Lagging renewables growth in South Korea exposes semiconductor and AI industries to multidimensional risks

Prioritizing renewable generation and storage technologies within a cohesive policy framework is critical for global competitiveness and carbon neutrality by 2050

August 14, 2024 (IEEFA Asia): A new report by the Institute for Energy Economics and Financial Analysis (IEEFA) suggests that delayed renewable energy deployment in South Korea could hinder its rapidly growing semiconductor and artificial intelligence (AI) industries.

According to Michelle (Chaewon) Kim, report author and IEEFA’s Energy Finance Specialist in South Korea, addressing the renewable energy gap is critical, given the increased global focus on environmental, social, and governance (ESG) factors in the supply chain.

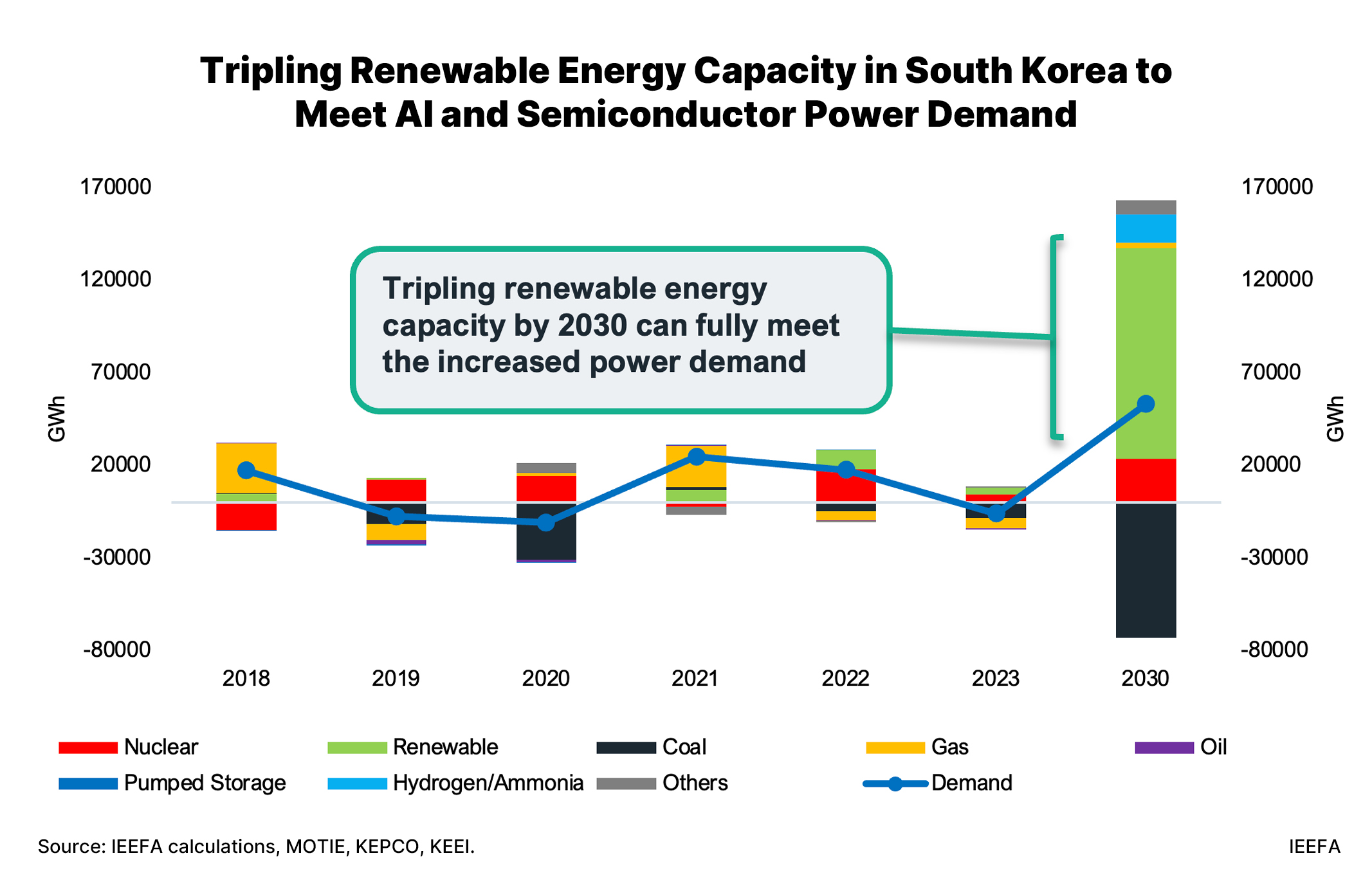

The report finds that renewable sources – which include wind, solar, and conventional hydropower, among other sources – could meet the additional electricity needs of the emerging semiconductor clusters and AI data centers. Tripling renewable energy capacity by 2030 can generate 113,434 gigawatt hours (GWh) of net increment of renewable power, exceeding the projected power demand increase of 53,168GWh.

