Shifting sands: The evolution of coal mining costs in Australia

Key Findings

Rising costs are impacting coal miners’ profits in Australia, with evidence mounting of a higher baseline for operational costs in the longer term amid lower market prices for coal.

Costs have been inflated due to a range of factors, from labour and consumables expenses to higher financing costs and coal royalties, and growing environmental obligations and climate change impacts.

Although until now miners have focused on getting volumes into high-priced coal markets, they must now shift focus to addressing the runaway growth in unit costs.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

Coal miners’ profits are fragile, with costs increasing to levels where some are reporting cashflow losses.

Amid the record coal prices achieved in recent years, little mention has been made of the consequent rising operating costs. Costs have been sustained at elevated levels, which has led to some operating cashflow losses. There is no reprieve in the long-term outlook for coal prices, yet the evidence is mounting to suggest a higher baseline for operational costs moving forward.

IEEFA warned of fragile profits in March 2023. A year on, the cracks are beginning to appear. Reported profits are down significantly from their peaks, and a number of coal miners have reported negative operating cashflows for the first time.

Given the structural decline in thermal coal markets, it is – surprisingly – the metallurgical coal sector that has first produced negative cashflows. Higher operating costs are impacting on profit margins and – combined with higher sustaining capex requirements – have led to the losses. Notably, in the six months to December 2023, mining businesses such as South23’s Illawarra Metallurgical Coal and Coronado’s Australian Operations reported negative pre-tax operating cashflows.

Several extenuating circumstances have contributed to this, and both companies expect future costs to decline. South32 experienced a higher number of longwall moves and spent capital on reconfiguring longwall and additional underground ventilation. Coronado had significant expenditure on contractor pre-strip operations and a costly legacy contract. Nonetheless, losses have extended into miners’ reported results for the quarter ending March 2024. Two miners, Coronado and Peabody, have issued 10-K earnings reports for the quarter, and both have reported negative free cashflows for their entire operations for this period.

More broadly, the narrative on coal miner production costs has changed.

Cost inflation has been experienced across the board over several years. During this time miners have continually revised unit cost outlooks upwards and have explained away variances as temporary pressures. However, far from being temporary, many of the cost increase elements have a longevity about them. There is an increasing risk of costs now remaining higher for longer – or becoming permanent.

