Kashish Shah is a Senior Research Analyst with Wood Mackenzie. Previously,

he worked as an Energy Finance Analyst with the Institute for Energy

Economics & Financial Analysis (IEEFA). He specialises in financing, policy

and technology matters of the Indian electricity market. He has a master’s

degree in economics from the University of Sydney and an engineering

degree from NMIMS University in Mumbai.

Languages: English, Hindi, Gujarati, Marathi

Research from Kashish Shah

See all Research from Kashish Shah >

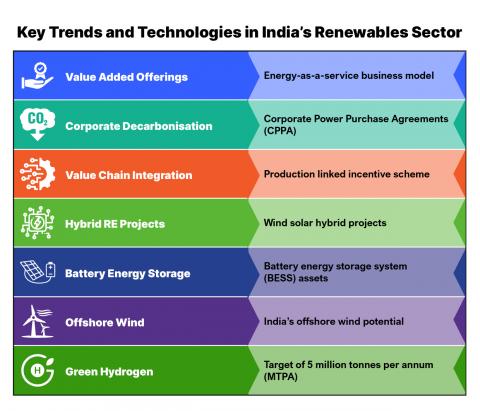

Emerging investment opportunities in India’s clean energy sector

January 18, 2023

Shantanu Srivastava, Kashish Shah, Amit Manohar...

