April was a milestone month for the renewable energy transition

Key Findings

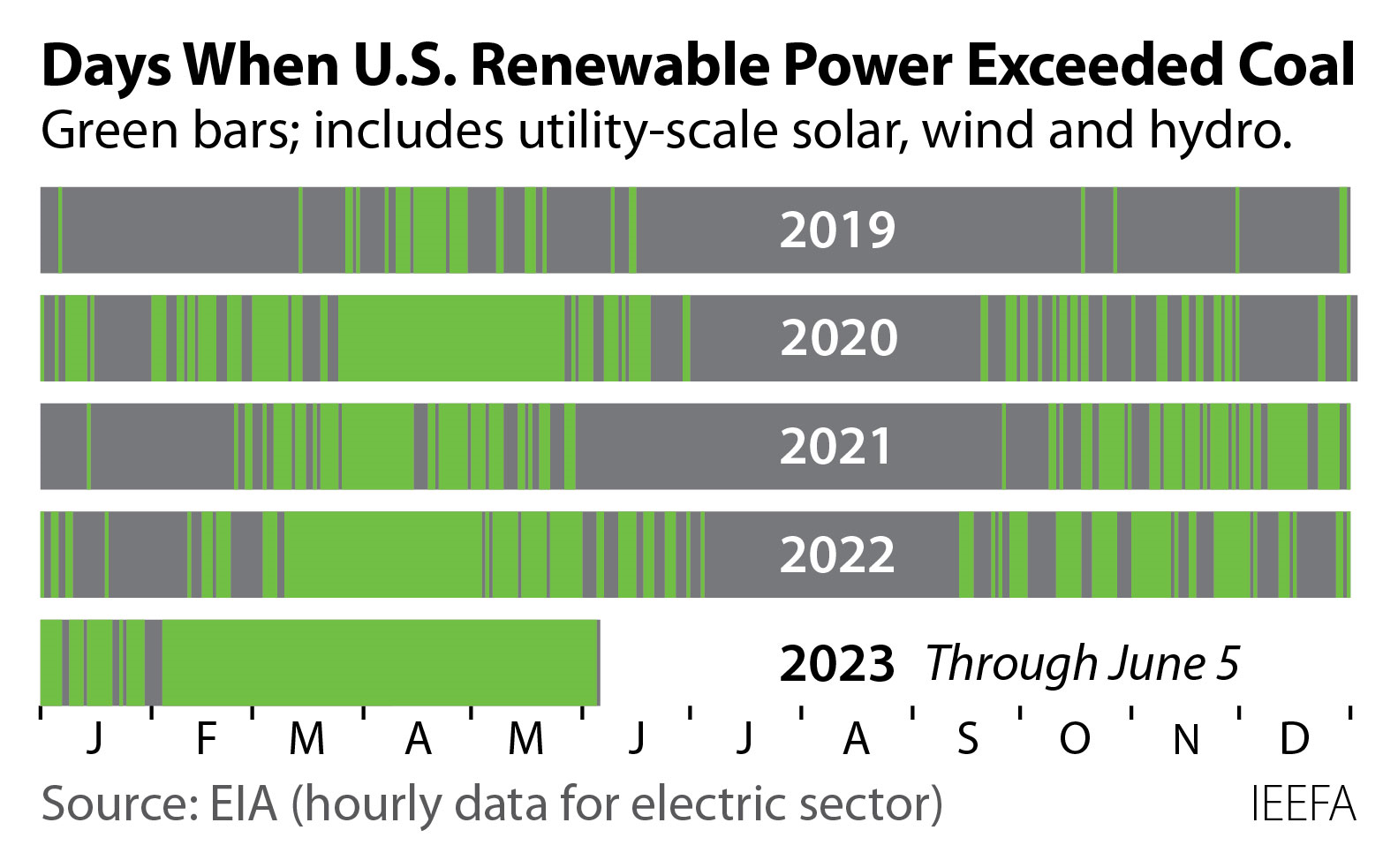

It has already been a year of milestones for the renewable energy transition: Wind generation alone topped coal in April 2023, according to the Energy Information Administration’s hourly grid data.

In addition, coal generation for April may have been just 36.7 million MWh—a record low for any month, falling below even the 40.6 million MWh generated during the pandemic shutdown in April 2020.

