Australian government forecasts peak thermal coal exports in three years but further downside risks for Asian seaborne market remain

Key Findings

Australian thermal coal exports are forecast to increase over the next three years in a declining global market the Australian government itself has signalled is likely to have passed its peak.

Australia’s largest export coal markets of Japan, South Korea and Taiwan are in decline and forecasts for continued growth are heavily reliant on imports of higher value coal by Asian countries such as India and China, which favour lower value coal imports from Indonesia and Russia.

The downside risks of overly optimistic forecasts for Australian exports are clear and finding replacement markets in Asia where power plants are being developed specifically for Indonesian coal or increasingly fuelled by domestic coal may not be easy.

Global thermal coal trade is beyond its peak. That’s what Australia’s Department of Industry, Science and Resources has signalled in its March 2023 Resources and Energy Quarterly, which states that “the overall peak in global thermal coal trade is likely to have passed”.

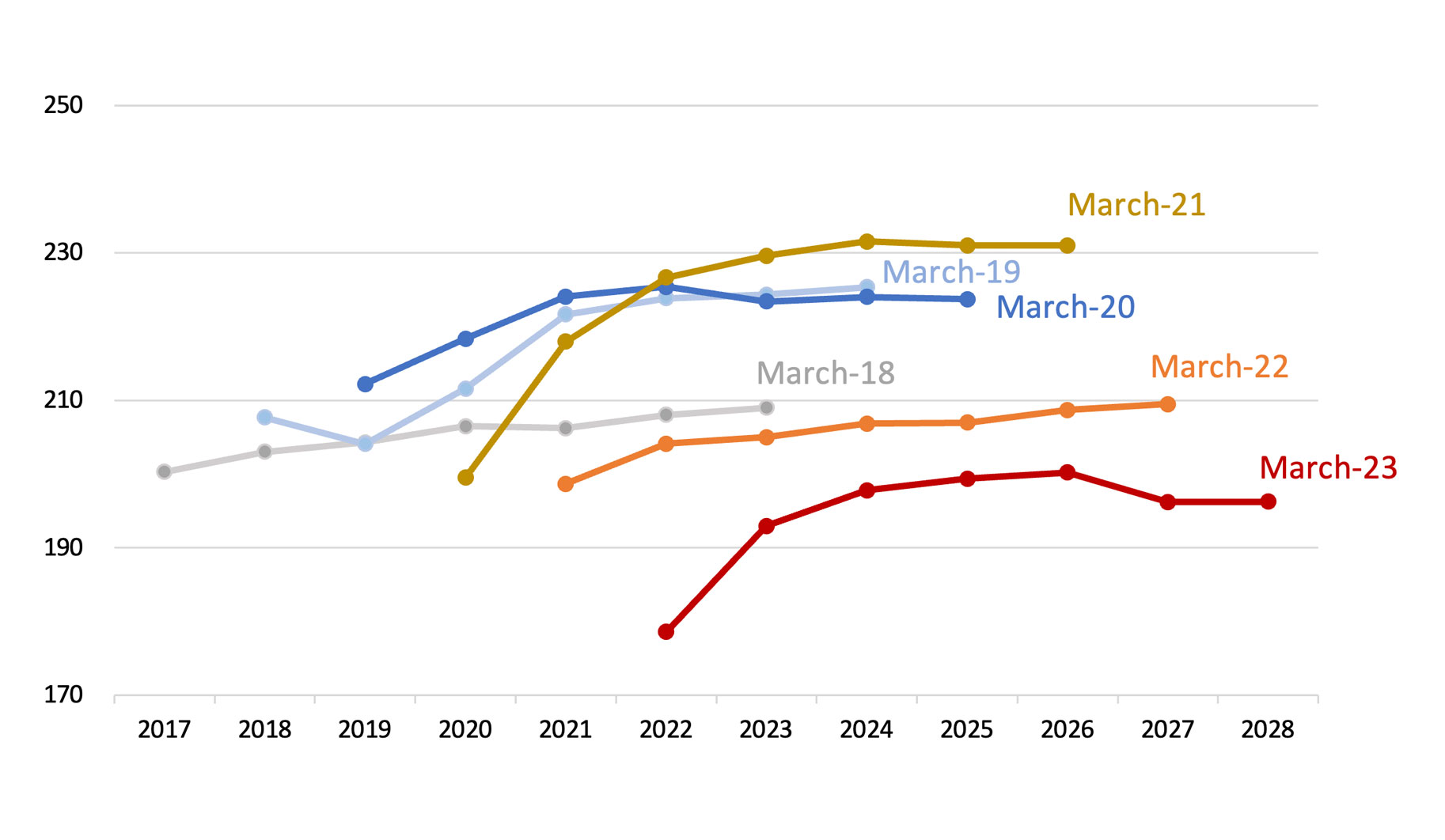

Each year the department’s March quarter review contains forecasts for the following five years. The most recent forecast has been revised down again after a significant adjustment to the forecast in March 2022 (Figure 1).

