Can aging thermal power plants in Pakistan be revitalized?

Download Briefing Note

Key Findings

Various furnace oil-based independent power producers (IPPs) in Pakistan are exploring the possibility of conversion to Thar coal in line with the country’s goal of indigenizing its power generation fuel mix. They claim that this would lower generation costs, but the presence of cheaper and cleaner alternatives suggests simpler solutions than a technically complex retrofit.

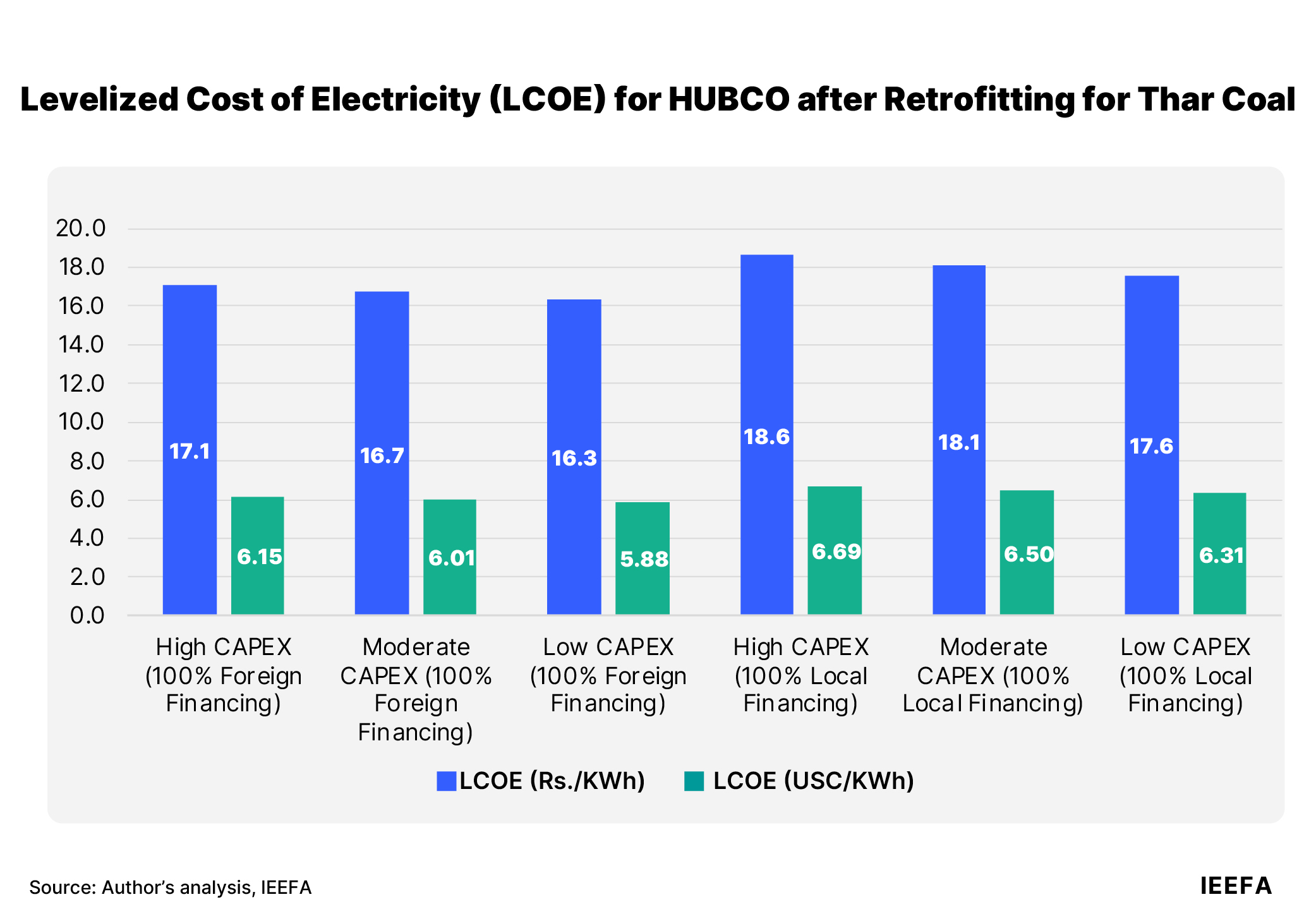

IEEFA’s analysis for retrofitting HUBCO, Pakistan’s largest IPP, which is scheduled for retirement in 2027, reveals that retrofitting the plant with coal-fired boilers and running it on Thar coal would have a levelized cost of electricity between 5.9 to 6.7 USc/KWh.

