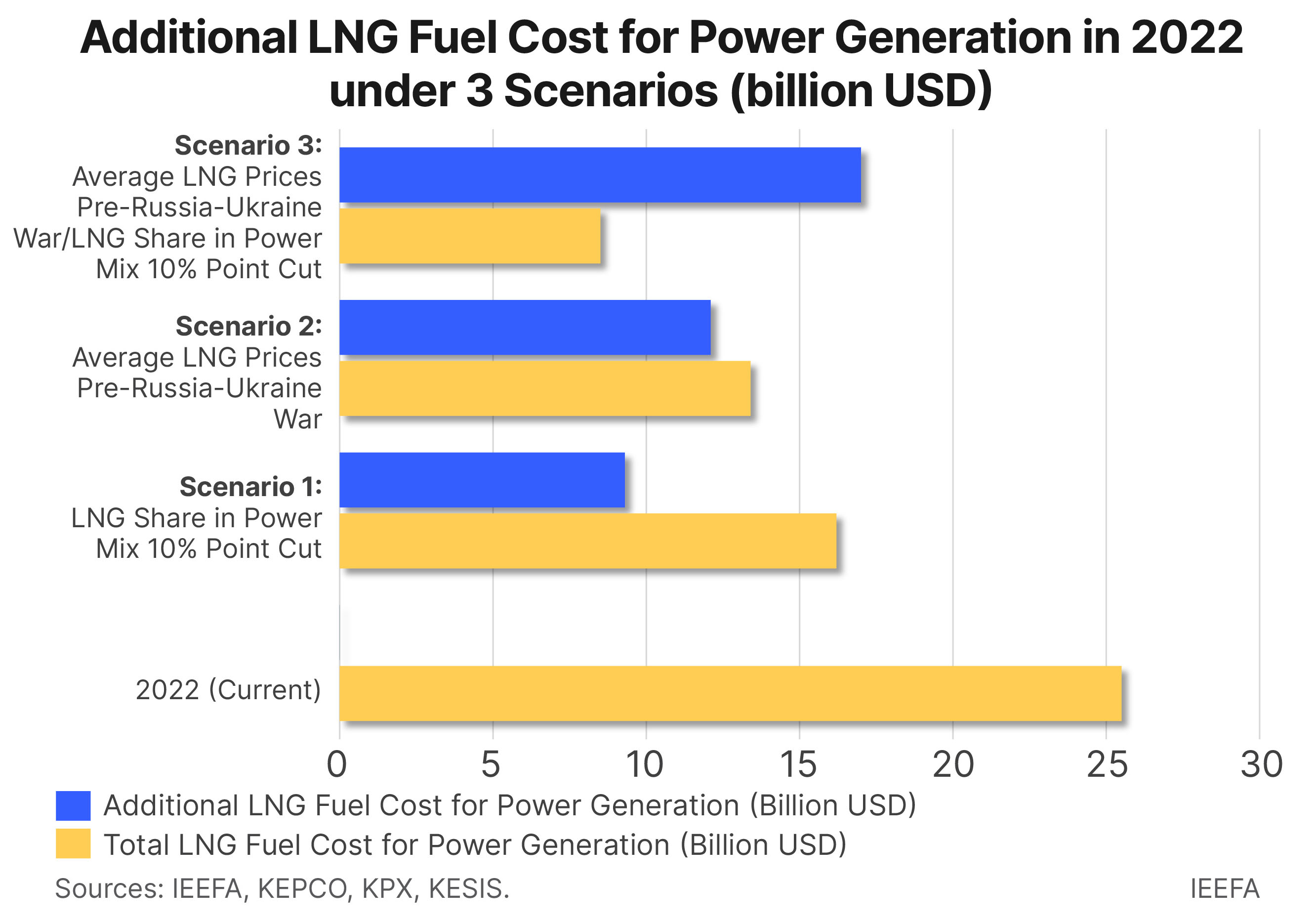

The report – “South Korea’s Power Trilemma” by Michelle (Chaewon) Kim, IEEFA’s energy finance specialist, South Korea – figured out the fossil fuel-intensive power mix burdened the country with an additional $17 billion (₩ 22 trillion) in electricity costs from liquefied natural gas (LNG) during 2022, after conducting three scenario analysis. This translates to roughly US$326 per person.

