KEPCO’s fossil fuel reliance limits options for reform

State-owned South Korean utility will continue to be vulnerable to fossil fuel price uncertainties while nuclear power generation has its limits

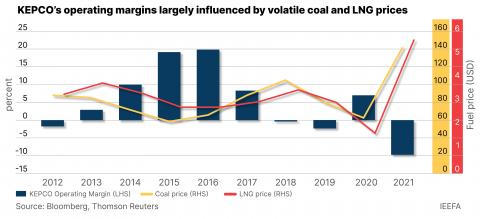

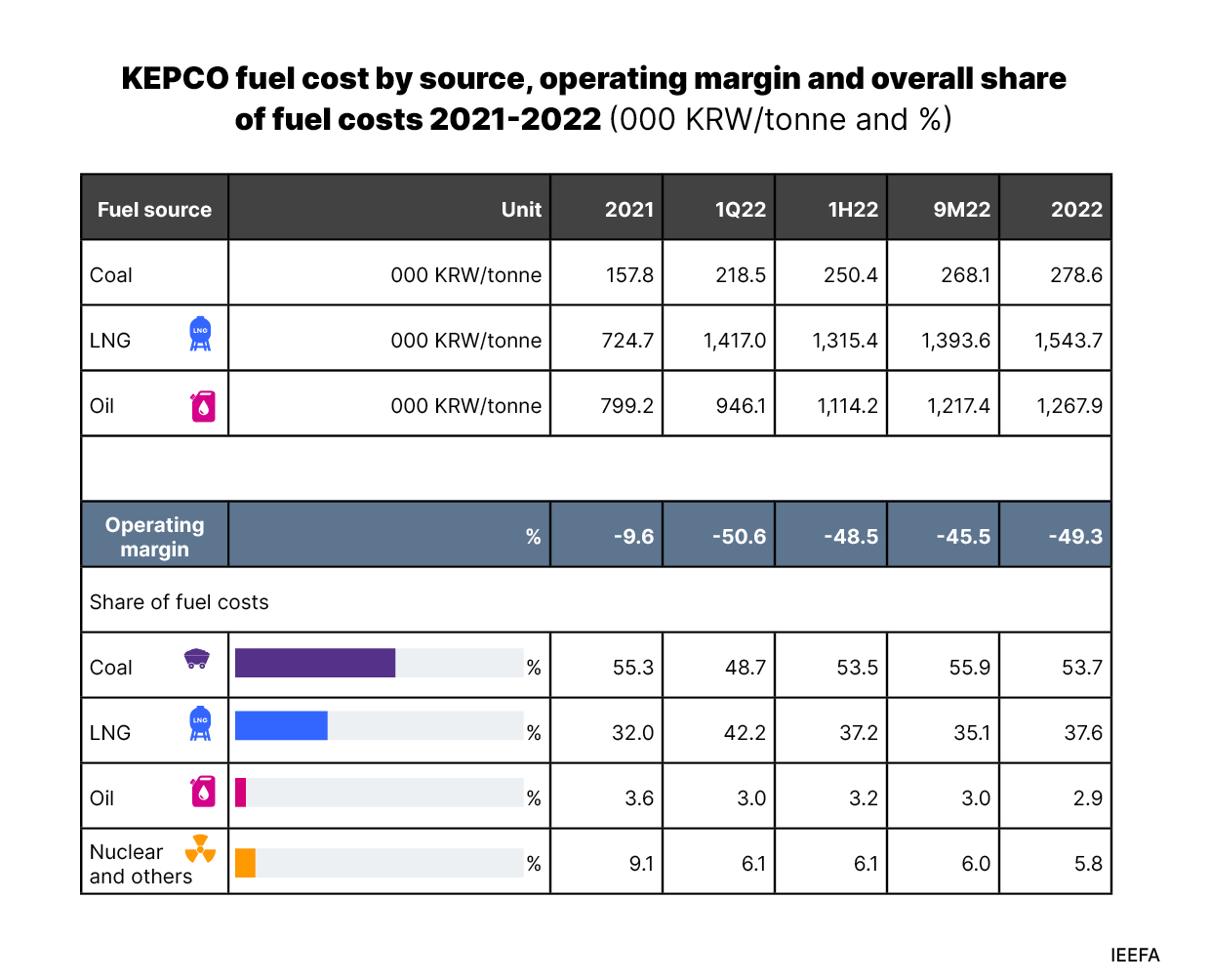

16 June (IEEFA Asia): Over the last decade, the earnings of South Korea’s public electricity provider Korea Electric Power Corporation (KEPCO) have deteriorated as fossil fuels dominate its generation mix. In 2022, KEPCO reported an operating loss of ₩32.6 trillion (US$24.4 billion) stemming from a combination of high fossil fuel prices and limited tariff increases.

