South Korea’s economy risks missing out on global transition to renewables

Download Full Report

View Press Release

Key Findings

Renewable energy is emerging as the frontline for national competitiveness, encompassing factors like geopolitical influence, national security, industrial leadership, access to financing, and public well-being. Despite a pledge to achieve net-zero by 2050, South Korea’s renewable energy made up a mere 9.64% of the country's power generation mix in 2023, lagging far behind world averages.

Despite aiming to reduce reliance on LNG, South Korea’s 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE) still prioritizes fossil fuels and speculative Small Modular Reactors (SMRs), to meet the growing power demand from semiconductor clusters and Artificial Intelligence (AI) data centers. This could be a high-cost, high-risk, and high-carbon strategy.

Using LNG-fired electricity to power semiconductor clusters and AI data centers could expose South Korea to substantial industry-trade and finance-capital risks amid strengthening decarbonization trends, such as the RE100 initiative, Carbon Border Adjustment Mechanism (CBAM), and Scope 1, 2, and 3 regulations.

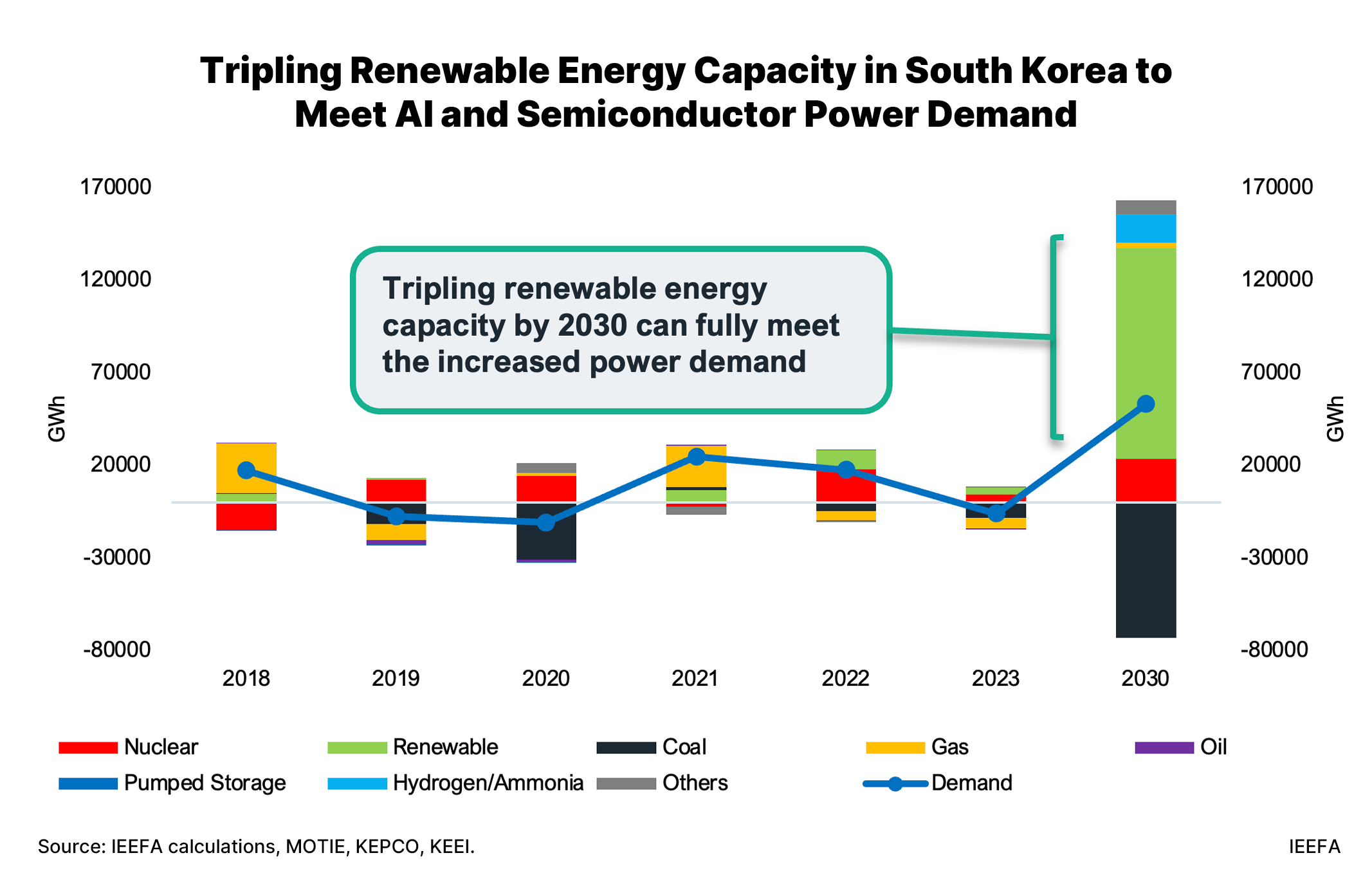

By tripling its renewable energy, as pledged at the 2023 United Nations Climate Change Conference (COP28), South Korea can meet the growing electricity demand from emerging semiconductor clusters and AI-driven data centers and remain globally competitive.

Executive Summary

Despite a pledge to achieve net-zero by 2050, South Korea’s renewable energy made up a mere 9.64% of the country's power generation mix in 2023, lagging far behind the averages of the world (30.25%), the Organization for Economic Cooperation and Development (OECD) (33.49%), and even Asia (26.73%). The status of renewable power in South Korea contrasts with the global trend where renewable energy generated a record 30% of the world’s electricity in 2023, driven by a strong growth in solar and wind.

South Korea's excessive reliance on fossil fuels creates vulnerabilities beyond environmental damage. Renewable energy is emerging as the frontline for global competitiveness, encompassing factors like geopolitical influence, national security, industrial leadership, access to financing, and public well-being.

