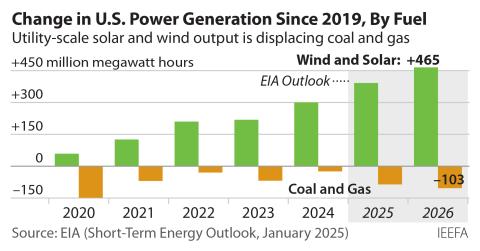

The United States, being the world’s largest economy in terms of gross national income, is one of the world’s biggest consumers and producers of fossil fuels. According to the U.S. Energy Information Administration, in 2023 the United States produced about 102.83 quads and consumed 93.59 quads of energy. About 84% of the energy consumed annually in the U.S. came from oil, gas or coal; only 8% was supplied by renewables, although this number is growing—particularly in the power sector.

See our additional coverage on Puerto Rico, Texas, and Louisiana.

Sign up for our quarterly newsletter to get the latest reporting from the North America team.

Latest United States Research

See more >

Prioritizing economic viability in South Korea’s U.S. LNG import strategy

June 23, 2025

Michelle (Chaewon) Kim, Grant Hauber

Insights

Who will pay for forcing the Campbell Coal plant to stay open?

June 05, 2025

Dennis Wamsted, Seth Feaster

Insights

Risk of AI-driven, overbuilt infrastructure is real

June 03, 2025

Cathy Kunkel, Dennis Wamsted

Insights

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Report

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Fact Sheet

A clear eyed view of coal

May 08, 2025

Seth Feaster, Dennis Wamsted

Slides

LNG market volatility clouds Venture Global forecasts, even with long-term contracts in place

May 05, 2025

Trey Cowan

Briefing Note

A pesar del daño a los abonados, la junta de supervisión fiscal de Puerto Rico abre la puerta para aumentos en la tarifa de la energía eléctrica

April 29, 2025

Cathy Kunkel

Insights

Despite harm to ratepayers, Puerto Rico oversight board opens door to increases

April 29, 2025

Cathy Kunkel

Insights

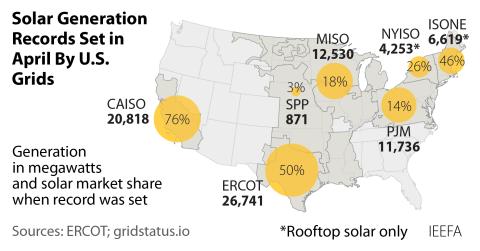

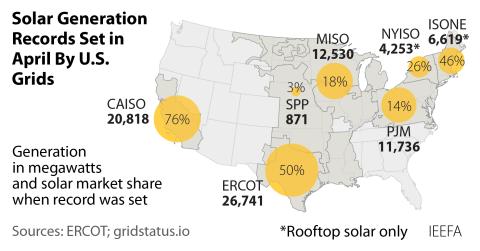

A sizzling spring for U.S. solar

April 29, 2025

Dennis Wamsted, Seth Feaster

Insights

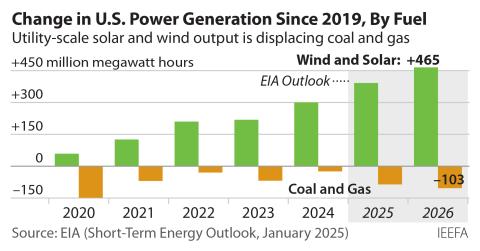

The energy transition is well underway in the U.S. electricity market

April 24, 2025

Fact Sheet

Puerto Rico Electric Power Authority bondholders insist on being paid $3.7 billion that doesn’t exist

April 24, 2025

Cathy Kunkel

Insights

Los bonistas de la Autoridad de Energía Eléctrica de Puerto Rico insisten en el pago de $3.7 mil millones de dólares que no existen

April 24, 2025

Cathy Kunkel

Insights

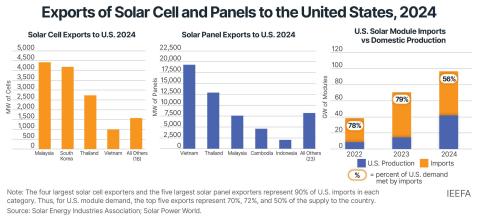

U.S. trade uncertainty presents domestic opportunities for Southeast Asian renewables suppliers