“Global semiconductor buyers are increasingly concerned about their supply chain’s carbon intensity and seek manufacturers who actively reduce their carbon footprint. Semiconductors account for over 20% of South Korea’s total exports, so embracing renewable energy is critical to safeguard the country’s economic competitiveness and secure future suppliers and customers within the upstream and downstream supply chains,” says Kim.

Delayed renewable energy development

Financial advantages resulting from renewable energy use are driving the United States (U.S.) and the European Union to invest heavily in domestic renewables development through the enactment of supportive policies, such as the Inflation Reduction Act and the Net-Zero Industry Act.

Stricter emission regulations, such as the Carbon Border Adjustment Mechanism (CBAM), IFRS Sustainability Standards (IFRS S2), and initiatives like RE100 and the green finance movement, put South Korea’s energy-intensive companies and its economy at a significant disadvantage.

In 2023, South Korea’s renewable energy made up a mere 9.64% of the country's power generation mix, lagging far behind the world average (30.25%), the Organization for Economic Cooperation and Development (33.49%), and Asia (26.73%).

In May 2024, the country’s 11th Basic Plan for Long-Term Electricity Supply and Demand (BPLE) outlined that renewable electricity will increase to 21.6% of the power mix by 2030 and 32.9% by 2038.

“This translates to South Korea lagging behind other countries by at least 15 years in reaching the 30% threshold for renewable electricity generation,” says Kim.

Despite aiming to reduce reliance on liquefied natural gas (LNG), South Korea’s 11th BPLE still prioritizes fossil fuels, coupled with nuclear generation from speculative Small Modular Reactors (SMRs), to meet the growing electricity demand from semiconductors and AI.

The 10th BPLE planned to reduce LNG in the power mix to 9.3% by 2036, while the 11th BPLE targets reducing it to 11.1% by 2038.

The report advises the phasing out of gas-fired power generation before 2035 to achieve its Nationally Determined Contributions (NDCs) target.

Importance for the semiconductor industry

Several South Korean companies recently requested approvals for new LNG-fired power plants, asserting that increasing electricity demand from data centers, semiconductor clusters, and other industrial complexes necessitates additional plants.

Companies like SK E&S, Hanwha Energy, POSCO International, GS E&R, and Hanyang plan to build new LNG-fired plants for captive use with a combined capacity of around 4,700 megawatts (MW).

In November 2023, SK E&S applied to construct a large LNG-fired power plant to supply SK Hynix, a major chipmaker, with electricity and power. In June 2024, SK E&S signed an agreement with Korea Midland Power to build the combined heat and power facility. (Note: On August 9, 2024, media reports indicated that SK Hynix only intends to procure heat from the facility.)

“IEEFA finds that semiconductor manufacturing powered by fossil fuels, such as LNG, could jeopardize the RE100 goals and market competitiveness of South Korea’s semiconductor companies, especially when U.S. fabless customers prioritize manufacturers who use renewable energy,” says Kim.

Given that the highest share of RE100 membership is in the U.S., South Korean chipmakers could potentially lose market share if buyers refrain from doing business due to environmental preferences.

Europe’s CBAM initiative, coupled with South Korea’s carbon tax on LNG, could hurt the competitiveness of South Korean semiconductor technologies if manufacturers do not adopt cleaner supply chain practices.

Semiconductor companies powered by LNG could face mounting global pressure due to the disclosure requirements for Scope 1, 2, and 3 emissions. This could raise concerns among investors and lenders, potentially limiting access to financing and capital. Additionally, downstream customers and upstream suppliers may hesitate to conduct business due to stricter reporting requirements related to Scope 3 GHG emissions.

Expanding fossil fuel-based power generation in South Korea to meet the growing electricity demand from semiconductor clusters and AI data centers is unnecessary. Instead, tripling renewable energy by 2030 is critical to meeting the increased demand and fulfilling the country’s COP28 pledge.

According to the IEEFA report, while the country has enacted several laws and policies to accelerate renewable power deployment, they overlap significantly and lack a unified approach.

It is crucial to develop a comprehensive policy that integrates national and energy security, industrial competitiveness, and renewable energy development holistically. In March 2024, South Korea proposed the Act on Special Measures for Protecting and Enhancing the Competitiveness of the Carbon Neutral Industry, which, as of July 2024, is pending approval in the National Assembly.

“South Korea should accelerate the renewable energy transition to safeguard geopolitical influence, national security, industrial leadership, access to financing, and public well-being. By addressing the renewable energy deficit, the country can maintain its global competitiveness,” says Kim.

Read the report: South Korea’s Economy Risks Missing Out on Global Transition to Renewables

Read this press release in Korean

Author contact: Michelle (Chaewon) Kim ([email protected])

Media contact: Alex Yu (ayu@ieefa.org)

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. Its mission is to accelerate the transition to a diverse, sustainable, and profitable energy economy. (www.ieefa.org)