KEPCO announced a restructuring plan in May to improve its finances by ₩25 trillion by 2026. Cheong Seung-il, the Chief Executive Officer (CEO), also resigned.

It is unlikely that the CEO’s resignation would resolve the fundamental issue of poor governance, says Ghee Peh, author of the report and Energy Finance Analyst at the Institute for Energy Economics and Financial Analysis (IEEFA).

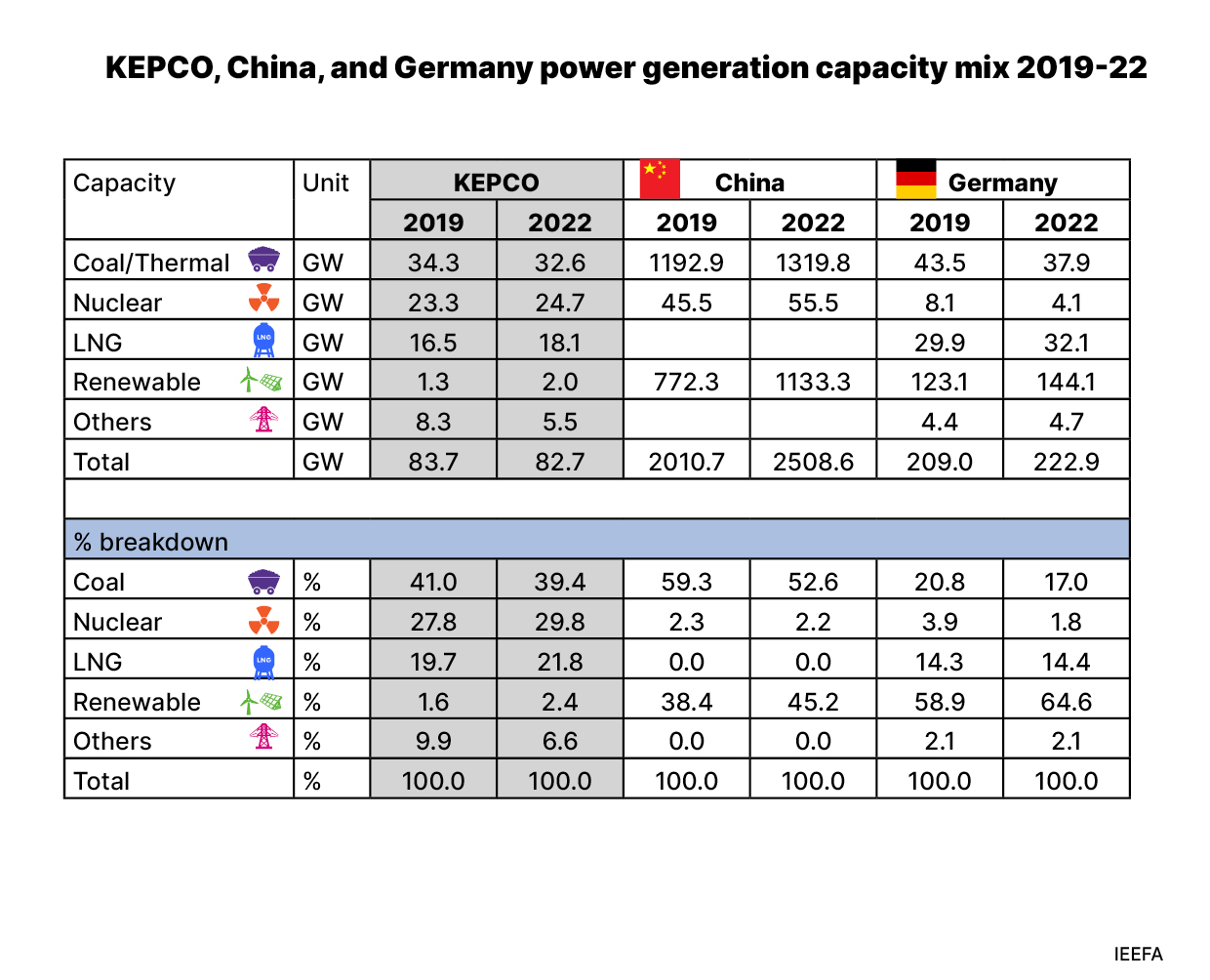

“KEPCO has 39% of total power capacity anchored in coal, and 22% in liquefied natural gas (LNG), while renewable energy makes up only 2.4%,” says Peh. “The need is real for the utility to diversify into renewable energy sources to mitigate the impact of elevated fossil fuel prices.”

