Energy Information Administration: U.S. energy transition to speed forward through 2025

Key Findings

Wind and solar expansions are expected to cover the entire growth in U.S. electricity demand by 2025.

The U.S. had 1 gigawatt of battery storage in 2019. The figure is expected to grow to 40 gigawatts by the beginning of 2026.

By 2025, renewables are expected to surpass gas as the biggest source of electricity in Texas, the largest market in the U.S. by far.

U.S. coal production is expected to fall to its lowest levels in more than half a century.

Over the next two years, the United States will experience a remarkable acceleration in the energy transition in the electricity sector, according to new figures released Jan. 9 by the U.S. Energy Information Administration (EIA).

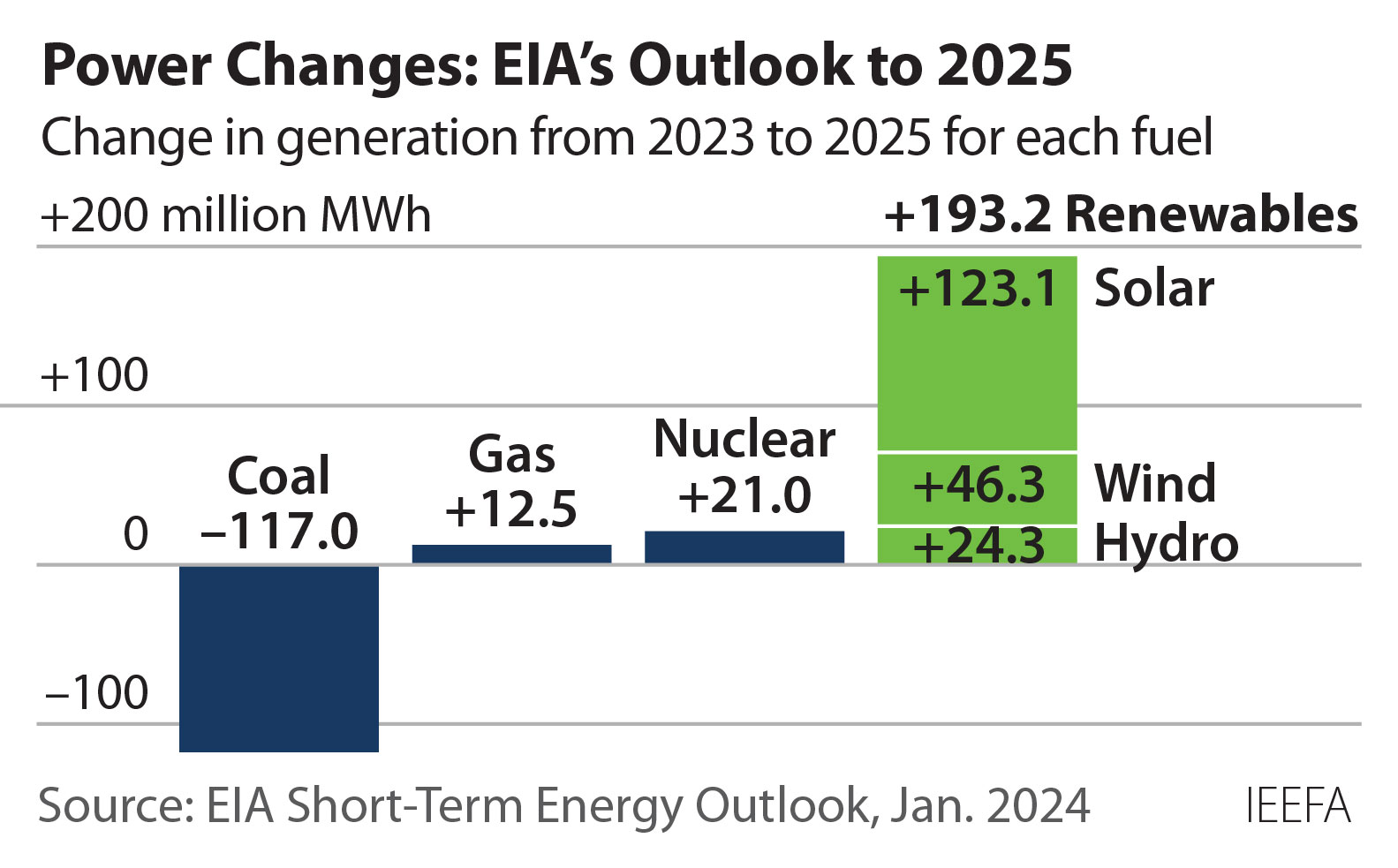

Utility-scale solar generation is set to grow by 75% in just two years, pushed by the anticipated addition of 79,000 megawatts (MW) of new capacity. The EIA described the increase as the “major driver” behind its electric sector power forecast, which expects generation from renewables—utility-scale solar, wind, and hydro—to be almost twice the amount generated by coal in 2025.

