Latest Coal Export Terminals Research

See more >

Australian met coal export forecast downgraded yet again as BHP reportedly considers an exit

April 14, 2025

Simon Nicholas

Insights

Australian coal exports face numerous downside risks, new projections show

April 14, 2025

Anne-Louise Knight

Insights

Rising costs to impact Australian coal miners’ margins sooner than expected

December 13, 2023

Andrew Gorringe

Insights

Financial risk in Australia's coal ports

October 24, 2023

Andrew Gorringe

Report

Whitehaven Coal: Assessing its claims about its long-term outlook

October 06, 2023

Simon Nicholas

Report

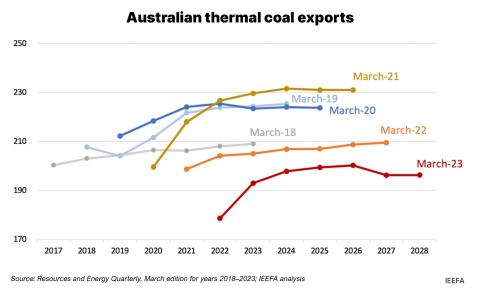

Australian government forecasts peak thermal coal exports in three years but further downside risks for Asian seaborne market remain

April 24, 2023

Andrew Gorringe, Simon Nicholas

Insights

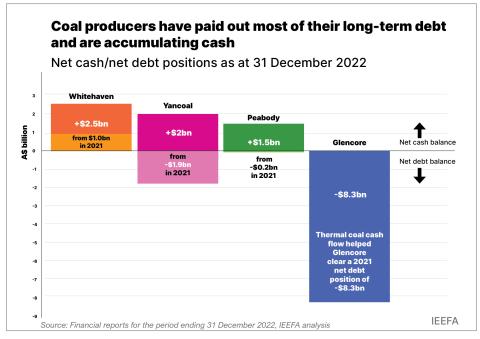

Australian coal miners should think carefully about what they do with their inflated cash balances

March 09, 2023

Andrew Gorringe, Simon Nicholas

Insights

A move into Australian coal mining doesn’t change long-term outlook for Thungela

March 06, 2023

Simon Nicholas

Insights

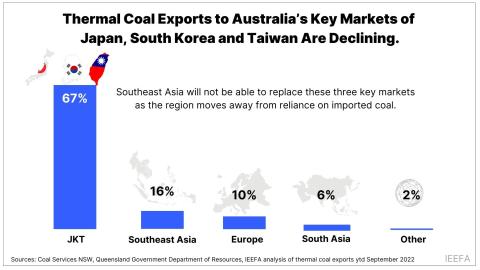

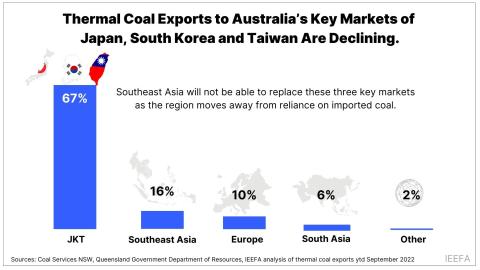

A reality check for Australian thermal coal exporters

February 27, 2023

Andrew Gorringe, Simon Nicholas

Report

Japan-funded Matarbari coal plant in Bangladesh costs 8 to 10 times more than comparable plants in China

June 01, 2022

Ghee Peh

Insights

IEEFA Update: South African coal miners must get used to low export volumes

February 10, 2022

Simon Nicholas

Insights

IEEFA: Will CEO Jane Fraser clean up Citi’s climate record?

October 04, 2021

Tim Buckley

Insights

Latest Coal Export Terminals Reports

See more >

Financial risk in Australia's coal ports

October 24, 2023

Andrew Gorringe

Report

Whitehaven Coal: Assessing its claims about its long-term outlook

October 06, 2023

Simon Nicholas

Report

A reality check for Australian thermal coal exporters

February 27, 2023

Andrew Gorringe, Simon Nicholas

Report

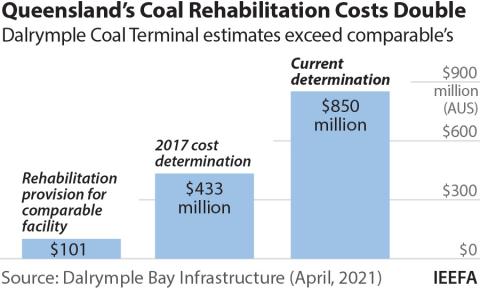

Queensland Competition Authority should exit Dalrymple Bay Coal Terminal pricing regulation

May 01, 2021

Owen Evans

Report

South African coal exports outlook - Approaching long-term decline

September 01, 2019

Simon Nicholas, Tim Buckley

Report

Billionaire Adani Being Subsidised for Carmichael Thermal Coal Mine - Adani's Thermal Coal Mine in Queensland Will Never Stand on Its Own Two Feet

August 01, 2019

Tim Buckley

Report

New South Wales thermal coal exports face permanent decline

November 01, 2018

Tim Buckley, Simon Nicholas, Kashish Shah...

Report

2017 U.S. coal outlook

January 01, 2017

Tom Sanzillo, David Schlissel

Report

Latest Coal Export Terminals Press Releases

See more >

IEEFA: QCA increase of Dalrymple Bay Coal Terminal’s remediation provisions to $850m concerning

May 10, 2021

Press Release

IEEFA: Utah Bailout of Bankrupt California Coal-Export Project

August 19, 2020

Press Release

IEEFA report: Transition planning a must as South Africa’s export markets pivot away from thermal coal

September 16, 2019

Press Release

IEEFA Australia: Australian taxpayers funding subsidies worth billions for Adani’s Carmichael thermal coal mine

August 29, 2019

Press Release

IEEFA report: Past their peak, New South Wales coal export volumes head toward terminal decline as markets transition

October 31, 2018

Press Release

IEEFA U.S. Coal Outlook 2017: Short-Term Gains Muted by Prevailing Weaknesses in Fundamentals

January 19, 2017

Press Release

Divestiture Movement, Deepening Distress of Coal Industry, Emerging Battles Over Solar, Overbuilding of Shale Gas Pipelines Highlight IEEFA Energy Finance 2016 Conference in New York City

February 29, 2016

Press Release

Coal-Lease Reform: ‘Obama Is Doing for the Coal Industry What It Cannot Do for Itself’

January 14, 2016

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.