Poor investment choices and corporate governance continue to cloud KEPCO’s outlooks and green ambitions

Continued reliance on fossil fuels and investing in unproven technologies add to credit and greenwashing risks

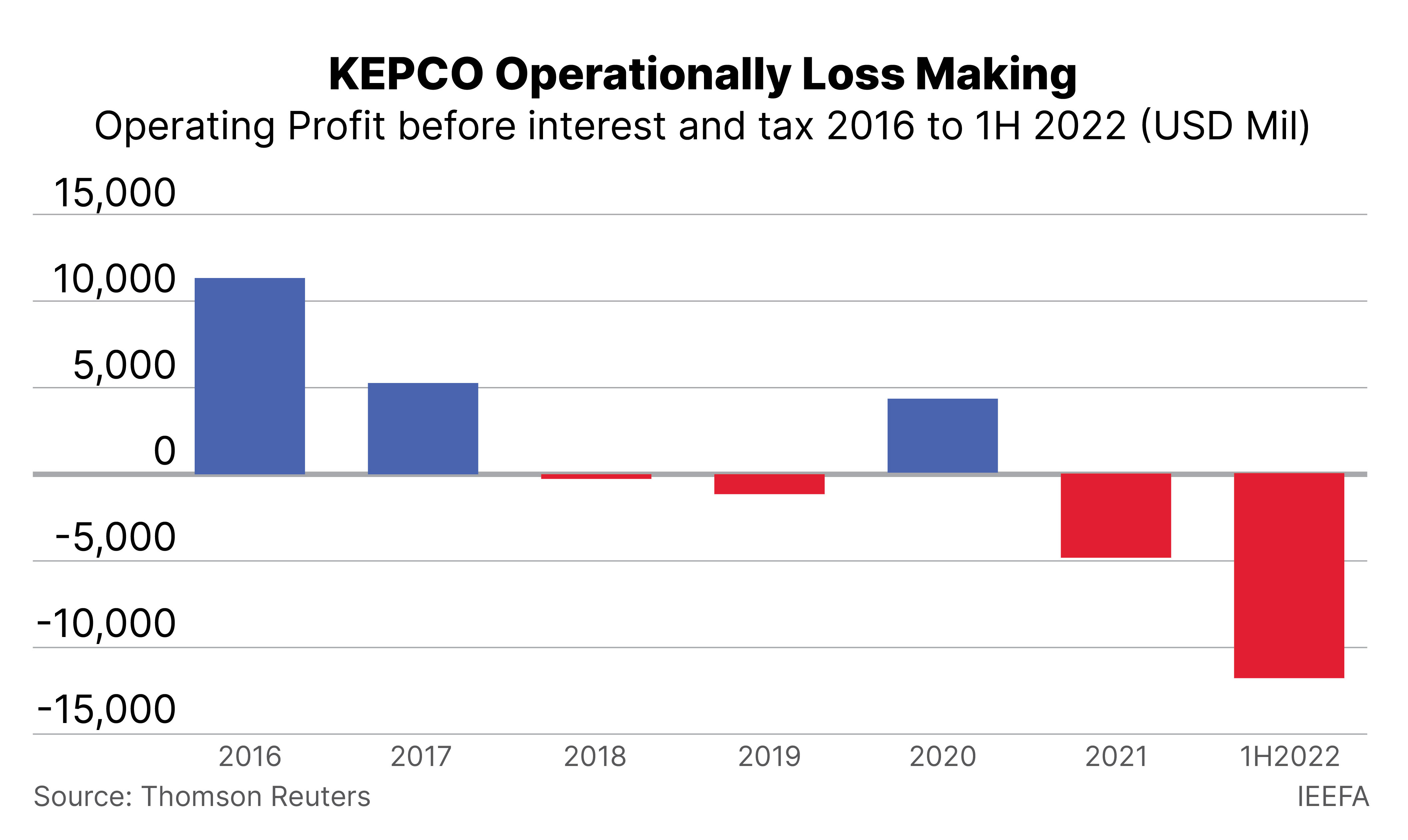

13 October (IEEFA Asia): South Korea’s predominant electric utility Korea Electric Power Corporation (KEPCO) announced its plan to offload coal and gas assets overseas, following its US$6 billion record-high operating loss in Q1 2022, which has since grown to US$12 billion as of 1H 2022.

