Australian coal exports face numerous downside risks, new projections show

Key Findings

Government projections show Australian thermal coal exports peak this year and decline to 2030, with Asia's coal power project pipeline unable to sustain seaborne thermal coal markets long term.

They project global metallurgical coal demand will fall to 2030 as non-coal-based steel production gains pace, but remain bullish on Australian met coal export growth despite a history of overestimating export volumes.

A key assumption that demand for Australia's higher-grade coal will be more resilient than lower grades is not backed by evidence, and is contrary to some analyst forecasts.

Global demand for metallurgical (met) coal is expected to fall as low emissions steel production gains pace, according to the latest Resources and Energy Quarterly (REQ) forecast from the Department of Industry, Science and Resources (DISR). However, DISR remains bullish on Australian met coal export growth, despite a history of overestimating expected export volumes.

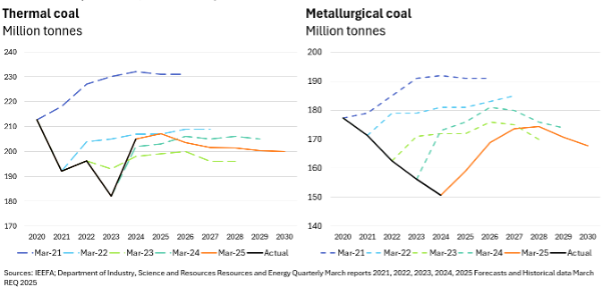

DISR projects Australian met coal export volumes will peak in FY2027-28, lower than previously anticipated, but to be 13 million tonnes (Mt) higher in FY2029-30 than FY2024-25. Meanwhile, for the first time, the REQ forecasts thermal export volumes will decline during the five-year outlook period (post 2025), down 14Mt in FY2029-30 on expected FY2024-25 levels. This means Australia’s thermal coal exports may have reached their peak in 2024 or 2025. Additionally, several factors could accelerate or deepen the forecast decline in Australian thermal and metallurgical coal export volumes through to 2030.

Figure 1: Australian coal export volumes, actual vs REQ forecasts

Metallurgical coal outlook

The REQ expects global metallurgical coal demand to fall through to 2030 due to an increasing share of electric arc furnace (EAF) steel production, compared with coal-consuming blast furnaces. Increasing uptake of low-emissions steel production technology or greater availability of feedstock (such as scrap steel) could reduce demand for met coal further over the outlook period.

However, the REQ’s five-year outlook for Australian met coal exports remains bullish, despite DISR consistently overestimating met coal export forecasts in previous outlooks. The projected growth in global met coal imports is based on increased demand from India and South-east Asia counteracting declines in China, Japan, South Korea and Europe.

Australia’s two largest met coal export markets are Japan and India, which together account for almost half of Australian exports. IEEFA has outlined why Australia may not be able to depend on coal exports to India as it shifts towards making steel using domestically produced green hydrogen, increases domestic coal production, and diversifies its coal import sources. Meanwhile, Japan has sufficient scrap metal supplies for its transition to EAF-based steel production in the near term, meaning its met coal demand may fall.

Additionally, the REQ assumes alternative met coal exports from Russia and Canada will remain flat through to 2030, although it is unclear why. It projects Mongolian exports to decrease as Chinese steel production declines. However, Mongolian exports to China rose 33Mt from 2020-2024, and China has been increasing import volumes of anthracite (the highest carbon content coal), which Mongolia and Russia export while Australia produces very little. If this trend continues, Mongolia could displace other met coal exports to China, from Russia, the US and Canada. These countries could, in turn, seek to increase exports to traditional Australian met coal markets – India, Japan and South Korea, placing downward pressure on the outlook for Australian met coal exports.

Ultimately, the outlook for Australian met coal will be influenced by:

- The pace of steel decarbonisation globally.

- India’s rate of adoption of green hydrogen in its steel sector, increased domestic met coal production and diversification of imports away from Australia.

- Price and quantity of supply from other met coal producers, such as Mongolia, Russia, Canada and the US.

- The impact of climate change and extreme weather events on Australian coal production.

Thermal coal outlook

The REQ states that, “The coal power project pipeline, concentrated in Asia, does not provide sufficient demand to support seaborne markets long term.” The impact of falling Chinese imports is unlikely to be fully offset by increased demand from India and South-east Asia, contributing to shrinking global thermal coal trade.

Additionally, global coal power capacity added in 2024 was the lowest in two decades. Thermal coal imports are expected to remain dominated by China and India, which together account for more than half of global demand.

The outlook for South-east Asia’s pipeline of coal-fired power projects is also uncertain. As the REQ notes, “Over the next decade, coal power unit retirements are forecast to be triple builds.” IEEFA has highlighted the uncertainty of new coal power plant developments and retiring coal power units in South-east Asia providing sufficient demand for Australian thermal coal.

