Seth Feaster is an Energy Data Analyst whose work focuses on the coal industry and the U.S. power sector.

Before joining IEEFA, he created visual presentations at the New York Times for 25 years with a focus on complex financial and energy data; he also worked at The Federal Reserve Bank of New York.

Seth holds an M.Sc. in Geography, Bristol University (UK), and a BA in Geography, University of Vermont.

Seth divides his time between Vermont and Brooklyn, NY where he lives with his wife and three children.

Research from Seth Feaster

See all Research from Seth Feaster >

Who will pay for forcing the Campbell Coal plant to stay open?

June 05, 2025

Dennis Wamsted, Seth Feaster

Insights

A clear eyed view of coal

May 08, 2025

Seth Feaster, Dennis Wamsted

Slides

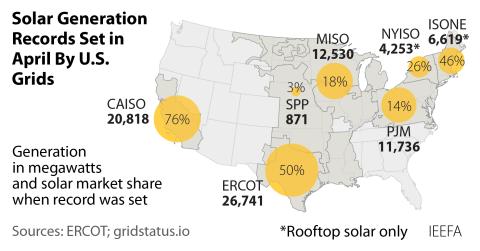

A sizzling spring for U.S. solar

April 29, 2025

Dennis Wamsted, Seth Feaster

Insights

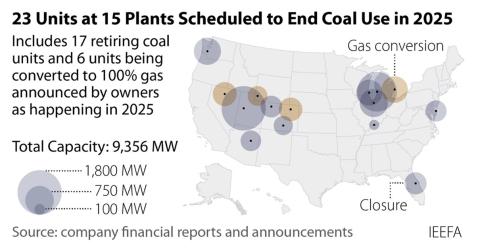

Drumbeat of coal plant closures to continue in 2025

April 15, 2025

Seth Feaster

Insights

Reopening closed coal plants makes no economic sense

April 10, 2025

Dennis Wamsted, Seth Feaster

Briefing Note

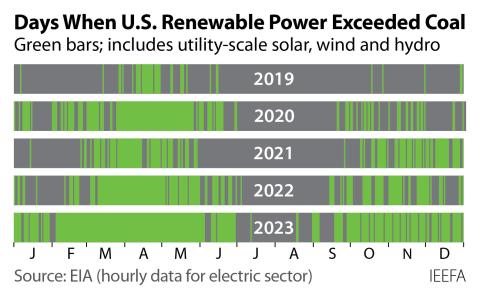

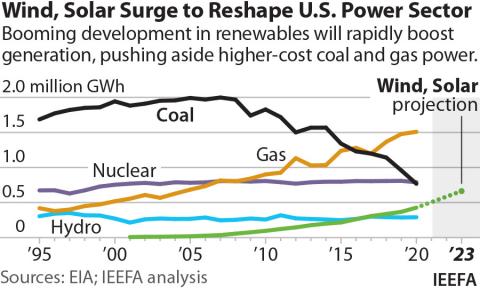

The Energy Transition: 2019-24 and Beyond

January 30, 2025

Dennis Wamsted, Seth Feaster

Insights

Mountain of coal at U.S. power plants a new threat to coal industry

December 16, 2024

Seth Feaster, Dennis Wamsted

Insights

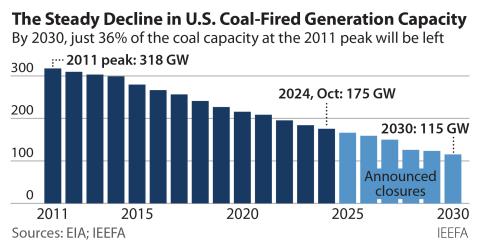

Nowhere to go but down for U.S. coal capacity, generation

October 24, 2024

Dennis Wamsted, Seth Feaster

Insights

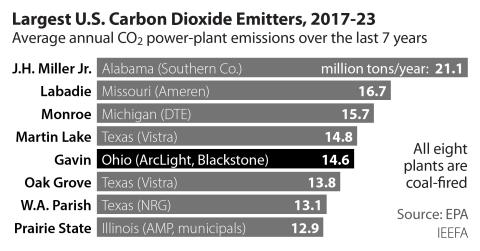

Private equity firm that is a “leading investor in the energy transition” to buy Gavin coal plant

October 10, 2024

Dennis Wamsted, Seth Feaster

Insights

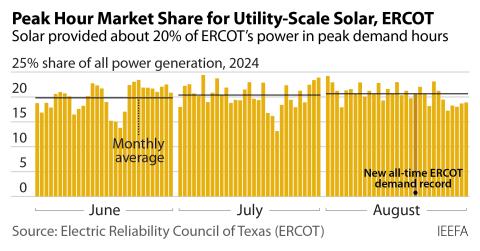

A transformative summer for U.S. electricity

September 24, 2024

Dennis Wamsted, Seth Feaster

Briefing Note

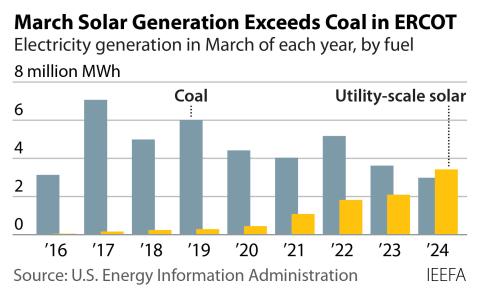

Texas marks milestone on the road to a greener grid as solar tops coal in March

April 05, 2024

Dennis Wamsted, Seth Feaster

Insights

Closure of last New England coal plant marks significant energy transition milestone