However, questions remain as to the buyers and the price that these soon-to-be stranded assets could fetch, while KEPCO’s capability to decarbonize remains uncertain, according to a new report by Christina Ng and Hazel James Ilango from the Institute for Energy Economics and Financial Analysis (IEEFA).

“KEPCO’s main responsibility is to ensure a cost-efficient and effective power supply in keeping with the government’s strict tariff environment,” says Ng. “However, a series of short-sighted missteps have weighed on profitability and business viability, therefore exposing KEPCO’s poor aptitude for business and corporate governance.”

KEPCO has been establishing itself as a seasoned green bond issuer since 2018/2019, of which proceeds are required to be allocated to green projects, which include renewable energy.

Nonetheless, KEPCO’s green projects appear inconsequential to its total capital expenditure. KEPCO was, in fact, still investing in large new coal and gas projects overseas as recently as 2020 — this includes the controversial coal power plants Jawa 9 and 10 in Indonesia and Vung Ang 2 in Vietnam. This appears inconsistent with its strategy to create a clean and efficient energy ecosystem.

“To this date, KEPCO’s negligible renewable generation assets and questionable future generation mix suggest that its green bond issuances were merely tokenism.”

In the new report, IEEFA analyses how KEPCO got into financial challenges, the potential risks for its debt investors, and the uncertainties of its transition plans.

A history of investment misjudgement

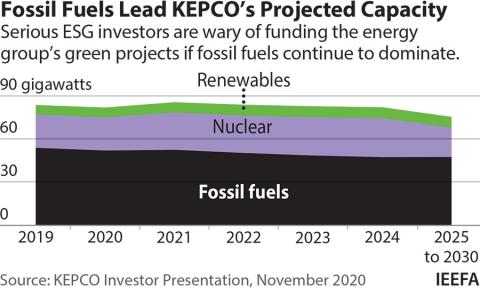

Based on KEPCO’s investor presentations, coal represented 43-52% of its power generation mix in the last ten years, followed by nuclear (34-38%) and liquefied natural gas (LNG) (8-19%).

