The U.S. is on track to close half of its coal-fired generation capacity by 2026

Key Takeaways:

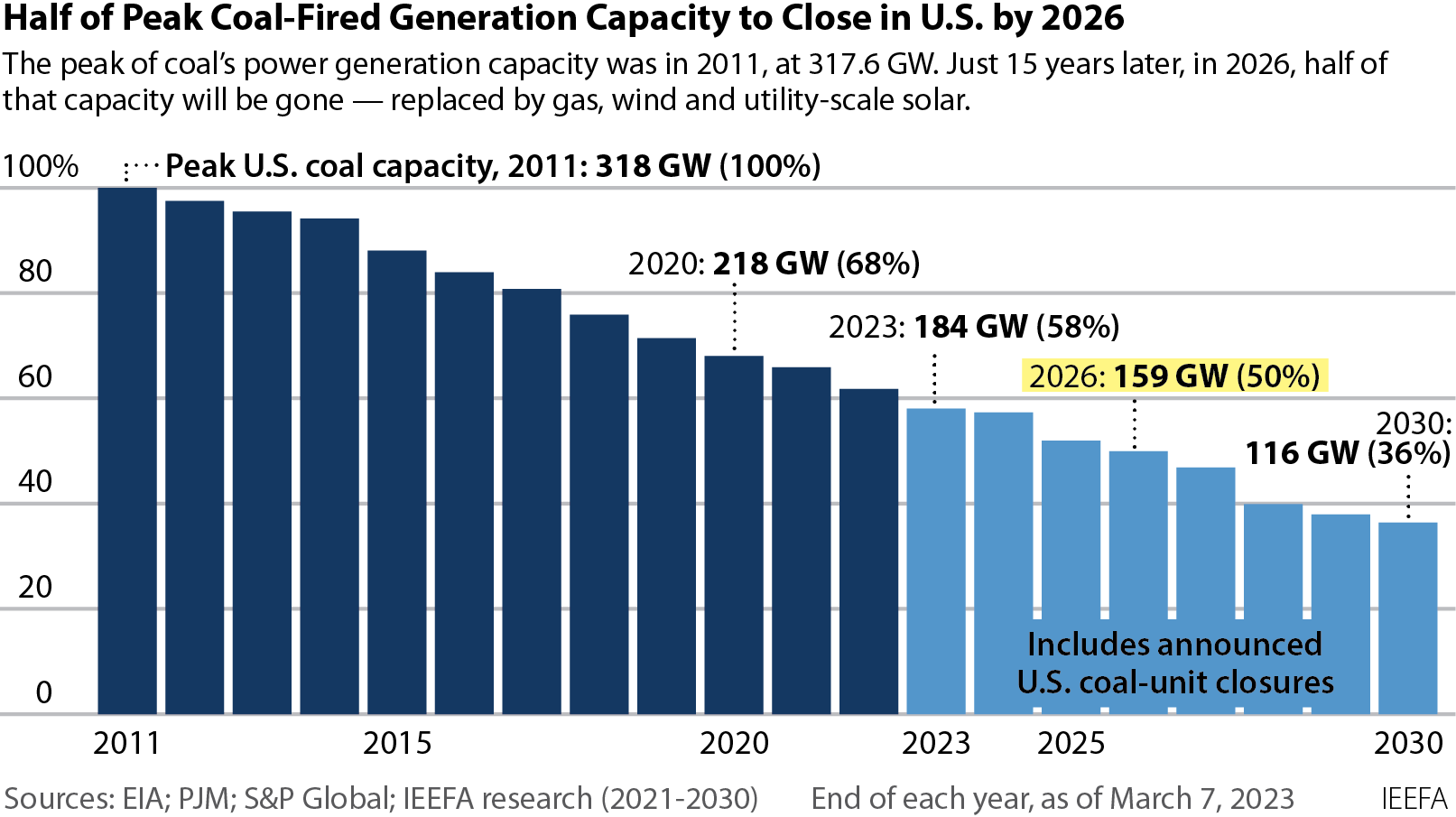

The U.S. is on track to close half of its coal-fired generation capacity by 2026, just 15 years after it reached its peak in 2011.

Roughly 40%, about 80.6 gigawatts, of remaining U.S. coal-fired capacity is set to close by the end of 2030.

Fewer than 200 large-scale coal-fired units (50 MW or more) remain without announced retirement dates, and 118 of those are at least 40 years old.

Coal use by U.S. electric-power producers is falling quickly again after a short-lived post-pandemic recovery, possibly falling to only 400 million tons in 2023—less than half of what was used just 10 years ago.

Coal use by U. S. electric-power producers is falling quickly after a short-lived post-pandemic bump

April 3, 2023 (IEEFA) — The United States is quickly approaching an electricity sector milestone: in 2026, half of the coal-fired generation capacity will have closed since it peaked in 2011, according to a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

This is now the earliest date for this milestone since IEEFA began closely tracking coal-plant retirements, and it has moved up despite high prices for gas, a major competitor to coal, and construction delays for renewables largely caused by pandemic-induced supply disruptions,. By another measure—actual electricity generation—the U.S. has cut coal use even faster, producing less than 50% of coal’s 2011 power level in both 2020 and 2022.

Based on current announcements from utilities, coal capacity will fall to 159 gigawatts (GW) by the end of 2026, down from 318GW in 2011. With more than 80GW of power plants set to stop using coal between 2023 and the end of 2030—a figure that includes mostly closures, with a limited number of conversions from coal to gas—total coal-fired capacity will fall to just 116GW by 2030. And actual coal use is likely to continue falling even faster, as aging units face higher operation and maintenance costs, and utilities increasingly favor the responsiveness of gas generation and battery storage to complement the variable output from solar and wind, both of which continue to be built at a rapid clip.

“This milestone is another clear sign of the ongoing and deep restructuring of the U.S. coal industry, as demand for the fuel continues to drop quickly,” said Seth Feaster, IEEFA energy data analyst and author of the report. “It is likely to result in significant mine closures, layoffs, and falling tax and royalty payments in coal-producing states.”

By the end of this decade, more than 200GW of the 318GW of peak coal-fired power will have been retired, based on current announcements. By then, coal consumption by the power sector could fall to just half of this year’s expected level, to about 200 million tons, IEEFA estimates.

U.S. utilities, all of which are engaged in long-term generation planning and capital spending budgets, have been finalizing their energy portfolio decisions. Most plans now include deep cuts or a complete phaseout in coal use (if they still have any), big buildouts of wind, solar, and battery storage, and a reliance on existing gas generation plants.

Reading through dozens of utility resource plans, financial statements, and announcements, the picture is clear: Quite simply, utilities no longer see coal as part of their future.

Read the report: U.S. on track to close half of coal capacity by 2026