KEPCO cannot keep resorting to bonds to pay fossil-linked debt

Key Findings

On 8 December 2022, parliament rejected a bill to increase KEPCO’s corporate bond issuance limit – the bond market is the company’s main financing avenue. Members believed that addressing KEPCO’s financial challenges by issuing more debt would not resolve mismanagement.

KEPCO had been slow to switch to renewables. Instead, it doubled down on fossil fuels which, in turn, led to recurring operational losses and a steady increase in debt.

Government intervention seems the only credible way out. But it should be accompanied by an immediate, material and enforceable pivot to renewables, a significant cost-cutting exercise that phases out substantial fossil fuels, and a rethink of the composition of management and the board.

State-owned electricity provider Korea Electric Power Corporation (KEPCO) may be running out of tricks to resolve its debt problems.

Last week, the National Assembly of South Korea declined a request to ease KEPCO’s bond issuance limit to help the company repay debt. The reasoning for the rejection: KEPCO must first rectify its management issues.

The thumbs-down signals that lawmakers are tired of enabling KEPCO’s debt addiction and mismanagement without a clear strategic direction out of its fossil-reliant future.

Alongside operating cash flow difficulties and a record US$23 billion in losses for 2022, the debt ceiling rejection does not bode well for the utility’s bond investors.

South Korea’s credit crunch fears

On 8 December 2022, parliament voted on a bill to increase KEPCO’s corporate bond issuance limit. The bond market is the company’s main financing avenue, and bonds make up the bulk of its borrowings.

KEPCO’s debt ceiling is capped at twice its equity capital and reserves. The bill called for the ceiling to be increased to five times equity and reserves, or six times in emergency cases, which KEPCO said would significantly raise the amount of bonds the company could issue to service existing debt, improve its operating cash flow and provide a stable electricity supply for the country.

The bill was rejected.

Members of parliament believed that addressing KEPCO’s financial challenges by issuing more debt would not resolve mismanagement, the root cause of the utility’s problems.

One member commented: “If money from the capital market is absorbed to increase the debt of AAA companies without solving the fundamental cause, private companies will run out of money and a crisis situation will happen to the Korean economy.”

KEPCO’s fossil-led disaster

The Institute for Energy Economics and Financial Analysis (IEEFA) considers the rejection a wise decision.

Just two weeks ago, IEEFA presented the issues that led to KEPCO’s financial difficulties to members of the National Assembly, including its carbon neutrality special committee.