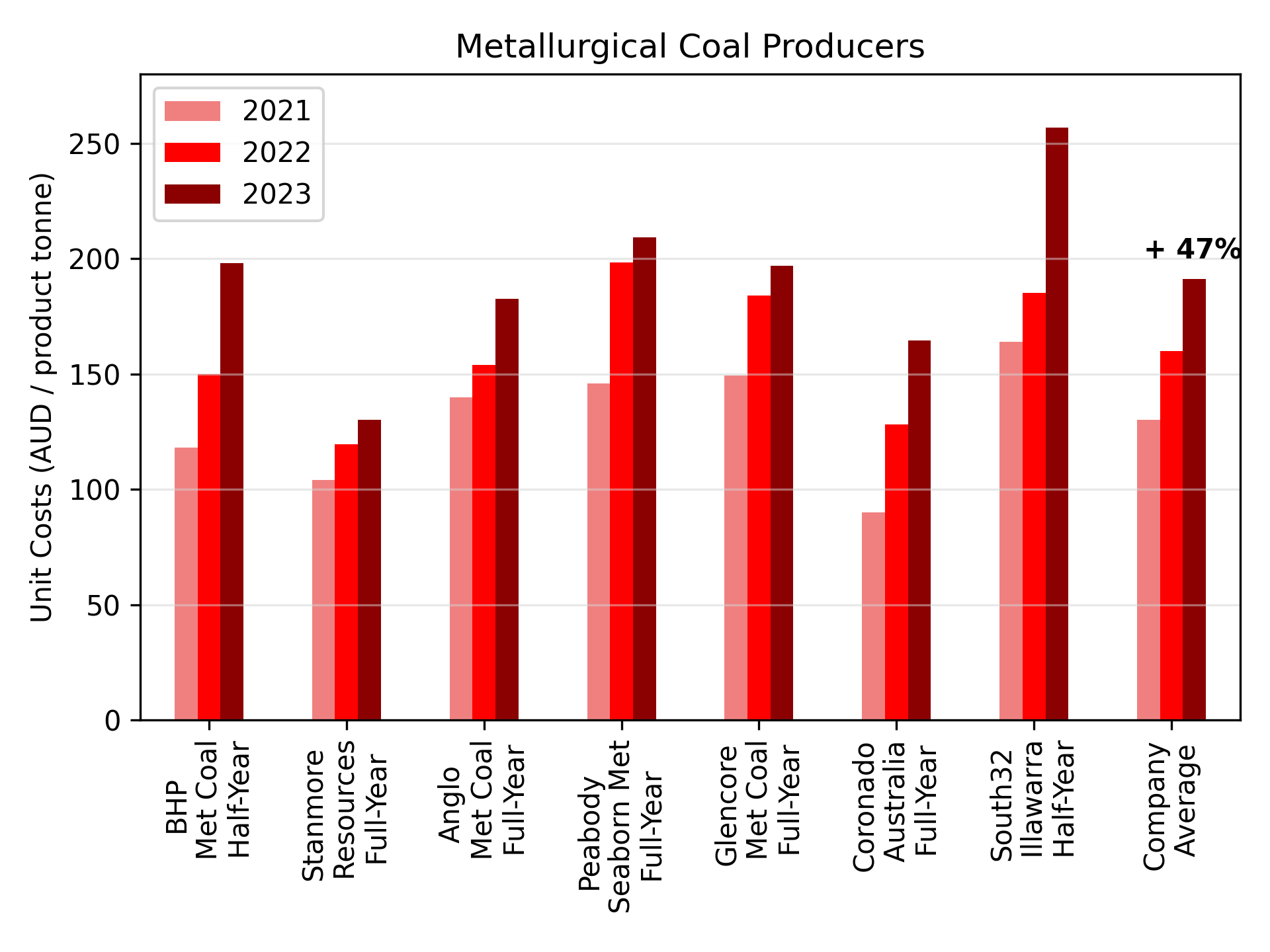

The increases are widespread. No coal miner across Australia is exempt. IEEFA reported in August 2023 that thermal coal miners experienced cost inflation of more than 50% over two years to (June) 2023. Metallurgical coal miners’ unit costs have also experienced similar increases over the two years to December 2023, as shown in Figure 1.

Metallurgical coal producers’ reported unit costs – to December 2023

Source: December 2023 company reported results. Normalised to AUD/tonne, given operations are undertaken in Australia with costs predominantly incurred in Australian dollars. BHP, Peabody and Glencore unit costs include royalties. IEEFA.

There is a symphony of factors impacting on miners’ costs – encompassing labour and fuel costs, higher distribution costs and coal royalties. Additional elements just beginning to exert their influence on embedded long-term costs include extreme weather events, rising strip ratios and new emissions management costs, such as ensuring compliance with the government’s Safeguard Mechanism.

- Labour costs

- Whitehaven reports some of its labour shortage issues have been resolved, easing short-term production rates, but cost inflation persists.

- The industry’s attractiveness for new hires who are conscious of environmental, social and governance (ESG) issues has not changed amid the looming retirement of existing mining engineers, as reported in Mining.

- Energy and consumables

- Inflation in electricity, diesel, explosives and equipment parts has been sustained.

- Increases in water costs have been experienced, and high-grade magnetite suitable for coal washing is in short supply in Australia.

- Rehabilitation costs

- Requirements and ESG-driven targets to progressively rehabilitate mine sites are bringing forward end-of-mine life expenditures.

- Geological conditions

- Rising strip ratios remain a trend for all open-cut miners. In Queensland, strip ratios have risen from 7.5:1 in 2018 to 8.7:1 in 2023. In NSW, the trends are similar. The trend to rising strip ratios was first reported by IEEFA in November 2023.

- Underground mines have recently suffered from difficult underground mining conditions, including: South 32’s Dendrobium; Anglo’s Moranbah and Grosvenor; BMA’s Broadmeadow; and Stanmore’s Millennium.

- Coal supply chain

- Higher port and rail costs have been experienced in NSW and Queensland.

