South Korea

South Korea is Asia’s modern manufacturing marvel, serving as the global go-to destination to source highly complex energy and shipping infrastructure components. Heavy industry is complemented by a globally relevant technology supply sector. All these industries require reliable and affordable access to energy. However, like its neighbour Japan, South Korea must rely on imported energy sources for almost all its economy’s needs.

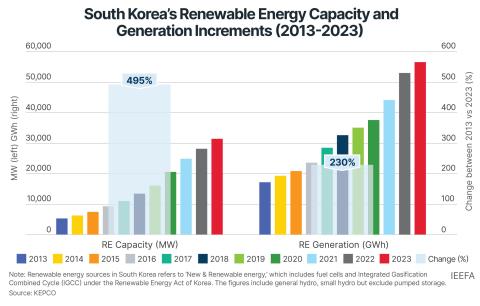

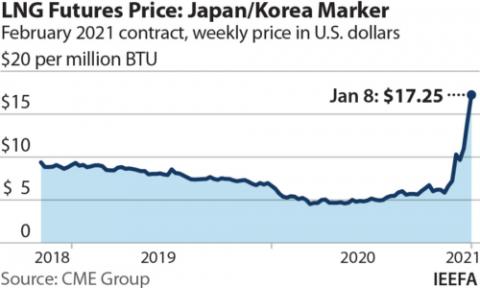

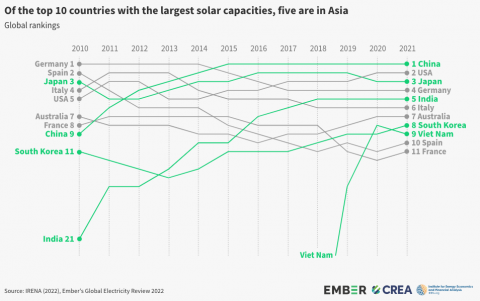

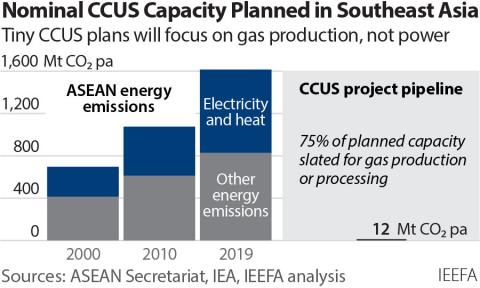

The country historically has tried to counter volatile fossil fuel commodity markets through an emphasis on an indigenously evolved nuclear reactor program. Yet, its reliance on coal and LNG stubbornly has persisted. Policymakers, eager to break this grip, are encouraging a nascent offshore wind sector. However, does South Korea have the technology, resources, and, most importantly, resolve to make the energy transition?

Can South Korea’s aviation industry pivot to green skies?

South Korea implemented a sustainable aviation fuel (SAF) mandate in August 2024. The mandate requires a 1% SAF blend for international flights by 2027 to drive aviation decarbonization, which accounts for 2-3% of global greenhouse gas emissions.