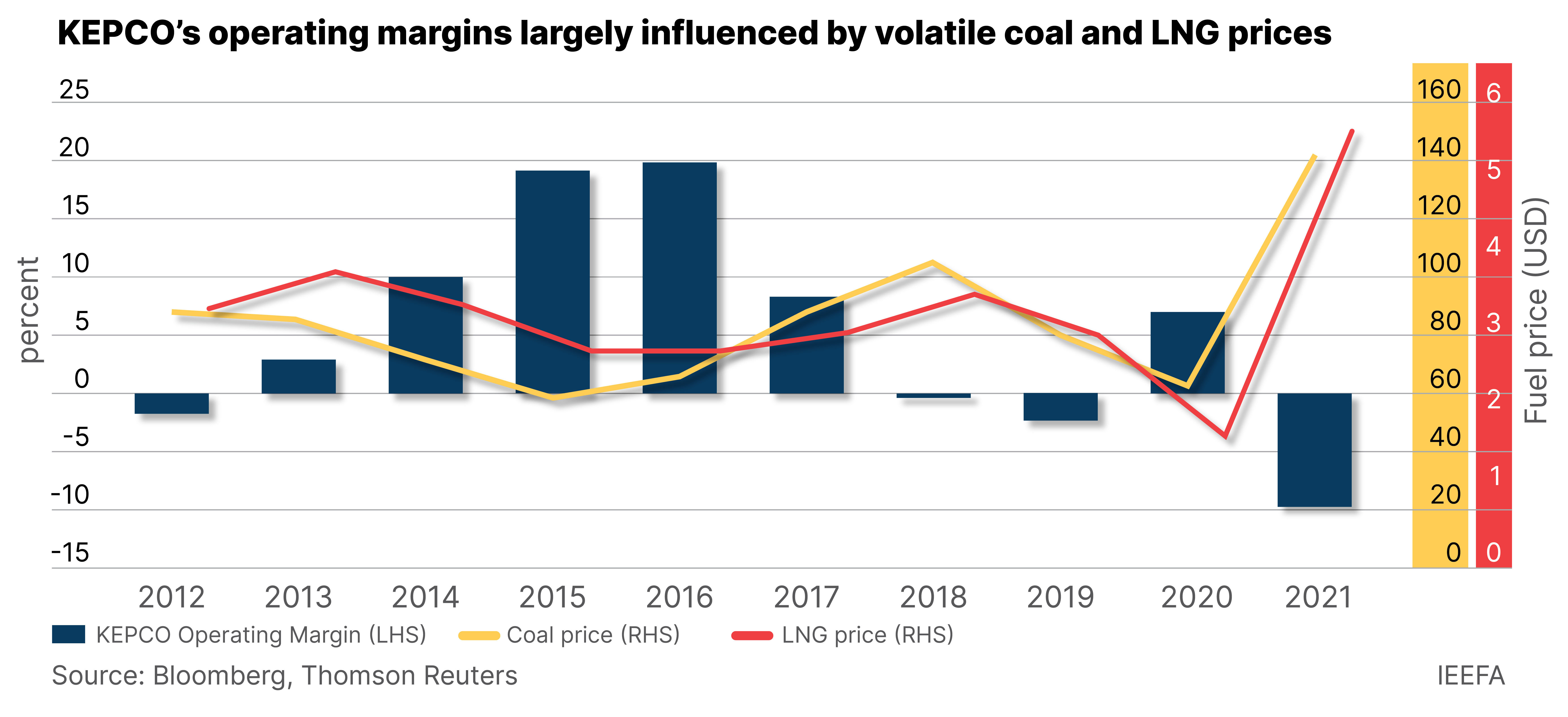

Our analysis found that KEPCO had been slow to switch to renewables compared to its global peers. Instead, the company had been doubling down on fossil fuels even while the evidence was clear that high and volatile coal and LNG prices largely determined its operating margins. As KEPCO had done nothing to correct its investment decisions, the inaction led to recurring operational losses for most of the last decade and a steady increase in debt despite the company already being overleveraged.

Compared to other major utility companies in Asia, such as Hong Kong’s CLP Power Hong Kong Limited, China’s Huaneng Power International, India’s NTPC Limited and Malaysia’s Tenaga Nasional Berhad, KEPCO has also fallen short on every metric.

Additionally, KEPCO’s decarbonization plan involves expensive fossil-reliant technologies that have not been proven credible. This includes carbon capture and storage and blue hydrogen, which the company is in no position to splurge on, nor is it known to have expertise in, creating additional risks for its investors and the South Korean market.

In May 2022, KEPCO announced that it planned to sell coal and gas-fired power plants outside the country to improve its financial situation and repay debt. IEEFA questioned in its October report who would be willing to buy these soon-to-be stranded assets. KEPCO’s most recent debt ceiling request suggests nobody.

There’s only one way out

KEPCO will not hit its peak bond maturity until 2025 – yet it faces refinancing risk close to US$9 billion within the next 12 months, given the potential default and the lack of clear strategy out of this mess. In any case, the refinancing cost will likely be much higher and would add to the company’s woes.

Further tariff hikes are said to be its means of salvation. However, IEEFA considers meaningful tariff adjustments unlikely, given the high inflation environment and the possibility that any raise would not fix KEPCO’s mismanagement issues.

Government intervention seems the only credible way out. But it should be accompanied by an immediate, material and enforceable pivot to renewables, a significant cost-cutting exercise that phases out substantial fossil fuels, and a rethink of the composition of management and the board.