Wind and solar are expected to account for 18.5% of all the electricity generated in the U.S., and hydro is anticipated to add another 6.5%. Wind and utility-scale solar by themselves will generate more power than coal in 2024.

The planned solar and wind expansion should be large enough to cover all the expected 107.1 billion kilowatt-hour (kWh) growth in electricity demand, plus take a big bite from coal generation. In other words, renewables will be bending the fossil fuel generation curve downward. Gas and coal’s market share in 2023 was 58.5%; by 2025, it will have fallen to 54.4%.

Another sign of the speeding transition is evident in ERCOT, the market operator for most of Texas, the state that by far uses the most electricity in the U.S. Here, EIA projects that the massive ongoing buildout of wind and solar capacity will push renewables ahead of gas by 2025 as the largest source of its electricity. EIA estimates wind and solar will generate 189.8 billion kWh of electricity—15 billion kWh more than gas, the market’s long-time No. 1 provider.

Utility-scale battery storage installations are also experiencing a boom. Between the end of 2023 and 2026, total U.S. capacity could double to more than 40 gigawatts (GW), a figure that is remarkable given that there was just 1 GW of battery storage capacity installed in the U.S. at the end of 2019.

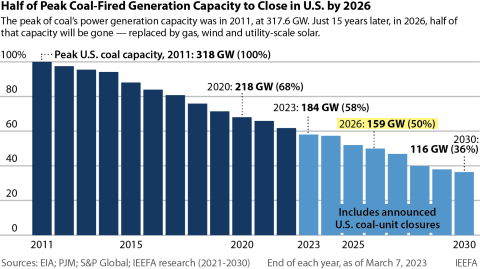

Meanwhile, coal-fired power is facing a sharp decline. The EIA outlook shows coal generation falling almost 18% over the next two years. Coal will supply just 13% of U.S. electricity in 2025 and also faces intense competition from low-priced gas, which is projected to continue providing 42% of electricity through 2025. Lower use and increasing maintenance costs at aging coal plants continue to lead to more plant retirements. IEEFA currently expects 18 gigawatts of coal plant capacity—about 10 percent of the total—to close or be converted to burn gas by the end of 2025.

Coal’s decline will have a big impact coal mining. After three years of relatively stable output, U.S. coal production may fall 26% over the next two years to just 429 million tons—a level so low that only two years (1954 and 1961) since the Great Depression posted less output. The biggest impact would be felt in Appalachia, according to the EIA, where production could fall almost 35% in two years to just 110 million tons.

In the West, which is dominated by the huge open-pit mines of the Powder River Basin in Wyoming, coal would also feel the pinch. Production in the region could fall 26% from 2023 levels to 236 million tons. Part of the problem is that coal stockpiles are very high at power plants that use the fuel. In October, there was enough to run the plants for 112 days, or more than three months at their current rate of use. Utilities have historically cut back on purchases until they have less than a 60-day supply.