The race to develop and deploy renewable energy sources is the defining energy challenge of this century. It mirrors the historical dominance of fossil fuels such as coal in the Industrial Revolution of the 18th-19th century and oil in the World Wars and Middle East conflicts of the 20th century. In 2024, global investment in clean energy will be double that of fossil fuels.

This fear of missing out on the financial advantages resulting from the benefits of renewables is driving countries and regions like the U.S. and E.U. to invest heavily in domestic renewable energy development through supportive policies, such as the Inflation Reduction Act (IRA) and the Net-Zero Industry Act (NZIA).

This report explores the potential risks that South Korean industries, particularly the semiconductor sector, could face as a result of missing out on global efforts to deploy renewable energy and address climate change.

Semiconductors play a vital role in the national economy, accounting for over 20% of South Korea’s total exports. Global semiconductor buyers are increasingly concerned about their supply chain’s carbon intensity, and are seeking out manufacturers who actively reduce their carbon footprint.

South Korean companies will, therefore, be highly exposed to global decarbonization trends in key semiconductor markets. In addition to the increased risk, this report investigates whether tripling South Korea’s renewable energy, as pledged at the 2023 United Nations Climate Change Conference (COP28), can meet the growing electricity demand from the emerging semiconductor clusters and artificial intelligence (AI)-driven data centers.

In November 2023, SK E&S applied to construct a large LNG-fired power plant to supply SK Hynix, a major chipmaker, with electricity and power. In June 2024, SK E&S signed an agreement with Korea Midland Power to build the combined heat and power facility.

SK Hynix is a member of RE100, a global initiative of over 400 companies aiming to meet 100% of their electricity demand with renewable sources by 2050. Despite the company’s renewable energy goal, its current 30% achievement falls short of the global average (50%). Procuring electricity from any new LNG-fired power plant, which has asset lives of 25 years or more, could jeopardize SK Hynix’s RE100 target and market competitiveness, especially when U.S. customers are prioritizing manufacturers who use renewable energy.

U.S. fabless companies that outsource the manufacture of their semiconductor designs to third parties are potential clients for SK Hynix and could choose suppliers using renewable energy. Given the highest share of RE100 membership is in the U.S., SK Hynix and other chipmakers with a high carbon footprint could potentially lose market share if buyers avoid doing business due to environmental preferences.

The situation is complicated beyond the U.S as well. The E.U.'s Carbon Border Adjustment Mechanism (CBAM) could tax imports based on embedded carbon emissions. Although currently exempt, the energy-intensive nature of semiconductor production raises the potential for future inclusion. Europe’s CBAM initiative, coupled with South Korea’s carbon tax on LNG, could hurt the competitiveness of South Korean semiconductor technologies if manufacturers do not adopt cleaner supply chain practices.

Financial risks to the South Korean semiconductor industry are also increasing. Upcoming International Financial Reporting Standards Sustainability Standards (IFRS S2), requiring companies to disclose climate-related risks and opportunities, will include the disclosure of Scope 1, 2, and 3 greenhouse gas (GHG) emissions. High GHG emissions could limit access to or increase the cost of financing and capital for South Korean chipmakers. Additionally, both downstream customers and upstream suppliers may hesitate to conduct business due to stricter reporting requirements related to Scope 3 GHG emissions.

South Korea's semiconductor industry stands at a crossroads. Embracing renewable energy is critical to safeguard its economic competitiveness and secure future suppliers and customers within the upstream and downstream supply chains.

This report finds that tripling renewable energy by 2030 could fully meet the increased electricity demand from emerging semiconductor clusters and AI-driven data centers.

Despite aiming to reduce reliance on LNG, South Korea’s 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE) guideline still prioritizes fossil fuels, coupled with nuclear generation from speculative Small Modular Reactors (SMRs), to meet the growing power demand from semiconductor clusters and AI data centers. This could prove to be a high-cost, high-risk, and high-carbon strategy.

This report finds that renewable sources could meet the additional electricity needs of the AI and semiconductor sectors. Tripling renewable energy capacity by 2030 can generate 113,434 gigawatt hours (GWh) of net increment of renewable power, exceeding the projected power demand increase of 53,168GWh. Ultimately, a portfolio of renewable generation and storage technologies tailored to the demand of key growth industries will be critical for achieving carbon neutrality by 2050.

An excess of 55,706GWh in gas-fired power would be created by 2030 if new LNG-fired power plants requested by various industrial sectors, including semiconductor clusters, are built. South Korea needs to phase out gas-fired power by 2035 to meet its climate targets. Building more LNG plants contradict the country’s net-zero goal and increases the risk of stranded assets.

These findings demonstrate that the increased electricity demand from semiconductor clusters and AI data centers does not justify expanding new fossil fuel-based power generation in South Korea.

Accelerating renewable electricity deployment is critical for South Korea's future. It safeguards economic competitiveness and ensures long-term sustainability for the vital semiconductor and AI sectors, while promoting geopolitical influence, national security, and public well-being.

IEEFA suggests the following recommendations for South Korea to secure its place as a leader in industry and environmental sustainability through a comprehensive and unified policy approach.

-

Reduce reliance on fossil fuels in the power mix and expedite the transition to clean energy sources.

-

Meet the COP28 pledge of tripling renewable energy by 2030 instead of continuing fossil-fuel based power generation to meet the growing electricity demand from semiconductor clusters and AI data centers.

-

Implement stronger policy measures to accelerate renewable power deployment with a cohesive and holistic policy framework rather than fragmented and overlapping policies.

-

Accelerate the renewable energy transition to safeguard geopolitical influence, national security, industrial leadership, access to financing, and public well-being.