- Restrictions or closures to coal supply chains hit Dalrymple Bay Coal Terminal in Queensland following Cyclone Kirrily in January.

- The recent Baltimore bridge collapse in the USA is a reminder of the fragility of concentrated supply chains, such as with coal.

- Increased state coal royalty rates in NSW and Queensland

- Interest rates and financing costs

- Financing restrictions are forcing miners into higher-cost private finance as traditional lenders transition away from coal mining.

- According to the International Monetary Fund (IMF), the global private credit market is growing rapidly, joining private equity markets in providing strong returns. This translates to higher borrowing costs for recipients. The IMF estimates that more than one third of all borrowers now have interest costs higher than current earnings.

- Some private debt in Australian coal mining features interest rates plus a royalty, further raising interest costs.

- On top of high interest rates borne by miners, the heightened mergers & acquisitions (M&A) activity may force higher cashflow requirements on miners, due to buy-back provisions in the event of a change of control.

- New greenfield coal projects are struggling for finance, as with the recently opened Olive Downs mine. The project’s CEO Barry Tudor said: “When I started, there were 20 banks vying to put in money as a lender. When I finished, I was scraping to get two.”

- Emissions management costs

- Miners are scoping the impacts of the Safeguard Mechanism and emissions reduction targets.

- Open cut mines will eventually be forced to pay more for carbon offsets. They face potential increases to reported emissions, with revised fugitive emissions estimation measurements threatening to expose widespread underreporting.

- A review of the National Greenhouse and Energy Reporting (NGER) regime is expected to phase out the simplistic Method 1 estimation in favour of more rigorous methods from 2025.

- Climate change impacts

- Recent history suggests miners’ planned-for weather expectations have been exceeded by a high frequency of wet-weather events.

- As well as flooding, there have been increases in the probability and severity of extreme weather events such as heat stress, bushfires and more intense tropical cyclones. Access to water is critical for coal production and will become more unreliable with more varied drought and flood conditions.

- The risk of climate adjustment was first reported by IEEFA in 2022.

- Sustaining capex to ‘stay in business’

- While some miners don’t disclose their capex details, sustaining capex such as for major equipment replacements has been on the rise.

- The higher sustaining and life-extension capex has combined to force miners into negative operating cashflow, such as South32 and Coronado Australia.

- Sustaining capex across the met coal producers is estimated by IEEFA to have near doubled in intensity over the past year. These additional demands just to stay in business are on top of declining revenues and add pressure to miners’ already squeezed operating cashflows.

The cost pressures experienced in Australian coalmining are clearly significant and widespread. Labour shortages, inflation in consumables and regulatory changes, as well as depleting mine resources, are setting a new higher baseline for operational costs moving forward.

Up until now, miners have focused on getting volumes into high-priced coal markets. They must now turn their focus to costs, and address the runaway growth in unit costs.

Traditional markets for Australia’s high-quality, low-ash thermal coals, such as Japan, South Korea and Taiwan, are in structural decline, while alternative markets in China, India and South-East Asia demand lower-quality coal. There are opportunities for Australian producers to adjust their production – with a lower proportion of coal washing – to meet these market needs. This will lower the unit operating costs and raise the effective product yields. However, this comes with lower market prices for coal. Hence, it is not going to save coal miner margins.

As mines spin off less cash and some potentially become a cash drain, miners will need to consider their options: placing mines on care and maintenance; throttling back production; or putting the mine up for sale. It is little surprise that South32 is selling out of Illawarra Metallurgical Coal and recently sold its share of Eagle Downs Project.

At the top end of town, both BHP and Anglo have experienced margin squeeze. Their met coal businesses both suffer from declining EBITDA margins and increasing capex requirements. Anglo’s coal mines are in the top quartile of the met coal cost curve.

The outlook for new greenfield projects is even more challenging. They contain all the above input cost issues experienced by operating mines, together with large development capital to pay back and more difficulty in attracting finance. Miners are also expected to trim recently committed expansions, where they now represent a further drag on cashflows with dwindling prospects of returns, rather than being positive growth stories.

Miners’ profits will remain fragile. There is no reprieve in the long-term outlook for coal prices. Analysts, including the Australian government, forecast further difficulty for both thermal and met coal as they enter long-term structural decline.