South Korea’s recycling systems could propel sustainable aviation fuel (SAF) leadership potential

Key Findings

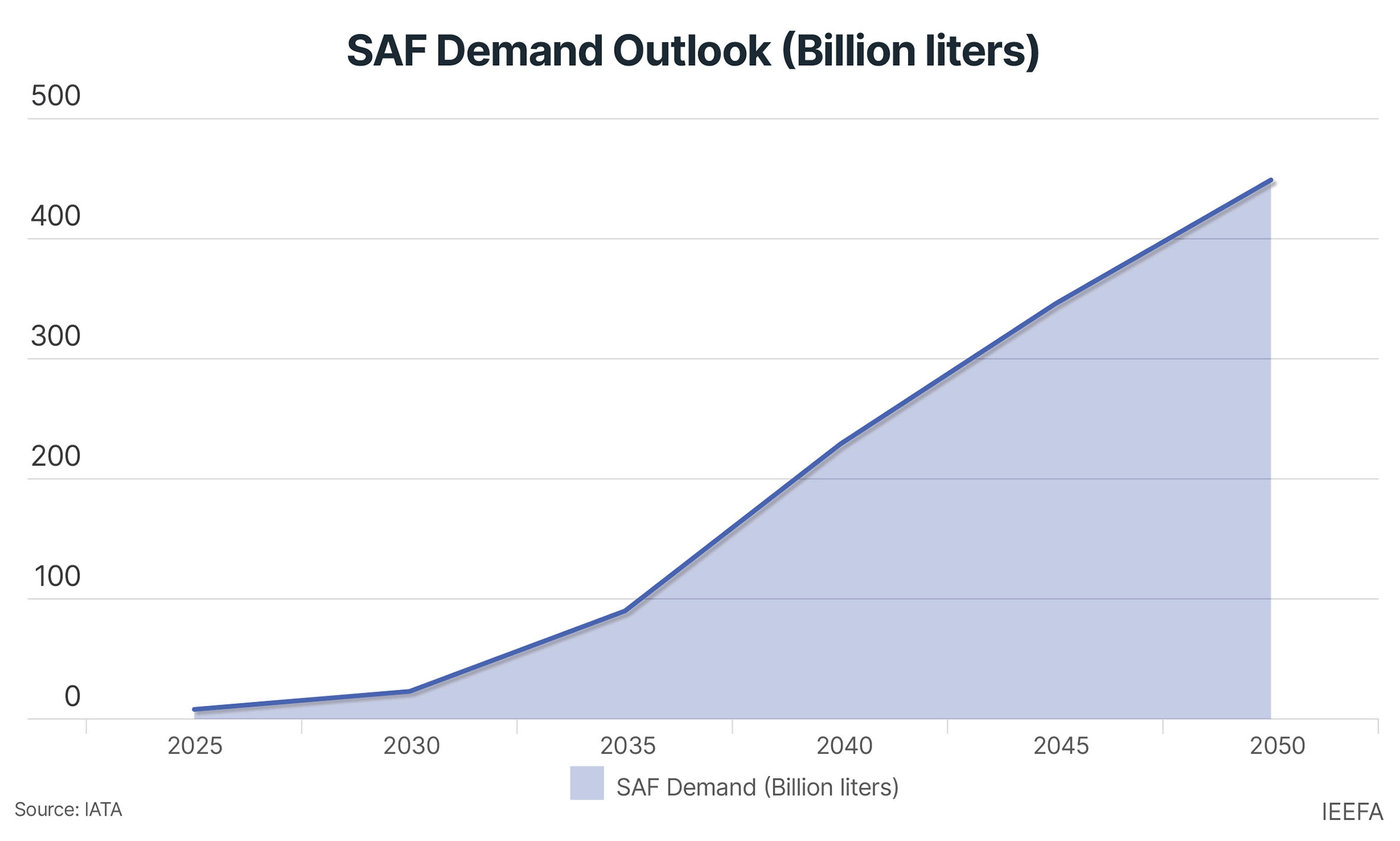

South Korea has expedited various projects and policies related to sustainable aviation fuel (SAF) since implementing a mandate in August 2024, which requires a 1% SAF blending starting in 2027. The International Air Transport Association (IATA) projects that 449 billion liters of SAF will be needed by 2050 to achieve net-zero emissions in the aviation sector.

The South Korean government is in the process of designating SAF as a ‘national strategic technology’. It has launched a task force to develop a roadmap for mandatory SAF blending and plans to establish an experiment center in Seosan by 2031.