The energy transition is certain to accelerate in the years ahead, helped by the easing of lingering supply chain issues from the pandemic and the capital influx from the Inflation Reduction Act.

EIA data for 2023 so far indicates more milestones can be expected, whether on the upside for renewables or on the downside for fossil fuels, as the energy transition continues to accelerate.

It has already been a year of milestones in the transition to renewable energy, and the books are only closed on the first five months.

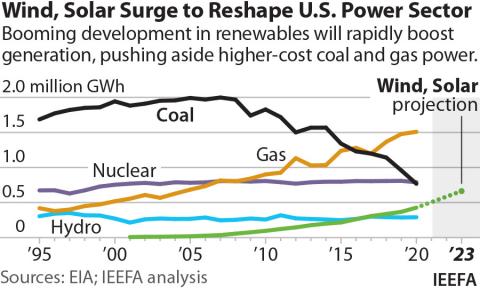

Most telling: Wind generation alone topped coal in April, according to the Energy Information Administration’s (EIA) hourly grid data. The numbers were close, with wind producing 42.7 million megawatt-hours (MWh) compared to 42.0 million MWh for coal, but the data highlights the massive changes under way in the U.S. electric sector. It was just four years ago that all utility-scale renewables together (wind, solar, hydro, geothermal and biomass) first topped coal generation for a month.

If data from EIA’s Short-Term Energy Outlook is used, the April milestone may turn out to be even more remarkable. In its latest forecast, released June 6, the agency estimates that coal generation for April may have been just 36.7 million MWh. That would be a record low for any month, falling below even the 40.6 million MWh generated during the pandemic shutdown in April 2020. The final April number, whether in the 30s or 40s, will also solidify February through April as the lowest three months of coal generation at least since 2001 (the first year included in EIA’s online data browser).

Combining utility-scale solar and wind yields another milestone. For the first five months of 2023 (through the end of May), utility scale solar and wind have generated more electricity than coal for the first time, pumping out 252.6 million MWh vs. 249.4 million for coal. This is another first—previous renewable records tracked by IEEFA included hydro generation.

And when hydro is added, renewable generation through May totaled 365.3 million MWh, 23.4% of the total and well above both nuclear and coal for the second spot in the generation stack.

Renewables achieved these milestones in part because coal generation was also setting records—in this case, record lows. The 249 million MWh produced by coal through May was the lowest for the first five months of a year in decades, even below the 252 million MWh generated in 2020 when the pandemic severely depressed electricity demand.