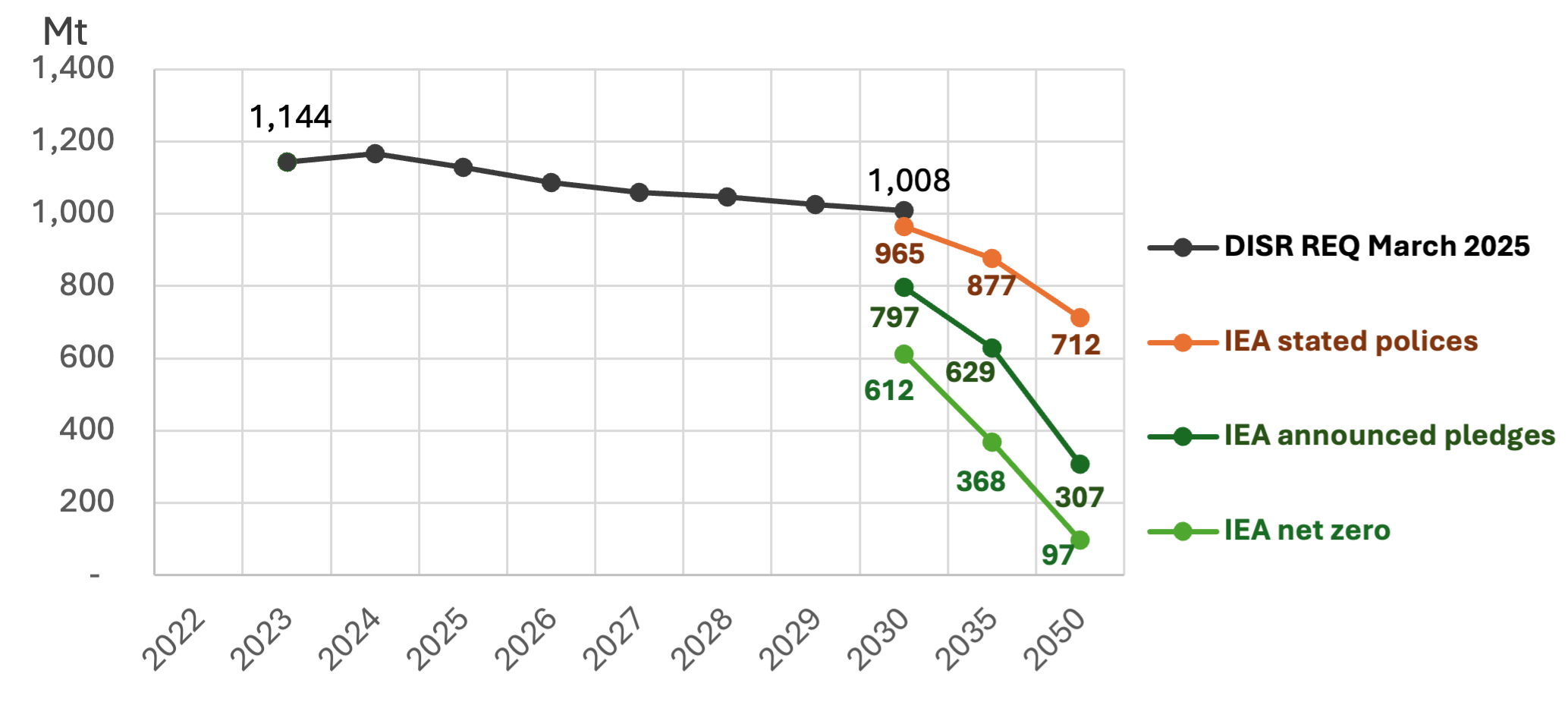

Additionally, the International Energy Agency’s World Energy Outlook 2024 shows global thermal coal trade could decrease at faster rates than the REQ outlook under each of the agency’s scenarios: Stated Polices, Announced Pledges and Net Zero.

Figure 2: Seaborne global thermal coal trade 2025-2030, REQ vs IEA scenarios (Mt)

Sources: IEEFA; DISR REQ March 2025; International Energy Agency World Energy Outlook 2024

The outlook for Australian thermal coal demand will be influenced by:

- The pace of renewable and alternative electricity generation technology deployment in export partner markets.

- High uncertainty around when full Russian export supply will resume, and the status and length of US sanctions.

- The impact of a predicted global LNG supply glut and consequent lower LNG prices on coal demand.

- The scale and pace of coal power unit retirements, which are forecast to be triple the number of projected new builds over the outlook period, and uncertainty over new coal-fired power station developments.

Higher-quality coal may not guarantee higher demand

A key assumption in the REQ is that, “While demand for higher grade coals is also expected to decline over the outlook, the pace is expected to be slower than for lower quality coals.”

This contrasts with some analyst forecasts. For example, Argus Media has stated there is, “Waning demand for high CV – some cyclical, much structural [… and a] quality shift away from high CV and towards lower qualities”. S&P Global Platts also highlighted that Japan may be looking to alternative sources to Australia’s high CV, high-cost coal.

There are no replacement markets for Australia’s high CV coal as Japan, South Korea and Taiwan phase out coal-fired power. And there is no evidence to suggest import demand growth in South-east Asia won’t be met by cheaper thermal coal suppliers such as Indonesia, South Africa, Russia or Colombia.

Additionally, the assumption that demand for Australia’s high CV coal will be more resilient has implications for the government’s emissions reduction targets, given that higher-quality coal generally emits more methane, a highly potent greenhouse gas.

A declining coal market could accelerate mine closures in Australia. As the REQ states, “a prolonged decline in prices may result in some older and smaller mine closures being brought forward”.

As IEEFA has discussed, this raises questions over the continued approval of new coal mine developments, some for beyond 2050, for both thermal and metallurgical coal. Additional approvals, if granted, would permit the production of more than double the volume of coal Australia is expected to export in 2030.