IEEFA highlights three key factors for surging electricity prices during the 2022 Russia-Ukraine crisis: first, fossil fuel-intensive energy security; second, lack of competitiveness; and third, delayed energy transition.

Fossil fuels dominate South Korea’s power generation mix (63.6% in 2022), which was higher than G20 (59.3%) and OECD (52.5%) averages. The high proportion of fossil fuels, particularly LNG (27.5% in 2022, 26.8% in 2023), in South Korea's power mix made the country highly vulnerable to global energy price fluctuations.

LNG price spikes are a crucial determinant of the wholesale electricity market’s system marginal price (SMP) due to the high proportion of LNG in the power mix, pushing electricity tariffs.

“South Korea has long pursued fossil fuel-oriented energy security under the strong belief that securing fossil fuels will guarantee stable and affordable electricity. Soaring fossil fuel prices, especially LNG, triggered sharp increases in both fuel costs and wholesale electricity prices,” says Kim.

IEEFA estimates South Korea’s total LNG fuel cost in the power sector in 2022 was ₩33 trillion (US$25 billion).

Based on three scenarios, IEEFA finds that South Korea was burdened with additional costs of ₩22 trillion (US$17 billion) for LNG-fired power generation in 2022, or ₩432,015 (US$326) per person, due mainly to South Korea’s overreliance on fossil fuels.