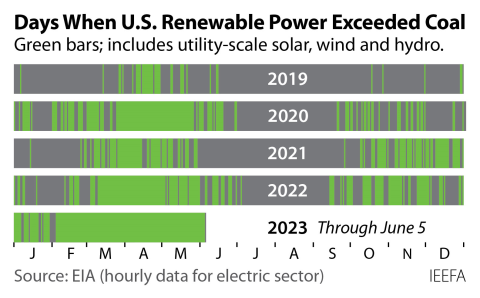

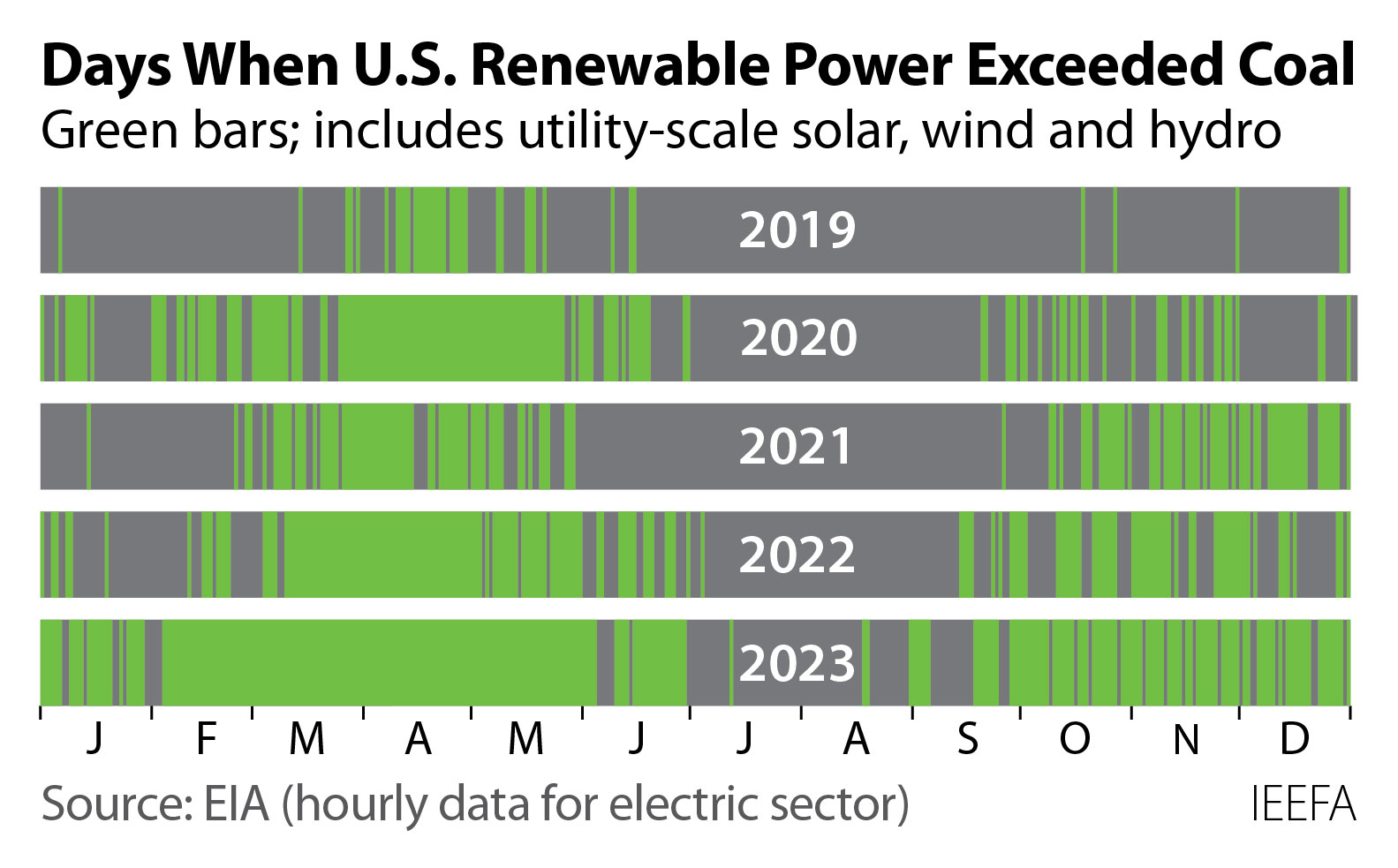

Looking back at 2023, there were many signs of it being a pivotal year in the energy transition. Utility-scale solar, wind, and hydro generated more electricity than coal on 257 days, including a stretch of 121 consecutive days from Feb. 4 through June 4. There was at least one day every month when renewable power surpassed coal power.

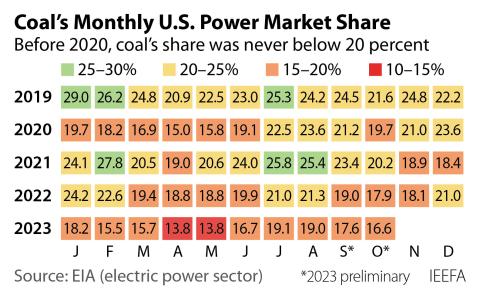

Coal’s decline can also be seen in its market share. In the years before the pandemic hit in 2020, coal’s market share had never fallen below 20% in any month. In 2023, that reversed: Coal’s market share was below 20% every month, and there were only 19 days during the entire year when it surpassed the 20% mark.

The 2023 figures stand in sharp contrast to 2019, when coal provided more than 20% of U.S. power on 335 days, including more than 25% on 90 days. Renewables provided more than 20% on 188 days last year, including 57 days at 25% or more, and the figures are certain to rise with increased solar and wind generation through 2025.