South Korea needs to accelerate renewable energy adoption to fuel Artificial Intelligence (AI) and semiconductor sectors

Key Findings

There is an increase in renewable energy demand from the Artificial Intelligence (AI) and semiconductor sectors, largely fueled by the strong decarbonization efforts of global Big Tech companies. However, South Korean companies are lagging in transitioning to renewable energy sources.

Unlike the rapid adoption of renewable energy in global industries, South Korean companies plan to build a combined capacity of around 4,700 megawatts (MW) of new liquefied natural gas (LNG) fired power plants for semiconductor clusters, AI data centers, and various industrial complexes.

International decarbonization requirements, such as the RE100 initiative, Europe’s Carbon Border Adjustment Mechanism (CBAM), and various Scope 1, 2, and 3 reporting regulations, are increasing. Using LNG-fired electricity and heat to meet the energy demands of South Korean semiconductor clusters and AI data centers could expose the country to substantial industry-trade and finance-capital risks.

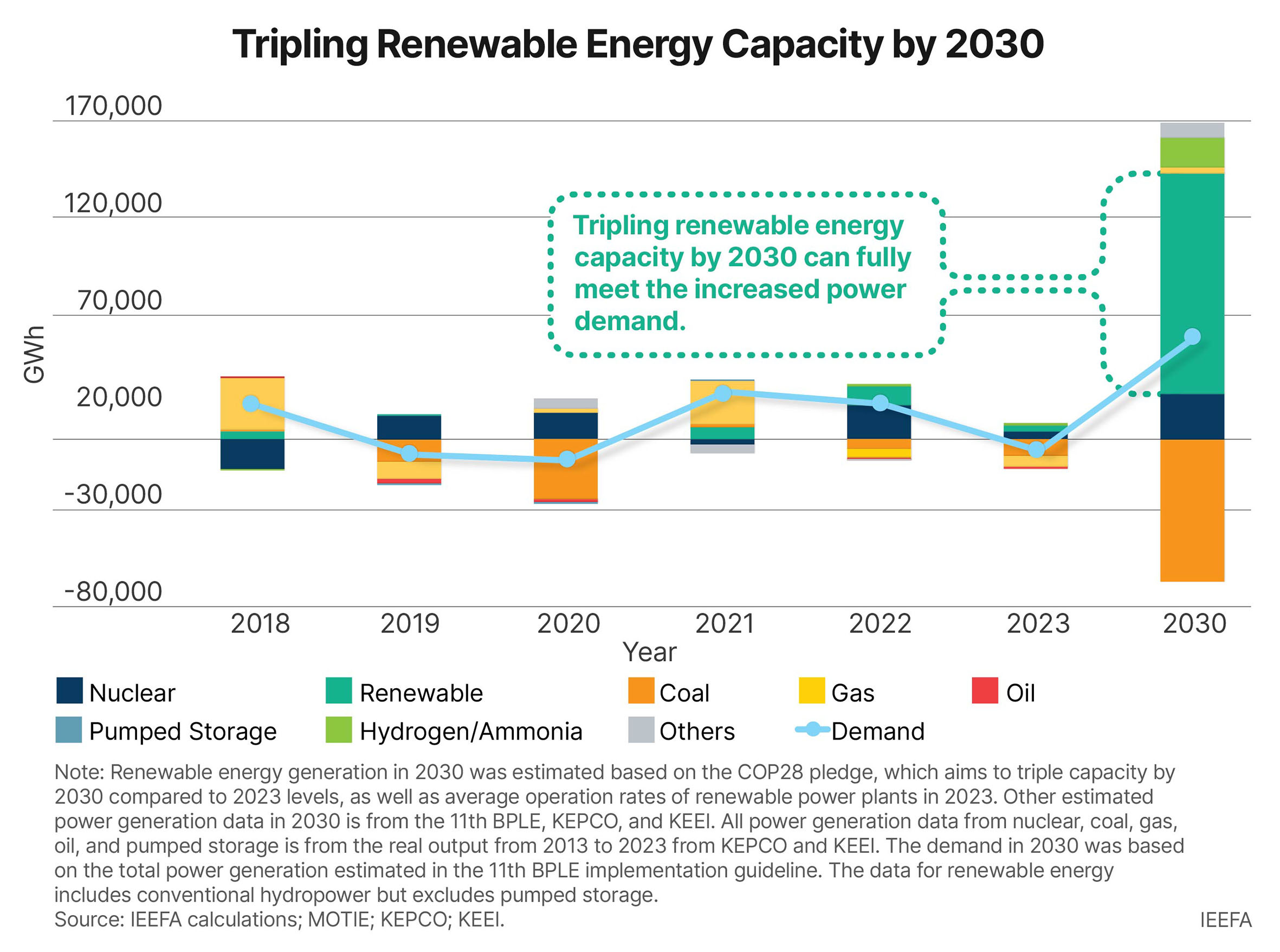

Tripling renewable energy capacity by 2030 could fully meet the projected electricity demand from South Korea’s AI and semiconductor sectors, assuming existing power plant buildout plans proposed in the country’s 11th Basic Plan for Long Term Electricity Supply and Demand (BPLE) guideline remain on track.