While SAF offers a promising path toward decarbonization with economic benefits, a cautious approach is needed to address various challenges associated with using unsustainable feedstocks and production technologies.

South Korea has one of the world's best waste recycling systems and could leverage this strength to become a leading SAF producer. The timely development of a domestic SAF industry is crucial for capitalizing on opportunities and achieving a greener aviation future.

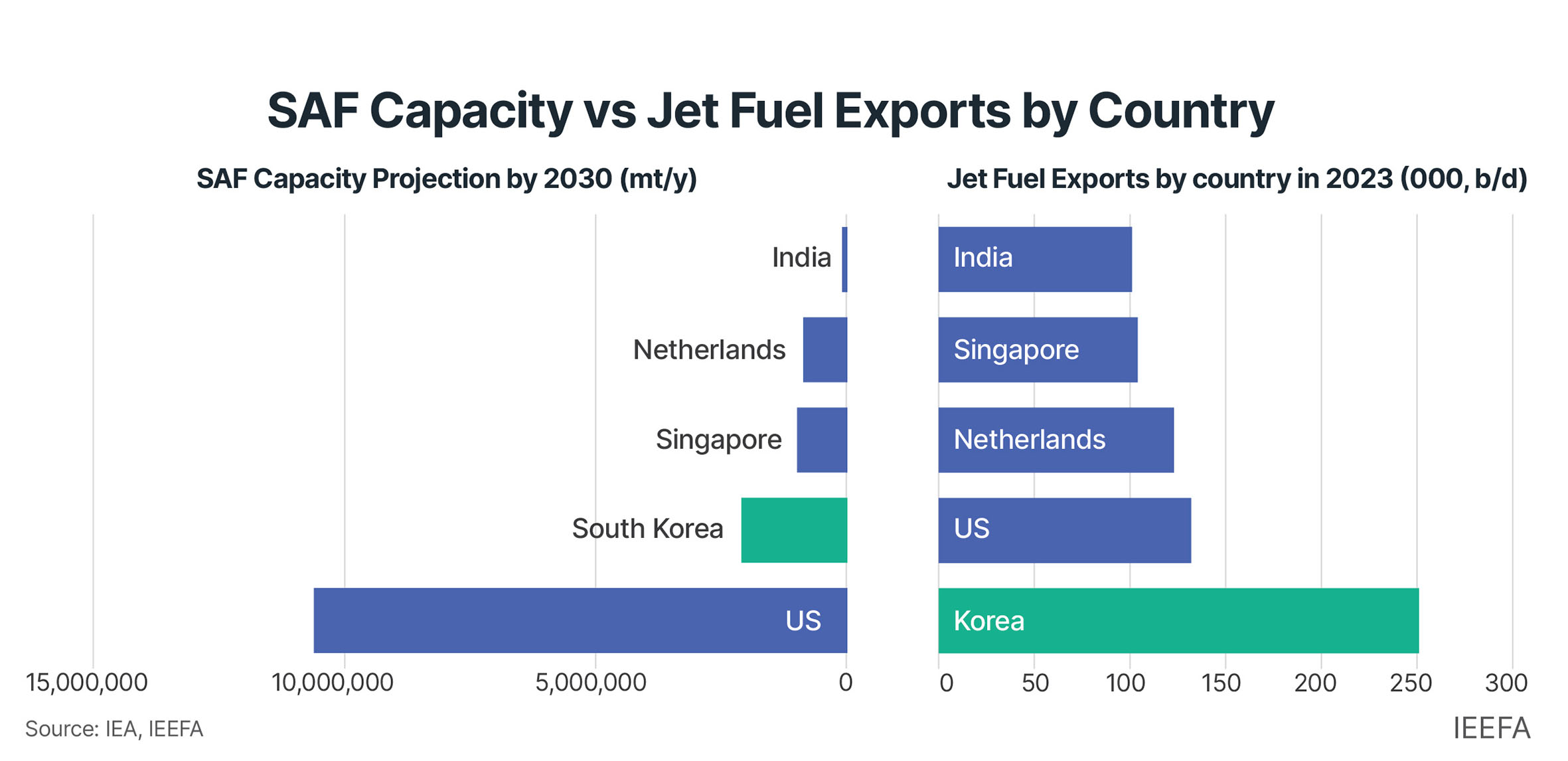

South Korea has expedited various projects and policies related to sustainable aviation fuel (SAF) since implementing a mandate in August 2024, which requires a 1% SAF blending from 2027 to safeguard its position as the largest jet fuel exporter.