While operations on Thar coal may result in a lower cost of generation than furnace oil, the logistics of transporting coal from the Thar coal fields in Sindh to Hub would be extremely complex, requiring the presence of dedicated railway tracks or the construction of additional off-loading and handling facilities and a jetty in Hub.

On the other hand, hybrid renewable energy systems consisting of solar, wind, and battery energy storage, which have a comparable cost of power generation ranging between 5.3 to 7.7 USc/KWh, offer a more viable opportunity for meeting the incremental increase in consumer demand.

This briefing note first appeared in Business Recorder.

Retrofitting retiring furnace oil-based plants to run on Thar coal will face significant logistical challenges

In line with Pakistan’s dedication towards indigenizing its energy mix, a new proposal is gaining traction: retrofitting existing furnace oil-based power plants with coal-fired boilers so that they can run on Thar coal.

Pakistan’s current furnace oil-based generation amounts to 5.6 gigawatts (GW) or 13% of the country’s total installed capacity, supplying roughly 20% of the thermal power generated by the national grid. The entire thermal fleet, consisting of state-owned generation companies (GENCOs) and independent power producers (IPPs), is at least 13 years old.

A significant 2.3 GW of privately owned and 1.8 GW of state-owned furnace oil-based capacity is slated for retirement by 2030 due to expiring power purchase agreements (PPA) and performance inefficiencies attributed to aging. Since furnace oil is an imported fuel with prices tied to global markets, power generation through these plants has been prohibitively expensive, averaging between 14-16 US cents per kilowatt-hour (USc/KWh).

Due to the high costs, a 2015 policy mandated a shift away from residual furnace oil (RFO)-based power generation, prohibiting the induction of new power plants using the imported fuel. Existing furnace oil-based plants would be gradually phased out and replaced by solar, wind, imported coal, or natural gas.

For some projects, like the Kot Addu Power Plant, extending the contracted life from 25 to 30 years becomes unavoidable due to transmission constraints and lack of backup capacity. The remaining capacity marked for retirement is expected to follow its retirement schedule.