The International Energy Agency (IEA) has predicted that Artificial Intelligence (AI) and data centers will sharply increase the demand for renewable power. The net increment of renewable power generation for AI will likely triple to 262 terawatt-hours (TWh) by 2026 compared to 2023, and the share of AI demand in renewable power generation is expected to double to 17.9%.

The increase in renewable power demand from the AI and semiconductor sectors is largely fueled by the strong decarbonization efforts of global Big Tech companies. RE100, an international initiative of over 400 companies, aims to meet 100% of its electricity demand with renewable sources by 2050. The progress of South Korean RE100 members is negligible, with companies like SK Hynix achieving only a 30% renewable energy share and Samsung falling below 10%.

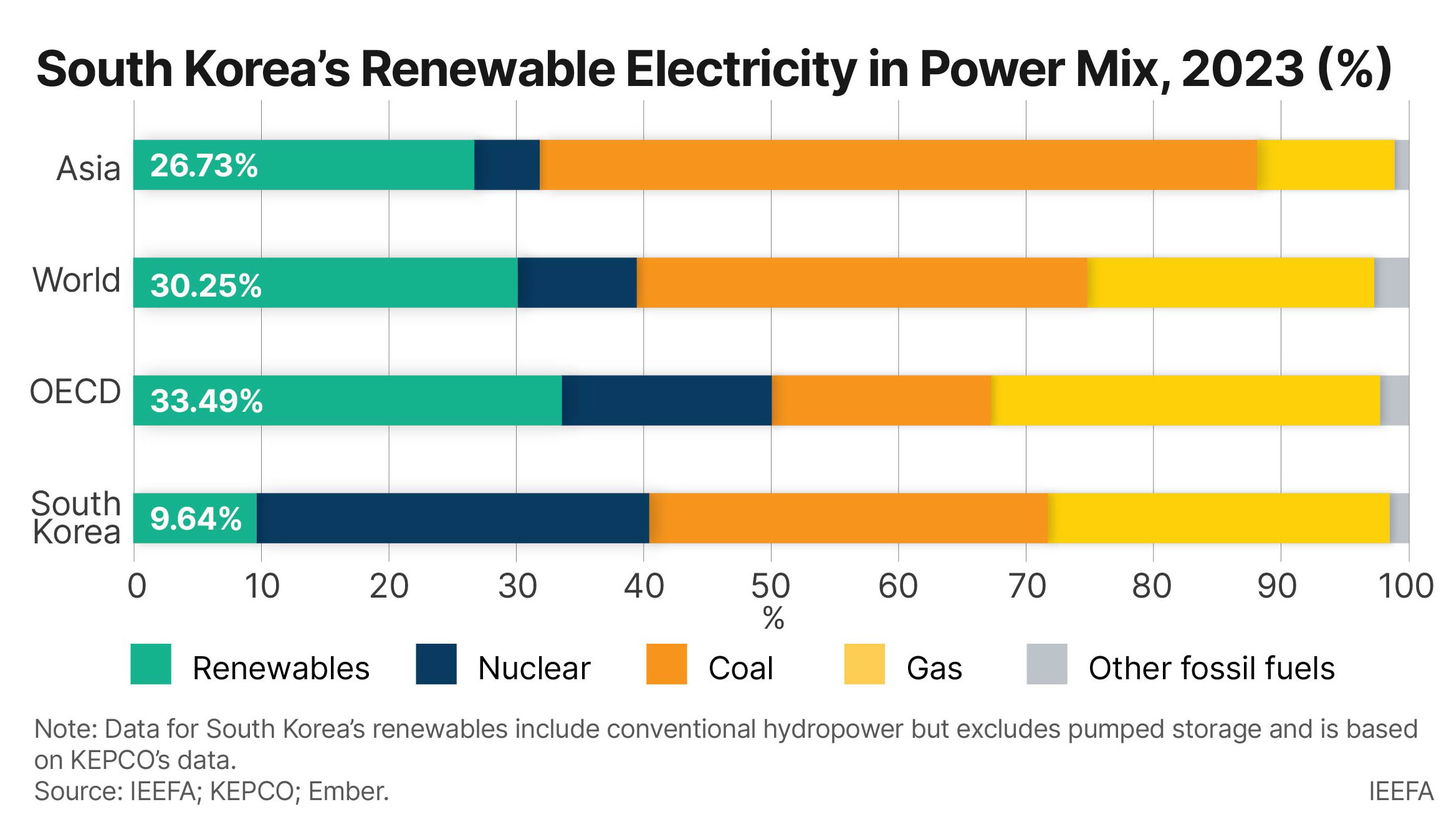

South Korea’s lagging renewable energy adoption further delays RE100 progress. In 2023, less than 10% of the country's electricity generation was from renewable sources, falling far short of the world (30.25%) and Asia (26.73%) averages. Renewable energy accounted for less than 6% of South Korea's total energy supply in 2022. Despite a comparatively high percentage of nuclear, South Korea’s electric grid carbon intensity was about 430 grams of carbon dioxide per kilowatt-hour (gCO2e/kWh), at par with Japan and Singapore, and above the United States.