April 24, 2025

Grant Hauber

Insights

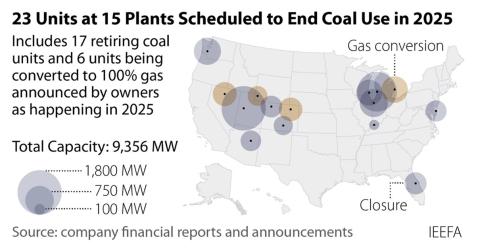

Drumbeat of coal plant closures to continue in 2025

April 15, 2025

Seth Feaster

Insights

Latest United States Reports

See more >

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Report

Expansión del GNL en México con gas importado de EE. UU.: Nuevos riesgos para los consumidores en EE. UU. y México

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

LNG build-out in Mexico based on U.S. gas: Rising risks for consumers in the U.S. and Mexico

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

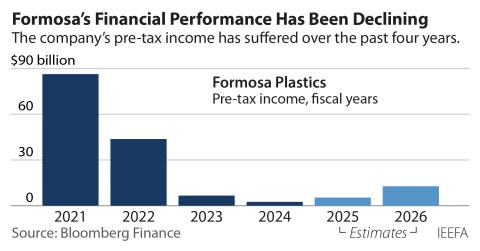

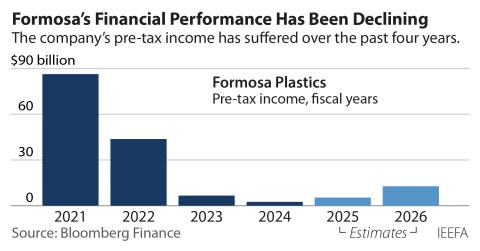

Formosa's proposed petrochemical complex in Louisiana faces more bad news

April 01, 2025

Abhishek Sinha

Report

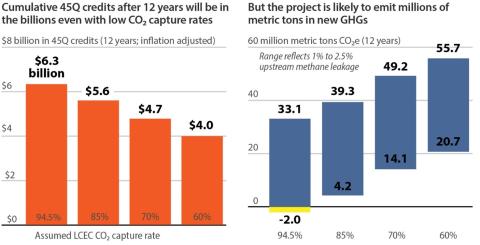

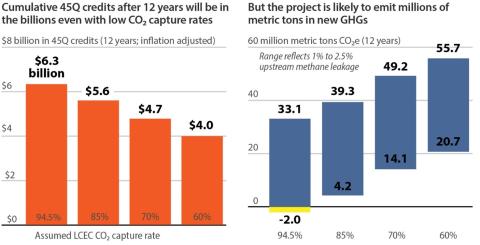

Blue hydrogen's carbon capture boondoggle

March 27, 2025

Anika Juhn, David Schlissel

Report

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Cathy Kunkel

Report

Hydrogen gas does not belong in your home: Hydrogen faces a diminishing future as a heating and cooking fuel

January 21, 2025

Suzanne Mattei

Report

Enbridge should consider closing its old, troubled Line 5 pipeline

January 07, 2025

Suzanne Mattei, Tom Sanzillo, David Schlissel...

Report

The declining significance of the petrochemical industry in Louisiana

October 28, 2024

Tom Sanzillo, Suzanne Mattei, Abhishek Sinha...

Report

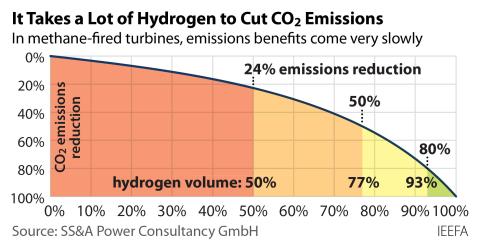

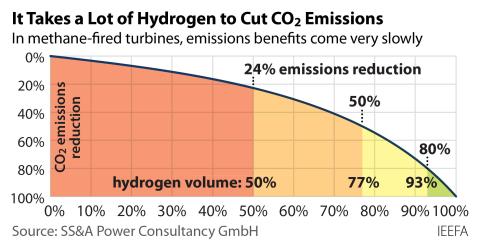

Hydrogen: Not a solution for gas-fired turbines

August 01, 2024

Dennis Wamsted

Report

Louisiana petrochemical project is a losing bet for investors and local communities