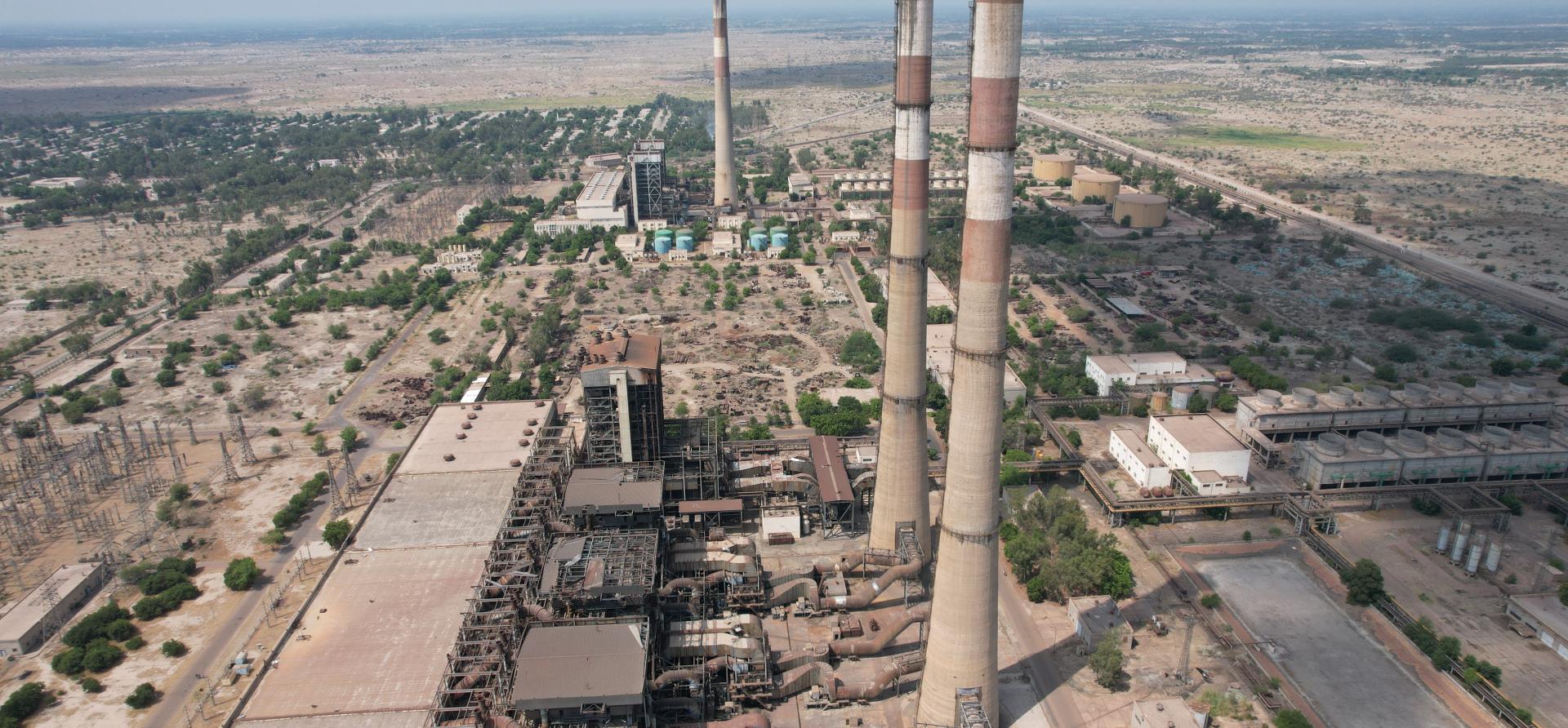

Meanwhile, Pakistan’s first and largest IPP, Hub Power Company Limited (HUBCO), commissioned in 1997, along with two other RFO-based plants, Lalpir Power Limited (Lalpir) and Pakgen Power Limited (Pakgen), each 27 years old with PPAs expiring in 2028, have hinted at extending their operational lives through conversion to Thar coal. Lalpir and Pakgen are 365 megawatts (MW) twin power plants in Mehmood Kot, Muzaffargarh, while HUBCO is a 1292 MW complex in Hub, Balochistan.

In January 2024, HUBCO signed a memorandum of understanding with K-Electric, a vertically integrated utility that supplies power to the megacity of Karachi and its surrounding districts, to explore the possibility of converting to Thar coal after its PPA expiry with the central grid. If feasible, K-Electric would purchase electricity from the converted plant under a new PPA.

Conversion of an oil-based plant to coal is a technologically complex process that typically involves replacing the entire boiler section to enable coal-firing. Additional equipment for coal handling, ash removal, and flue gas cleaning is also required. The only salvageable parts of the existing plant are the steam turbines/generators and the switchyard.

