Energizing sustainable bond markets in Asia

Download Briefing Note

Key Findings

The development of sustainable bond markets in the ASEAN+3 (the Association of Southeast Asian Nations, China, South Korea, and Japan) region is inconsistent and lags behind Europe.

Unlike the conventional bond markets, the public sector’s involvement in the ASEAN+3 sustainable bond markets is significantly limited, which has impacted market depth and investor confidence.

The role of the public sector is critical in advancing sustainable bond markets. The presence of sovereign and government-related issuances fosters a more robust market environment, particularly when supported by strong regulatory frameworks and well-designed taxonomies.

ASEAN+3 countries should follow successful European models and strengthen public sector participation to unlock the full potential of their sustainable bond markets, which will help address sustainability investment gaps, elevate regional standing, and contribute significantly to global sustainability goals.

The public sector’s involvement in the ASEAN+3 (the Association of Southeast Asian Nations, China, South Korea, and Japan) sustainable bond markets is substantially lower than in Europe, limiting market development and investor confidence. Europe’s sustainable bond markets have thrived because of credible taxonomies, developed infrastructure for green instruments, and active issuance strategies, supported by public sector involvement. Strengthening public sector participation in ASEAN+3 markets is crucial for market liquidity, setting benchmarks, and closing investment gaps in sustainable projects.

Sustainable bonds in the ASEAN+3 region

The European Investment Bank, the lending arm of the European Union (EU), issued the world’s first green bond in 2007. “Sustainable bond” describes a bond where the proceeds are utilized for environmental or social projects or those meeting the United Nations’ Sustainable Development Goals (SDGs). Often issued as “green bonds”, the current sustainable bond market includes social, sustainability, sustainability-linked, and transition bonds (see Tables 1 and 2 for details of the types of sustainable bonds) with a market size of over US$4 trillion by outstanding amount.

Asia has gradually embraced the sustainable bond market since the Asian Development Bank’s landmark US$500 million green bond issuance in 2015 to finance projects aimed at fostering low-carbon and climate-resilient growth in its developing member countries. It was a significant milestone for sustainable finance in the region and drew interest from 44 investors across diverse financial subsectors, including Nippon Life, Morgan Stanley, and BlackRock.

However, progress has been sluggish since then. Until 2021, unlike the general bond market (bonds not specifically labeled as sustainable) trend, the growth of the sustainable bond market (by outstanding amount) in the ASEAN+3 region lagged that of global growth. This trend then reversed, with the region’s growth in sustainable bonds outpacing the rest of the world (Figure 1). With an outstanding value of US$799 billion (bn) as at end-2023 (Figure 2), the ASEAN+3 economies accounted for 20% of global sustainable bonds, the second largest regional market behind Europe.

Like Europe, the sustainable bonds outstanding in the ASEAN+3 region mainly comprised green bonds (Figure 3), although the share decreased from 93% as at end-2018 to 64% as at end-2023. The reduction was primarily attributed to the increasing popularity of social (17% of the region’s sustainable bonds outstanding) and sustainability bonds (14%), which usually rank second and third in annual issuance by value regionally (Figure 4).

The remaining bond categories, sustainability-linked bonds (SLBs) and transition bonds, are sustainable financing tools introduced in recent years. These debt instruments constituted merely 4% and 1% of ASEAN+3’s sustainable bonds outstanding, respectively, as at end-2023. The most prominent difference between SLBs and Green, Social, and Sustainability (GSS) bonds is that SLBs are linked to the issuer’s achievement of specific sustainability performance targets, while GSS bonds have proceeds allocated for funding specific sustainable projects (also known as “use of proceeds” bonds).

Meanwhile, transition bonds are a separate and relatively new category. Similar to green bonds, transition bonds finance projects promoting environmentally friendly outcomes. However, transition bond issuers typically operate in the fossil fuel sector or other hard-to-abate, large carbon footprint industries and are transitioning to lower-carbon operations. Transition bonds aim to finance the change to greener, less emissive methods. Such financing is likely to be particularly important in Asia, given the region’s heavy reliance on fossil fuels to meet energy demands and the need for funding to make the transition.