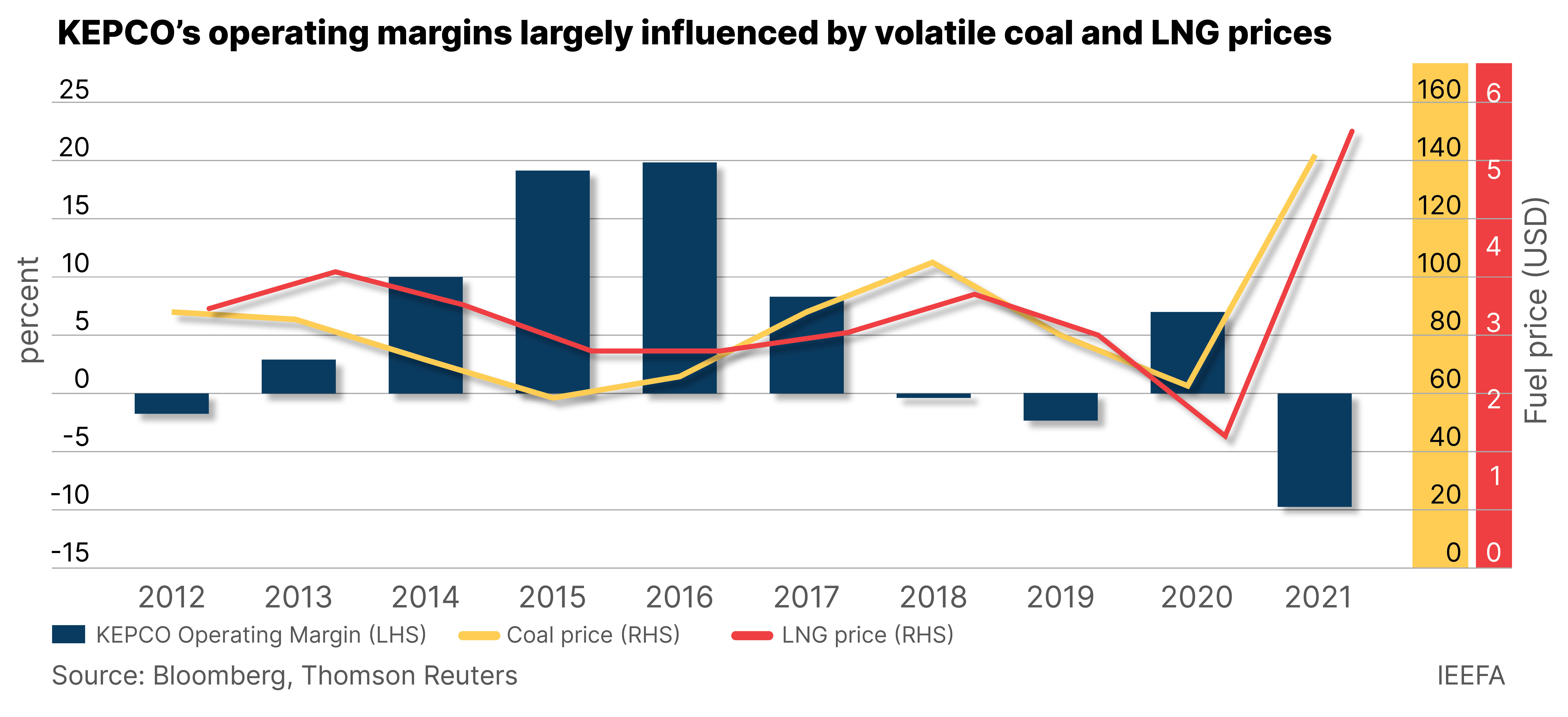

“Fossil fuels dominate KEPCO’s generation mix and fuel costs are not passed through to customers. Therefore, high and volatile fuel prices have been the major culprit behind its deteriorating earnings over the last decade,” says Ilango.

In the last six years, KEPCO’s earnings were hit and have been on a downward trend, with the exception of the financial year 2020, owing to low fuel prices in the pandemic-triggered economic slowdown.

Meanwhile, high credit ratings have enabled KEPCO to have good financing options, despite its underperformance. KEPCO has been steadily incurring more debt despite being overleveraged and recording operating losses, while its ability to service its debt has been weakening.

“KEPCO has benefited from the sovereign ratings’ umbrella and received a final rating six to eight notches higher than its baseline credit assessment, thus enabling it to go from a speculative investment to high investment grade,” says Ilango.

At the end of 2021, KEPCO’s internal cash sources were insufficient to cover its debt maturing in the next 12 months and future capital spending. This has placed KEPCO at risk of defaulting on its obligations in the near term.

Compared to other major utility companies in Asia, KEPCO has also fallen short on every metric. This demonstrates that its management and board’s strategy has put KEPCO at severe financial risk.

“Instead of revisiting investment choices, KEPCO has become overconfident of government bailout, which suggests the need for a rethink in how sovereign-linked entities are assessed,” adds Ng.

Major reforms required

KEPCO’S highly leveraged business and operating losses did not prevent its fixation with coal. For many years, KEPCO has deemed coal as a reliable earnings generator.

This led KEPCO to take its time with renewable energy buildout, even as renewable power generation costs dropped significantly over the last decade.

Despite a reorientation in 2022 towards renewable energy with its “Zero for Green” vision, LNG appears to play a pivotal role in KEPCO’s future generation mix.

“The replacement of one fossil fuel for another means that high and volatile fuel prices will continue to undermine profits and exacerbate stranded asset risks,” says Ng.

In addition, investing in technologies unfit for net-zero ambitions, such as blue hydrogen and carbon capture, utilization and storage (CCUS), is also alarming, given that KEPCO is not in any position to splurge and has limited experience in such technologies. This creates additional risks for KEPCO’s investors and the South Korean market.

“Unless there’s a marked overhaul that involves a complete change in KEPCO’s management and board, and significant capital injection or intervention from government, KEPCO’s bonds deserve more scrutiny, including those that are due to be refinanced.”

Read the report: KEPCO’s clean energy transition hangs in the balance

Author contact:

Christina Ng ([email protected])

Hazel James Ilango ([email protected])

Media contact:

Alex Yu ([email protected]), +852 9614-1051