The South Korean government is in the process of designating SAF as a ‘national strategic technology’. Currently, the government is offering tax credits of 15% for large and mid-sized companies and 25% for small businesses that invest in national strategic technology facilities. The Ministry of Trade, Industry and Energy and the Ministry of Land, Infrastructure and Transport launched the SAF Blending Mandate Design Task Force and are developing a roadmap by the first half of the year.

In February 2025, the government announced that a SAF experiment center will be established by 2031 in Seosan, a city on the country’s western coast, with an investment of KRW311 billion (bn) (approximately US$2bn). In the same month, SK Innovation, GS Caltex, S-Oil, and HD Hyundai Oilbank disclosed that they are jointly building a SAF plant at a cost of KRW1 trillion (approximately US$0.6bn) to process 250,000 metric tonnes (mt) annually.

South Korea’s ambitious moves come amid fast-growing opportunities in the SAF market. The International Air Transport Association (IATA) estimated that 449bn liters of SAF will be required by 2050 to achieve net-zero emissions, representing a compound annual growth rate (CAGR) of 17.5% compared to the 2025 level. The SAF market value is projected to surge from US$0.6bn in 2022 to around US$45bn in 2030, a nearly 75-fold increase.

Challenges in SAF production

SAF is an innovative solution for decarbonizing the aviation sector by replacing petroleum in fuel production with alternative feedstocks such as waste fats, oils, and grease (FOG), municipal solid waste (MSW), food waste, algae, and photosynthetic organisms. Compared to traditional jet fuel, SAF can reduce carbon dioxide (CO2) emissions by up to 80%. It offers a drop-in decarbonization solution, requiring minimal aircraft or infrastructure modifications, with current operation standards allowing up to 50% SAF and fossil jet fuel blend. The aviation industry aims for complete SAF compatibility (100% blend) by 2030.

Despite its environmental benefits, SAF production faces challenges, including limited feedstock availability, high manufacturing costs (two to five times higher than fossil jet fuel), and technological limitations, as highlighted in a previous report by the Institute for Energy Economics and Financial Analysis (IEEFA). The dominant SAF production process, hydroprocessed esters and fatty acids (HEFA), relies on feedstocks like used cooking oil and animal fats, which are in short supply.

This feedstock scarcity and unaffordability risks a shift towards first-generation feedstocks (such as soybean and palm oil), which are cheaper and more readily available but are associated with sustainability concerns. Associated problems include deforestation, biodiversity loss, water scarcity, competition with food uses, and land-use emissions that may exceed fossil fuel impacts.

Additionally, not all SAFs achieve the same degree of carbon reduction. Some production methods have higher carbon footprints than others.

Seizing opportunities by availing domestic advantages

Against this backdrop, shifting from first to second-generation SAF feedstocks, including waste-based components, is gaining momentum among many governments.

South Korea has one of the world's best waste recycling systems (86% waste recycling rate) and is ranked second in the Organization for Economic Cooperation and Development (OECD) for municipal waste recycling (56.5%). The country could leverage this strength to become a leading SAF producer since reliable and consistent resource capture from recycling is key to creating second-generation fuels.

South Korea could utilize its recycling program for different SAF production pathways. Domestically aggregated used cooking oil could be collected for HEFA and co-processing production, while MSW could be used for Fischer-Tropsch (FT) and Alcohol-to-Jet (ATJ) processes. Domestic feedstock procurement could reduce reliance on imported raw materials, potentially moderating SAF production costs and hedging feedstock availability.

The timely development of a domestic SAF supply chain is crucial for South Korea to take advantage of market opportunities. For instance, the collection of used cooking oil, a vital feedstock for HEFA and coprocessing-based SAF production, could pave the way for new businesses in the country. Establishing a robust used cooking oil collection network would enhance energy security and improve the competitiveness of local SAF producers and the airline industry.

The International Renewable Energy Agency’s (IRENA) 1.5°C Scenario projects that bioenergy, including SAF, will account for over 18% of the total final energy consumption by 2050. SAF is a key solution for hard-to-abate sectors like aviation.

However, widespread SAF adoption requires strong governance to balance sustainable feedstock use, environmental impact, and economic equity. Leveraging its strategic initiatives, waste recycling expertise, and leadership in the jet fuel market, South Korea is well-positioned to develop a domestic SAF industry and accelerate the transition toward a greener aviation future.