July 22, 2024

Tom Sanzillo

Report

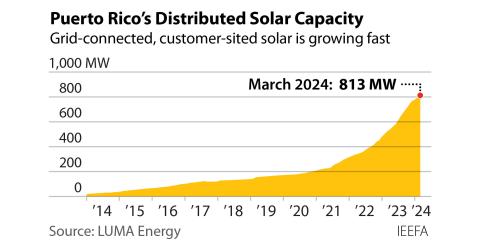

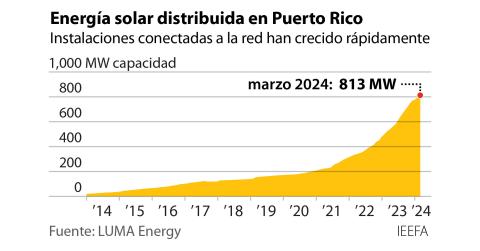

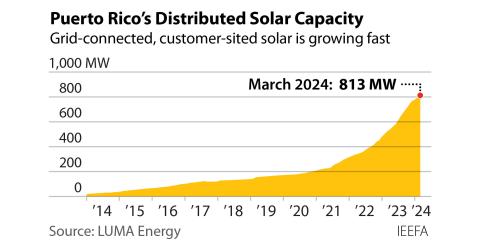

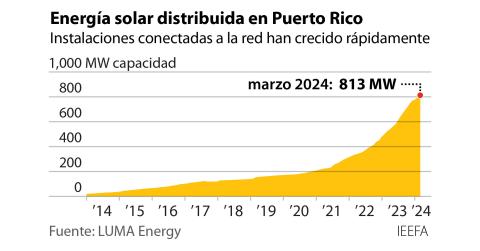

Solar at a crossroads in Puerto Rico

June 12, 2024

Tom Sanzillo, Cathy Kunkel

Report

La encrucijada que enfrenta la implantación de la energía solar en Puerto Rico

June 12, 2024

Tom Sanzillo, Cathy Kunkel

Report

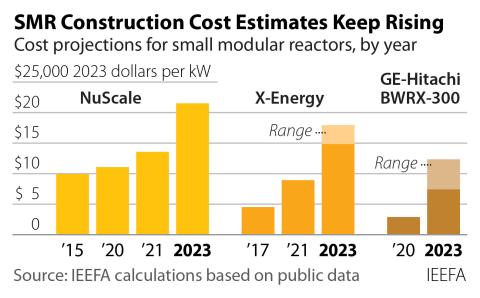

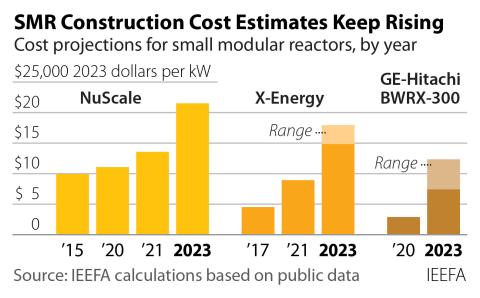

Small Modular Reactors: Still too expensive, too slow and too risky

May 29, 2024

David Schlissel, Dennis Wamsted

Report

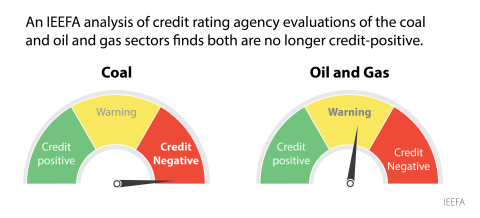

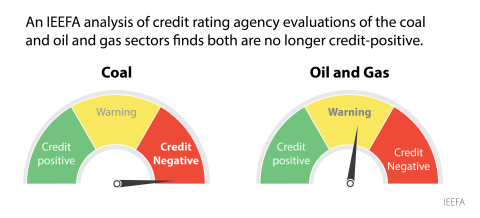

A matter of opinion: Credit rating agencies evolve on climate change, fossil fuel risk

March 14, 2024

Tom Sanzillo

Report

Latest United States Press Releases

See more >

Data center-driven electricity transmission buildout in PJM region puts West Virginia ratepayers on the hook

May 29, 2025

Press Release

LNG market volatility clouds Venture Global forecasts

May 05, 2025

Press Release

Reopening closed coal plants makes no economic sense

April 10, 2025

Press Release

LNG buildout in Mexico could mean rising risks for consumers in the U.S. and Mexico

April 02, 2025

Press Release

La expansión del GNL en México podría implicar mayores riesgos para los consumidores de EE. UU. y México

April 02, 2025

Press Release

Formosa’s proposed petrochemical complex in Louisiana faces more bad news

April 01, 2025

Press Release

Blue Hydrogen’s carbon capture boondoggle

March 27, 2025

Press Release

Can maritime hydrogen overcome the headwinds?

February 12, 2025

Press Release

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Press Release

Another bad year – and decade – for fossil fuel stocks

January 27, 2025

Press Release

Hydrogen gas does not belong in your home

January 21, 2025

Press Release

Mitsubishi announces termination of proposed petrochemical plant in Louisiana

January 08, 2025

Press Release

Latest United States Research

See more >

Prioritizing economic viability in South Korea’s U.S. LNG import strategy

June 23, 2025

Michelle (Chaewon) Kim, Grant Hauber

Insights

Who will pay for forcing the Campbell Coal plant to stay open?

