Key Findings

The Indonesian Adaro Group’s planned Phase 1 development of an aluminum smelter of 500 kilotonnes per annum and a 1,100-megawatt coal plant will need eight to 11 years to recoup capex of US$2 billion under a best-case price scenario of US$2,800 per tonne of aluminum.

The smelter and coal plant could add 5.2 million tonnes of CO2, almost 1% of Indonesia’s 2021 carbon emissions.

Captive power plants could boost coal capacity by 52% from 2023 levels and coal consumption by 17%.

Standard Chartered and DBS Bank, two financial institutions with coal exit policies in place, have declined to finance Adaro’s Phase 1 aluminum smelter and coal power plant, which later secured funding from five Indonesian banks.

Executive Summary

A major Indonesian coalminer, the Adaro Group, has been signaling an intention since 2020 to expand its business into aluminum smelting.

The plant complex will be located in Kaltara Industrial Park, North Kalimantan province. It is to be constructed in three phases, each phase building smelter facilities with an output capacity of 500 kilotonnes per annum (ktpa).

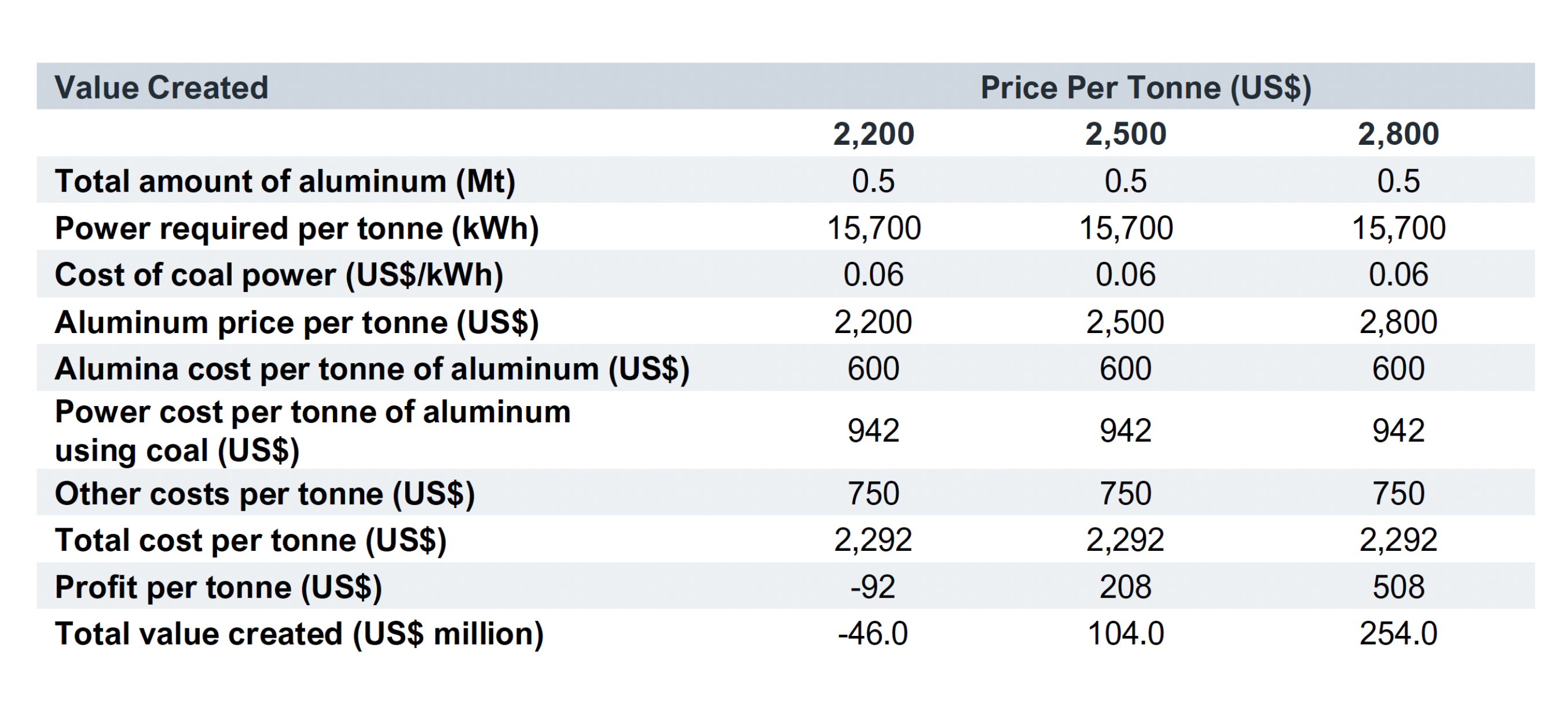

Adaro’s Phase 1 aluminum smelter will have a supporting 1,100 megawatt (MW) coal-fired captive power plant to supply energy. Total capital expenditure of the project is US$2 billion. However, the financial case for the development is shaky at best as the payback period at US$2,800 per tonne of aluminum, the upper bound of the global price range in the last five years, is eight to 11 years.

Phase 1 will also add 5.2 million tonnes (Mt) of carbon dioxide emissions to the environment.

|

Weak Financial Case for Adaro Smelter Project From its research and calculations, the Institute for Energy Economics and Financial

|

Source: Statista; Bloomberg; IEEFA estimates. Note: kWh/tonne = kilowatt-hour per tonne.

In this report, IEEFA will demonstrate why the financial justification for this aluminum smelter project can be difficult and how we arrived at the aforesaid findings. In addition, beyond this project, IEEFA is of the view that planned captive power plants across Indonesia and their coal power capacity are worth monitoring, given especially that recent developments in Indonesia’s green taxonomy may heighten greenwashing risks.