| Bond | Type | Definition |

|---|---|---|

| Green Bonds | Use of Proceeds | Bonds whose proceeds are exclusively applied to finance or re-finance, in part or in full, new and/or existing projects with clear environmental benefits. |

| Social Bonds | Use of Proceeds | Bonds whose proceeds are exclusively applied to finance or re-finance, new and/or existing projects that directly aim to address or mitigate a specific social issue, and/or seek to achieve positive social outcomes. |

| Sustainability Bonds | Use of Proceeds | Bonds whose proceeds are exclusively applied to finance or re-finance a combination of both green and social projects. |

| Sustainability-Linked Bonds | General Purpose | Bonds for which the financial and/or structural characteristics (e.g. coupon, maturity, repayment amount) can vary depending on whether the issuer achieves predefined sustainability/Environment, and/or Social, and/or Governance (ESG) objectives within a predefined timeline. |

| Transition Bonds | Use of Proceeds / General Purpose | Green Bonds, Sustainability Bonds or SLBs that are issued by those looking to align their financing strategy with their climate transition strategy and decarbonisation trajectory. |

Source: The International Capital Market Association (ICMA).

| Bond | Guideline | Issuance Value (US$ billion) in 2023 | |

|---|---|---|---|

| Global | ASEAN+3 | ||

| Green Bonds | Green Bond Principles | 586 | 151 |

| Social Bonds | Social Bond Principles | 180 | 53 |

| Sustainability Bonds | Sustainability Bond Principles | 159 | 27 |

| Sustainability-Linked Bonds | Sustainability-Linked Bond Principles | 66 | 9 |

| Transition Bonds | Green Bond Principles, Sustainability Bond Principles, Sustainability-Linked Bond Principles | 3 | 2 |

| Total | 995 | 799 | |

Source: ICMA, Environmental Finance Bond Database, AsianBondsOnline.

Comparison of the sustainable bond markets in ASEAN+3 and Europe

Europe has dominated sustainable bond issuance over the years. The EURO-20 economies collectively accounted for 38% of the global sustainable bonds outstanding as at end-2023. The region has been a leader in progressive regulation that promotes greater transparency and confidence for issuers and investors. The enhanced European Green Bond Standard (EUGBS) established in June 2023, supports greater transparency and reporting obligations from green bond issuers and mitigates fears of greenwashing. EUGBS issuers must ensure that at least 85% of the funds from a green bond are used for financing that complies with the EU taxonomy for sustainable activities. The taxonomy is a stringent classification system that defines criteria for economic activities aligned with a net-zero trajectory by 2050.

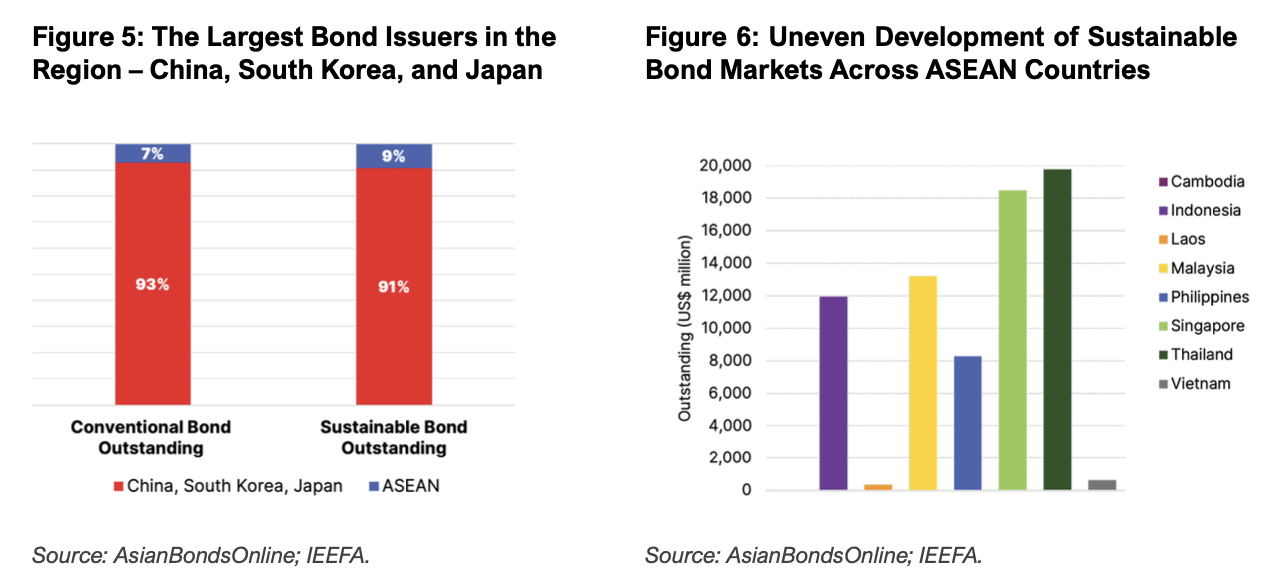

With their relatively larger economies, China, South Korea, and Japan dominate sustainable bond issuance in the ASEAN+3 region, mirroring their performance in the conventional bond market. These three countries collectively constituted 91% of the region’s sustainable bonds outstanding (Figure 5) as at end-2023. China led with US$390bn, while South Korea and Japan followed with US$172bn and US$163bn, respectively.

