Coalmine M&A, financing and unintended consequences

Key Findings

Coalminers’ appetite for mergers and acquisitions (M&A) is strong, partly fuelled by thermal miners responding to financing restrictions.

Coalmine debt is already highly priced, reflecting the higher risks and introduction of private credit risks, raising costs even further.

Miners are sitting on healthy balance sheets but with profit margins compressing, they may need to reconsider their growth ambitions.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

Following BHP’s withdrawal of its bid for Anglo American, attention turns to the sale of Anglo’s metallurgical (met) coalmine assets. Bids are expected predominantly from pure-play coalminers, part of a growing trend in the industry.

This trend can be traced back to Rio Tinto's sale of its coal assets, followed by the sale of BMC's assets to Stanmore Resources, BMA's sale of its Daunia and Blackwater mines, and similar moves by South32. In all these cases, coal assets were offloaded to smaller, pure-play coalminers. Glencore also plans to spin off its coal operations now it has acquired the coal business from diversified miner Teck.

What is driving this trend?

On the sell side, diversified miners are disposing of coal assets either because they see diminishing returns or are under increasing pressure from shareholders to improve environmental and social governance (ESG) performance, such as reducing greenhouse gas (GHG) emissions.

On the buy side, undiversified coalminers are saddled with increasing restrictions for their thermal coal businesses, particularly on financing and insurance, both of which are becoming increasingly expensive and difficult to secure on favourable terms.

Misaligned bank policies

Pure-play coal companies appear to be attempting to regain favour with banks, insurers and super funds, whose financing restrictions on thermal coal mining are incentivising a relative increase in met coal production.

The Big 4 banks have split policies on coalmine investment exposures. These restrict investments in thermal coalmining but provide continued support for met coal financing.

Moody’s labelled this move away from larger diversified miners to pure-play coal companies as “higher risk and, in some cases, below investment grade” in 2021.

Banking policy stances are at odds with the federal government’s position and international measures. Both the Paris Agreement and the Global Methane aim to reduce (GHG) emissions. They don’t make allowances or exclusions for one type of coal over another. They recognise that all forms of fossil fuel production create harmful GHG emissions, and need to be minimised.

Met coalmines, including those with some thermal coal, account for about 70% of Australian coalmines’ methane emissions. Yet financing of the met coal and iron and steel sectors continues to grow.

This policy split among the banks and insurers has unintended consequences for Australia’s coal sector. To remain viable, pure-play thermal coalminers are being enticed to grow their met coal businesses. As a result, met coalmining is expanding and their GHG emissions are growing.

Recent policy updates are encouraging. From October next year, NAB will stop new lending for met coalmining clients without a Paris-aligned climate transition plan. CBA has a similar policy against funding met coalmining (if >15% of revenue) from next year, where clients “do not have independently verified plans to cut all emissions – in line with the Paris Agreement’s ‘well-below 2°C’ upper warming limit”.

Market forces and regulatory mechanisms are insufficient to motivate change. The financial services sector needs to realise that the only feasible pathway to decarbonisation is for both thermal and met coalmines to enter a downward trajectory.

Demand for new coal deposits to be opened

Beyond growth through acquisition, coalminers have also been investing in met coal exploration. High exploration expenditure is an indication of further development of existing or new coal deposits.

