Coal plants in the PJM region are a losing bet for private equity investors

New report shows challenging economics and rising competition are undercutting the region’s coal-fired power plants

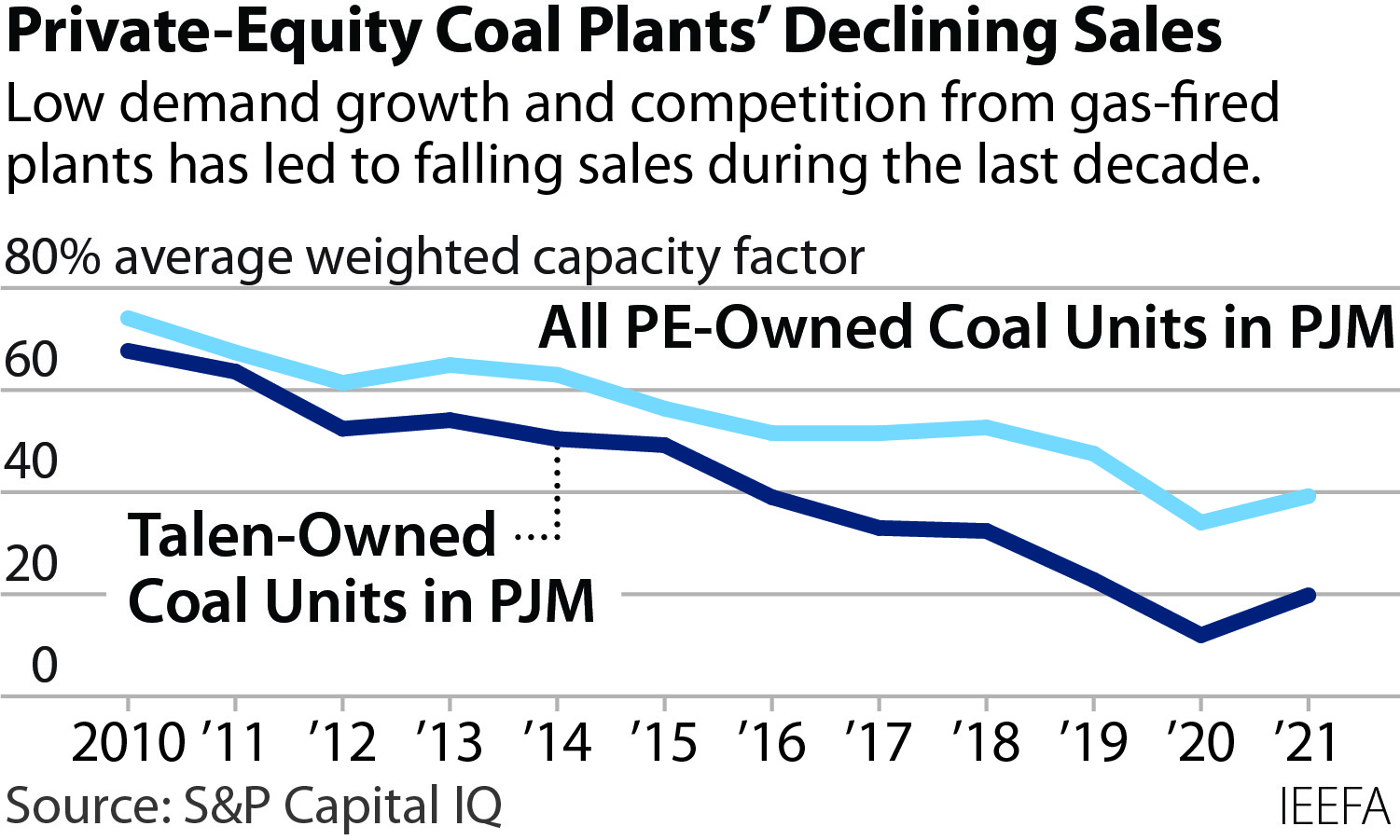

June 2, 2022 (IEEFA) – Private equity firms operating in the PJM power market are in for a difficult year as aging coal-fired power plants are expected to see declining revenues, according to the latest report by the Institute for Energy Economics and Financial Analysis. "PJM" stands for Pennsylvania, New Jersey, and Maryland but the market stretches south to North Carolina and west to parts of Illinois.

One key financial piece, the price PJM pays for capacity, will drop from $140 per megawatt-day to just $50 in June for the 2022-23 delivery year. This will reduce revenues for generators across the board, but it is particularly troublesome for the region’s coal plants, which are struggling to remain competitive in the day-to-day energy market as well.

“Our analysis shows that these financial pressures are only going to grow,” said Dennis Wamsted, IEEFA Energy Analyst and co-author of the report. “Coal generation across PJM through the first four months of 2022 is lower than the 2021 figure, even though overall demand in the region is up.”

This report is divided into two sections. First, it presents an overview of regional factors that have undercut the economics for private equity (PE)-owned coal plants, and that will continue to do so in the years to come.

These include:

- Falling capacity payments, a particular problem this year with the drop to $50/MW-day. Forecasts do not see any major increase in payments in the next several years.

- A significant planned increase in renewable generation, including offshore wind. PJM is studying how to integrate more than 100,000MW of renewable energy capacity in the next 15 years.

- Continued low growth expectations.

- The rising difficulty in financing coal-related infrastructure.

- The age of the plants.

Following that, the report takes a deeper look at the PE-owned coal plants, examining their ownership, past performance and future expectations. The IEEFA analysts lay out how the plants’ financial difficulties are only expected to grow. The next capacity auction, for generation availability from June 1, 2023 to May 31, 2024, is scheduled for June 2022. Although the results remain uncertain, it is not likely there will be a significant increase—if any—in regional capacity prices, given PJM’s existing robust capacity reserves and predictions of slow demand growth.

The findings are a warning for both the financial sector and potential coal plant investors: The risks of such investments are growing quickly. Better, less risky options are available in the renewable generation sector, the report concludes.

Full Report: Private equity’s losing bet on PJM coal plants

Author Contact:

Dennis Wamsted ([email protected]) IEEFA Energy Analyst

Seth Feaster ([email protected]) IEEFA Energy Data Analyst

David Schlissel ([email protected]) IEEFA Director of Resource Planning Analysis

Media Contact:

Susan Torres ([email protected]) 908-565-3451

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.