The development of the sustainable bond markets in the rest of the ASEAN region is widely varied across countries. Some countries like Thailand, Singapore, and Malaysia have made significant strides in issuing sustainable bonds (Figure 6), partly due to increasing regulatory support and market readiness. However, the market size is still limited compared to Europe and North Asia.

Frameworks and taxonomies in ASEAN

Three factors are likely to play crucial roles in accelerating the development of the sustainable bond markets in Asia. These are the availability of credible taxonomies, transformative infrastructure development for sustainability-linked instruments, and an active issuance strategy to provide liquidity, all of which are typically lacking in less developed regions.

Within the ASEAN region, Indonesia, Thailand, Singapore, and Malaysia have made progress by developing standards for green and sustainable bonds, typically backed by relevant taxonomies. Arguably, the presence of sovereign issuance in each of these countries has contributed to the establishment of legal frameworks and taxonomies (Table 3). Developing national frameworks that align with global standards can help address the countries’ specific environmental, social, and economic priorities. This approach ensures consistency with local regulations and policies while streamlining the issuance process and reducing regulatory uncertainties.

| Country | Framework/Taxonomy |

|---|---|

| Indonesia | Framework: Green Bond and Green Sukuk Framework Taxonomy: Taxonomy for Indonesian Sustainable Finance |

| Malaysia | Framework: Sustainable and Responsible Investment (SRI) Linked Sukuk Framework Taxonomies: Principle-based Sustainable and Responsible Investment Taxonomy Climate Change and Principle-based Taxonomy |

| Singapore | Framework: The Singapore Green Bond Framework Taxonomy: Singapore-Asia Taxonomy for Sustainable Finance |

| Thailand | Framework: Sustainable Financing Framework Taxonomy: Thailand Taxonomy |

| Philippines | Taxonomy: The Philippines Sustainable Finance Taxonomy Guidelines |

Defraying and reducing friction costs

Some countries in the ASEAN+3 region have introduced various incentive schemes to foster the development of sustainable debt instruments. For example, Malaysia has instituted the SRI Sukuk and Bonds Grant Scheme to reimburse up to 90% of the costs incurred by issuers on independent expert reviews of sustainable sukuk (debt instruments adhering to Islamic banking principles) and green bond issuances under the Malaysian or the ASEAN frameworks and standards.

The Monetary Authority of Singapore (MAS) established the Sustainable Bond Grant Scheme (SBGS) in 2017, which has been extended to 2028. The scheme reimburses up to SGD125,000 of additional eligible expenses on external reviews of eligible Green, Social, Sustainability, and Sustainability-Linked (GSSS) bonds and advocates for the adoption of internationally accepted standards. The scheme encourages the issuance of GSSS bonds in Singapore by helping issuers cover additional costs associated with external reviews typically needed to establish a bond’s sustainability or green status.

Similarly, the Hong Kong Monetary Authority’s (HKMA) Green and Sustainable Finance Grant Scheme provides subsidies for eligible first-time green and sustainable debt issuance in Hong Kong, covering half the issuance costs and all verification and external review costs associated with green instruments. This scheme, introduced in 2021, has recently been extended to 2027.

The ASEAN Green Bond Standard and the Sustainability-Linked Bond Standards also aim to facilitate enhanced transparency, consistency, and uniformity of the instruments, reducing due diligence requirements through standardization and thus helping the region’s market development.

Asia needs to accelerate green finance

In the conventional bond market, sovereign bonds are the cornerstone, typically comprising more than 60% of the global bonds outstanding. Government bond interest rates are used as a proxy for the “risk-free” rate or the interest rate that forms the basis for all others, typically including an added premium to reflect associated risk. With its lower-risk perception, this debt market is an important avenue for governments to raise funds for public spending.