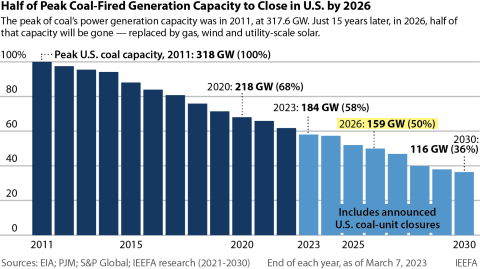

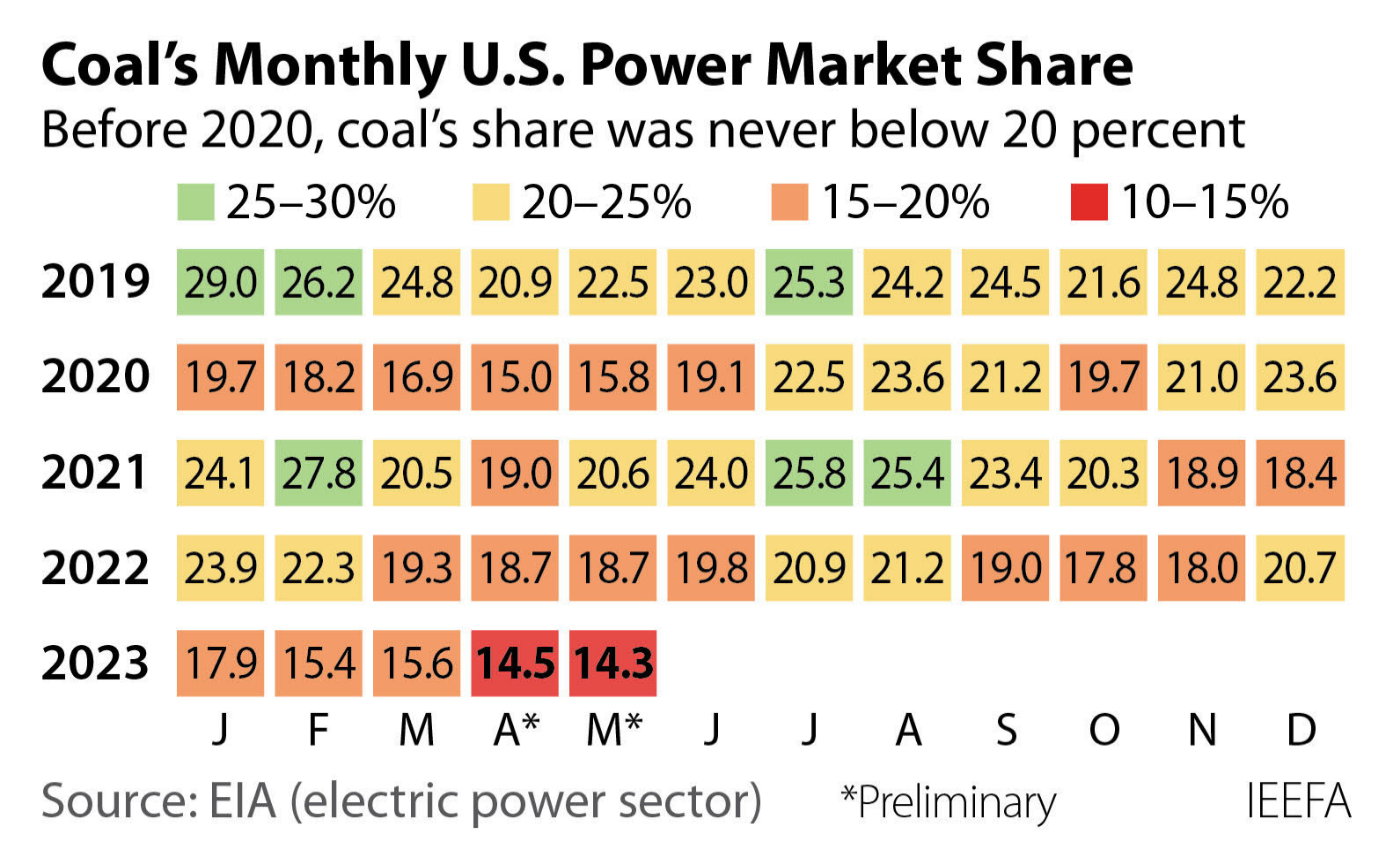

Using 2019 for comparison to 2023 is instructive, since total electricity generation for the first five months in the two years was almost the same (1,555 million MWh in 2019; 1,562 million MWh). But within those totals are huge changes. Wind and solar generation have jumped 102 million MWh since 2019—a 68% rise. Coal generation has gone in the opposite direction, with output dropping from 380.9 million MWh in 2019 to 249 million MWh in 2023—132 million MWh less and a 35% decline. Exceptionally low output in April and May pushed coal’s market share below 15% in those months, an unprecedented level for a fuel that had never had a month with a market share less than 20% before 2020.

This building transition is certain to accelerate in the years ahead, helped by the easing of lingering supply chain issues from the pandemic and the capital influx from the Inflation Reduction Act, which channeled significant long-term tax credits to renewable energy resources, including battery storage. Already this year, EIA projects that summer generation from solar will be 24% higher than just a year ago. The agency also expects higher wind and nuclear output this summer.

On top of these longer-term renewable trends, the coal sector is being battered this year by low gas prices. The decline has been dramatic: The Henry Hub spot price in 2022 averaged $6.42 per million British thermal unit (mmBtu) and was almost $8/mmBtu in the third quarter. Since then, prices have plummeted and were $2.15/mmBtu in May. Not surprisingly, gas generation has risen this year, totaling 599.3 million MWh through May, up 60.6 million MWh from a year ago.

Taken together, EIA says coal-fired generation may be as much as 15% lower this summer than in 2022, a season that is usually one of its strongest generation periods, and yet another clear sign of the sector’s structural decline.

More milestones, both on the up and downside, are certainly in the offing.