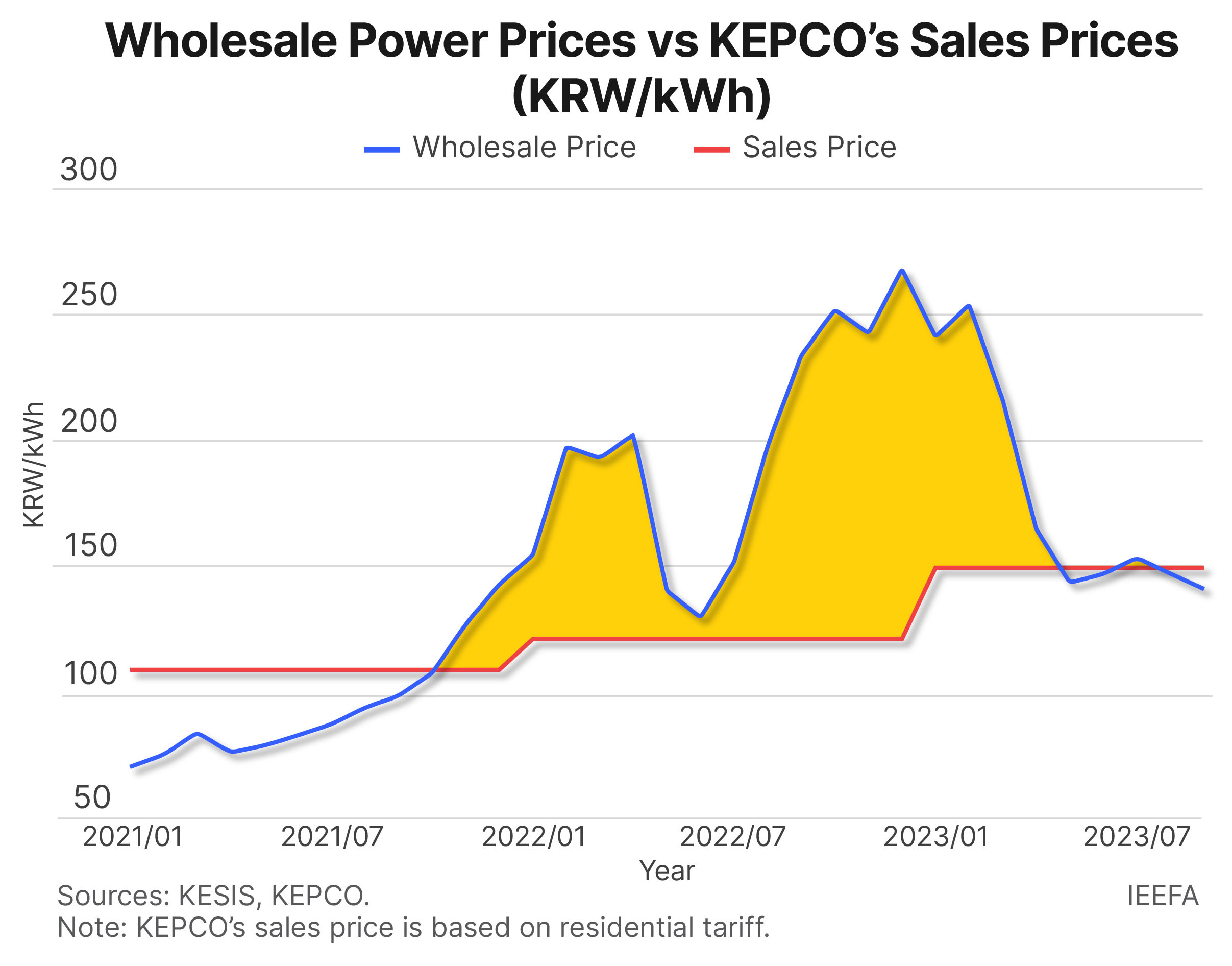

Meanwhile, the soaring wholesale power prices, while artificially low retail electricity tariffs amid the global energy crisis, worsened the state-owned energy utility Korea Electric Power Corporation (KEPCO)’s tenuous financial instability. When wholesale power prices nearly doubled year-on-year to a record high in December 2022, KEPCO’s power sales price to consumers increased by only 11.1%.

One of the root causes of KEPCO’s mounting debts is South Korea’s artificially regulated power pricing mechanism, so-called ‘Pseudo Competitiveness’,” says Kim.

Since 2022, the South Korean government opted to combat the inflationary impacts of the global energy crisis by maintaining low end-user power tariffs, which ultimately required KEPCO to sell electricity to consumers at prices at massive losses. In early 2024, the South Korean government froze power tariffs for the first quarter of the year, citing concerns about inflation.

“Low regulated prices aggravated KEPCO’s financial troubles, leading the company to issue more bonds, which are implicitly backed by the government, creating ‘Double Moral Hazard’,” says Kim.

The report finds the government’s implicit underwriting of KEPCO’s debt has diminished competitiveness further in South Korea’s domestic power market, as it disincentivizes debtors’ cost-reduction and innovationefforts, while creditors’ fiduciary duty.

“This worsening KEPCO’s financial problems and leading to issue billions of dollars worth of bonds again – potentially creating “a vicious cycle” of spiraling debts for KEPCO and deficits for government – which will end up the financial burden of the future generation,” adds Kim.

Regarding the third facet of South Korea’s power tariff trilemma, Kim said, “The delayed transition to renewable power generation has contributed to rising climate-environmental tariffs, a component of the country’s power pricing formula.”

With the delayed deployment of renewable energy and rising costs associated with RPS, ETS, and coal-fired power reduction, KEPCO increased the climate-environmental surcharge unit cost from ₩7.3/kWh in 2022 and to ₩9/kWh in 2023, which were estimated to burden South Korean consumers around ₩4.3 trillion in 2022, ₩5.8 trillion in 2023.

Slow-paced renewable energy investment in South Korea carries opportunity costs for the country since renewable technologies are increasingly at cost parity with conventional energy sources. By not transitioning more quickly, the country may miss out on significant power generation cost reductions.

“Additionally, growing international climate initiatives, such as the Renewable Energy, Europe’s Carbon Border Adjustment Mechanism, and the Sustainable Finance Disclosure Regulation, could impose increasing negative externality costs on South Korea due to its delayed energy transition,” highlights Kim.

IEEFA makes the following recommendations: reduce reliance on fossil fuels in the power mix and expedite the transition to clean energy sources; reform power pricing to reflect actual costs and avoid politically motivated determination of electricity tariffs; address KEPCO's financial challenges through cost-cutting measures and innovation focused on renewable energy; and accelerate the renewable energy transition to mitigate rising power costs associated with delays and achieve declared decarbonization goals.

Read the report: South Korea’s Power Trilemma

Read this press release in Korean

Author contact: Michelle (Chaewon) Kim ([email protected])

Media contact: Josielyn Manuel ([email protected])

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. (www.ieefa.org)