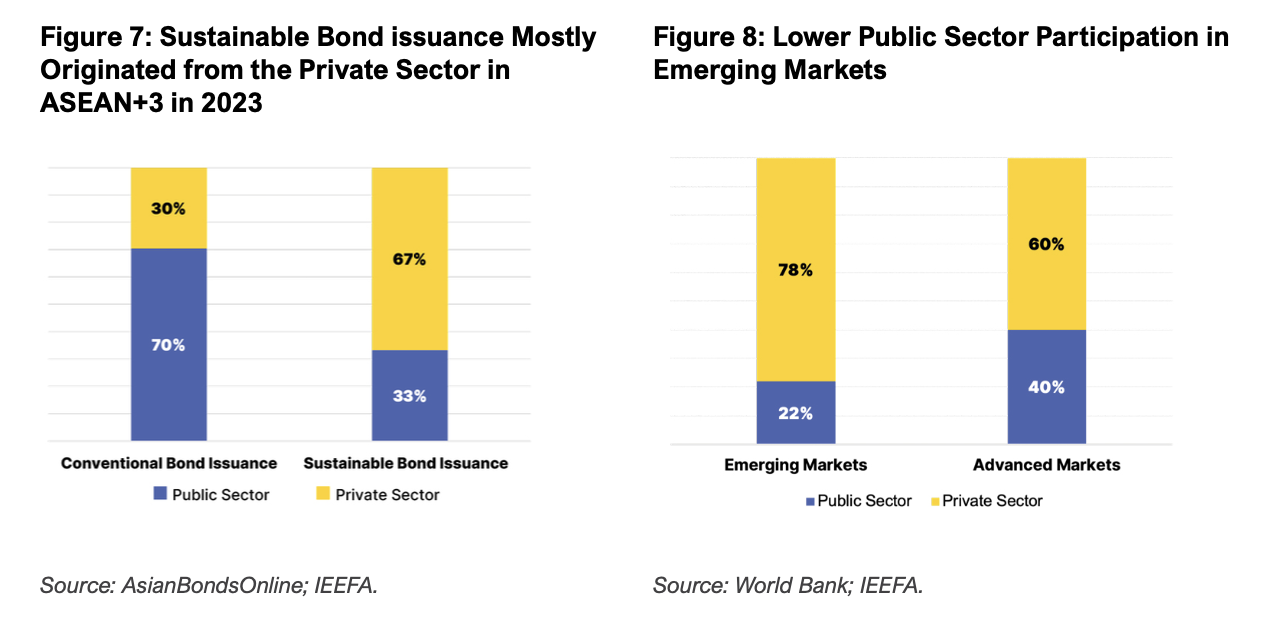

However, the sustainable bond market in ASEAN+3 is primarily led by private sector issuers (Figure 7), which contrasts with the traditional non-labeled bond markets, where public sector issuers make up the majority. While it is encouraging to see the private sector leading in sustainable bond issuance, the participation of the public sector – including sovereign government agencies, government development banks, regional governments, municipalities, and local governments – is crucial for providing liquidity and market size for a new instrument, especially in the early years.

Meanwhile, Europe’s larger share of the sovereign green bond space results from the political will to invest in green projects and easier access to such funding. The EU has committed to funding up to 30% or EUR250bn of its Next Generation EU (NGEU) program (designed in response to the COVID-19 pandemic) through green bonds. Similarly, EU initiatives such as the Green Deal and RePower EU have prioritized creating projects eligible for green funding backed by national and supranational will.

Meanwhile, Europe’s larger share of the sovereign green bond space results from the political will to invest in green projects and easier access to such funding. The EU has committed to funding up to 30% or EUR250bn of its Next Generation EU (NGEU) program (designed in response to the COVID-19 pandemic) through green bonds. Similarly, EU initiatives such as the Green Deal and RePower EU have prioritized creating projects eligible for green funding backed by national and supranational will.