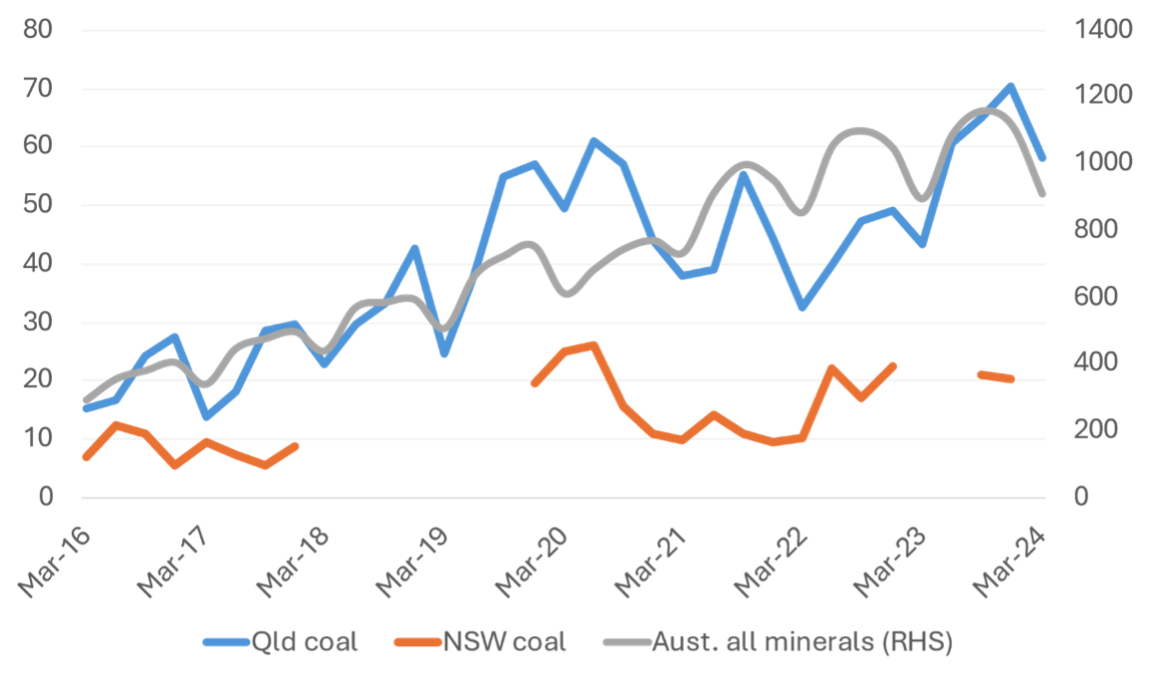

Australian Bureau of Statistics (ABS) data of coal exploration in Queensland (largely met coal) shows strong growth – on a similar trajectory to all minerals exploration across Australia (Figure 1). This contrasts with the stagnating growth of exploration in NSW (which is predominantly thermal coal).

Figure 1: Queensland met coal exploration expenditure (A$m)

Sources: ABS, IEEFA

With high growth ambitions for met coal, the burning question is how pure-play coal companies will finance this growth. Both M&A purchases and organic growth require additional funding. Miners may turn to debt and equity markets to help finance these strategies.

Coalminers need to look to financial markets again

The strength of coalminer's cashflows will be revealed in the upcoming reporting season. Coalminers have paid down debt, and returned funds to shareholders, but are now saddled with a historically high operating cost base. For coal mine operators to remain profitable, coal prices must remain higher than historical levels.

Some pure-play coalmines have struggled with uneconomic conditions. Stanmore Resources recently announced it would close its Mavis underground met coalmine and New Wilkie Energy closed its open-cut coalmine, both within months of opening.

Shares in coal producers have rallied on the withdrawal of met coal supply following Anglo’s Grosvenor mine fire. Debt providers, on the other hand, are more concerned with repayment obligations, and are looking for long-term stable cashflows. They would be more concerned whether similar incidents could affect the production capacity of their financed asset(s).

Finance with higher costs and complexity

With traditional coal financiers becoming increasingly wary of the sector, there has been an influx of new and higher-cost debt markets supporting coalmining deals.

Several high-profile M&A coal transactions have been backed by private credit (also known as private debt). The most recent was Whitehaven’s acquisition of Daunia and Blackwater mines, supported by cash and A$1.1 billion in private debt. Additionally, Stanmore Resources secured nearly half of the funds for its acquisition of BHP’s 80% stake in BMC in 2021 through debt deals. All came with higher rates of interest than traditional bank debt.

Private credit was also involved in refinancing the Adani port infrastructure, as highlighted by the Sustainable Investor, which raised the prospect of further private deals in Australian coal.

McCulloch Robertson has noted an increase in the use of convertible notes in the Australian energy and resources sector, including with BHP. In September 2023, BHP raised US$4.75 billion to refinance its acquisition finance facility and for other corporate purposes. New Hope announced last week it would issue A$300 million in convertible notes to fund its coal operations and potentially expansion into met coal. These hybrid forms of finance can provide lenders with access to lower initial funding costs and investors the option to convert this to equity at a later date.

IEEFA has observed a number of additional trends with global coalminers in Pitchbook data.

While M&As are typically corporate-backed (largely funded via a miner's balance sheet), secondary transactions such as subsequent sell-downs are common. Debt refinancings in coal typically use high-cost traditional debt instruments (such as high-yield bonds and leveraged loans) and to a lesser extent private debt.

If private credit or convertible notes are increasingly used to fund mine acquisitions, this may add complexity to the selling process. Regulatory approvals such as state resource regulators, the Foreign Investment Review Board (FIRB) and potentially, the Australian Competition and Consumer Commission (ACCC), may become involved.

Whether investors then have the patience to ride commodity cycles, industry structural changes and risks of significant production interruptions remains to be seen.

The growth strategies of pure-play coalminers are being driven by policies established in the financial services industry and increased shareholder ESG considerations.

Despite growing awareness of the rising financial costs of greenhouse gas emissions and climate change, real change on the ground is minimal. In fact, investment in met coalmining is being advanced for both organic and inorganic growth. Coal production, and its associated emissions, continue to grow.

The financial services industry is effectively rewarding pure-play coalminers for increasing their met coal exposure. This runs counter to decarbonisation goals and Australia’s climate commitments. Instead, they need to set more rigorous standards for the decarbonisation of coalmining.