Headwinds from fossil fuel usage in the AI & semiconductor sectors

Unlike the rapid adoption of renewable energy in global industries, South Korean companies such as SK E&S, Hanwha Energy, POSCO International, GS E&R, and Hanyang plan to build a combined capacity of around 4,700 megawatts (MW) of new liquefied natural gas (LNG) fired power plants, including Combined Heat and Power (CHP) for semiconductor clusters, AI data centers, and various industrial complexes.

Additionally, South Korea’s 11th Basic Plan for Long Term Electricity Supply and Demand (BPLE) guideline continues prioritizing greenhouse gas (GHG) emitting, LNG-fired power and nuclear power from unproven Small Modular Reactors (SMRs), which is expensive and only a near-term solution.

Using LNG-fired electricity and heat to fuel semiconductor clusters and AI data centers could expose South Korea to substantial industry-trade and finance-capital risks amid strengthening decarbonization trends, such as the RE100 initiative, Europe’s Carbon Border Adjustment Mechanism (CBAM), and various Scope 1, 2, and 3 reporting regulations.

Semiconductors make up more than 20% of South Korea's total exports. The U.S. is the fifth largest export destination for South Korean semiconductors and is home to 428 RE100 member companies. There would be significant consequences if major U.S. fabless companies were to switch chip suppliers from South Korean firms to others in search of lower embedded carbon for their products.

Regardless of the outcome of the imminent U.S. presidential election, upcoming bipartisan carbon tax-related bills, such as the Clean Competition Act (CCA), PROVE IT Act, Foreign Pollution Fee Act, and Market Choice Act, are most likely to be passed. These bills may further erode the market share of high carbon-intensive South Korean companies in the U.S.

The CBAM, proposed in 2021, aimed to prevent “carbon leakage” by taxing imported goods into Europe based on embedded carbon emissions, including iron, steel, aluminum, cement, hydrogen, electricity, and fertilizer. When this mechanism includes the semiconductor and AI sectors in its scope, high carbon-intensive South Korean companies will face substantial financial consequences.

The CBAM is a carbon tariff that potentially equalizes carbon pricing between the European Union (E.U.) and non-E.U. countries. If other countries adopt similar mechanisms and the scope of CBAM expands, it could lead to a convergence in carbon prices across different countries. South Korean producers would then face higher operating costs associated with using fossil fuel-based electricity and heat procurement. Simultaneously, their exports would be subject to upward cost adjustments due to the carbon intensity.

Additionally, from 2024 onwards, the International Financial Reporting Standards Sustainability Standards (IFRS S2) introduced mandatory disclosure of Scope 3 emissions, which also applies to the South Korean semiconductor sector. Scope 3 emissions, as defined by the GHG Protocol, represent the broadest category of GHG emissions, encompassing all indirect emissions throughout an organization's value chain. Various national jurisdictions are considering expanding companies’ supply chain reporting to include Scope 3. Once these regulations come into effect, South Korean AI and semiconductor companies with high GHG emissions could face difficulties procuring feedstocks and parts as upstream suppliers would request the carbon footprint of these manufacturers for their own Scope 3 reporting. Companies that purchase South Korean chips would need to add the carbon intensity of those products to their Scope 3 reporting. Thus, downstream end-users may prioritize sourcing chips from lower emissions manufacturers to reduce their carbon footprint.

Tripling renewable energy to safeguard national competitiveness

By tripling its renewable energy, as pledged at the 2023 United Nations Climate Change Conference (COP28), South Korea can meet the growing electricity demand from emerging semiconductor clusters and AI-driven data centers and remain globally competitive.

According to IEEFA’s analysis, tripling renewable energy capacity by 2030 could fully meet the projected electricity demand from the AI and semiconductor sectors, assuming existing power plant buildout plans proposed in the 11th BPLE remain on track.

The net increment of renewable power generation compared to 2023 could reach 113,434 gigawatt hours (GWh) by 2030. This projected level of renewable energy generation would be more than sufficient to meet the anticipated net increase in power demand, estimated to be around 53,168GWh in 2030.

Consequently, renewables could fulfill the additional power requirements of high-growth industries and contribute to the overall electricity mix while helping South Korea meet its Paris Agreement commitments. This echoes IEA’s projection that low-carbon electricity will meet all additional demand by 2026.

South Korea, a nation propelled by rapid economic growth and technological advancement, was expected to become a renewable energy transition leader alongside the U.S., Europe, China, and Japan. Renewable energy could offer greater supply stability and autonomy backed by an abundant and decentralized resource distribution system.

However, South Korea still relies heavily on imported fossil fuels and lags at least 15 years behind other countries’ target of meeting the 30% renewable power threshold.

Renewable energy is emerging as the frontline for national competitiveness. Using fossil fuel-based energy to fuel emerging AI and semiconductor sectors will jeopardize industrial competitiveness and undermine geopolitical influence, national security, access to financing, and public well-being. It is essential for South Korea to recognize the cost of missing out on the energy transition and to address industry risks by ensuring an accelerated renewable energy adoption.