According to Peh, KEPCO’s allocation of just 2.4% of its total capacity to renewable energy at the end of 2022 is low. Having a low renewable energy capacity makes it financially vulnerable to high fossil fuel prices, a risk which, unfortunately, materialized last year. Meanwhile, the buildout of more capacity for renewable sources requires significant capital expenditure, which takes time and financing.

Peh notes that South Korea’s renewable energy capacity of 2.4% is vastly small compared to Germany (64.6%) and China (28.8% wind and solar power, and 16.4% hydropower).

IEEFA released a report in October 2022 that analyzed a series of shortsighted missteps by the KEPCO management and board to invest in fossil fuels.

“Any upcoming government intervention or reform of the market system should be accompanied by an immediate, material and enforceable pivot at KEPCO to renewable energy and a significant cost-cutting exercise that phases out substantial fossil fuels,” says Peh.

Growing risks from nuclear and fossil fuels

KEPCO has plans to build three new nuclear reactors that have an aggregate capacity of 4.2 gigawatts and are set to begin operations between 2023 and 2025. However, any further nuclear expansion comes with safety, finance, execution, and policy risks, says Peh.

KEPCO boosted nuclear generation to 45% in the first quarter of this year, which implies the firm operated its plants at a usage rate of more than 80%, compared to below 30% in Japan.

“Increasing nuclear plant usage beyond 80% would strain the plants to a greater extent and escalate safety risks,” says Peh.

“Drawing from experience, any delays in obtaining approval for commissioning new reactors due to safety concerns could also impede KEPCO’s road to recovery.”

KEPCO plans to cut costs by delaying facility construction projects and investments. Chances are, it is refraining from an ambitious expansion of nuclear operations in the near term.

President Yoon Suk-yeol has rejected the notion of phasing out nuclear energy. This is a divergent view from the former South Korean president, who had wanted to phase out nuclear energy.

“Yoon’s stance marks the second significant policy reversal for the industry in less than a decade that has resulted in business losses. Business risk in the nuclear industry, which requires long-term investments and commitment, could increase due to policy uncertainty caused by the constitutional limit of a single five-year presidential term,” says Peh.

In the first quarter of this year, KEPCO reported an operating profit margin of 9% for coal and an operating loss margin of 95% for LNG.

“KEPCO used nuclear power in the first quarter of 2023 to reduce financial losses, in the process lowering coal generation to 39% from last year’s 40%. The move was consistent with the Group of Seven pledge to lessen energy usage powered by coal,” says Peh.

IEEFA has calculated that KEPCO is making losses at current LNG prices. While LNG spot prices fell in May, these lower levels will take two to three months to flow through to the company, making LNG a financially unviable resource until the third quarter at least — and probably after that as well, given the absence of any planned diversification from a heavy fossil fuel generation mix, coupled with the highly uncertain current forecast of LNG prices.

There is a need for fuel diversification into renewable energy to mitigate high fossil fuel prices.

“Accepting LNG as a bridging fuel in the future generation mix simply replaces one fossil fuel with another, without addressing the fundamental problem of high and volatile fuel prices. The lack of diversification from fossil fuels will continue to undermine profits and exacerbate stranded asset risks to KEPCO’s new LNG projects,” says Peh.

Loss reduction and reform

In this report, Peh suggests three possible strategies for KEPCO to manage its financial losses: tariff increases, renewable energy capacity expansion, and government funding.

On May 16, the KEPCO power rate went up by ₩8 per kilowatt-hour after a delay since March as the government tried to manage the impact of higher costs of living.

“Going forward, it may be difficult to put further tariff increases through, and at the very best, delays can be expected,” says Peh.

Read the report: KEPCO’s Fossil Fuel Problem

Report contact:

Ghee Peh ([email protected])

Media contact:

Alex Yu ([email protected]) Ph: +852 9614 1051

About the author:

Financial Analyst Ghee Peh has worked in investment research since 1995, including at Jefferies, BNP Paribas, and UBS. He has covered Asian coal, cement, and metal companies.

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)