A reality check for Australian thermal coal exporters

Download Full Report

Key Findings

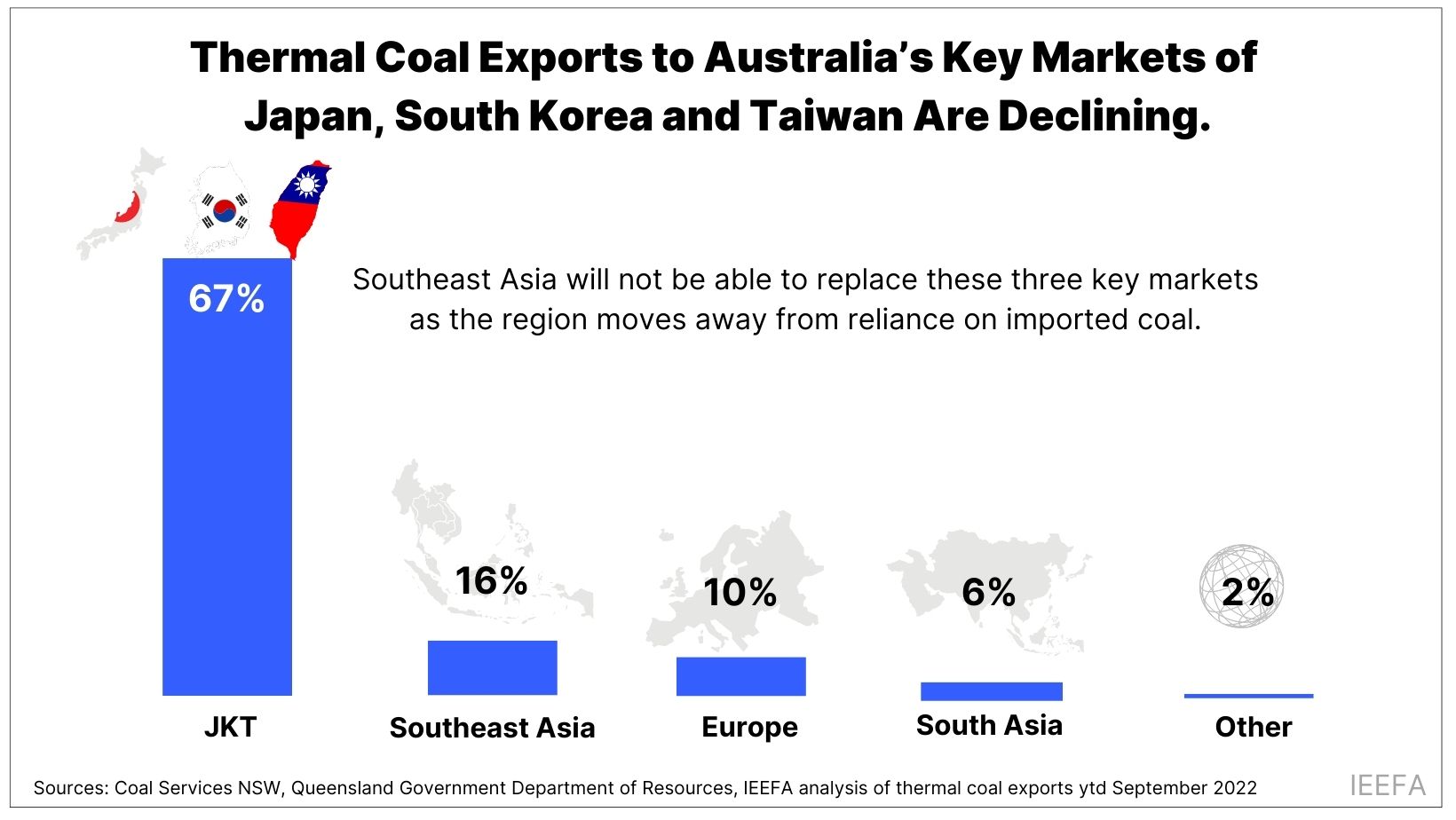

The great majority of Australian thermal coal exports go to Japan, South Korea and Taiwan, markets now forecast to go into decline.

Vietnam and other Southeast Asian nations have been identified as the new growth markets for Australian thermal coal, but relatively little Australian thermal coal currently goes to Southeast Asia.

As Vietnam’s new US$15.5 billion energy transition deal further highlights, Southeast Asian markets will be unable to replace Australia’s main export destinations as they shift away from reliance on imported coal.

Executive Summary

The Southeast Asia region has been identified as a key growth market by Australian thermal coal exporters. However, this growth is likely to be short-lived. In the case of Vietnam, for example, the December 2022 US$15.5 billion Just Energy Transition Partnership deal will build on recent renewables construction by supporting its integration and driving its growth while limiting coal power construction. In addition, coal power plants currently under construction in Vietnam are being configured for Indonesian, not Australian, coal. Elsewhere in the region, public finance for coal-fired power plants has been withdrawn and coal-fired power plant construction will be all but complete in a number of countries by 2030. The Southeast Asia market at 16% is a small portion of Australia’s thermal coal exports.

Southeast Asia will not be able to replace these three key markets and in the longer term the decline in Australia’s thermal coal export market is inevitable.

Meanwhile the Australian government’s Department of Industry, Science and Resources has forecast that the main export markets of Japan, South Korea and Taiwan are already in decline as they move to renewables and look to decarbonise to meet 2050 net zero emissions targets. Southeast Asia will not be able to replace these three key markets and in the longer term the decline in Australia’s thermal coal export market is inevitable.

Southeast Asia Made Up a Small Portion of Australia’s Thermal Coal Exports in 2022