June 05, 2025

Dennis Wamsted, Seth Feaster

Insights

Risk of AI-driven, overbuilt infrastructure is real

June 03, 2025

Cathy Kunkel, Dennis Wamsted

Insights

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Report

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Fact Sheet

A clear eyed view of coal

May 08, 2025

Seth Feaster, Dennis Wamsted

Slides

LNG market volatility clouds Venture Global forecasts, even with long-term contracts in place

May 05, 2025

Trey Cowan

Briefing Note

A pesar del daño a los abonados, la junta de supervisión fiscal de Puerto Rico abre la puerta para aumentos en la tarifa de la energía eléctrica

April 29, 2025

Cathy Kunkel

Insights

Despite harm to ratepayers, Puerto Rico oversight board opens door to increases

April 29, 2025

Cathy Kunkel

Insights

A sizzling spring for U.S. solar

April 29, 2025

Dennis Wamsted, Seth Feaster

Insights

The energy transition is well underway in the U.S. electricity market

April 24, 2025

Fact Sheet

Puerto Rico Electric Power Authority bondholders insist on being paid $3.7 billion that doesn’t exist

April 24, 2025

Cathy Kunkel

Insights

Latest United States Reports

See more >

West Virginia ratepayers footing the bill for infrastructure build out

May 29, 2025

Cathy Kunkel

Report

LNG build-out in Mexico based on U.S. gas: Rising risks for consumers in the U.S. and Mexico

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

Expansión del GNL en México con gas importado de EE. UU.: Nuevos riesgos para los consumidores en EE. UU. y México

April 02, 2025

Clark Williams-Derry, Suzanne Mattei

Report

Formosa's proposed petrochemical complex in Louisiana faces more bad news

April 01, 2025

Abhishek Sinha

Report

Blue hydrogen's carbon capture boondoggle

March 27, 2025

Anika Juhn, David Schlissel

Report

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Cathy Kunkel

Report

Hydrogen gas does not belong in your home: Hydrogen faces a diminishing future as a heating and cooking fuel

January 21, 2025

Suzanne Mattei

Report

Enbridge should consider closing its old, troubled Line 5 pipeline

January 07, 2025

Suzanne Mattei, Tom Sanzillo, David Schlissel...

Report

The declining significance of the petrochemical industry in Louisiana

October 28, 2024

Tom Sanzillo, Suzanne Mattei, Abhishek Sinha...

Report

Hydrogen: Not a solution for gas-fired turbines

August 01, 2024

Dennis Wamsted

Report

Louisiana petrochemical project is a losing bet for investors and local communities

July 22, 2024

Tom Sanzillo

Report

Solar at a crossroads in Puerto Rico

June 12, 2024

Tom Sanzillo, Cathy Kunkel

Report

La encrucijada que enfrenta la implantación de la energía solar en Puerto Rico

June 12, 2024

Tom Sanzillo, Cathy Kunkel

Report

Small Modular Reactors: Still too expensive, too slow and too risky

May 29, 2024

David Schlissel, Dennis Wamsted

Report

A matter of opinion: Credit rating agencies evolve on climate change, fossil fuel risk

March 14, 2024

Tom Sanzillo

Report

Latest United States Press Releases

See more >

Data center-driven electricity transmission buildout in PJM region puts West Virginia ratepayers on the hook

May 29, 2025

Press Release

LNG market volatility clouds Venture Global forecasts

May 05, 2025

Press Release

Reopening closed coal plants makes no economic sense

April 10, 2025

Press Release

LNG buildout in Mexico could mean rising risks for consumers in the U.S. and Mexico

April 02, 2025

Press Release

La expansión del GNL en México podría implicar mayores riesgos para los consumidores de EE. UU. y México

April 02, 2025

Press Release

Formosa’s proposed petrochemical complex in Louisiana faces more bad news

April 01, 2025

Press Release

Blue Hydrogen’s carbon capture boondoggle

March 27, 2025

Press Release

Can maritime hydrogen overcome the headwinds?

February 12, 2025

Press Release

Data centers drive buildout of gas power plants and pipelines in the Southeast

January 29, 2025

Press Release

Another bad year – and decade – for fossil fuel stocks

January 27, 2025

Press Release

Hydrogen gas does not belong in your home

January 21, 2025

Press Release

Mitsubishi announces termination of proposed petrochemical plant in Louisiana

January 08, 2025

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.