Figure 1: Australian thermal coal exports: March quarter forecasts over past six years

Source: Resources and Energy Quarterly, March edition for years 2018–2023; IEEFA analysis

While actual thermal coal shipments have underperformed recent forecasts, the March quarterly forecasts growth of 12% or 22 million tonnes (Mt) through to 2026. The department’s most recent data shows that Australian thermal coal made up 17% of global trade in 2022 and this is forecast to increase for another three years to 20% by 2026. Its outlook also points to supply-side issues, such as persistent weather-related disruptions, curtailing 2022 exports and highlights future growth markets for Australian coal.

So why is Australia positioned to benefit from an increasing share in this declining global market?

Australia’s largest export coal markets – Japan, South Korea and Taiwan (JKT) – are in decline. This market underpins most of Australian coal producers’ profits. It represents a massive concentration risk with over two-thirds of Australian coal going to this market, according to producers’ annual reports. The department’s latest outlook also notes that in Japan, Australia’s largest single market, the government “has released plans to close 100 coal plants over the next seven years”.

Japan, South Korea and Taiwan are the only nations that import the highest calorific value (CV) thermal coal (6,000 kcal/kg NAR) that makes up a significant chunk of Australian exports. The outlook assumes, however, that other markets for Australia’s high-CV coal will make up the shortfall. It states that “over the longer term, coal markets are likely to gravitate towards higher grades of coal, as efforts to reduce carbon emissions and transform global energy markets continue”. No evidence is presented for this statement.

Nations attempting to reduce emissions are shifting away from coal entirely, not tweaking the grade of coal they use.

This notion seems doubtful. Nations attempting to reduce emissions are shifting away from coal entirely, not tweaking the grade of coal they use. Southeast Asia is halting new coal plant construction to reach its peak of coal-fired power and is turning to renewables not higher-grade coal.

Further, the price of coal will remain the key determinant of coal sourcing for developing countries. If all importers start to shift towards higher grade coal it will remain more expensive, further destroying its demand.

As a result, Australia may not gain market share as forecast.