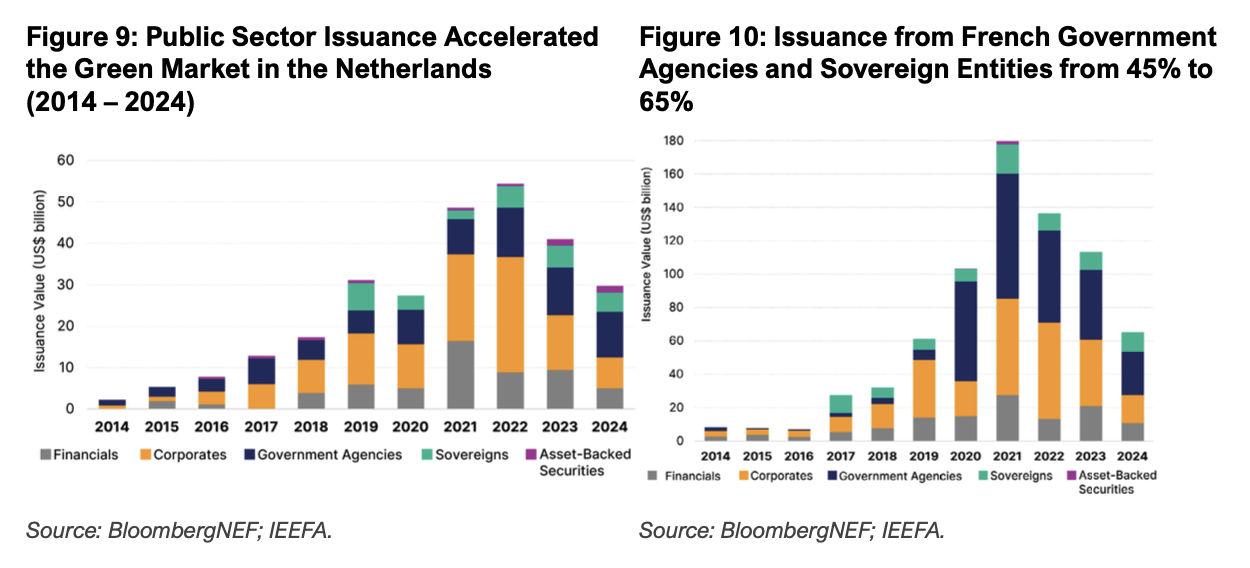

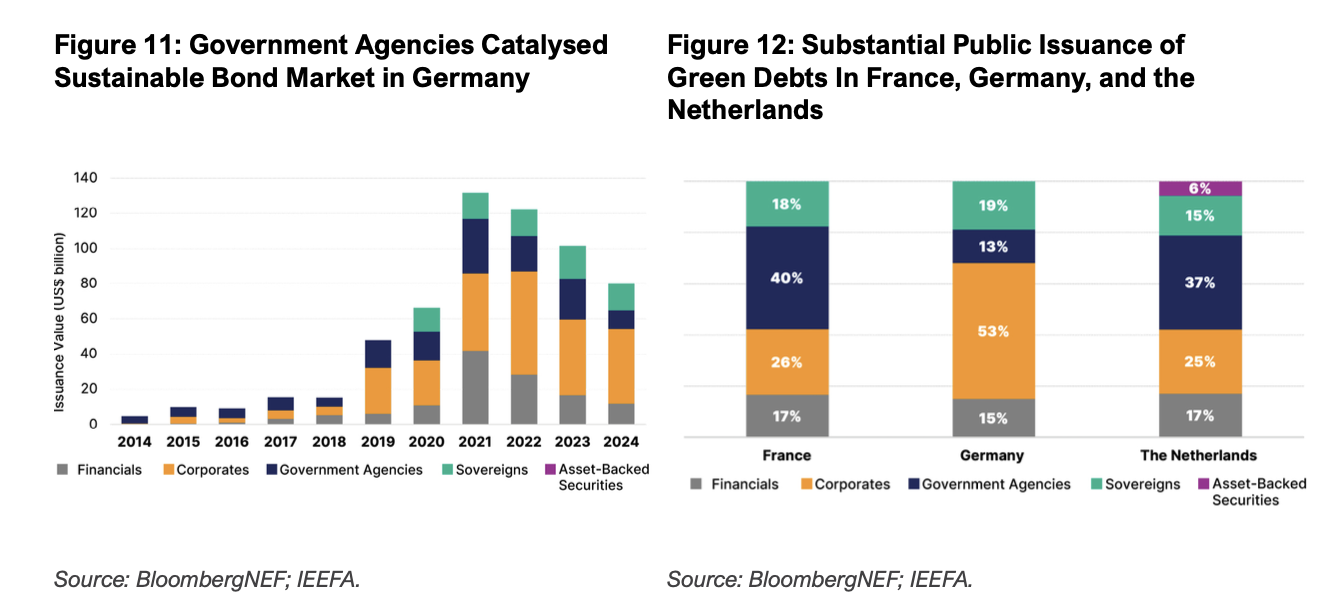

In France, green debt issued by government agencies and sovereign entities collectively constituted over 40% and over 30% of green debt issuance in 2017 and 2018, respectively. In 2020, during the COVID-19 pandemic, the share increased to over 60% in 2020, remaining at 50% since. Similarly, in Germany, sovereign and government-related green issuances accounted for between 50-60% of green debt issuances from 2014 and 2017, helping to create a liquid market and expanding during the COVID-19 crisis. The Netherlands likewise used public sector issuances to boost the green debt market (Figure 9). Germany, France, and the Netherlands are among the countries that have developed their legal frameworks aligning with the EU’s Green Bond Standard while also including specific criteria relevant to their domestic markets.

In the United Kingdom, the issuance of green gilts set a notable benchmark in the green bond market, attracting diverse investor interest and resulting in high subscription rates and frequent oversubscription. The continued issuance of green gilts signals a strong government commitment to funding sustainable projects and achieving net-zero by 2050. In 2021, Italy began issuing “Green BTPs, new sustainable finance government bonds whose proceeds would be used for public expenditures with positive environmental impact, contributing to the country’s ecological transition. These Green BTPs have attracted strong investor demand reflecting a high enthusiasm for green investment.

Public sector debt can catalyze ASEAN+3 sustainable bond issuance

In the ASEAN+3 region, social bonds appear to be the public sector’s preferred choice. In 2023, over 60% of the region’s social bond issuance originated from the public sector, with South Korea and Japan as the two largest contributors. Korea Housing Financing Corporation, a state-owned enterprise providing affordable home financing in South Korea, contributed more than half of the region’s social bond issuance. In Japan, social bond issuance was driven by the Japan Expressway Holding and Debt Repayment Agency, a government entity that supports the expansion and maintenance of expressway services.

Excluding China, South Korea, and Japan, the public sector’s involvement in the ASEAN region’s sustainable bond markets is even lower. Data from the World Bank suggests that public sector participation was around 22% in emerging markets’ sustainable bond issuance, far lower than 40% in advanced markets (Figure 8).

The European examples demonstrate how increased public sector involvement in ASEAN+3 countries’ sustainable bond markets could significantly enhance the supply of sustainable bonds and attract a broader range of investors, including those with specific mandates for sustainable assets. This is particularly true when these instruments are backed by carefully designed local taxonomies and schemes to minimize issuance and related costs.