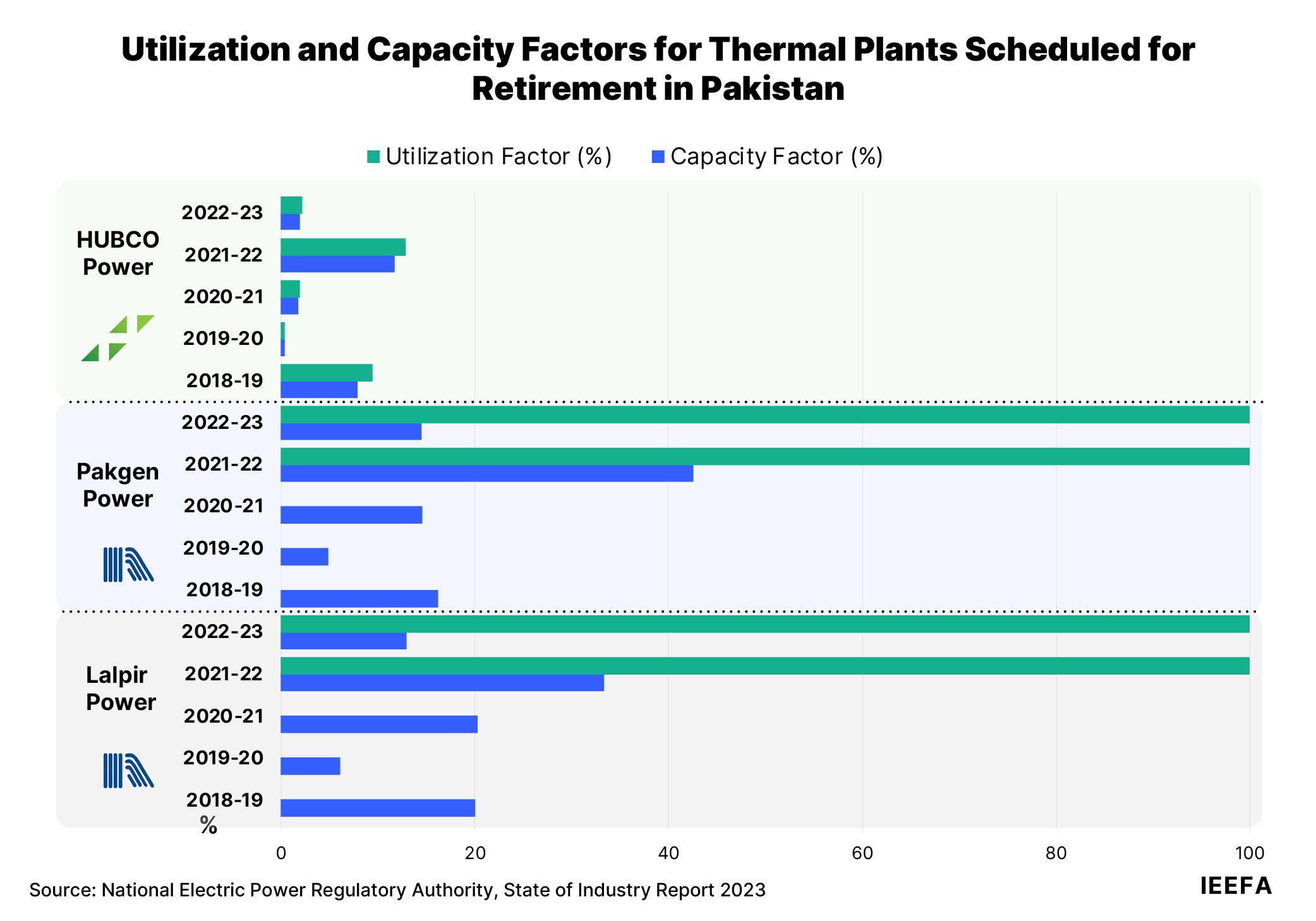

HUBCO, Lalpir, and Pakgen rank at the bottom of Pakistan’s National Transmission & Despatch Company’s (NTDC) merit order dispatch list and have historically low utilization and capacity rates, sometimes only serving the purpose of grid stability. However, the ‘take or pay’ nature of PPAs signed with these plants necessitates the payment of hefty capacity charges despite their low provision of electricity to the grid.

Economic feasibility of retrofitting to Thar coal

Conversion to Thar coal could move these power plants up the merit order and reduce the volume of additional capacity payments for idle capacity. However, according to the National Electric Power Regulatory AuthorityGrid Code and NTDC’s Indicative Generation Capacity Expansion Plan (IGCEP), any new capacity added to the grid must compete with other candidate projects on a least-cost basis. This may not be the case for these plants for various reasons.