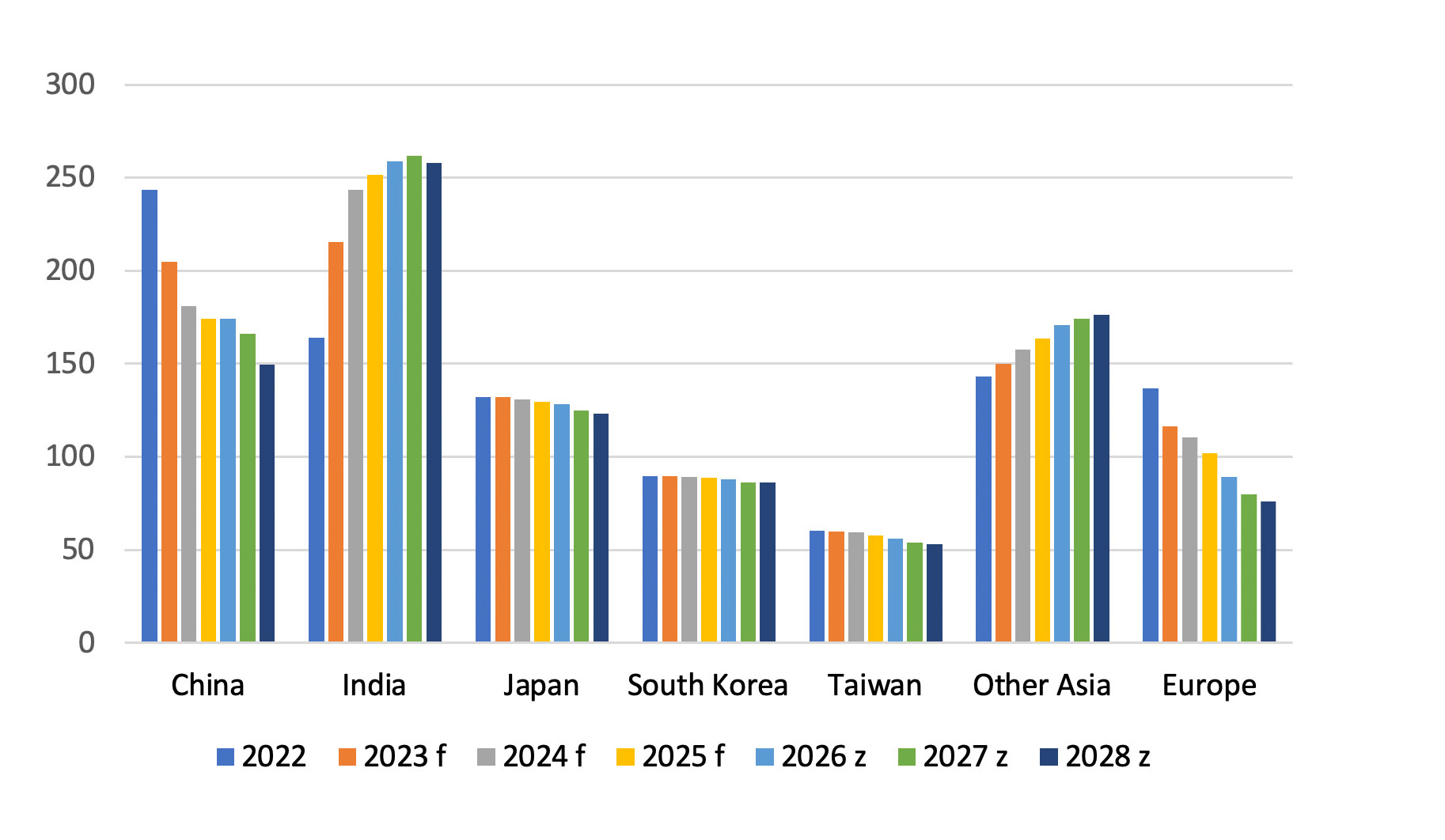

The department has cautioned that “thermal coal demand has become fragile — increasingly vulnerable to potential government policy changes in its remaining growth spots”. Figure 2 highlights the regions where growth and decline are forecast.

Figure 2: Thermal coal imports: Global by region

Source: Resources and Energy Quarterly, March 2023; IEEFA analysis. Notes: f = forecast, z = projection

Growth in global trade, and replacement of declining markets, is highly dependent on continued growth in demand from India and other developing Southeast Asian countries.

Despite China resuming coal trade with Australia, Chinese imports are in structural decline according to the department and “Australian exporters are expected to largely hold to their new and more diverse supply chains”. Domestic coal supply could match domestic coal consumption by the 2030s, but raises a risk that this import market could fall away completely in the longer term beyond its forecast outlook.