The positive effects of sovereign issuance are well established in conventional bond markets, as shown in studies across developed and emerging markets. Recent research suggests that the sustainable bond field also experiences similar positive impacts. A Working Paper published by >the International Monetary Fund (IMF) empirically shows that sovereign green bond issuance can have quantitative and qualitative benefits for the development of private sustainable bond markets. The study found a significant increase in corporate issuance of green and sustainable bonds following a sovereign green bond issuance.

The study also found a marked reduction in yield premium (the premium over risk-free rates) and an improvement in liquidity (measured by the bid-ask spreads for the bonds), especially after the debut of a country’s sovereign green bond. An additional benefit discovered by the IMF and related research is that the verification ecosystem develops faster and becomes more robust. Green verification< becomes prevalent when sovereign and public sector issuance is enhanced. A larger share of corporate green bonds is issued after the sovereign debut has used green verification either through second-party opinion or green bond certification.

Concerted policy efforts can help develop sustainable debt markets

Further effort and financing are required for the ASEAN+3 region to have actively functioning sustainable debt markets, which is crucial for achieving climate goals and sustainability targets. Sovereign sustainable bonds can stimulate local sustainable bond markets by setting long-term pricing benchmarks, boosting liquidity, and serving as models for private issuers. Increasing sovereign sustainable bond issuance can signal a dedicated government commitment to sustainability goals and fund necessary projects and initiatives. Government involvement can also drive the development of a more robust and transparent regulatory environment, which is imperative for the long-term growth and stability of the local sustainable bond markets. Academic research and real-world examples demonstrate how this is possible.

According to the International Energy Agency’s World Energy Outlook 2023, investment gaps are prominent in emerging markets and developing economies (excluding China) where most of the global fossil fuel consumption occurs and the bulk of fossil fuel subsidies exist. These gaps are particularly prevalent in areas like energy efficiency and end-use decarbonization. Sovereign and government-related issuances of sustainable bonds can be crucial in initiating substantial capital inflows to address these gaps while exemplifying how the public sector can catalyze sustainable finance.