Report

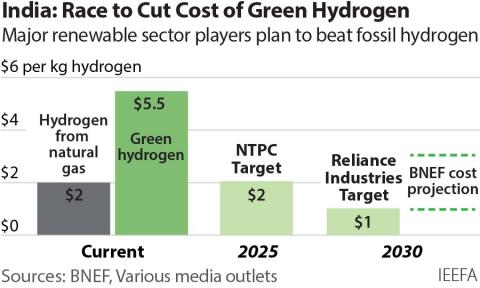

India must act fast to avoid trailing in the global race for green hydrogen

September 01, 2022

Kashish Shah

Insights

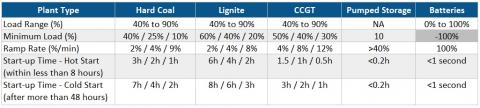

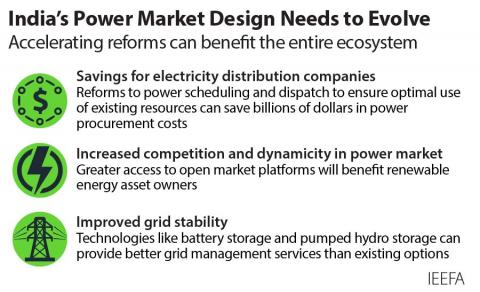

India's power market design needs to evolve

August 25, 2022

Kashish Shah

Report

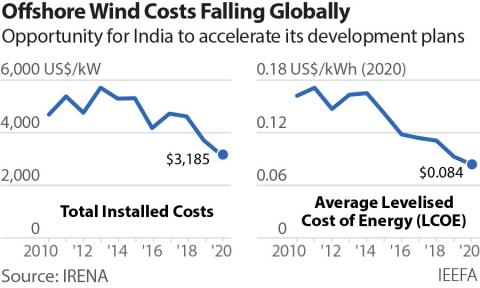

Another boost for India's offshore wind development

August 19, 2022

Kashish Shah

Insights

India’s renewables ministry reignites its offshore wind dreams

July 13, 2022

Kashish Shah

Insights

The race for new-generation clean energy technologies in India

July 11, 2022

Kashish Shah

Insights

IEEFA: India's renewable energy journey: Two steps forward, one step back

May 27, 2022

Kashish Shah

Insights

In India's power shortage crisis, easing green norms for coal is no solution

May 19, 2022

Kashish Shah

Insights

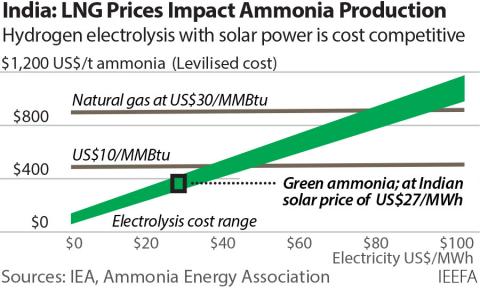

Green hydrogen: Fuelling India’s ambition for energy independence

May 11, 2022

Kashish Shah

Insights

The energy transition in India – onwards and upwards

May 02, 2022

Kashish Shah

Insights

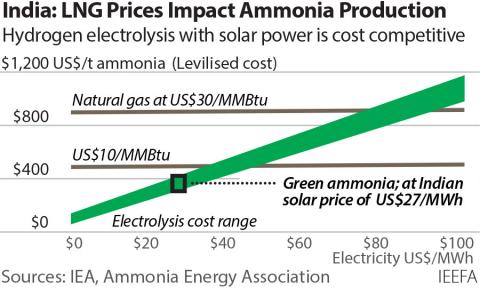

Green ammonia: low-hanging fruit for India's green hydrogen dream

April 20, 2022

Kashish Shah

Report

IEEFA: Boosting domestic solar PV manufacturing will fuel green hydrogen takeoff in India

February 25, 2022

Vibhuti Garg, Kashish Shah

Insights

IEEFA: India’s Budget 2022 a step in the right direction but assistance for critical new energy technologies ignored

February 02, 2022

Vibhuti Garg, Kashish Shah, Shantanu Srivastava...

Insights

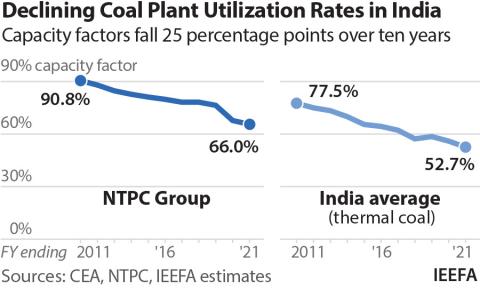

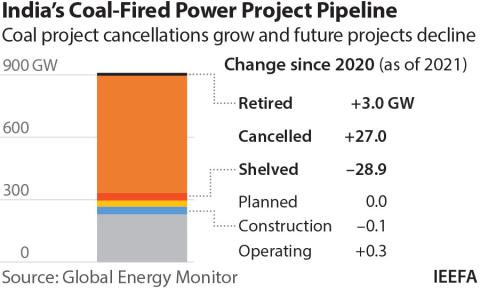

IEEFA India: Endgame for new coal power projects?

January 28, 2022

Kashish Shah

Insights

IEEFA India: There has never been a better time for domestic solar module manufacturing

December 23, 2021

Kashish Shah

Insights

Posts from Kashish Shah

See all Posts from Kashish Shah >

India’s renewable energy sector ripe for global and domestic investments

January 18, 2023

Press Release

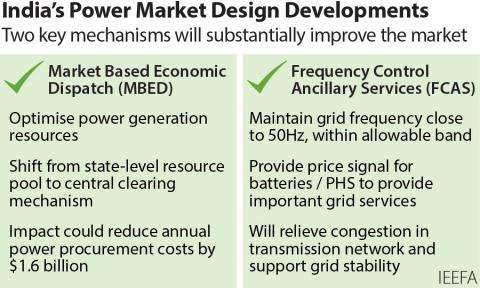

Accelerating power scheduling and dispatch reforms can help save billions of dollars for Indian electricity distribution companies

August 25, 2022

Press Release

A shift to green ammonia from green hydrogen can reduce India’s fertiliser subsidy burden

April 20, 2022

Press Release

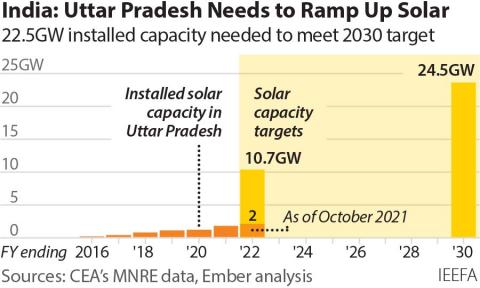

IEEFA/Ember India: Uttar Pradesh is at a crossroads in its electricity transition