Experts estimate that replacing HUBCO’s four oil-fired boilers, along with other plant modifications and upgrades, would cost at least a billion dollars. While fuel costs for Thar coal will generally be lower than imported furnace oil, some of these savings will be offset by reduced plant efficiency when running on Thar coal. Additionally, operation and maintenance expenses will be higher. According to IEEFA’s analysis, this combination results in a levelized cost of electricity (LCOE) between 5.9 and 6.7 USc/KWh.

Logistical challenges are aplenty

Transporting coal from Thar to Hub, Pakistan, presents significant logistical challenges. With an estimated coal consumption of 0.94 kg/kWh and a capacity factor of 85%, a typical 40-tonne semi-truck would need to arrive at the project site every two minutes, 24 hours a day, year-round, to meet the power plant’s coal requirements. This makes road transportation physically untenable, highly unreliable, and extremely difficult to finance.

Railway transportation could be an alternative. Although a railway track from Thar to Port Qasim was recently approved, construction on the project has not yet commenced. Extending the railway track to Hub would require a right of way through densely populated areas, leading to residential displacement.

Another option is to haul coal by rail to Port Qasim and then transship it via barge to Hub. This would involve acquiring or sharing a bulk yard in Port Qasim, building off-loading and handling facilities for barges, and constructing a jetty and another set of unloading facilities in Hub.

Regardless of the coal transportation method, the plant in Hub would need a coal storage yard capable of holding at least 30 to 45 days of stock, plus a daily supply, and an environmentally stable ash pond to handle the higher waste volume from Thar coal. Running the plant on Thar coal would also require upgrading environmental controls, including installing an electrostatic precipitator for flue ash capture, which would increase project costs.

These upgrades would also apply to Lalpir and Pakgen power plants, which are further inland and have even higher logistical costs.

Better alternatives exist

This is not the first time Pakistan has considered retrofitting furnace oil-based power plants to coal. In 2012, the government, with support from the Asian Development Bank (ADB), considered converting its thermal GENCOs to imported coal. However, price volatility, additional land requirements, and the high cost of retrofitting plant equipment prevented the project from advancing, even before addressing environmental challenges.

Similarly, HUBCO considered converting to imported coal in 2013 and again to Thar coal in 2019, but no progress was made on either front. The latter proposal received several reservations from Pakistan’s Central Power Purchasing Authority.

Now, HUBCO plans to move beyond the central grid and supply power to K-Electric, which may be interested due the scheduled retirement of 682 MW of thermal capacity from its generation fleet by 2024, according to the 2022 IGCEP.

However, K-Electric aims to achieve a 30% share of renewable energy in its generation fleet (currently 97% thermal) by 2030. Adding more thermal capacity may not align with this goal. In addition, if replacing the retiring capacity is the goal, a retrofit would take at least three to four years to complete, depending on timely financial closure and the availability of funds.

Instead, K-Electric could leverage HUBCO’s strategic grid connectivity and opt for a mix of solar and battery storage on the project site or set up a greenfield solar plus wind plus battery energy storage system (BESS) nearby to meet increasing consumer demand.

A 2021 study by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) reveals that a combination of solar, wind, and BESS could have an LCOE of 5.30 to 7.74 USc/KWh, with a capacity factor of up to 80%.

While such a setup may require a higher upfront investment due to the current high cost of battery storage, a 42% drop in Chinese solar panel prices throughout 2023 may reduce the total capital cost of solar PV systems from 0.61 million US$/MW to 0.47 million US$/MW. This would lower the overall capital requirement for hybrid plus storage renewable energy projects.

Given the potential for cheaper, more environmentally friendly power projects with shorter turnaround times, the feasibility of extending the lifetime of aging thermal power plants should be reconsidered.

Note: The author would like to acknowledge the contribution of Grant Hauber, IEEFA’s Strategic Energy Finance Advisor, Asia, for calculating the trucking frequency required for transporting Thar coal to HUBCO’s plant site in Balochistan.