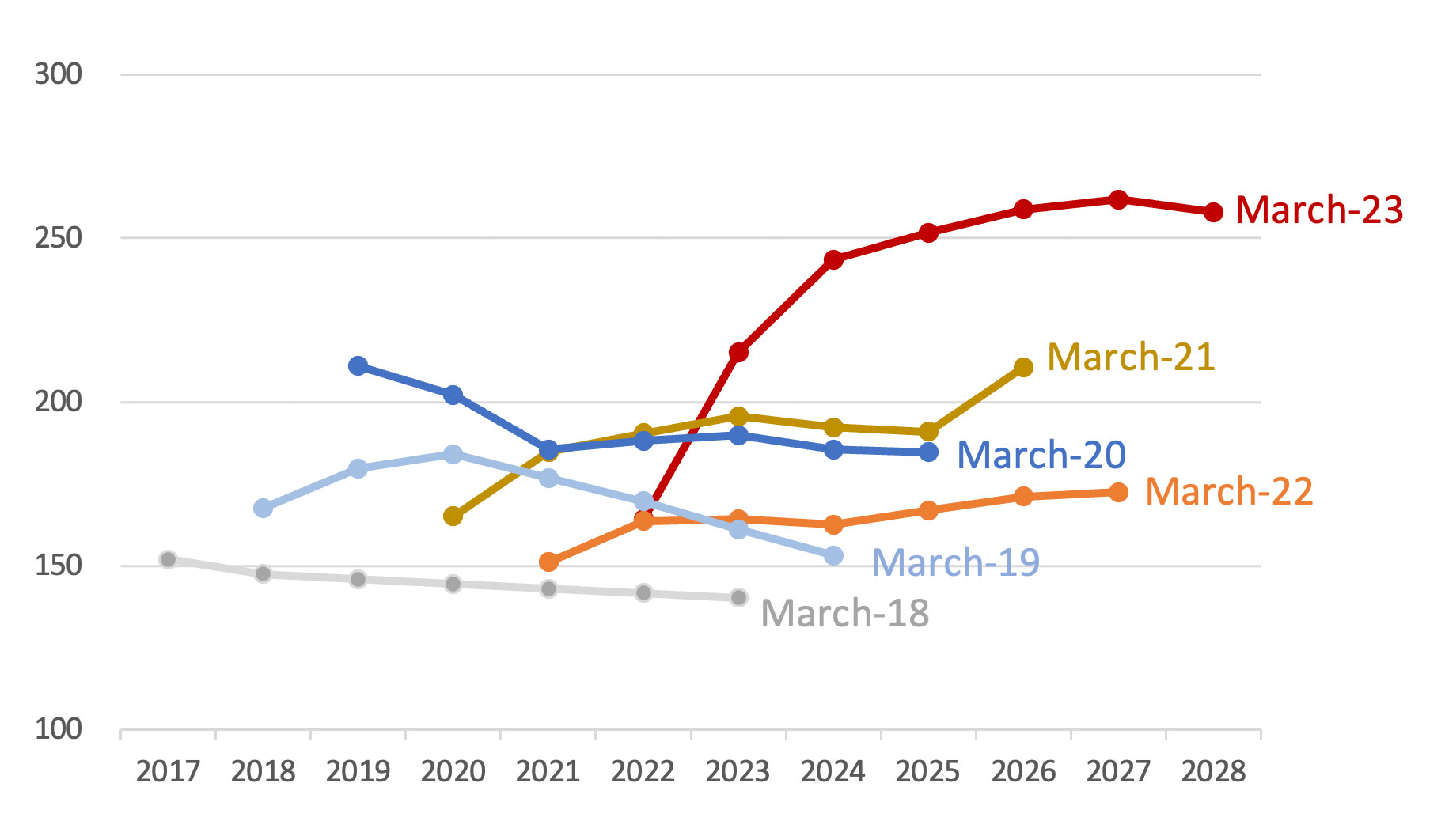

India has been identified as a major growth market for seaborne thermal coal, with significant upward revision on previous forecasts (Figure 3). The department estimates 30% growth for 2023 volumes and 60% growth by 2027 (of 98Mt). This is in response to India’s continued economic growth and the country’s dependence on coal-based energy.

India is not an importer of 6,000 kcal/kg coal but imports lower-grade 5,500 kcal/kg coal from Australia.

Figure 3: Indian thermal coal imports: March quarter forecasts over past six years

Source: Resources and Energy Quarterly, March edition for years 2018–2023; IEEFA analysis

However, the growth in imports predicted is in stark contrast to the Indian government’s narrative and other forecasts. India is the second-largest coal producer after China and has ambitions to grow its domestic production to reduce reliance on imports.

In 2022 India’s domestic thermal coal production reached 892Mt for the year and was up 15% on 2021. Its ambitions are highlighted in a recent address by Union Coal Minister Pralhad Joshi, who said that India has adequate coal reserves and the country aims to begin exporting thermal coal by 2024–25.

Admittedly, the Indian government has a long history of pledging to reduce reliance on thermal coal imports with little to show for it so far. However, reliance on fossil fuel imports means India has a major energy security challenge to address.

Other forecasters recognise growth in Indian coal imports but at more modest levels than assumed by Australia. According to Wood Mackenzie, India’s domestic production ambitions in 2023 will be thwarted. Logistical challenges in India will delay domestic production growth this year and lead to an increase in thermal imports of 3% in 2023 to 169Mt. Indian government data suggests that Australian coal imports are lower in January and February 2023 than for previous years.

Despite the potential for India’s market growth, it imports predominately Indonesian coal and is one of the few countries to increase imports of Russian coal while other countries enforced trade sanctions.

This substantial divide in outlook could, if realised, translate to Australia’s exports yet again missing the forecast target and subsequent Department of Industry forecasts revised down again.

Developing Asian countries outside of India are also poised for growth, with 23% volume growth (33Mt) to 2028 predicted. However, the outlook notes that Asian markets “have developed power plants specifically suited to Indonesian coals”. This implies that much of the growth prospects in the Southeast Asia market could be served by neighbouring Indonesia.

Finding a replacement market for Australia’s long-serving JKT premium thermal coal export market may not be easy. With global thermal coal trade set to decline, the competitiveness of Australian coal within these and new markets remains central to Department of Industry forecasts for continued volume growth to 2026. If Indian forecasts prove overly optimistic, the further downside risks for Australian exports are clear.

This article first appeared in Renew Economy.