April 02, 2024

Dennis Wamsted, Seth Feaster

Insights

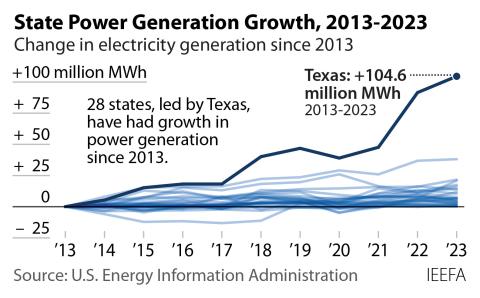

Meeting demand growth and greening the grid can go hand in hand

March 27, 2024

Dennis Wamsted, Seth Feaster

Insights

Energy Information Administration: U.S. energy transition to speed forward through 2025

January 11, 2024

Seth Feaster

Insights

Bad news for blue hydrogen

December 19, 2023

Suzanne Mattei, Dennis Wamsted, Seth Feaster...

Report

Posts from Seth Feaster

See all Posts from Seth Feaster >

Reopening closed coal plants makes no economic sense

April 10, 2025

Press Release

A transformative summer for U.S. electricity

September 24, 2024

Press Release

Bad news for blue hydrogen

December 19, 2023

Press Release

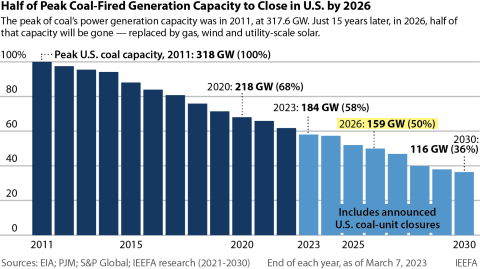

The U.S. is on track to close half of its coal-fired generation capacity by 2026

April 03, 2023

Press Release

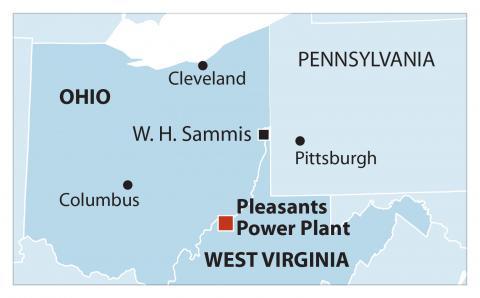

IEEFA U.S.: Pleasants coal plant purchase would be high-risk, low-reward

September 19, 2022

Press Release

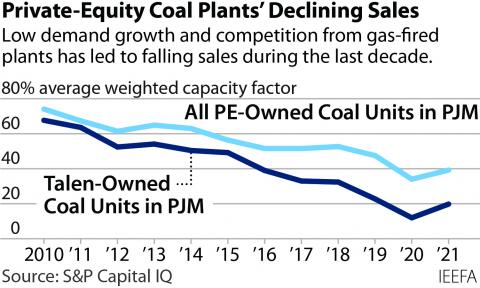

Coal plants in the PJM region are a losing bet for private equity investors

June 02, 2022

Press Release

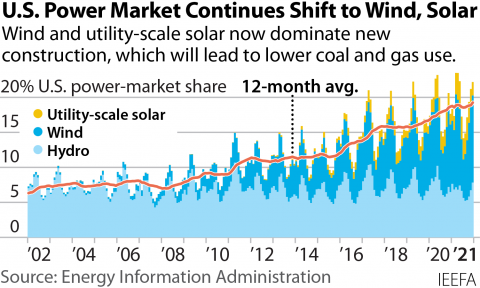

Surging energy prices accelerating pace of wind, solar and battery adoption

April 04, 2022

Press Release

Federal blue hydrogen incentives: No reliable past, present or future

February 08, 2022

Press Release

IEEFA U.S.: Pension funds investing indirectly in Ohio’s Gavin coal plant are at risk as financial, environmental disadvantages mount

October 14, 2021

Press Release

IEEFA webinar: U.S. transition to renewables is likely to accelerate over next two to three years

April 06, 2021

Press Release

IEEFA U.S.: Energy transition to renewables likely to accelerate over next two to three years

March 31, 2021

Press Release

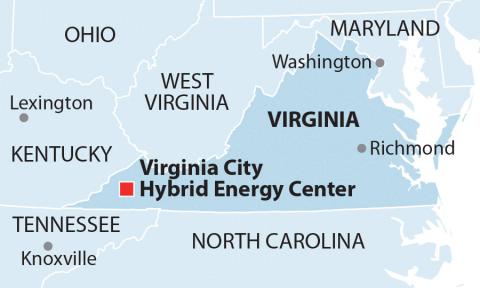

IEEFA U.S.: Virginia coal plant’s future isn’t bright: preparation for transition should commence now

December 16, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.