December 17, 2021

Press Release

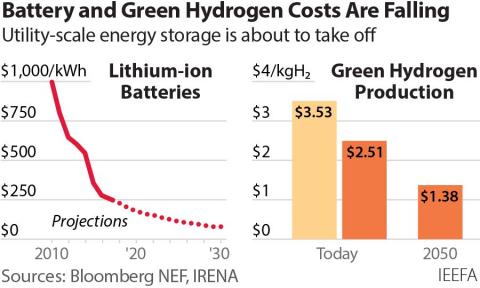

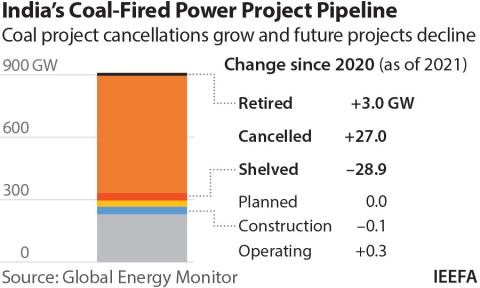

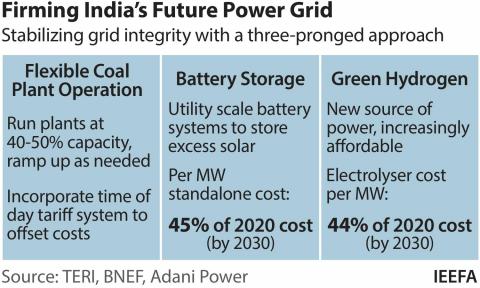

IEEFA: Battery storage and green hydrogen can boost India’s renewable energy efforts

October 22, 2021

Press Release

IEEFA India: Proposed power market reforms could reduce renewable energy costs further

September 09, 2021

Press Release

IEEFA India: Overestimated LCOEs of coal-fired power plants create a financial bubble

July 07, 2021

Press Release

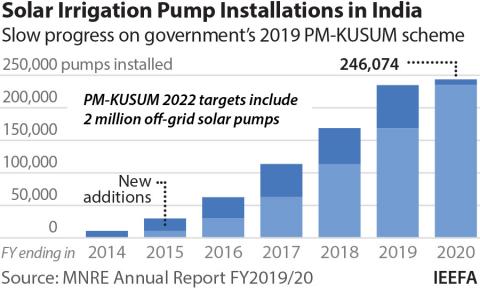

IEEFA: Powering up solar irrigation effort will support India’s renewable energy targets

June 11, 2021

Press Release

IEEFA: New coal-fired power plants in India will be economically unviable

June 04, 2021

Press Release

IEEFA: There’s no way out for India’s stranded thermal power assets

March 29, 2021

Press Release

IEEFA: India needs to be ready to ride the energy storage wave

February 26, 2021

Press Release

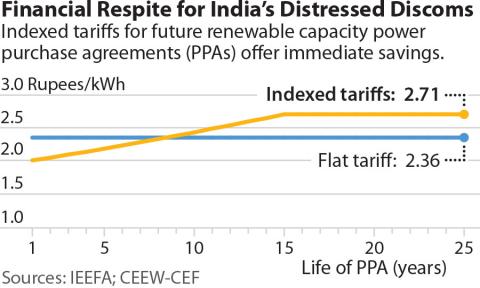

IEEFA: Indexed renewable energy tariffs could save India’s discoms up to Rs21,880 crore (US$3bn) over five years

October 21, 2020

Press Release

Footer menu

Contact us

INSTITUTE FOR ENERGY ECONOMICS AND FINANCIAL ANALYSIS

PO Box 472, Valley City, OH

44280-0472 USA

T: +1-216-353-7344

© 2025 Institute for Energy Economics & Financial Analysis.